The garment exports sector of Cambodia stands strong and many opportunities lie ahead. A Market Intelligence (MI) report from Fibre2Fashion.

Cambodia, a member of ASEAN (Association of Southeast Asian Nations), is a leading garment exporter-it stands ninth among the top garment exporters. The sector has been playing a leading role in the economy of Cambodia since 2010, accounting for 60 per cent of the country's total merchandise exports in 2018. The sector is a major contributor to the country's GDP.

Cambodia's Garment Exports Sector

Cambodia's garment export value was $8,367.0 million in 2018-an increase of 17.1 per cent over the previous year. China's garment export value diminished slightly in the same period. In 2018, the EU, US, Hong Kong, China and Canada were the main garment export destinations. In terms of value, 52.0 percent of the garment production were exported to ten countries. Among these top importing countries, the demand of Russia and China have increased by 26.0 and 13.0 per cent respectively, while it has dropped in Hong Kong, China and the UAE (United Arab Emirates) by 6.0 per cent each.

Source: ILO And TexPro

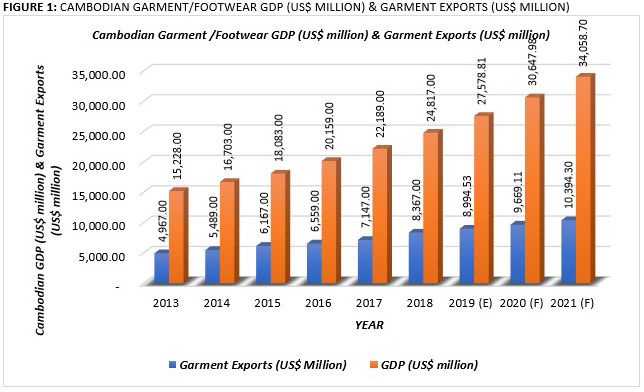

Between 2013 and 2018, Cambodia's garment exports have shown a sizeable gain with a CAGR of 11.0 per cent-from $ 4,967.0 million to $ 8,367.0 million. This is expected to increase to $10,394.3 million in 2021 with a decent CAGR of 7.5 per cent over 2018. The sector has contributed significantly to the creation of new jobs in the country. The EU and US are the largest export destinations, but the forecast may drop as Cambodia is under review by the EU and US over duty-free access of Cambodian imports.

Factories and Related Investments

Source: ILO And TexPro

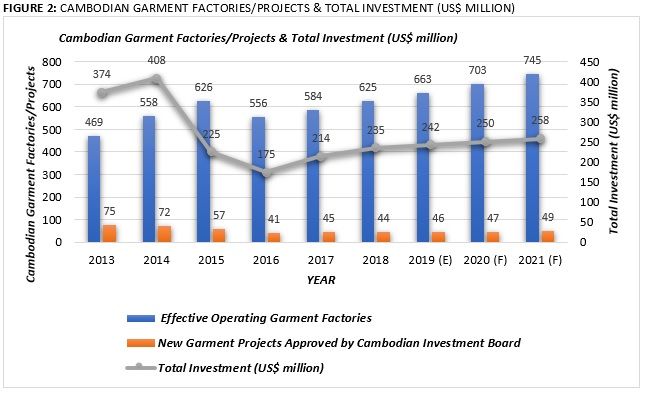

By the end of 2018, the number of operational garment factories in Cambodia rose to 625 from 469 in 2013, witnessing a growth of 33.3 per cent. A sharp drop had been observed in 2016 (556), but the sector recovered in 2018. The number is expected to increase to 745 by the end of 2021, with a CAGR of 6.0 per cent. The Cambodian Investment Board has been planning a number of projects for the development of the sector. Investments for projects had dropped in 2015 and 2016, but was back on track in 2017, increasing to $235 million in 2018. The figure had jumped by 34.3 per cent in two years. This may reach $258 million in 2021, with a CAGR of 3.2 per cent.

