Traditionally, India's textile sector not only employed millions of people directly but also gave the country the lion's share in global trade. This was possible due to two significant advantages the country enjoyed vis-a-vis its competitors in the global market:

Lower Labour costs

Significant government support (capital subsidy, duty drawbacks etc.)

However, things have changed in recent years, and the industry is now losing its edge. Countries such as Bangladesh and Vietnam are leaving India behind in their race to the top. While India saw a mere 0.8 percent improvement in share of global apparel market in the decade between 1995-2015, Vietnam's has soared from 1.7 percent to 5.3 percent, and that of Bangladesh from 2.5 percent to 6.7 percent. Consequently, textile mills in India are shutting down, and expansion plans are being shelved. This clearly shows that we are losing the plot.

However, things have changed in recent years, and the industry is now losing its edge. Countries such as Bangladesh and Vietnam are leaving India behind in their race to the top. While India saw a mere 0.8 percent improvement in share of global apparel market in the decade between 1995-2015, Vietnam's has soared from 1.7 percent to 5.3 percent, and that of Bangladesh from 2.5 percent to 6.7 percent. Consequently, textile mills in India are shutting down, and expansion plans are being shelved. This clearly shows that we are losing the plot.

Industry Perspective of the Problem

Industry players point out that higher input costs are making end products more expensive compared to other competing markets2. Many feel that government support to the industry has not only been dwindling, some recent policies have also worked against the industry. So it is widely believed that unless immediate steps are taken to restore export incentives and reduce levies, the industry will continue to decline. But since the country has to abide by WTO norms, there are limitations to subsidies that can be offered to the sector.

Textile companies are also looking at ways to control the rising wage bills. Minimum wage in the industry is mandated by the government. Therefore, hiring regular employees is on a decline while short term contract workers are emerging as the basis of most of the new recruitment in this sector. The unfortunate consequence is high labour mobility, lower skill levels, and absenteeism leading to chronic labour shortage and increased overtime costs. Moreover, depending on labour availability, the plants' capacity too fluctuates widely and unpredictably. All these not only increase cost of operations and reduce productivity but also make the manufacturing units unreliable.

One of the other strategies being used to stay competitive is triangle manufacturing- i.e. manufacturers shift the labour intensive parts of their operations to a low-cost destination and then ship garments back to India. However, this strategy too, is fraught with huge risks of lead time expansion and poor reliability.

The Hard Reality - Why traditional solutions will not work

Neither lobbying for government support nor trying to control the wage bill, are sustainable solutions to build a long term competitive edge for the industry. This is because:

Wages have to and will go up: Recent years have seen a 25-30 percent jump in labour costs in apparel production. Minimum wage is required to be revised every five years according to the minimum wages act (1948). Moreover, with improving prosperity, wages will inevitably go up further. And any attempts to control wage increase can only lead to a demotivated workforce and labour unrest.

Trying to compete with country specific trade advantages is not sustainable: In addition to access to much cheaper labour force, countries like Bangladesh and Vietnam have also established advantageous trade relationships. The textile industry in Bangladesh has quota-free, duty free access to European markets, and desirable quotas, and duty free access to the American and Canadian markets. Vietnam has already signed 12 free trade agreements with various nations. Further, the country is also expected to be a major gainer of the soon-to-be-signed Trans-Pacific Partnership (TPP) with US which will open unprecedented channel for trade and investment among member nations. Other underdeveloped countries too may become part of such trade advantages in the future. So there is no way, Indian industry can depend on such "sweeteners" to stay competitive in a sustainable manner.

