The Indian economy has observed an average growth rate in the range of 5 to 7 per cent since the initiation of economic reforms in 1991-92, except for few years. The reforms also integrated the Indian economy into the global economy, increasing trade and investment flows, with India’s share in global trade rising from 0.5 per cent in 1991 to around 2 per cent in 2023. The Indian economy performed well in FY24, maintaining its strong momentum from the previous year despite global challenges, demonstrating resilience and continued economic growth. Real GDP growth reached 8.2 per cent, exceeding 7 per cent for the third consecutive year, driven by stable consumption and improving investment demand. The economic growth attained by India in the last few years is one of the highest in the world, surpassing the growth rate of China, despite global challenges. As per the Economic Survey 2023-24, the projection for the country’s real GDP growth stands between 6.5 per cent to 7 per cent. These estimates are projected by taking a conservative approach, however, according to some experts India’s GDP growth will surpass the projections.

Retail inflation was maintained at 5.4 per cent, the lowest since the pandemic, due to effective policy interventions and RBI measures. Inflation is expected to decline further to 4.5 per cent in FY25 and 4.1 per cent in FY26, assuming normal monsoon and no external shocks.

To avoid the low-middle income trap, India needs to focus on economic reforms and active and dynamic policy interventions across sectors of the economy. The budget of a country reflects the fiscal policy of the nation in general. On July 23, Finance Minister Nirmala Sitharaman presented the Budget for fiscal 2024-25 showing continuity as well as needful deviation from the previous years. The focus of the present budget was on the empowerment of youth, farmers, the poor, and women by generating new employment, skilling of labour and supporting MSMEs. The textile and apparel sector is directly linked to the budget focus and themes. The budget has significant implications for the textiles and apparel sector as it addresses various aspects like production incentives, export growth, and sustainability.

The textile and apparel industry contributes nearly 2.3 per cent of India’s GDP and 10.5 per cent of the country’s export earnings. The export income elasticity of textile products varies from 0.428 to 0.943 to various export destinations (Arora, 2015, ISEC WP-338). GDP expansion of India’s major trading partners will have a positive spillover effect on the exports of the sector. The sector caters to a vast and growing domestic market and is a major player in the global textiles market, exporting to key markets such as the United States, Europe, and other regions. Textiles and apparel are among the top export categories for India. The sector contributes significantly to the country’s foreign exchange earnings, with products like garments, fabrics, and home textiles being exported worldwide. The growth of the textiles and apparel sector stimulates investment in industrial infrastructure, including textile parks, manufacturing units, and logistics facilities. The sector also supports various ancillary industries such as dyeing, printing, and textile machinery manufacturing, hence contributing to broader industrial development. The sector also contributes to value addition in the supply chain, from raw materials to finished garments, enhancing overall economic productivity.

As per the National Accounts published by the Central Statistics Office, the textiles and wearing apparel sector generated a gross value added (GVA) of ₹3.77 lakh crore ($45.24 billion) in FY23, which was about 10.6 per cent of the manufacturing GVA at current prices. The sector also accounted for 29.3 per cent of the total non-corporate manufacturing GVA and 7.9 per cent of the corporate manufacturing GVA in FY23. Available statistics also indicate that the textiles and apparel sector is one of the largest employers in India. In terms of the sectoral share of factory employment (total persons engaged), textiles (10 per cent) remained the second largest employer after agriculture, followed by wearing apparel (7 per cent) in 2022 (ASI, MoSI). It provides direct employment to millions of people, particularly in rural and semi-urban areas, including workers in spinning, weaving, dyeing, printing, and garment manufacturing. This sector has strong forward and backward linkages thereby having a strong employment multiplier effect on the economy.

Despite fundamental differences in unemployment data reported by CMIE and Annual PLFS reports, unemployment is a critical issue that continues to challenge the economic landscape and public discourse in India, particularly youth unemployment. As one of the world’s most populous nations with a diverse workforce, fluctuations in the unemployment rate have far-reaching implications for the country’s growth and development. This is a major concern among youth, policymakers, and the political class as well. From an employment perspective, the textile and apparel industry has contributed significantly to employment generation and poverty alleviation. For millions of people, many of whom are women who reside in rural areas, it offers both direct and indirect employment along with a source of livelihood. The textile and apparel industry is completely in line with the government’s major empowerment programmes such as Make in India, Skill India, Women Empowerment, and Rural Youth Employment (Annual report 2022-23, Ministry of Textiles).

