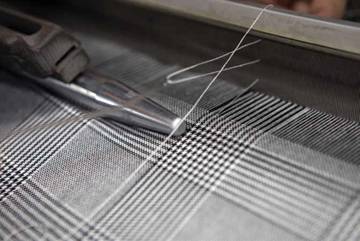

The way forward for manufacturers in South India is to take maximum benefit of the textiles heritage of the region and combine it with modern manufacturing techniques.

India's textiles and apparel sector is one of the oldest industries of the country's economy dating back several centuries. The industry continues to be a major participant in the country's economic growth in this century. In foreign trade, India's overall textiles and apparel exports during financial year (FY) 2017-18 stood at $37 billion and are expected to grow to $80 billion by 2025.

A major contributor to this growth will be and have been the southern states-Andhra Pradesh, Karnataka, Kerala, Tamil Nadu and Telangana.

Thalaiva of Textiles

South India in the last century has developed itself into a major textile hub, and Tamil Nadu has been at the forefront of this textiles revolution. The state alone represents 46 per cent of India's entire spinning capacity, 60 per cent of yarn exports, 20 per cent of weaving and 70 per cent of the knitted apparel production capability. The state has four major textile cities which carry the onus-Coimbatore, Tiruppur, Salem and Erode. These are the contributors to the growth in the state.

South India in the last century has developed itself into a major textile hub, and Tamil Nadu has been at the forefront of this textiles revolution. The state alone represents 46 per cent of India's entire spinning capacity, 60 per cent of yarn exports, 20 per cent of weaving and 70 per cent of the knitted apparel production capability. The state has four major textile cities which carry the onus-Coimbatore, Tiruppur, Salem and Erode. These are the contributors to the growth in the state.

Coimbatore, an industrial town in the western region of the state, is known as the cotton town. It has a flare of cotton production because of its rich black soil which suits cotton growing. The city is also known as the Manchester of South India and manufactures blended and cotton yarns. The spinning industry is well supported by a strong weaving base which consists of 15-20 largescale weavers including Akshaya Textiles, Gobald, KPM Textiles, KG Denim, Prime Textiles, Southern Textiles, Hindustan Textiles, Lakshmi Mills, Gangotri and Premier.

About 50 km to the east of Coimbatore, the town of Tiruppur is known as the knit city and has many cotton ginning units that cater to the main cotton markets of Tamil Nadu. Tiruppur contributes more than 45 per cent of knitwear exports from India. The products produced by the manufacturing units in the town generally include cardigans, t-shirts, jerseys, undergarments, pullovers, blouses, skirts, sportswear and trousers. These knitwear units form 80 per cent of the total exports from Tiruppur.

These units are usually largescale units that have a vertical integration. The raw material for these units is the yarn manufactured by the spinning mills of Coimbatore and the conversion of this yarn to knitted garments are undertaken in the garment manufacturing units. This type of business model helps manufacturers to have a strong hold on the supply chain and keep themselves cost-effective.

The state is well equipped in almost all the segments of the textiles value chain. The historic presence of textiles ecosystem in the state supports further growth and development of the textiles industry. However, the ageing technology, low availability of trained labour and non-adherence to international compliances tend to inhibit this growth of the industry.

Apparel Export Cradle

Karnataka is an all-rounder in the production of textiles and apparel. However, the state is primarily focused on apparel production and contributes 20 per cent to the garment production in the country with the presence of over 6,500 units. The state is also responsible for 8 per cent of the national exports in the textiles sector and 35 per cent of the country's raw silk production. Silk exports account for 24 per cent of the silk goods export value at the national level. The state also contributes 11 per cent of the country's total wool production and 6 per cent of the cotton production.

Industrial production, export earnings and employment generation has made textiles a key sector in the economy. Karnataka also has an upper hand as many brands have their headquarters situated in state capital Bengaluru. Apart from this, the state is home to several large garment manufacturing companies including Raymond, Shahi Exports, Gokaldas Exports, Texport Industries, etc.

Industrial production, export earnings and employment generation has made textiles a key sector in the economy. Karnataka also has an upper hand as many brands have their headquarters situated in state capital Bengaluru. Apart from this, the state is home to several large garment manufacturing companies including Raymond, Shahi Exports, Gokaldas Exports, Texport Industries, etc.

Karnataka may not be as well-equipped as Tamil Nadu in all the segments of the textiles value chain, but the presence of organised players and largescale investments puts it in a strong position among other textile manufacturing states.

The Budding State

Andhra Pradesh, the sunrise state, is the eighth largest and rapidly urbanising state of India. It possesses a large raw material base and is one of the largest cotton producer and second largest producer of raw silk. The state has a presence in the entire textiles value chain starting from raw material to manufacturing of apparel. Well-developed ginning and spinning facilities are spread across the state which makes it one of the leading producers of cotton (22 lakhs bales) with a 6 per cent share in total production of the country.

