Cotton Area Harvested versus Consumption

Source: United States Department of Agriculture

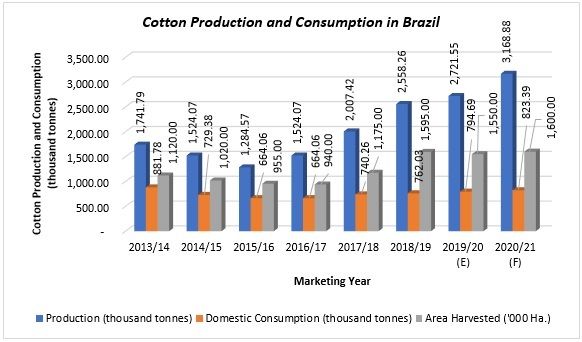

The total cotton production in Brazil was 1,524.07 thousand tonnes in marketing year (MY) 2016/17, which sharply increased by 67.85 per cent to 2,558.26 thousand tonnes in MY 2018/19. Total production was boosted by 27.44 per cent in MY 2018/19 over the previous year and is expected to reach 3,168.88 thousand tonnes in MY 2020/21 with a CAGR of 11.29 per cent from MY 2018/19.

Due to favourable backdrop of external market demand along with strong global prices and Brazil’s internal production capacity, farmers chose to put aside the maximum planted and harvested area this season.

The cotton harvested area in Brazil was 940 thousand hectares in MY 2016/17 and moved up by 69.68 per cent to 1,595 thousand hectares in MY 2018/19. This massive growth has been driven by ample availability of convenient land for cotton farming and favourable climate along with strong international demand and high prices all over the globe. Cotton producers have been flourishing not only from rising global prices, but also the relatively weak domestic currency, the Real.

Total harvested area of cotton increased by 35.74 per cent in MY 2018/19 over the previous year and is expected to surge slightly to 1,600 thousand hectares in MY 2020/21 with a CAGR of 0.16 per cent from MY 2018/19. The slight drop of estimation of harvested area in MY 2019/20 was based on several factors. Producers expected that global cotton prices would remain modest due to adequate global supply. Brazil had a bumper crop in that season, with a massive exportable surplus, which carried over into the next export season.

Planted Area and Production Forecast by State for 2019/20

Mato Grosso and Bahia are the major cotton producing states in Brazil, followed by Goias, Mato Grosso Do Sul, Minas Gerais, Maranhao and Piau. Mato Grosso and Bahia together contributed for 90 per cent of the total cotton planted area of the country and 87 per cent of country’s total cotton production.

|

Area |

Planted Area (1000 HA) |

Per cent of Total Area Planted |

Production (thousand tonnes) |

Per cent of Total Production |

|

Mato Grosso |

1100 |

69 |

1775 |

65 |

|

Bahia |

335 |

21 |

600 |

22 |

|

Goias |

43 |

3 |

72 |

3 |

|

Mato Grosso Do Sul |

37 |

2 |

67 |

2 |

|

Minas Gerais |

40 |

3 |

61 |

2 |

|

Maranhao |

28 |

2 |

47 |

2 |

|

Piau |

16 |

1 |

28 |

1 |

|

Total |

1600 |

100 |

2722 |

100 |

Source: Post Brasilia Forecast

The cotton producers in the Mato Grosso are expected to finish the season with the plantation of more than a million hectares. They have expanded production in the state with the help of municipalities who usually plant corn or cover crops to follow up the first season of soybean crop. The major part of the cotton planted in Mato Grosso is a second season crop, after soybeans. The harvesting of cotton usually starts in June but picks up in July with the bulk of the crop picked in August and September.

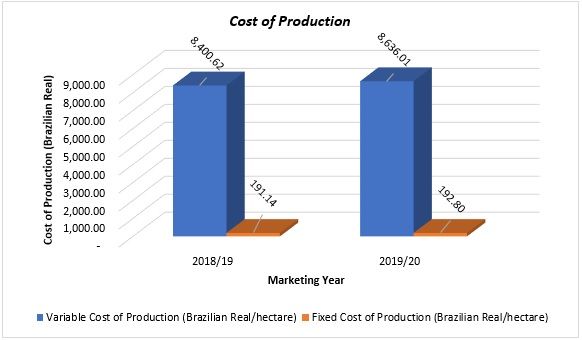

Cost of Cotton Production

The variable cost of production and fixed cost of production of cotton in Brazil was R$8,400.62 per hectare and R$191.14 per hectare respectively in MY 2018/19 and it increased to R$8,636.01 per hectare and R$192.80 per hectare by 2.80 per cent and 0.86 per cent respectively in MY 2019/20.

Source: Mato Grosso Institute of Agricultural Economics (IMEA)

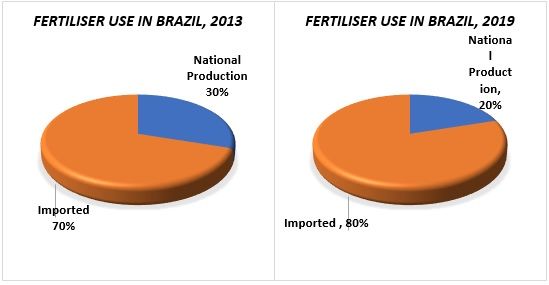

Fertiliser Trend

Source: National Fertilizer Association (ANDA)

Cotton Consumption of Brazil

The cotton consumption in Brazil was 664.06 thousand tonnes in MY 2016/17, which increased by 14.75 per cent to 762.03 thousand tonnes in MY 2018/19. Total consumption slightly leapt up by 2.94 per cent in MY 2018/19 over the previous year and is expected to reach 823.39 thousand tonnes in MY 2020/21 with a CAGR of 3.94 per cent from MY 2018/19.

