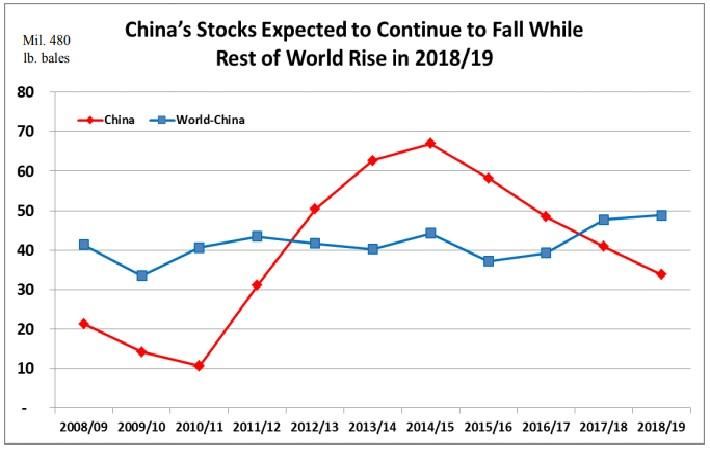

Outside of China, despite forecast lower production, rest-of-world stocks are expected to rise for the third consecutive year as an expected modest growth in consumption and relative weak import demand by China leave supply higher than demand, the Foreign Agricultural Service of the USDA said in its March 2018 report ‘Cotton: World Markets and Trade’.

Meanwhile, US cotton exports are projected at a 13-year high of 16 million bales of 480 lb each in 2018-19, due to expectations of a large exportable surplus. The US share of world trade is projected to rise. Ending stocks are projected at 6 million bales, which would be the highest level since 2008-09. Greater supplies outside of China are expected to pressure cotton prices in 2018-19 with the average price received by producers falling within the range of 58-68 cents per pound, compared with the 2017-18 current forecast of 69 cents.

For 2017-18, global cotton production and trade are both raised. Production is raised due to expected higher production in Australia and Sudan, partially offset by lower production in Uzbekistan and the US. Trade is up on higher imports in Turkey, Vietnam, Bangladesh, and China. The US exports are raised. World consumption is marginally higher with world ending stocks up reflecting the increased production. The US balance sheet has lower production, higher exports, and lower ending stocks. (RKS)

Fibre2Fashion News Desk – India