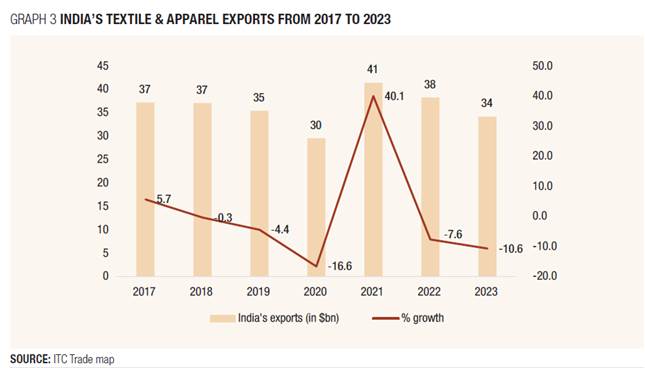

The textile and apparel sector is one of the key sectors supporting India’s growth story. The government has given priority to including world-class textile infrastructure along with plug-and-play know-how, particularly emphasising technical advancement, the promotion of handloom and handcraft items, quality, and standards. India has a robust end-to-end value chain in the textile industry, spanning raw materials like natural and MMF fibre to the final product and covering apparel, home textiles, and technical textiles. India is one of the world’s largest clothing manufacturing and exporting nations. In FY24, the export of textiles and apparel, including handicrafts, increased by 1 per cent, reaching ₹2.97 lakh crore ($35.64 billion). The readymade garments contributed around 41 per cent of total exports worth ₹1.2 lakh crore ($14.4 billion), followed by cotton textiles (34 per cent), and man-made textiles (14 per cent) during the financial year 2023-24. When it comes to micro, small and medium enterprises (MSMEs), their contribution is more than 80 per cent of India’s textile and apparel manufacturing capacity. However, their operation size is small, hence this reduces the efficiency and economies of scale in large-scale production.

Until 2030, the Indian economy needs to create an average of about 78.5 lakh non-farm employment each year through Production Linked Incentive (PLI), PM Mega Integrated Textile Region and Apparel (PM MITRA) Parks, and Pradhan Mantri MUDRA Yojana (PMMY) schemes. To satisfy this need, out of 78.5 lakh jobs in the non-farm sector, 60 lakh employment would be created through PLI schemes within five years, 20 lakh jobs through PM MITRA and PMMY schemes, and some employment through the route of other schemes. Seven PM MITRA Parks, with a budget of ₹4,445 crore ($533 million), will be established from FY22 to FY28 in Tamil Nadu, Telangana, Gujarat, Karnataka, Madhya Pradesh, Uttar Pradesh, and Maharashtra. The parks will feature 1,000-acre industrial infrastructure and ‘plug-and-play’ facilities and will have ‘technology-driven’ ecosystems with R&D, start-up incubation, forward and backward linkages with logistics parks, and market access systems.

The Indian government approved a PLI scheme with ₹10,683 crore ($1.28 billion) over five years for man-made fibre apparel and fabrics and technical textiles. The government also has taken good steps towards linking skill development to the PLI scheme and employment-linked incentive schemes in high-growth potential industries including textile and clothing industries, which will help to upgrade skills as manufacturing advances up the value chain. Textiles and apparel’s average annual growth rate in manufacturing GVA at constant prices is 3 per cent from FY14 to FY23.

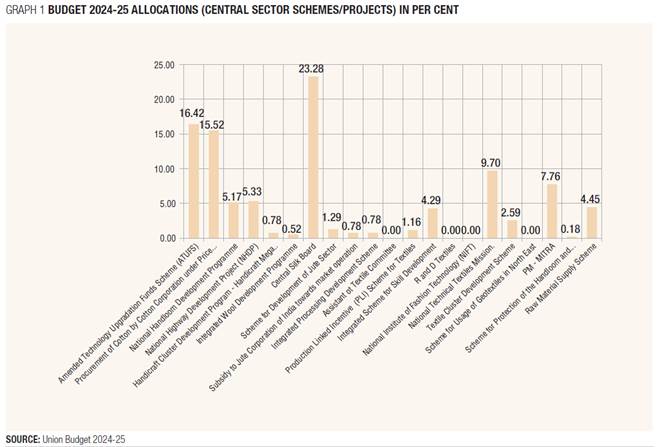

In the Budget for 2024-25, the government increased its allocation for the textile industry to ₹4,417 crore ($530 million) from the revised budget projection of ₹3,443 crore for the fiscal year 2023-24, indicating a vigorous commitment to expanding the industry. This is a significant increase of 28.29 per cent over the previous year. The gross budget allocation of ₹4,417 crore has been distributed into three heads, i.e., ₹375.41 crore is proposed to be spent on establishment expenditure of the Centre, ₹3866.17 crore on central sector schemes/projects and ₹175.41 crore on other central sector expenditure. The expenditure on central sector schemes/projects is a significant 45.63 per cent increase over the previous year. The top 5 centrally sponsored schemes under budget allocation for the textile sector are the programmes of the Central Silk Board (23.28 per cent), the Amended Technology Upgradation Fund Scheme (16.42 per cent), Procurement of Cotton by the Cotton Corporation of India under the Price Support Scheme (15.52 per cent), National Technical Textiles Mission (9.70 per cent) and PM MITRA (7.76 per cent) (see Graph 1).

