The Central Asian country of Uzbekistan is both a leading cotton producer as well as exporter. The government there has been taking a lot of initiatives to boost domestic consumption of cotton. A Market Intelligence (MI) report from Fibre2Fashion

Uzbekistan is listed among the top cotton producers and exporters in the world. Since the marketing year (MY) 2016-17, the country has been reducing its targeted cotton planting area and cotton production. The cotton planted area in MY 2019-20 is expected to be about 1.06 million hectares (mha) with expected cotton production of about 729,080 metric tonnes.

Also, the domestic cotton consumption of the country has been growing year-on-year (YoY) with new investments, which has been diminishing the cotton exports. In MY 2019-20, the estimated domestic cotton consumption of Uzbekistan reached 649,907 metric tonnes and cotton exports plunged to 174,180 metric tonnes as the government focused on exports of cotton yarn, fabric and textiles with new investments, technologies and policies.

Figure 1: Uzbekistan Cotton Production (Metric Tonnes)

Source: TexPro

Uzbekistan cotton production has been showing a regular decline due to the planning made by the Uzbekistan government, implemented since MY 2016-17. The domestic cotton production of Uzbekistan was 936,215 metric tonnes in MY 2013-14. It dropped to 801,226 metric tonnes in MY 2017-18 with the CAGR (compound annual growth rate) of 3.8 per cent. It is anticipated to show a further decline at the rate of approximately 2 per cent to drop to 755,873 in MY 2020-21.

The government of Uzbekistan has planned to reduce the cotton planting area by 185,000 hectares (ha) as many field yields were lower than the country average. These consist of salinised and mountain regions where the growth of other crops could be facilitated. Once cotton planted areas decrease, the land could be allotted to other crops such as vegetables, orchards, fruits, vineyards, etc, with better yields as compared to cotton in the region. Also, some additional new cash crops have been introduced for farmers in smaller areas. It includes soybeans, saffron, chili peppers, potatoes, grains, etc.

Uzbekistan has been following the plan of cutting cotton plantation area over the last three years, starting from MY 2016-17. The plan was made to achieve the targeted final planting area of 1 million ha by the end of MY 2020-21. As per the plan of the government, approximately 37,500 ha of cotton planting area would be reduced in MY 2019-20. Hence, the cotton planted area in MY 2019-20 would be about 1.06 million ha.

Table 1: Reduced Cotton Planting Area, Year-Wise

|

SR. NO. |

MARKETING YEAR |

REDUCED COTTON PANTING AREA (Hectares) |

|

1 |

2016-17 |

30500 |

|

2 |

2017-18 |

50000 |

|

3 |

2018-19 |

35000 (Additional 20000), Total - 55000 |

|

4 |

2019-20 |

37500 |

|

5 |

2020-21 |

30000 |

Source: TexPro

In MY 2018-19, the government had planned a reduction of 35,000 ha, but the government had reduced additional 20,000 ha for further better opportunities of business growth. In MY 2019-20, farmers have already started cotton plantation with limited rains during winter months and in the month of March. But mild winter with little rain and snow may cause water scarcity during the season and may steer pest problems.

The Uzbekistan government is also planning to implement a new concept of fully integrated cotton-textile clusters for cotton and textile production in order to achieve strong and organised supply chain and value chain in the sector with high foreign investment. These privately-run clusters are expected to bring new technologies such as drip irrigation, machine picking, and modern ginning. The modern cotton harvesting would be promoted through both imports and domestic production. The country has planned to expand drip irrigation area for cotton by 25,000 ha in the coming years. They are more focused on improving seed quality and manufacturing quality cotton yarn and fabrics. The drip irrigation would save water and prevent soil salinity, an increase in mechanical picking would lower picking cost, and modern gins would support to improve ginning rates and reduce ginning cost.

Textile clusters can also trade and export cotton as needed. In MY 2019-20, the number of clusters is expected to increase to 58, which would cover 30 per cent of the cotton planted area. As announced by the president of Uzbekistan, there were only 15 clusters in 20 districts in MY 2018-19 which covered 164,000 ha of cotton production. The government has planned to form 80 clusters which can control the overall cotton planting and processing in the country.