West Godavari, Krishna, Guntur, Prakasam and Chittoor districts complete the rest of the value chain with the presence of weaving, hosiery and spinning mills. Andhra Pradesh is home to 145 spinning mills with a combined capacity of 3.6 million spindles which accounts for 7 per cent of India's total spindlage and produces approximately 380 million kg yarn per year.

Even with such a strong raw material base and a well-established spinning industry, Andhra Pradesh has an under-established weaving infrastructure with nearly 12,000 operational powerloom units. Moreover, the state does not have a major presence in fabric processing and garment manufacturing. The underdevelopment of these segments of the textiles value chain can be attributed to the huge exports of the yarn manufactured in the state. The local unavailability of yarn poses a challenge to the industry, but government support and the industrial growth of the state makes up for it.

Even with such a strong raw material base and a well-established spinning industry, Andhra Pradesh has an under-established weaving infrastructure with nearly 12,000 operational powerloom units. Moreover, the state does not have a major presence in fabric processing and garment manufacturing. The underdevelopment of these segments of the textiles value chain can be attributed to the huge exports of the yarn manufactured in the state. The local unavailability of yarn poses a challenge to the industry, but government support and the industrial growth of the state makes up for it.

There are more than 600 garment manufacturing facilities spread across the state, representing some of the biggest names in the business, such as Shahi Exports, Texport Industries, Gokaldas Exports, Page Industries, Loyal Textiles, NSL Textiles, Brandix, etc. These facilities are mainly located in the Anantapur, Chittoor, Nellore and Visakhapatnam districts.

Andhra Pradesh is well equipped in supplying manpower to the industry with 70 per cent of the working population ready to be employed. The government has set the minimum wage at ₹6,300 per month for semi-skilled workers engaged in garment manufacturing. Two of the three deep draft ports-Visakhapatnam and Gangavaram-are around 40 km from the state's major apparel manufacturing cluster. Due to these factors, in the span of just five years, the Andhra garment industry has attracted an investment of approximately ₹2,000 crore, which is highest among all the other segments of the textiles value chain.

Weavers' Lost Paradise

Kerala-God's own country as it is popularly known-was a major textile producing state in the previous century. With the presence of over 500,000 weavers back in the late 20th century, the state contributed significantly to the country's weaving prowess, but at present the contribution of the state in India's textiles produce is not significant. Earlier, the weavers in the state were well-supported by the yarn supply from the rich spinning base of Tamil Nadu.

However, due to the emergence of powerlooms and development of Tiruppur, the weavers of Kerala had to give up to the modern technology and consumption pattern. Another reason for the decline of its weaving industry is the absence of the entire textile value chain. Moreover, the state lacks a dedicated textiles investment policy that could attract new investment.

The textiles and apparel industry is not showing any sign of revival. However, a well-planned textiles policy could change the scenario and may make manufacturing in the state profitable. Moreover, the state could leverage the presence of textile industries in the other four southern states.

New Kid on the Block

After gaining the stature of an independent state in 2014, the newest state of India has placed itself as a major hub for textiles and apparel. Telangana is known for its production of long staple cotton, with an annual production of around 60 lakh bales. However, processing and value addition to cotton in the state is largely limited to ginning and pressing.

The 35 spinning mills present in the state that have a capacity of 9.3 lakh spindles consume roughly 10 lakh bales of the total produce. Accounting for its weaving industry is the presence of 49,000 powerlooms. Out of these, about 36,000 powerlooms are concentrated in the industrial town of Sircilla. The state lacks the presence of a strong garment manufacturing base which breaks the value chain link.

The 35 spinning mills present in the state that have a capacity of 9.3 lakh spindles consume roughly 10 lakh bales of the total produce. Accounting for its weaving industry is the presence of 49,000 powerlooms. Out of these, about 36,000 powerlooms are concentrated in the industrial town of Sircilla. The state lacks the presence of a strong garment manufacturing base which breaks the value chain link.

Outdated weaving technologies, lack of backward and forward linkages, shortage of credit support, dependence on middlemen, absence of product diversification, are some of the common problems. But on the contrary, the availability of raw material and trained manpower native to the state present an opportunity for setting up new businesses.

Policy Support

Taking all five southern states into consideration, the policy support in South India for textiles and garment manufacturing is very attractive. Both Telangana and Andhra Pradesh have policies that have been widely lauded by the industry. The Telangana Textiles and Apparel Incentive Scheme 2017 and the Andhra Pradesh Textiles and Apparel Policy 2015-20 offer various incentives for establishing new setups.

Tamil Nadu also announced an integrated textiles policy in 2019 in order to provide a supportive ecosystem and compete with the factories that are coming up in other states. Karnataka, in its previous policy offered various subsidies, and is in the process of introducing a fresh policy in the coming months that is expected to offer benefits better than the previous policy.

The Fatal-5 Issues

Although these five states have a history of manufacturing textiles and apparel, there are a few issues that are persistent and can potentially threaten the current growth trend of the industry. These can be broadly categorised into five fatal problems:

1. High labour cost: The textiles industry, especially garment manufacturing, is fairly labour-intensive. The expenses borne by a company on the muster roll can make or break the profits of the company. Although, most of these states have comparatively low wages, Karnataka in particular has high minimum wage and the fact that the state is primarily into garment manufacturing, makes it a difficult business.