In the Budget 2024-25, the PLI and PM MITRA schemes have been given substantial funding, which will boost investment in the country. In other words, one of the budget’s primary features is a considerable increase in financing for the Textile PLI programme. The budget for PLI has been increased to ₹45 crore ($5.4 million) from ₹5 crore, which is 800 per cent higher than the previous year. The funding has also been enhanced from ₹0.01 crore to ₹600 crore for CCI’s cotton purchase under the price support scheme. Furthermore, funding for the Integrated Scheme for Skill Development has increased from ₹115 to ₹166 crore, while the budget for the Development of the Jute Sector and the Amended Technology Upgradation Fund Scheme (ATUFS) has fallen from ₹75 to 50 crore, and ₹675 to ₹635 crore respectively.

The textiles ministry anticipates this significant increase in the budget allocation to spur greater investment and strengthen the sector’s global competitiveness. For expanding technical garment exports, the budget towards the National Technical Textiles Mission has gone up from ₹170 crore to ₹375 crore, an increase of more than 100 per cent. The allocation to the National Handicraft Development Programme has been increased from ₹155 crore to ₹206 crore, an increase of 32.48 per cent. Likewise, the allocation of National Handloom Development Programme has been raised from ₹190 crore to ₹200 crore. Also, the budget allocation for the Handicraft Cluster Development Program (Handicraft Mega Cluster) has increased from ₹15.7 crore to ₹30 crore, an increase of 91 per cent, to derive investment, encourage innovation, and catalyse growth within the textile and apparel industry.

The government has heightened the gender budget allocation to ₹387.65 crore from 371.55 crore in the financial year 2024-25. The capital outlay on the village and small industries in the budget is ₹40.56 crore, an increase of 145 per cent, while capital outlay on other general economic services is ₹3.09 crore, an increase of 57 per cent, from the previous budget.

To enhance the global competitiveness of India’s textiles, which is vital to the country’s economy, the Finance Minister proposed a reduction in customs duty. This will reduce input costs, deepen value addition, promote export competitiveness, correct inverted duty structure, boost domestic manufacturing, etc. For instance, the Basic Customs Duty (BCD) on methylene diphenyl diisocyanate (MDI) for spandex yarn production has been reduced from 7.5 per cent to 5 per cent. This move addresses duty inversion and reduces input costs for manufacturers. BCD on real down-filling material from ducks or geese will be lowered from 30 per cent to 10 per cent, making premium filling materials more affordable for garment manufacturers. Tariff rates have been reduced to zero for certain additional accessories and embellishments for the manufacture of textiles. As a bottom-up reform, the Finance Minister has proposed to create new tariff lines concerning many products including technical textiles to align them to the tariff lines with WCO (World Customs Organisation) classification and better identification of goods. These changes shall come into effect from October 1, 2024. This is a trade facilitation measure. Further, the government plans to expand the list of exempted goods used in the manufacture of leather and textile garments, footwear, and other leather articles intended for export. This expansion aims to reduce production costs and encourage more manufacturers to enter the export market.

