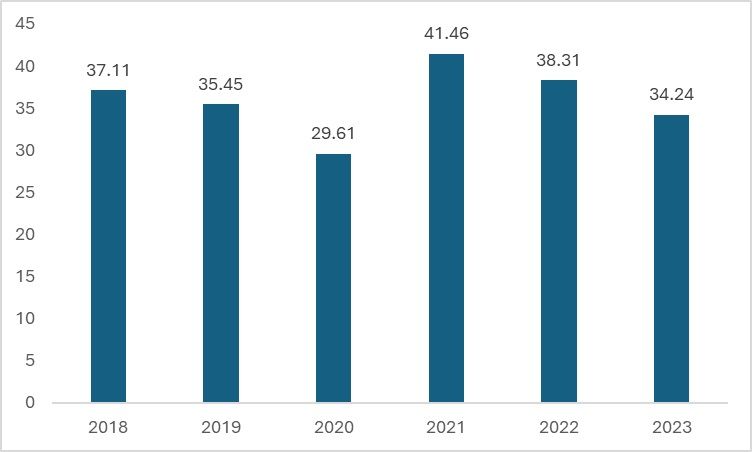

India occupies a significant place as one of the foremost textile exporters worldwide. Nevertheless, the country's total textile exports have stayed relatively unchanged since 2020, amidst the uncertain global economic conditions and supply chain obstacles domestically. As illustrated in the graph below, Indian textile exports reached their zenith at $41.46 billion in 2021 before witnessing a subsequent decrease. This variation highlights the difficulties confronting the industry amid changing international dynamics and internal limitations. Initiatives to tackle these issues are crucial for maintaining and improving India's status as a principal contributor to the global textile market.

Figure 1: Indian textile and apparel exports (in $ bn)

Source: ITC Trade Map

India's textile industry stands out as one of the most dynamic sectors, benefitting from a broad geographical presence across the nation. However, several bottlenecks hinder its growth, and one significant challenge is the reliance on imported textile machinery. Despite the domestic production capability and an active export market for such machinery, the industry continues to heavily import these crucial components. As the government steps up its investments in the textile sector through various initiatives like the establishment of textile parks, there is a pressing need for increased investment in machinery and capital expansion. Addressing the import dependency on textile machinery would not only bolster the domestic manufacturing sector but also enhance the industry's self-reliance and competitiveness on the global stage.

Imports up, exports down

Regarding India's trade in the export and import of textile machinery, the data indicates a growing deficit. While Indian imports experienced a slight decline of 2 per cent, attributed partly to geopolitical conditions and uncertainties surrounding trade prospects, exports plummeted by over 5 per cent. This downturn underscores the underutilisation of domestic capacity. Addressing this imbalance is crucial to optimising the potential of the domestic textile machinery sector and enhancing its contribution to both the national economy and global trade.