The local cotton consumption of the country is expected to grow at a lower rate as Brazil’s economy is anticipated to grow by 2 per cent only in 2020. This slow growth is expected to impact manufacturing and consumer sentiment.

The Brazilian Association of the Textile and Apparel Industry (ABIT) has projected the growth rate of 0.5 per cent in domestic textile production and 1.5 per cent in retail.

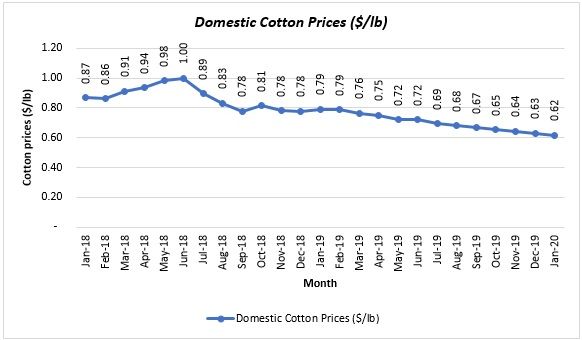

Cotton Price Trend in Brazil

Source: Centre for Advanced Studies in Applied Economics (CEPEA)

The price of cotton has been showing downward trend from the beginning of this calendar year. This trend is expected to continue in the second half of the year, in line with the drop in global market prices and massive harvests in the US and Brazil. The US inventories are expected to reach a 12 year high in MY 2019/20 season. Meanwhile, global demand is also decelerating amid a global economic slowdown.

The price of domestic cotton was 0.79 $/lb in the beginning of the year 2019 and dropped by 7.38 per cent to 0.72 $/lb by the end of first half of 2019 and it is expected to decrease further by 14.45 per cent to 0.62 $/lb by the end of this year.

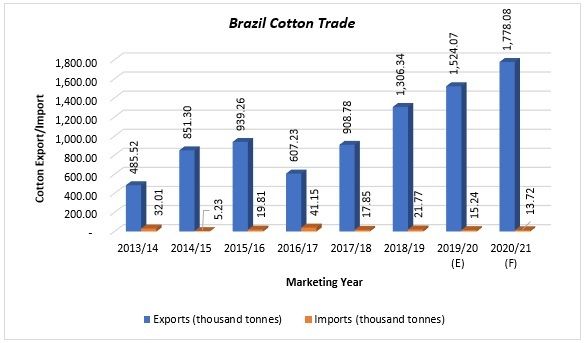

Brazil Cotton Trade

The cotton exports and imports of Brazil were 607.23 thousand tonnes and 41.15 thousand tonnes in MY 2016/17 and moved to 1,306.34 thousand tonnes and 21.77 thousand tonnes in MY 2018/19. Total exports increased by 115.13 per cent in MY 2018/19 over MY 2016/17 and total imports moved down by 47.08 per cent in MY 2018/19 over MY 2016/17.

The cotton exports of the country are expected to move up to 1,778.08 thousand tonnes in MY 2020/21 from MY 2018/19 with the CAGR of 16.66 per cent. The Brazilian cotton farmers’ sales contracts for around two thirds of their production and significant crop of this season, have boosted the cotton export despite an environment of moderating global prices. The massive exportable supplies of current season and consistent strong cotton demand from China have also supported the cotton exports of the country.

Usually the harvest of current marketing year gets exported in the next marketing year. Approximately 70 per cent to 80 per cent of MY 2018/19 crop has been commercialised for MY 2019/20 delivery. Hence the current drop in cotton prices would not have notable impact on volumes shipped next season. The Real also have been devaluating due to deep economic recession and sluggish economic recovery that began in 2018.

Source: United States Department of Agriculture

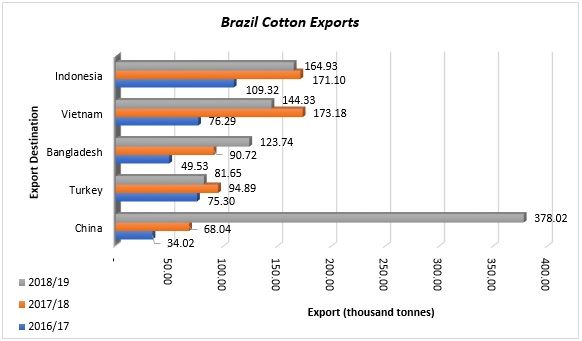

Brazil Cotton Exports by Export Destinations

China, Indonesia, Vietnam, Bangladesh and Turkey were the major export destinations of Brazil in MY 2018/19. In MY 2016/17, Indonesia was the biggest importer of the Brazilian cotton in the world, but China went far ahead by MY 2018/19. In MY 2016/17, China imported 34.02 thousand tonnes of Brazilian cotton and imports increased to 378.02 thousand tonnes in MY 2018/19.

Source: Foreign Trade Secretariat (SECEX)

New export trends emerge in 2018/19

• In previous years, Brazil used to ship more than two-third of its cotton exports in the first half of the marketing year (August-December). Currently, the split between the first and second half of the marketing year has become 60/40.

• China became the leading buyer of Brazilian cotton despite Vietnam and Indonesia being the top leading destinations for Brazil’s cotton in MY 2016/17. In 2018/19, the Brazilian cotton imported by China increased to 3.62 million metric tonnes from the 0.73 million metric tonnes in the past. This trend is expected to continue in the future as the Ministry of Agriculture, Livestock and Supply (MAPA), the Ministry of Foreign Affairs (MRE), the Brazilian Agency for the Promotion of Exports and Investments (Apex), and Brazilian Cotton Exporters association (Abrapa) has planned to open a permanent office in Asia in order to increase promotional efforts for exports.

Comments