Learning from the China Story: Going Beyond the "Low Cost" Narrative

Learning from the China Story: Going Beyond the "Low Cost" Narrative

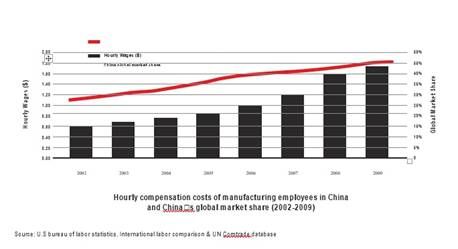

The example of China, the world's largest producer of textiles by far, provides evidence that lower input costs or preferential trade access is unnecessary to build a strong textile sector. Even after a decade of near continuous increase in wages, the average price of apparel exported by China to the US actually fell from 2008 to 2013. And despite the absence of any trade privileges, when China's wage costs went up from $0.60 per hour in 2002 (approximately India's current wage level) to nearly triple that by 2009, the country's share in the global garment export market went from 18 percent to around 33 percent3. In spite of competing nations enjoying a tremendous labour cost advantage, China has even now managed to sustain its leadership and has ceded very little of its global market share. China continues to attract buyers till date because it offers a wide range of apparel, produced at not only very high levels of productivity but also with short lead times.

The Deal Clincher - Lead Time

The evolving importance of offering shorter lead times is clearly demonstrated by the case of Zara, world's largest fashion retailer, which sources more than 50 percent of its requirement from Europe and Turkey in order to ensure rapid deliveries (note: these are destinations with wage bills many times higher than India). Since, lower lead times prevent stock-outs and eliminate need for discounting excess stock, Zara enjoys a gross profit margin of approximately 60 percent, one of the best in the industry. Following the Zara example, other retailers like C&A are also exploring options for developing fast fashion retail models, as this segment can give a substantial boost to a retailers' bottom-line.

Bad News for India

This changing global scenario is disturbing for India because as a recent World Bank report has shown that, in addition to deteriorating cost competitiveness, India scores the worst, amongst South Asian suppliers, in terms of non-cost factors like lead time, and on time delivery. So, on the one hand there are countries like Bangladesh, which are highly cost competitive, and then there are countries like China, Turkey and Portugal which score

Building a New Decisive Edge

To get out of this conundrum, garments export companies in India should move beyond just being a "me-too" low cost destination, and build a compelling, sustainable new decisive competitive edge. For this, they will have to solve market challenges of their major customers- i.e. large retail chains based in the U.S., Europe, in a way that no typical company in any of the competing countries can!

Most large Western retailers have two major kinds of apparel on their shelves and sourcing these items poses different challenges:

1. Core products or basic items like standard jeans, under garments, socks etc. generally sell throughout the year in fairly good volumes. These products are usually procured in bulk from manufacturers in Asia based on forecasted sales. These manufacturers are able to keep the cost of production low because of long production runs and consequent manufacturing efficiencies. However, with large lot production of their orders, retailers end up with huge inventory (at times as much as seven to eight months' worth). Thus, for retailers, not only is their working capital blocked, they are also stuck with large lots of the same designs. So, for them, the low sourcing cost of these items comes at a price!

2. Fashion garments or trendy, more complex and differentiated items like skirts, dresses, shirts, coats etc. are mostly ordered by retailers based on trends forecasted six months in advance for the forthcoming season. Their dilemma at this point is whether to 'Buy Deep' (more numbers per product at better price) or 'Buy Shallow' (less numbers per product with more variety).

But whether they buy deep or shallow, when the season starts not everything sells at the projected rate. Brands who chose to buy deep often find themselves with an inventory problem. Some designs ("laggards") end up as excess inventory at the end of the season, and they are forced to sell these at discounts to release working capital, and clear shelves for new arrivals. Therefore, to avoid excess inventory, most brands choose to buy 'shallow'.

But when they do that, they usually find themselves with a stock-out problem. Some designs ("hits") sell out very quickly but repeat buys of these cannot usually be done because long lead times make it impossible to source them within the same season. Rough estimates indicate that if retailers are able to buy shallow but get repeats of "hits" quickly into the stores, company profits can go up by as much as 35-40 percent even without any increase in the purchase budget (Refer to the example of a hypothetical retailer).