In order to increase the efficiency of cotton textiles production, government has modernised the 98 government-owned gins in recent years. In MY 2018-19, 15 gins were under the newly-formed clusters. Additional 43 gins would be leased by the clusters in current marketing year. Eventually, all gins would become a part of cluster system. The government of Uzbekistan and the newly-formed clusters have together made an effort to buy new modern gins with modern technology to improve the ginning efficiency.

Uzbekistan also has an extensive cottonseed breeding and research programme. In recent years, it was found that about half of the planted seeds were early-ripening types such as Sultan and Namangan-77. These varieties have better yields and resistance to various common diseases. Except these cottonseed varieties, 1/3rd are mid-ripening including Bukara 6, Bukara 8 and Bukhara-102. The new varieties such as Porloq has better fibre quality.

|

Type of Resource |

Resource Components |

Supply Source |

Level and Components of Interaction |

Conditions for Better Efficiency |

|

Human |

Manpower: workers specialists office workers |

labour market including the one inside cluster universities colleges personnel training department of enterprises |

internal environment of cluster main interaction direction “education infrastructure - textile industry” interaction with other cluster participants |

manpower requires consolidation of efforts of cluster participants synergy effect is possible |

|

Material |

plant raw materials (cotton fibre) yarn, dyes, auxiliary substances and materials |

ginning factories chemical and petrochemical enterprises textile enterprises |

internal environment of cluster interaction levels: raw material suppliers auxiliary materials suppliers inside textile industry by production processes |

more efficient use assumes higher quality of supplies |

|

Facility and Equipment |

textile production machinery technologies spare parts |

textile machine engineering plants instrument making plants |

internal environment of cluster interaction level: supplier of machinery |

long-term established links result in better production planning |

|

Energy |

electricity, heat, steam, water, gas, black oil |

power plants oil and gas industry |

internal environment of cluster main interaction level: innovative infrastructure interaction with other cluster elements |

more efficient use of energy is possible at expense of applied energy saving technologies |

|

Innovation |

Know-how: Patents Licenses Developments Technologies |

research institutes design bureaus scientific production associations university research divisions technology transfer offices techno-parks |

R&D potentials requires consolidation of efforts of cluster participants Synergy effect is possible | |

|

Information |

IT: Software Services |

telecommunication enterprises information centres universities IT companies |

Internal and external environment interaction level: information infrastructure interaction with other cluster elements |

more efficient use of information resources requires consolidation of efforts of cluster participants synergy effect is possible |

|

Finance |

Cash Loans State budget Debt capital |

Banks Financial companies Investment funds Government Enterprises |

internal and external environment interaction level: financial-credit infrastructure interaction with other cluster elements |

consolidation provides easier access to financial resources due to higher credibility synergy effect occurs automatically |

Source: 'Uzbekistan: Forming a cluster strategy for textile industry development'; D Ilyafruz Nasirkhodjaeva, Institute of Economics, The Academy of Sciences, Uzbekistan

Textile clusters-A strategic tool to flourish textile production

Usually, this tool is used in developed countries for implementing industrial development policy in the region or the entire country / state in order to enhance the competitiveness of industrial sector.

• It offers favourable and cheap access to specific production factors such as technology, qualified personnel, etc.

• It allows to accumulate specific and significant information / knowledge and reduce expenditures.

• It ensures compatibility and speed of activities which would increase quality and efficiency.

Source: TexPro

Uzbekistan cotton consumption has been showing regular increase since MY 2016-17. The local cotton consumption of Uzbekistan was 344,500 metric tonnes in MY 2013-14. It increased to 500,766 metric tonnes in MY 2017-18 at a CAGR of 9.8 per cent. It is anticipated to show a further rise to reach 701,900 in MY 2020-21 at a rate of 11.9 per cent.

Uzbekistan has planned rapid and continued growth in domestic cotton consumption. The domestic cotton consumption in MY 2018-19 was 566,083 metric tonnes and is projected at 649,907 metric tonnes in MY 2019-20. At present, approximately 500 companies are engaged in cotton textile production in Uzbekistan.

