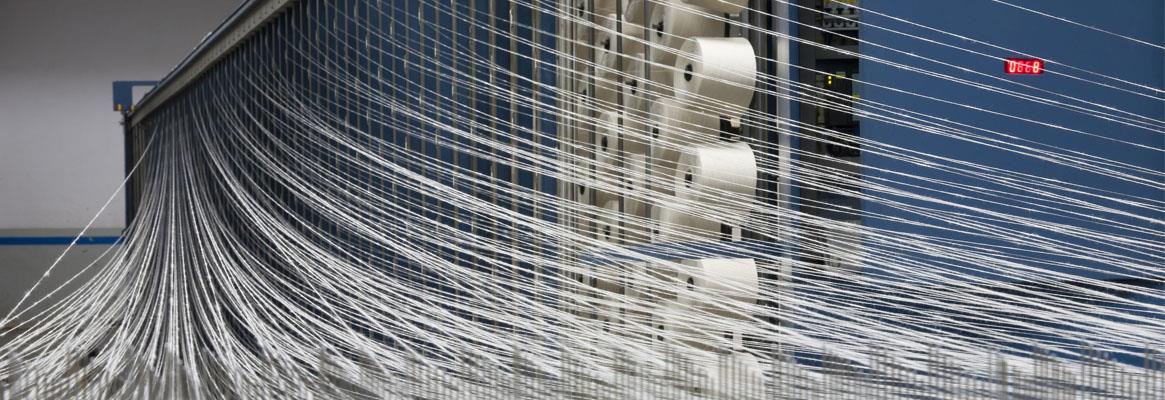

The textiles and apparel industry of South Korea has been showing a continuous growth since 2017 after the significant drop between 2014 and 2016. A Market Intelligence report from Fibre2Fashion.

The overall textiles and apparel trade of South Korea was $26.60 billion in 2016 and reached $30 billion in 2018 with a growth rate of 12.78 per cent. The total trade increased by 8.30 per cent in 2018 over the previous year. It is expected to reach $31.36 billion in 2021 with a CAGR of 6.19 per cent over 2018.

Fig 1: South Korean Textile & Apparel Exports ($billion) and Imports ($billion)

Source: CCF GROUP & TexPro

The total textiles and apparel exports of South Korea was $13.30 billion in 2016 and reached $13.70 billion in 2018 with a growth rate of 3 per cent. Exports moved up by 2.23 per cent in 2018 over the previous year. It is expected to reach $14.32 billion in 2021 with a CAGR of 1.5 per cent over 2018.

The total textiles and apparel imports of South Korea was $13.30 billion in 2016 and reached $16.30 billion in 2018 with a growth rate of 22.56 per cent. Imports surged by 13.99 per cent in 2018 over the previous year. It may reach $17.04 billion in 2021 with a CAGR of 10.70 per cent over 2018.

Textiles & Apparel Exports: Breakups

South Korea's major exports in terms of ITC HS codes (Indian Trade Clarification - Harmonised System) are 60 (knitted or crocheted fabrics), 54 (man-made filaments; strip and the like of man-made textile materials), 55 (man-made staple fibres), 59 (impregnated, coated, covered or laminated textile fabrics; textile articles of a kind suitable for industrial use) and 62 (articles of apparel and clothing accessories, not knitted or crocheted). These product segments contributed 78 per cent to the total textiles and apparel exports in 2018.

Fig 2: South Korean Textiles & Apparel Exports by ITC (HS) Codes, 2018

Source: CCF GROUP & TexPro

In South Korea's textile and apparel exports, the product segments attained major export growth in 2018 compared to 2017 were 53 (other vegetable textile fibres; paper yarn and woven fabrics of paper yarn), 56 (wadding, felt and nonwovens; special yarns; twine cordage, ropes and cables and thereof), 62 (articles of apparel and clothing accessories, not knitted or crocheted), 55 (man-made staple fibres) and 54 (man-made filaments; strip and the like of man-made textile materials) with a growth rate of 32.50 per cent, 8 per cent, 7.50 per cent, 16 per cent and 3.5 per cent respectively.