Figure 3: Cambodian Garment Exports (Us$ Million)

Source: ILO and TexPro

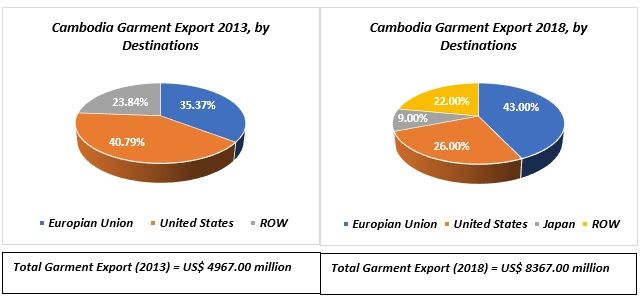

In 2013, the US was the largest garment export destination for Cambodia with an export share of 40.8 per cent followed by the EU and Japan. The slant has since shifted-in 2018, the EU became the largest garment export destination for the country with an export share of 43.0 per cent followed by US and Japan with 26.0 and 9.0 per cent respectively.

Source: ILO and TexPro

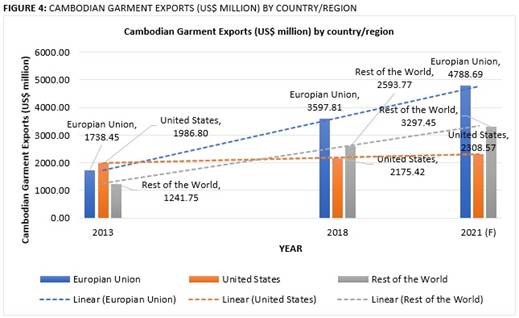

The growth rate of Cambodian garment exports to the EU has remained high. The CAGR of garment exports to the EU was 15.7 per cent between 2013 and 2018, while the CAGR of garment exports to the US diminished to 1.83 per cent. The growth of Cambodian garment exports to Rest of the World (RoW) also remained significant with a CAGR of 15.9 per cent.

Garment exports to the EU, US and RoW are expected to grow at CAGR of 10.0, 2.0 and 8.3 per cent to $4,788.7 million, $2,308.6 million and $3,297.5 million in 2021 from $3,597.8 million, $2,175.4 million and $2,593.8 million in 2018 respectively.

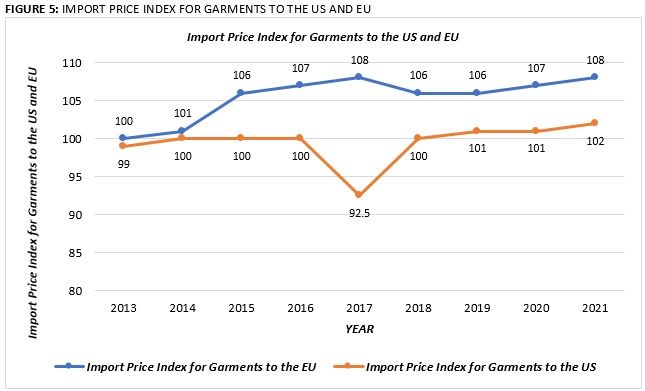

Garment Import Prices

The prices of garments imported by the US and EU remained stable between 2012 and 2014. In 2018, garment prices to the EU increased by 2 per cent. The price rise in the US, however, was negligible in 2018 compared to the baseline of 2012.

Source: ILO and TexPro

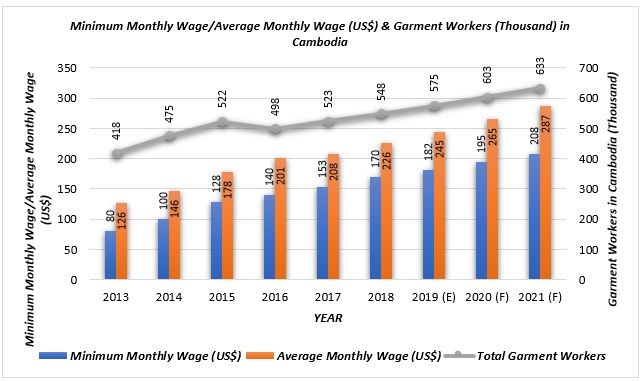

Employment and Wages

The minimum monthly wages and average monthly wages of garment workers have been rising since 2013, reaching $170 and $226 in 2018 with a CAGR of 16.3 and 12.4 per cent respectively. These are forecast to reach $208 and $287 in 2021 with a CAGR of 7.0 and 8.3 per cent respectively.

