The US has recently experienced several economic fluctuations, including soaring inflation and industry calls for strict enforcement of laws to prevent the import of Chinese goods. However, persistently high inflation and the risk that it might not decrease remain some of the most pressing issues; if not addressed timely, they could have serious repercussions on the US economy. Nonetheless, many of the main US indices suggest otherwise.

High cost of persistent inflation

Since July 2023, the US has been grappling with inflation due to rising oil prices, global geopolitical tensions, and resultant supply chain disruptions. The US consumer confidence index has risen marginally, yet it remains highly dependent on other prevailing conditions in the US economy, including the elections.

Figure 1: Month-wise US inflation (in %)

Source: US Bureau of Labour Statistics

Currently, inflation is a significant concern for the US economy. The US Federal Reserve (FED) is maintaining high interest rates in an effort to bring inflation within its acceptable range. However, the Consumer Price Index (CPI) trends indicate a different scenario. Inflation has remained at around 3 per cent consistently from June 2023, suggesting that the US is experiencing persistent inflation levels that are not diminishing, despite the elevated interest rates. These persistent inflation levels are likely to continue for extended periods, potentially undermining the US FED's plan to start reducing rates from July 2024. This situation could impact a broad array of economic factors, including consumer spending, business expansion, retail sales, demand, and investments, among others.

It's here to stay

Persistent inflation paired with the higher interest rates set by the Fed, if not yielding results in reducing the CPI below the current levels to 2 per cent, increases the chances for the economy to face a mild recession. Generally, interest rates play a crucial role in reducing inflation. As the interest rates are higher, borrowing becomes costlier for households and businesses. As demand from households reduces, businesses temporarily halt their expansion processes, which then gradually helps to bring prices under control. However, if the interest rate remains at the same level for a prolonged period, it is bound to negatively affect the overall economic functioning of the US economy.

Figure 2: Inflation forecast for the US (in %)

Source: US bureau of labour statistics and F2F analysis

If we consider the projected figures, the interest rates are not as effective as they were in the previous months; it will become a significant challenge for the economy not only to recover from the interest rate-induced slowdown but also to avoid falling into the recessionary trap. The US keeping the interest rates high will affect spending on all discretionary goods in the economy, which includes textiles and apparel, electronics, and so on.

Consumer confidence fluctuates

With the interest rate being higher and now predicted to increase or remain at the same level, the confidence that consumers have in the economy reduces eventually. With the Fed keeping interest rates higher, the CCI has been fluctuating but is still increasing compared to January 2023. Although the index is still lower compared to the 2022 levels, the increase in consumer confidence may point towards more spending from households, as of April 2024.

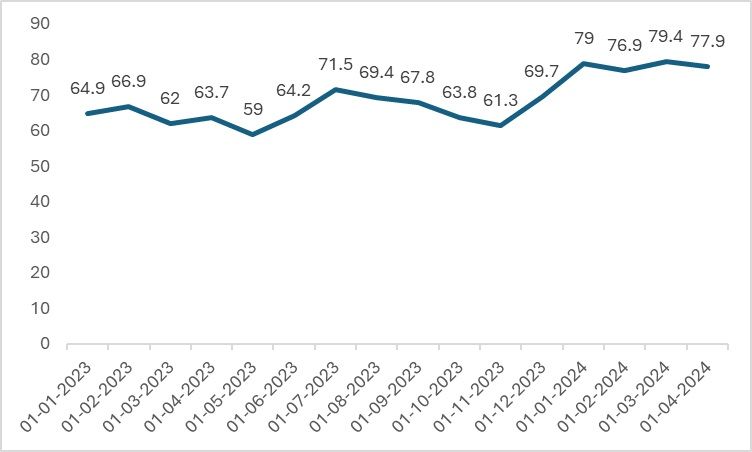

Figure 3: Month-wise Consumer Confidence Index (in %)

Source: Survey of Consumers, University of Michigan

Consumer spending has increased by 0.6 points compared to the overall trend of 0.2 points. The survey results indicated some confusion among consumers over the stalled progress on inflation, but spending remains robust as there is no perceived threat of any major upheaval in the economy. Thus, although the index has reduced by minor points, a steady trend still points to stability in spending despite higher interest rates.

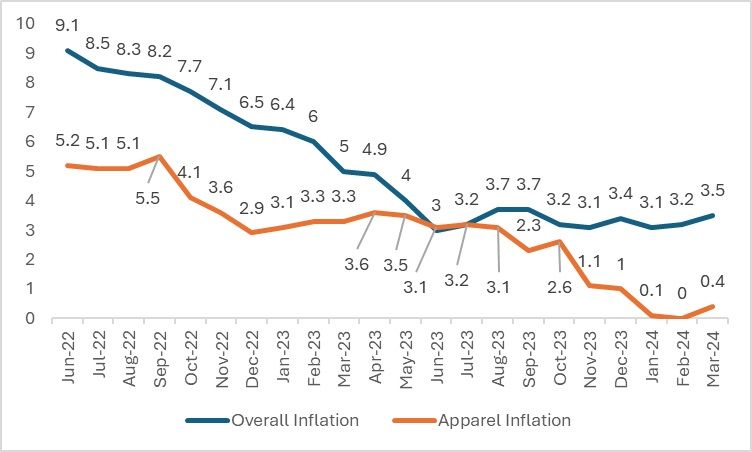

Inflation increases, as does apparel inflation

Even though the prices of other commodities may increase or stay muted, apparel shows an interesting trend in the US. With inflation increasing, apparel inflation is also rising. This follows because the industry is closely linked with the interest rates set by the US Fed. Additionally, fuel inflation also affects the industry, leading to a situation where, as inflation increased by 0.3 points, so did the apparel inflation by 0.3 points.

Figure 4: Month-wise overall inflation and apparel inflation (in %)

Source: US bureau of labour statistics

Along with the increase in fuel prices and higher interest rates, other geopolitical factors have also affected US apparel inflation. The effects of the increase in apparel inflation were reflected in the recently released retail index, where spending on clothing fell by 1.6 per cent, even though there was an overall increase reflecting the continued trend of increased spending.

What next?

With the current situation being much more complex, the US Fed faces a tightrope walk and the dilemma of whether to keep interest rates high in the coming periods. If the interest rates are maintained at the same levels, the country may encounter problems as prolonged higher interest rates can have counterproductive effects on the economy, which may involve lowered consumer spending and reduced investments due to higher interest rates. However, if the persistent trend of inflation ends, there is still a ray of hope at the end of the dark tunnel for the US.

Fibre2Fashion News Desk (KL)