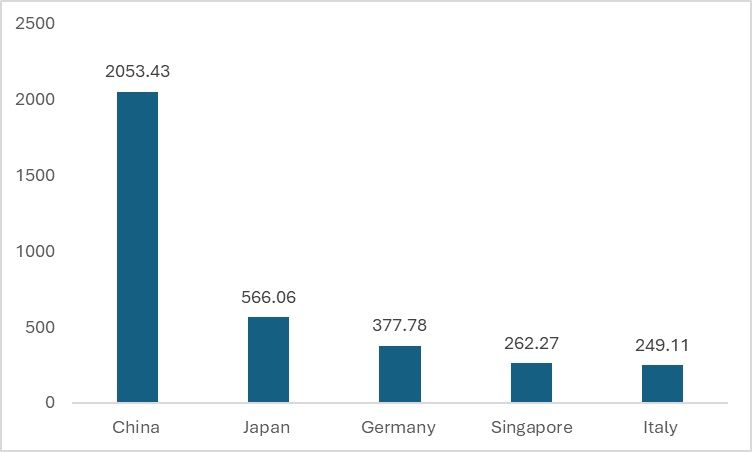

India boasts approximately 3,250 companies engaged in the production of textile machinery and related equipment, showcasing its robust industrial landscape. This sector not only caters to domestic demand but also exhibits significant potential for export. India's status as both an importer and exporter of textile machinery is emblematic of its unique position in the global market. Data from 2023 illustrates this dynamic, with India engaging in the import and export of machinery for spinning, auxiliary functions, and printing. Importing machinery, particularly from countries like China, Japan, and Germany, often serves to secure products at a more competitive cost compared to domestic production. Concurrently, India exports textile machinery to various destinations, including Bangladesh, Turkiye, and the UAE, indicating its prowess as a global supplier in this domain. Balancing these import and export dynamics is essential for fostering a thriving textile machinery industry and enhancing India's role in the international market.

Figure 2: India's textile machinery exports in 2023 (in $ mn)

Source: Directorate General of Commercial Intelligence and Statistics (DGCI&S)

India's significant imports from countries like China and Japan provide a compelling justification for its reliance on imported machinery. Calculating the trade deficit specifically for textile machinery in the calendar year 2023 reveals a substantial shortfall, amounting to $3,813.41 million. This figure suggests that India may face a comparative disadvantage in the production and export of such machinery. A country enjoys a comparative advantage when factors both within and outside its borders contribute to lower production costs, facilitating economies of scale. Addressing this deficit requires strategic measures to enhance domestic production capabilities, reduce dependency on imports, and leverage India's inherent strengths to compete more effectively in the global textile machinery market.

Figure 3: India’s textile machinery imports for 2023 (in $ mn)

Source: DGCI&S

Widening trade deficit and unused potential

The trade dynamics of textile machinery in India present a perplexing trend, characterised by a widening deficit despite varied patterns of growth in imports and exports. While exports have shown nearly exponential growth, the trade deficit continues to expand. Notably, the trade in textile machinery widened by 25 per cent in FY 2022-2023, reaching its peak at 70 per cent in FY 2021-2022. This discrepancy underscores the complexities within the industry and highlights the need for a comprehensive analysis to understand the underlying factors driving these divergent trends. Addressing this disparity requires strategic interventions to bolster domestic production capabilities, enhance export competitiveness, and mitigate import dependency, thereby fostering a more sustainable and balanced trade environment in the textile machinery sector.

Figure 4: India’s textile machinery imports and exports (in $ mn)

Source: DGCI&S

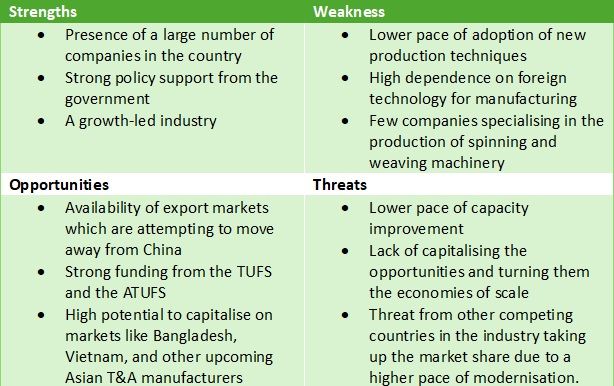

SWOT analysis of Indian textile machinery industry

Source: Department of Scientific and Industrial Research (DISR)

What can be done?

In the long term, India, as a major textile powerhouse, indeed has the potential to reduce its dependence on imported textile machinery. However, a significant bottleneck exists: the widespread use of outdated technology and the industry's slow adoption of modern advancements. This challenge is not unique to India but is also prevalent in countries like Bangladesh, where outdated technology hampers progress in the apparel sector.

Despite these obstacles, India has implemented policies such as the Technology Upgradation Fund Scheme (TUFS) and the Amended Technology Upgradation Fund Scheme (ATUFS), which receive government funding aimed at aggressively reforming the textile industry from a technological standpoint. While these policies hold promise for boosting the Indian textile industry, reducing imports and modernising equipment will likely require a considerable amount of time. Nonetheless, sustained efforts and strategic investments in technological upgrades are essential for India to enhance its competitiveness and achieve greater self-sufficiency in textile machinery production.

Fibre2Fashion News Desk (KL)