South Korea's major textiles and apparel export destination countries are Vietnam, China, the US, Japan, Turkey and Hong Kong. These countries contributed 57 per cent of the total textiles and apparel exports. Vietnam, China, the US, Japan, Turkey and Hong Kong had a share of 23 per cent, 13 per cent, 10 per cent, 5 per cent, 3 per cent and 3 per cent respectively.

Fig 3: Change in TextileS and Apparel ExportS from 2017 to 2018, by ITC (HS) Codes

Source: CCF GROUP & TexPro

FIG 4: SOUTH KOREAN TEXTILES & APPAREL EXPORTS BY COUNTRIES, 2018

Source: CCF GROUP & TexPro

South Korea's major textiles and apparel export destinations with maximum export growth recorded in 2018 over 2017 were Turkey, the US, Thailand, Cambodia, Japan and Vietnam. The export growth rates recorded in 2018 over 2017 to Turkey, the US, Thailand, Cambodia, Japan and Vietnam were 12 per cent, 11.50 per cent, 7 per cent, 6 per cent, 5 per cent and 4 per cent respectively.

FIG 5: Change In Textiles And Apparel Exports From 2017 To 2018, By Countries

Source: CCF GROUP & TexPro

Textiles and Apparel Imports: Breakups

In 2018, South Korea's major imports in terms of ITC HS codes were 62 (articles of apparel and clothing accessories, not knitted or crocheted), 61 (articles of apparel and clothing accessories, knitted or crocheted), 52 (Cotton) , 54 (man-made filaments; strip and the like of man-made textile materials) and 63 (other made up textile articles; sets; worn clothing and worn textile articles; rags). These segments contributed 83 per cent to the total textiles and apparel import into the country.

The product segments with major import growth in 2018 over 2017 were 53 (other vegetable textile fibres; paper yarn and woven fabrics of paper yarn), 63 (other made up textile articles; sets; worn clothing and worn textile articles; rags) wadding, felt and nonwovens; special yarns; twine cordage, ropes and cables and thereof), 61 (articles of apparel and clothing accessories, knitted or crocheted), 62 (articles of apparel and clothing accessories, not knitted or crocheted), 51 (wool, fine or coarse animal hair; hair; horsehair yarn and woven fabric) and 56 (wadding, felt and nonwovens; special yarns; twine, cordage, ropes and cables and articles thereof) with a growth rate of 25 per cent, 17 per cent, 16 per cent, 15 per cent, 15 per cent and 9 per cent respectively.

FIG 6: South Korean Textiles & Apparel Imports By Itc (Hs) Codes, 2018

Source: CCF Group and TexPro

FIG 7: Change In Textiles And Apparel Imports From 2017 To 2018, By Itc (Hs) Codes

Source: CCF Group and TexPro

South Korea's major textiles and apparel supplier countries in 2018 were China, Vietnam, Indonesia and Italy. These countries had a share of 74 per cent in South Korea's total textiles and apparel imports from other countries. China, Vietnam, Indonesia and Italy accounted for 37 per cent, 27 per cent, 6 per cent and 4 per cent respectively of the country's total textiles and apparel imports.

FIG 8: South Korean Textiles & Apparel Import By Countries, 2018

Source: CCF Group and TexPro

South Korea's major textile and apparel supplier destinations with maximum import growth reported in 2018 over 2017 were India, Bangladesh, Vietnam, Burma, Indonesia and Italy. In 2018, import growth rates recorded for India, Bangladesh, Vietnam, Burma, Indonesia and Italy were 30 per cent, 23.50 per cent, 23 per cent, 17.80 per cent, 13 per cent and 12.50 per cent respectively.

FIG 9: Change In Textiles And Apparel Import From 2017 To 2018, By Countries

Source: CCF Group and TexPro

FIG 10: Comparison Of Textiles & Apparel Import Of South Korea From China And Vietnam, By Itc (Hs) Codes

Source: CCF Group and TexPro

It has been observed that imports from China have dropped in most of the product segments where Vietnam has shown tremendous growth. This shift has been caused by cost advantages and technological improvement in Vietnam along with escalating trade tensions between China and the US.

