How GST Stands Today

By: Arun Kumar Singh

Much has changed, particularly for the textiles andapparel industry, since the goods and services tax (GST) regime was rolled outin July 2017. Arun Kumar Singh looks at the state of things.

The textiles-apparel industry is one of the oldest andlargest contributors to India's economy. As the second largest industry afteragriculture, the sector employs both skilled and unskilled people. The industrycontributes more than 14 per cent of the total annual exports, which is likelyto increase under the goods and services tax (GST) regime. This sector wasdoing well in the pre-GST era as well. With the rolling out of GST-which is nodoubt a daring step by the government to strengthen the economy-this sector,particularly apparel exports, has suffered a jolt.

Rate of GST ontextile goods:Knitted apparel and clothing falls under Chapter 61 of the harmonised system ofnomenclature (HSN) code under articles of apparel and clothing accessories.Apparel and clothing that are not knitted fall under Chapter 62 of the HSNcode. Other textile products like curtains, bedsheets and used clothes arelisted under Chapter 63 of that code under other made-up textile articles,sets, worn clothing and worn textile articles. Under all categories, any pieceof apparel or clothing is taxed 5 per cent GST if the taxable value of thegoods does not exceed ₹

Fabrics are classified under the first schedule of theCustoms Tariff Act, 1975, based on their constituent materials and attract auniform GST rate of 5 per cent. Garments and made-up articles of textiles underChapters 61, 62 and 63 attract GST at the rate of 5 per cent, when their valueis up to ₹

wipes, wet face wipes, PVC mats and reusable baby cotton nappies are classified differently.

Treatment of exports: As per the provisions contained under Integrated GST (IGST) Law, export of goods or services or both are to be regarded as 'zero-rated supplies' and a registered taxable person exporting such goods or services or both is allowed to claim GST refund paid under one of the following two options:

· Export of goods or services or both under bond or letter of undertaking (LUT) without paying any integrated tax; can claim refund of unutilised input credit.

· Export of goods and service or both on the payment of integrated tax; the exporter can claim GST refund.

Job work activity: The Central GST Act, 2017, defines 'job work' as any treatment or process undertaken by a person on goods belonging to another registered person and the word 'job worker' is construed accordingly. The tax rate on job work activity related to textile and textile products is 5 per cent. The responsibility of keeping proper accounts of the inputs sent for job work lies with the principal. Moreover, if the timeframe of one year for bringing back or further supplying the inputs is not adhered to, the activity of sending the goods for job work is deemed to be a supply by the principal on the day when the said inputs were sent out by him. It is the principal's responsibility to send the goods for job work and bring those back or supply.