Example of a Hypothetical retailer

Let us suppose there is a retail company with four fashion products A, B, C, & D and they are bought based on their respective forecasted demand for a season. Let's compare the difference in the retailer's profits if

-

Scenario One (retailer orders the entire projected quantity upfront)

-

Scenario Two (retailer has an opportunity to place repeat order within the season)

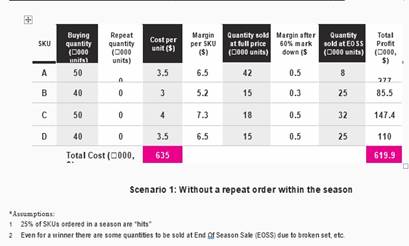

Scenario One

In the first scenario, the entire forecasted quantity is procured upfront. Let's also assume that, although one cannot predict upfront which ones they will be, 25 percent of these items are "hits" during the season. In this situation let's assume A is a "hit". This means that almost all of item "A" sells out (except for some broken sets etc.) but some of B, C & D becomes excess and has to be sold during the end of season sale (EOSS) on discounts (assumed to be 60 percent here). So, based on margins of items sold at full price and the items sold on a discount, this retailer makes a profit of $619,900 as shown in the table.

In the first scenario, the entire forecasted quantity is procured upfront. Let's also assume that, although one cannot predict upfront which ones they will be, 25 percent of these items are "hits" during the season. In this situation let's assume A is a "hit". This means that almost all of item "A" sells out (except for some broken sets etc.) but some of B, C & D becomes excess and has to be sold during the end of season sale (EOSS) on discounts (assumed to be 60 percent here). So, based on margins of items sold at full price and the items sold on a discount, this retailer makes a profit of $619,900 as shown in the table.

*Assumptions:

1. 25% of SKUs ordered in a season are hits

2. Even for a winner there are some quantities to be sold at End Of Season Sale (EOSS) due to broken set, etc.

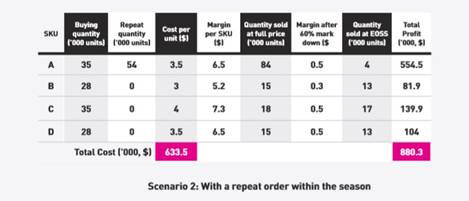

Scenario Two

In a second scenario, let's keep all parameters the same as the first (same purchase budget, same per unit cost, same demand patterns, same discount and same margins per SKU).

In a second scenario, let's keep all parameters the same as the first (same purchase budget, same per unit cost, same demand patterns, same discount and same margins per SKU).

The only difference is that the retailer is given an option to make a repeat purchase during the season and therefore, only procures, let's say, 70 per cent of the forecasted quantity upfront. Again as in scenario one, item A is a hit. But now the retailer places a repeat order for this fast selling item and by the end of the season, he succeeds in selling much more of item A! Moreover, while he sells the same amount of B, C & D at full price as in the earlier case, the quantity of these items which has to be sold at EOSS is quite low as he had only ordered 70 percent of the forecasted quantity upfront. So the retailer's profits in the second scenario are a whopping 42 percent higher compared to the first. This huge gain is because of the dual effect of more number of 'hits' sold at full price, and fewer items sold at end of season sale.

*Assumptions:

1. 25% of SKUs ordered in a season are hits

2. When there is opportunity to reorder, all SKUs are initially ordered at 70% of the projected quantity 3 Broken sets etc. comes down when there is an opportunity to net off and order again.

Given that fashion trends are not accurately predictable, brands would love to place their orders as late as possible (close to the season) and then reorder based on offtake in the market. Moreover, many also want to cash in on emerging fads, and introduce fast fashion collections. But these strategies require garment manufacturers to respond rapidly to requirements.

Way Ahead

Indian Garment exporters have to look at two strategies to solve the problems faced by their major customers

Rapid Replenishment of Core products - this will reduce the inventory levels western retailers have to hold, and give them the flexibility to tweak designs, and keep the products fresh.

With this offer, Indian textile companies can have a significant edge over companies in countries like Bangladesh and Vietnam which primarily cater to core products with the 'big batch' production approach.

Low lead time for fashion items -

This offer will help India beat the current low lead time destinations like Turkey and Europe which are mostly high wage countries.