Initiatives to increase domestic consumption

1. Supporting new partnerships to increase the domestic use of cotton

2. New textile investments have been approved

3. Plan to start operations with 10 new mills in 2019

4. Growing capacities of existing mills

The government has planned to utilise all local cotton production domestically by the end of MY 2020-21. As mentioned, Uzbekistan has been increasing the implementation of the new textile clusters to vertically integrate the sector. With the help of new cluster system, the government would support foreign companies through tax reliefs, custom benefits, and land provision to grow and process cotton to produce final garments.

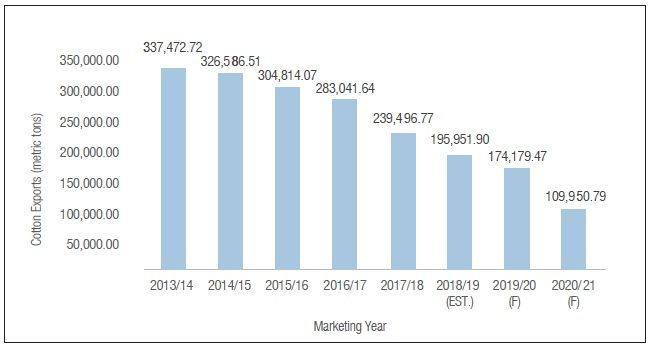

Uzbek cotton exports have been showing a regular decline from MY 2016-17. Uzbekistan cotton export was 337,473 metric tonnes in MY 2013-14. It went down to 239,497 metric tonnes in MY 2017-18 at a CAGR of 8.2 per cent. It is anticipated to show a further decline at the rate of approximately 22.9 per cent to reach 109,951 metric tonnes in MY 2020-21.

As Uzbekistan has increased its domestic cotton consumption, the country's exports of cotton yarn, textiles, and readymade garments have increased. Initially, CIS (Commonwealth of Independent States) countries were the significant markets for Uzbekistan cotton textiles. Countries such as China and Russia, who were major importers of Uzbekistan cotton, are now mostly importing Uzbekistan cotton yarn and textile products.

Impact of trade agreements

The Uzbekistan government has signed an agreement with the European Union, which went into force in June 2017, and reduced the tariff for Uzbek textile goods. This agreement facilitated the exports of Uzbekistan cotton textiles in the European Union. Also, Uzbekistan has signed an agreement with Georgia on mutually reducing railway shipping charges. It will ease the country's utilisation of newly opened railroad which connects Baku, Azerbaijan through Tbilisi, Georgia, to Kars, Turkey. The new railroad track would increase export of cotton and products from Central Asia, including Uzbekistan, to Turkey and beyond.

The burgeoning domestic consumption has limited Uzbekistan's cotton exports. The US decision to lift Uzbekistan cotton ban would also not impact the nation's cotton exports as the government has planned to increase domestic consumption.

The Uzbekistan government introduced an electronic platform for cotton trading from calendar year 2018. Bangladesh and China are the major importers of the Uzbekistan lint cotton. The other export destinations for Uzbek cotton are Iran, Belarus and Turkey.

Uzbek cotton yarn and fabric exports have been showing continuous rise since calendar year 2016. In 2013, Uzbekistan cotton yarn export was 128,712 metric tonnes. It increased to 265,867 metric tonnes in 2018 at a CAGR of 15.6 per cent. It is anticipated to show a further rise to reach 416,744 in 2021 at a rate of 16.2 per cent. In 2014, Uzbekistan's cotton woven fabric export was 89.6 million sq m (MM2). It increased to 220.5 MM2 in 2018 at a CAGR of 19.3 per cent. It is anticipated to show a further rise to reach 398.0 MM2 in 2021 growing at a rate of 21.8 per cent.

The raw cotton is limited for exports, but the export of Uzbekistan cotton yarn and textiles has been increasing. China and Russia were leading importers of Uzbek cotton yarn in MY 2018- 19. Now, Uzbekistan has become one of the leading suppliers of cotton yarn to Turkey. Other export destinations of Uzbek cotton yarn in MY 2018-19 were Belarus and Iran. Uzbekistan continued to be the leading supplier of cotton fabrics to Russia. Poland, Korea, Kazakhstan, Germany, Belarus and China are also the major importers of Uzbek cotton fabric.

Comments