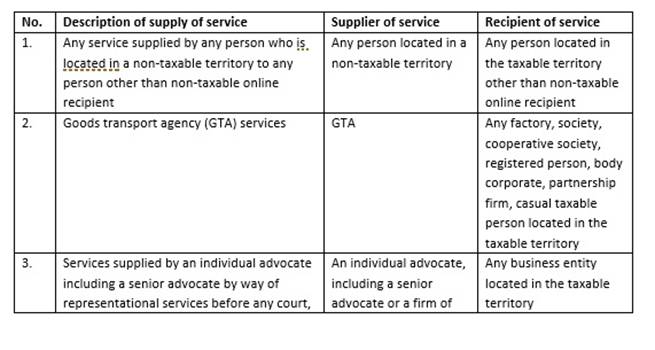

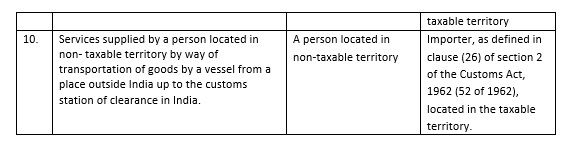

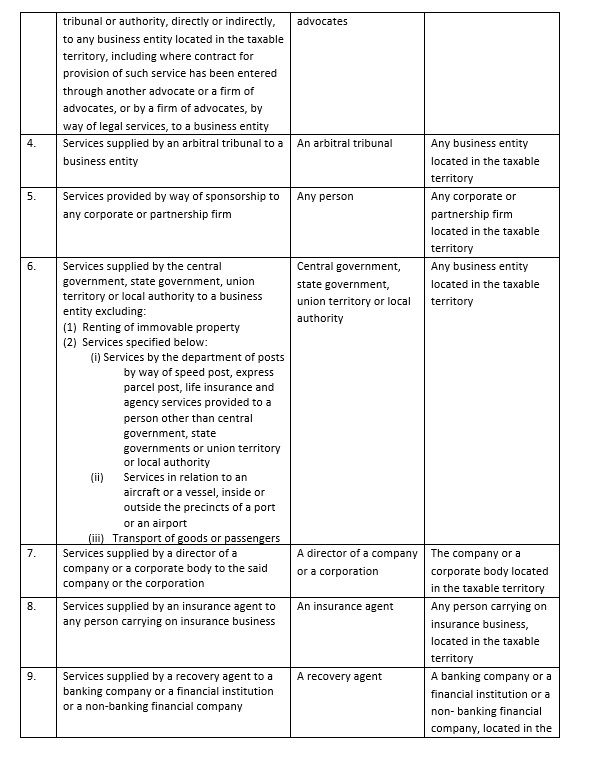

Duty liability under RCM: On a little activity of supply of goods or services or

both, the tax liability on taxable supplies to any other person other than the

supplier is with the recipient. The list of supply of services under reverse

charge system is as follows:

Duty liability under RCM: On a little activity of supply of goods or services or

both, the tax liability on taxable supplies to any other person other than the

supplier is with the recipient. The list of supply of services under reverse

charge system is as follows:

![]()

![]()

![]()

![]()

![]()

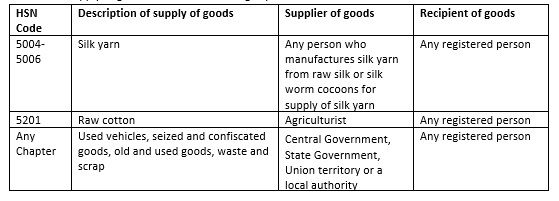

The list of supply of goods under reverse charge system is as follows:

E-way bill: The e-way bill is an electronic way bill for movement of goods to be generated on the e-way bill portal. For a person with GST registration, if the value of goods is worth more than ₹50,000 (single invoice/bill/delivery challan) and is made to or from a registered person, then the registered person or the transporter must generate an e-way bill. It should be generated when there is inter-state and intra-state movement of goods in relation to supply, reasons other than supply and inward supply from an unregistered person. An e-way bill is required even if goods are transferred from one vehicle to the other. A consolidated e-way bill is required for multiple consignments.

Input tax credit under GST: The CGST Act provides that a person with GST registration is entitled to take credit of input taxes charged on any supply of goods or services or both to him, which are used or intended to be used in the course or furtherance of his business. The said amount shall be credited to his electronic credit ledger. The provisions provide for the following:

(i) Only a person with GST registration is entitled to take input tax credit (ITC).

(ii) Input tax is available on all supply of goods and services equivalent to the amount of tax charged.

(iii) The aforesaid goods or services or both must be used or intended to be used either in course of business or in furtherance of business.

There are, however, certain restrictions to ITC under GST.

Refund of ITC: Refund is a very important aspect in the apparel sector. Most textile assessees export goods. The tax paid on input is more than the output tax liability or the same is accumulated due to zero-rated supply under letter of undertaking or bond. The assessee is entitled to the refund in case of zero-rated supply of goods or services made without payment of tax and refund is also given if credit has accumulated due to higher amount of tax on input and lower amount of tax on output supply.

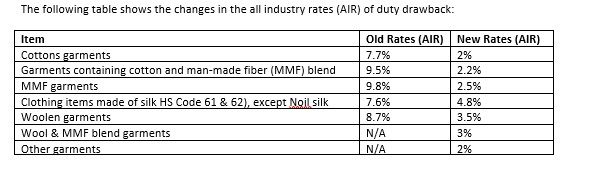

Duty drawback: Duty drawback is a refund in payments that were initially collected upon import of foreign-made goods; these payments could be for customs duties or other fees. The department of customs issues these refunds only when the imported merchandise is either exported or destroyed. Pre-GST duty drawback on the textile sector was on the higher side but after implementation of GST, the rate of duty drawback has been reduced.

Rebate of state levies: The ministry of textiles announced post-GST rates for rebate of state levies (RoSL) on export of garments and made-ups under AA-AIR combination and made-up textile articles. These rates were effective from October 1, 2017.

Comments