Rapid Replenishment offer for core SKUs

Western retailers will not have to hold a lot of inventory but can still enjoy low prices if the manufacturer holds the inventory for them. In this situation, the inventory will only have to account for demand during shipping time. This means that stocks can be reduced from current levels of approximately seven to eight months to less than two months (assuming shipping time to be approximately 20 to 25 days, and including some additional stocks to act as buffer).

This strategy is not new. Getting suppliers to stock has been tried before in the industry. But this soon deteriorates into a "lose-lose" proposition. With plant efficiency in mind and

with visibility to forecasted sales (usually of six months), most plants run large batches of the needed SKUs. But if sales of some items fall, the plant would not have much time to correct production. So, time to time, suppliers got their fingers burned and got stuck with a large amount of unwanted inventory that the retailer refused to pick up. So, such deals have become uncommon. It is evident that merely holding stocks without changing manufacturing strategy will not help.

Vendor managed inventory can work only if the manufacturer implements "pull" based replenishment i.e. consumption based inventory creation rather than forecast based manufacturing. Under this system, when the retailer consumes stock from the plant warehouse, there would be an equivalent trigger for manufacturing. But this method calls for reduced batch sizes in production, and more change-overs to ensure that production responds rapidly to changing patterns in the offtake of retailers.

Low lead time offer for fast fashion:

In order to cater to the fast fashion segment, Indian suppliers have to make significant paradigm changes in three areas

1. Manufacturing Methods

2. Sampling and Design

3. Sales (Go-to-Market Approach)

1. Manufacturing Method

As discussed, customers sourcing fashion garments usually require orders to be serviced in short lead times. This necessitates suppliers' manufacturing strategy to move away from the existing practice of manufacturing in large batches to producing a wider variety in smaller batches. Theory Of Constraints method of planning and scheduling offers a way to enable this and crash lead time of manufacturing. However, adopting this methodology involves planning for some protective capacity. Manufacturing units will need this protection to buffer against potential capacity fluctuations due to erratic labor mobility, absenteeism or other uncertainties. This buffer will also help in rapid ramp up during style changes - one of the major sources of productivity losses in garment manufacturing.

2. Sampling and Design

Catering to fast fashion also requires excellent design and rapid sampling capabilities. Companies will, in essence, have to partner retailers in responding quickly to market fads and help them keep their offering fresh, as against the current practice of only manufacturing designs given to them. This not only involves offering trendy designs to buyers to choose from but also ensuring very short sample turnaround times. Samples will have to be presented frequently, feedback incorporated, and quickly resubmitted for approval. Implementing TOC flow processes in the sampling section can crash lead times for sample making. Garment and fabric sampling can also be decoupled to further reduce turnaround time.

3. Sales Approach

If they want to be in the fast fashion segment, suppliers will also have to move away from the prevalent practice of only meeting international retailers once or twice a year and securing orders for the forthcoming season. Instead, the sales team and designers will have to find a way to interact frequently, and work very closely with these firms. This will call for a geographical presence closer to the retailers. Indian manufacturers may also have to tie up with dedicated design firms to better understand Western fashion trends.

Role of Government

Using the discussed strategy, apparel companies in India can grow to earn a significant share of global market share. That having been said the government can also play a significant role, in accelerating this industry's ascent, by aiding in two major areas - land and labor reforms. Reliability, lead time, quality, and productivity issues in the country, to a small extent, also stem from inefficiencies in the domestic textile supply base. Most of the apparel companies in this industry are in the informal sector, small, and not vertically integrated. So to improve the industry's global standing, the government should help companies take advantage of economies of scale by entering the formal sector, and encourage investments in large vertically integrated plants. But for these to fructify, the government has to bring about the much needed land and labour reforms.

To sum it up!

To be competitive in the evolving global market scenario, Indian textile exporters have no option but to make a huge paradigm change. To edge out the competition, they have to move on from being "low-cost-mass-manufacturers" and become more 'agile'.

Comments