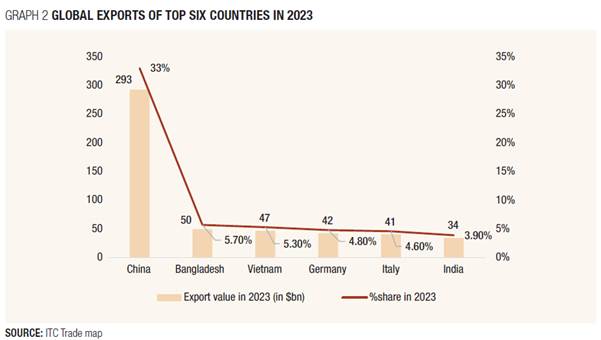

The textiles and apparel sector holds significant importance for the Indian economy, influencing various aspects from employment to trade. The vision statement of Ministry of Textiles states, “Positioning India as a global textiles manufacturing hub by developing a $250 billion textile industry and attaining $100 billion in global textile exports by 2030 by focusing on high-tech & high-growth product segments, leveraging inherent strengths, developing large scale plug and play infrastructure, keeping sustainability at the core, while ensuring large-scale livelihood opportunities, providing impetus to traditional sectors and becoming Atmanirbhar in raw material value chain”. After the abolition of quota policy under the MFA in 2005, the sector was brought into the scope of the GATT of WTO. The WTO Treaty on textiles and garments represented a significant change in the trading environment for the textile and apparel sector. Many developing and least developed countries (LDCs) were able to penetrate in the global market. India’s export of textile and wearing apparel sector was $34.23 billion (4.80 per cent) out of $712.45 billion global exports in 2023. This is far below China’s exports of $290.6 billion (40.79 per cent). China is the major global player in the export of the textile and clothing sector, followed by Bangladesh and Vietnam. India stands at the sixth position as an exporter in the world economy (Graph 2). The latest budget allocation supports the vision set by the ministry and is indicative of the Indian textile industry’s robust expansion. The tariff reduction on inputs is an important step towards India becoming competitive in global markets.

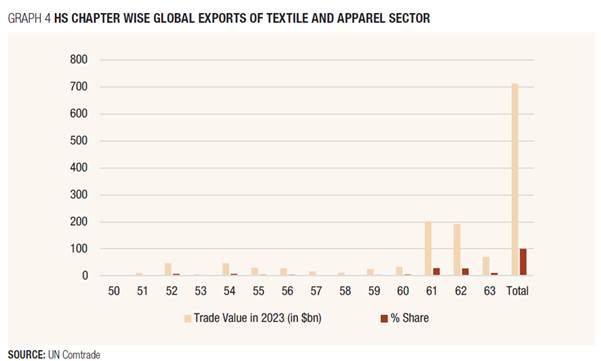

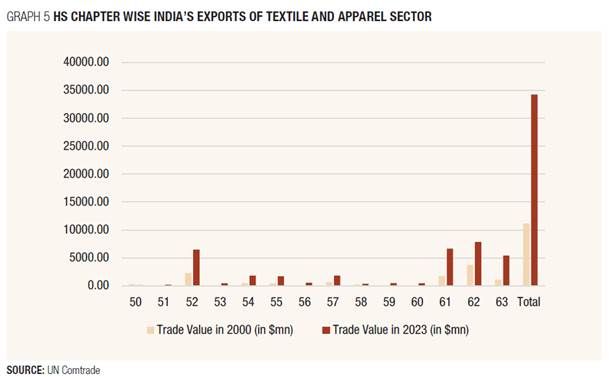

Graph 4 presents global exports of the textile and apparel sector at HS-2-digit level. The share of exports of the textile and apparel sector in global exports has almost doubled from $358 billion in 2000 to $712 billion in 2023 in the last two decades. However, the combined share of HS Chapter 61 (articles of apparel and clothing accessories knitted or crocheted), 62 (articles of apparel and clothing accessories, not knitted or crocheted) and 63 (other made-up textile articles; sets; worn clothing and worn textile articles; rags) was 65 per cent of global exports of textile and wearing apparel in 2023. In these sub-sectors, namely HS chapters 61, 62, and 63 of the textiles and wearing apparel sector, India’s exports are $6.6 billion, $7.8 billion, and $5.3 billion out of global exports of $201.6 billion, $199.6 billion and $69.8 billion respectively (Graph 5). This is 58 per cent of total exports. Additionally, India has its presence in global exports in chapter 52 (cotton). However, despite the availability of cheap labour and relatively low wages in the sector, India is still lagging behind the countries where wages are relatively higher. These statistics also indicate that India has a lot of scope to penetrate in global market. It is easy to infer that the country lags behind in policy and required support to the industry for innovation, upgradation, and diversification.

It can be concluded that India has already emerged on the global landscape as a country aspiring to attain a developed nation status by 2047 through necessary economic reforms. The textile and apparel sector is critical for sustaining a high growth rate and generating employment opportunities. The sector is also essential to India’s economy due to its significant economic contributions, substantial export earnings, role in industrial development, and ongoing innovations. The sector is preparing to capitalise on rapidly evolving global market trends, and the latest budget boost is timely. Due to this additional focus and financing, the industry is more prepared to improve its international competitiveness. The government’s intent to strengthen one of India’s fundamental industries is evidenced by its comprehensive approach to supporting the textile sector through a variety of initiatives. Given the significance of the textile and apparel sector in the economy, the sector requires long term structural changes to address the challenges such as technology upgradation, rationalisation of GST and custom duties, promotion of GI products, non-tariff barriers, etc. In the policy space, the allocations and policy actions in the budget regarding the industry are the steps in the right direction. The health and growth of the sector are crucial for the broader economic stability and development of the country.

Comments