Strategic Moves and Trade Agreements

1) South Korea/Israel Free Trade Agreement: It will give the country a headway in innovation and technological development. The agreement is expected to take effect in the first half of 2020. At present, South Korea has 17 free trade deals with 58 countries. Its trade volume with Israel was $2.72 billion last year. Once new deal comes into effect, Israel would slash tariffs on 97.4 per cent of Korean goods. Tariffs on Korean textiles (6 per cent) would be removed.

2) South Korea has made a trade pact with five Central American countries (Costa Rica, El Salvador, Honduras, Nicaragua and Panama) which would take effect in October 2019.

3) The US International Trade Commission (USITC) has proposed modifications to the rules of origin (ROOs) of the United States-Korea Free Trade Agreement (KORUS) on US trade under the agreement, on total US trade, and on domestic producers of affected articles.

The proposed modifications would liberalise the current ROOs for certain textiles and apparel products by allowing the use of more non-originating inputs, thus making more products eligible for duty-free treatment under KORUS. The proposed modifications cover three products:

-

Certain cotton yarns (under Harmonised Tariff Schedule of the United States [HTS] heading 5206) with viscose rayon staple fibres (under HTS subheadings 5504.10 or 5507.00)

- Certain woven fabrics (under HTS heading 5408) with cupr-ammonium rayon yarns (under HTS subheading 5403.39)

-

Certain apparel (under HTS heading 6110), accessories, and apparel parts (under HTS heading 6117) of cashmere yarns (under HTS heading 5108).

4) South Korea recently assured Bangladesh of considering duty-free and quota-free market access for all Bangladeshi products.

-

South Korea would prefer the import of woven garments, knitwear, jute and jute products from Bangladesh.

5) South Korea and the Philippines FTA.

-

Both the countries have planned to conclude the agreement during the South Korea-ASEAN summit in November this year.

6) South Korea to form a bilateral free trade agreement (FTA) with Malaysia, Vietnam, Singapore and Indonesia.

-

Seoul and Kuala Lumpur would try to conclude the deal till South Korea's summit with the Association of Southeast Asian Nations (ASEAN) in November.

-

South Korea already holds FTAs with ASEAN and has clinched FTAs with Vietnam and Singapore. Also, South Korea has been in discussion with Indonesia.

- If all the negotiations become successful, South Korea will have free trade deals with all its top five ASEAN trading partners.

7) South Korea has targeted South Vietnam as a major investment region. These investments are significantly in the fibres and textiles manufacturing sector. In 2018, South Korea invested $234.2 million in Dong Nai with about 40 projects. It ranked second among foreign investors in Binh Duong with total registered capital of over $302 million.

8) The Uztextileprom Association and the South Korean Techno Park Geoji Daedzhin would sign a memorandum of understanding on cooperation in the textiles industry as Uzbekistan is the main trading partner of Korea among the countries in Central Asia.

-

Uztextileprom Association, with the assistance of Geongei Daejin, have organised a business briefing in order to implement the Uzbek-Korean textile techno park in Tashkent on December 6.

-

It would enhance both the exchange of experience and the mobilisation of additional resources. Technological experience of Korea would help Uzbekistan create an advanced textile infrastructure facility.

- This platform will help generate competitive ideas and translate them into products. The construction of the Uzbek-Korean techno park funded by South Korean amounted to $15 million. It will be located in the Yakkasaray district of Tashkent.

9) South Korea would help local firms adopt smart manufacturing solutions and supporting research projects on next-generation fabrics. Government has allocated ₩ 39 billion ($33.7 million) over the 2018-22 period to help local sewing and dyeing factories adopt smart solutions for production on-demand. This move is in line with the global trend of making customised products for individual clients instead of mass producing pre-designed goods. The plan also calls for ₩ 52.4 billion to be earmarked up to 2023 for the development of next-generation fabrics which can be used in firefighters' suits and other specialised areas.

Comments