Source: ILO and TexPro

The Ministry of Labour and Vocational Training (MoLVT) has reported an increase in the statutory minimum wage in October 2018, after the negotiations with unions, employer's representative and the Labour Advisory Committee (LAC). The statutory minimum monthly wage for 2019 is $182, representing an increase of 7 per cent from $170 in 2018. From 2017 to 2018, the minimum wage of a worker grew from $153 to $170 showing an increase of 11.1 per cent.

According to employment data from the Ministry of Commerce (MoC) of Cambodia and ILO (International Labour Organization) as of December 2018, the employment count in the garment sector stood at 548,000. This represents an increase of 4.9 per cent, a slightly higher growth compared to the 4.8 per cent growth in 2017.

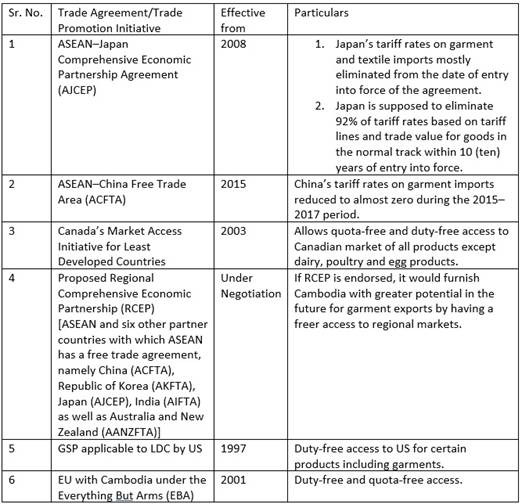

Policy Developments to Boost Sector

First, a new minimum wage law was introduced in Cambodia in July 2018, following its adoption by the country's parliament in June 2018. It has the following objectives:

a. to ensure the minimum wage fixing for all workers under minimum wage law for all persons covered by labour law (i.e. to expand minimum wage coverage beyond the current scope of applicant to the garment sector);

b. to establish a scientific minimum wage fixing procedure based on social and economic criteria;

c. to establish a new National Minimum Wage Council as a tripartite mechanism for research and recommendations on minimum wage and other benefits of all persons covered by Cambodia's labour law.

Second, in September 2018, the MoLVT issued a Prakas (a ministerial regulation) on the payment given as seniority indemnity. This took effect in 2019. Under this scheme, qualified workers would get indemnity pay equal to 15 days of their wage and benefits per year with regular pay-outs in the months of June and December. The Prakas was issued since bankrupt employers in Cambodia were found wanting on their obligation to pay workers.

The MoLVT has also issued a Prakas on wage disbursement. From January 1 this year, wage payments would be done twice per month. The first half of the net monthly salary would be paid in the second week of each month and remaining in the fourth week of that month.

Meanwhile, a healthcare MoU had been signed between the National Social Security Fund (NSSF) and the Techo Volunteer Youth Doctor Association, for garment workers in April 2018. According to the MoU signed, the healthcare services will be provided to citizens who qualify for social security including garment workers.

Source: ILO and TexPro

Challenges Ahead

In October 2018, the European Union sent a notice to the government of Cambodia over the launch of a process to withdraw country's duty-free and quota-free access under the Everything But Arms (EBA) scheme. The process is of 18 months which has already begun since February 2019. The European Commission and the European External Action Service (EEAS) visited the country in March and June this year and discussed the matter with the government and civil society organisations, besides UN and ILO representatives. The monitoring and evaluation were carried out in mid-August. After that, the EU will provide the report with discussion and examination findings with all conclusions. The Cambodia government must reply within the following month; then, a final decision will be taken over the withdrawal of tariff preferences. Any withdrawal would come into effect after a further six-month period. No tariffs will be revoked before mid-2020.

Meanwhile, United States Trade Representative (USTR) and Department of State delegations visited the country to discuss bilateral trade issues and the labour situation. The delegations were said to be looking into the potential of removing Cambodia from the US' Generalized System of Preferences (GSP), a preferential trade scheme that grants tariff and quota-free status to exports. The USTR, the agency responsible for advising the US President on trade policy, is believed to be weighing whether to launch a review of Cambodia's GSP status because of the alleged poor labour rights' conditions.

Comments