2. Lack of automation: The industry in these states being predominantly old, faces the problem of ageing of technology and lack of automation. A way to tackle high wages is to minimise the human interaction with the manufacturing process. In textile processes, this can be achieved by bringing in newer technologies. However, for garmenting, the process is not as straight-forward.

3. Lower efficiency levels: An extension of the second problem-lower efficiencies in textiles can be attributed to obsolete technologies and poor quality of raw material. On the other hand, efficiencies in garment manufacturing are a function of the worker efficiencies as well as the process efficiencies. However, the solution to these low efficiencies cannot be brought about by just upgrading the technology being used, and requires individual skill enhancement and training.

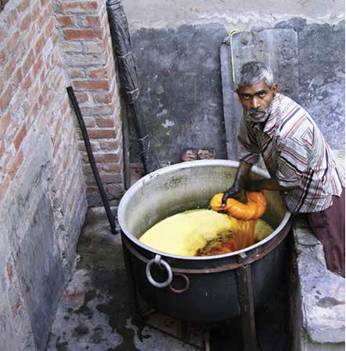

4. Increasing focus towards compliance and sustainability: In order to bring about a change in how ethically clothing and related products are made, a majority of international buyers have come up with stringent compliance policies that have to be adhered. Since these South Indian states predominantly manufacture for the purpose of exports, a lot of manufacturers need to modify their manufacturing setups to make them compliant.

5. Lack of product development: Product design and development is a major aspect of production that most manufacturers overlook. Although, the problem is faced by the entire country's textiles and apparel industry, a few of the southern states including Karnataka and Tamil Nadu (Tiruppur) are engaged in mainly manufacturing commodity products that lack innovation and product design. This may be part of the business model that the industry is following in these regions, but in a longer run this production model could become unsustainable and result in the collapse of the industry.

Engineered Approach

As captured in this article, the textiles and apparel manufacturing industry in South India is huge and has a rich history associated with it. Ironically, even though the industry here is old, it presents limitless investment opportunities across the value chain, especially in garment manufacturing. Raw material availability and huge installed capacities in ginning, spinning and weaving/knitting, have been identified as the strong suit of these southern states. Also, it has been established that the manufacturing in these states is plagued by a few issues that remain persistent across the manufacturers in the region. Most of the fatal-5 issues are mainly faced by the garment manufacturers of the region. But the potential of this huge industry can be tapped by simply improving upon the ways that garments are being manufactured.

The industry requires factories that are engineered in a way that they minimise their input, maximise their utilisation and realise their profits well-factories that have trained manpower, optimum technology, ideal infrastructure and rationally designed processes. These engineered factories at the moment are almost a rarity in India, let alone South India.

The industry requires factories that are engineered in a way that they minimise their input, maximise their utilisation and realise their profits well-factories that have trained manpower, optimum technology, ideal infrastructure and rationally designed processes. These engineered factories at the moment are almost a rarity in India, let alone South India.

An engineered factory is one that is built upon the four pillars-organisation, technology, infrastructure and processes. An engineered factory should be able to tackle all of the above mentioned fatal-5 issues with ease with its unique features:

1. Low man-to-machine ratio (MMR): A low MMR ratio helps bring down the number of workers / personnel required by any manufacturing setup to undertake a certain work. An engineered factory develops its processes in such a way that workers are placed in critical positions and the number of workers allocated for non-critical tasks is kept minimum. This reduces the overall manufacturing cost for the organisation.

2. Maximum usage of low cost automates and work-aids: An engineered factory adopts the maximum use of automates, wherever required. Automation does not only imply the use of futuristic concepts like Industry 4.0, but it can be realised by the use of simple work-aids. The use of such automates and work-aids do not just result in an increase in efficiency, but are also cost-effective.

3. Low efficiency levels: The biggest reason for low efficiency in the Indian garment manufacturing industry is the lack of appropriately skilled workforce. An engineered factory employs workers that are specially trained for specific tasks for garment manufacturing. Through a skilled workforce, a garment manufacturing unit can achieve an increase in overall efficiencies by over 20 per cent. Also, an engineered factory employs the use of lean tools and ideologies like right-first-time (RTF) and quick changeover (QCO), which further give a boost to the efficiency.

4. Compliance: An engineered factory is designed keeping in mind the safety, health and environment compliance norms. Aligning a manufacturing unit with these norms automatically ensures that the factory adheres to the demands of major international buyers.

5. Competitiveness: An engineered factory leverages all the cost-effective measures and techniques to achieve competitiveness. With a cut-to-ship ratio of up to 99 per cent for basic products, a company can realise the gains for product development and cater to diversified needs of buyers. The way forward for the manufacturers in South India is to take maximum benefit of the textiles heritage of the region and combine it with modern manufacturing techniques. This will help develop manufacturing establishments that are capable of competing with other countries and at the same time can meet the increasing domestic market demand in the country.

Comments