World Cotton Production

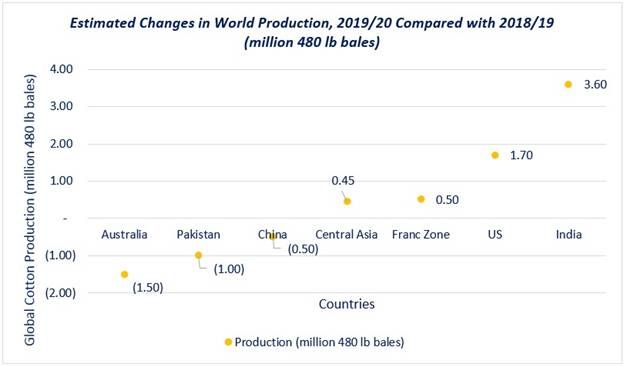

The global production of cotton was 123 million bales (480 lb each) in MY 2017/18, which increased by 2.27 per cent to 121.30 million bales in MY 2019/20. Its production was boosted majorly in the US and India while its production decreased in Australia and Pakistan. The reason for its surge in US was due to an increase in harvested area by 9.40 per cent and higher production in the Delta and Southeast regions. India became the world’s largest producer with increase in harvested area and higher yields. Indian cotton production has remained at its highest in the last five years with actual production of 29.5 million bales in MY 2019/20, an increase of 14 per cent over the previous year.

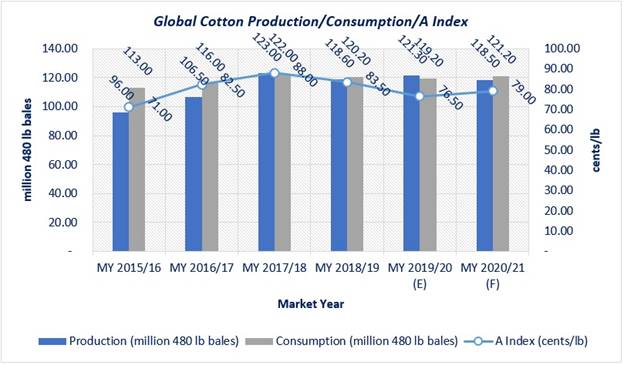

Global Cotton Production/Consumption/A Index

Source: USDA

On the other hand, the cotton production in Australia witnessed a sharp downfall in MY 2019/20 due to severe occurrence of drought in the country. China, ranked 2nd in cotton production, curtailed the production to 27.3 million bales with slightly lowered cotton harvested area as compared to the harvested area in MY 2018/19. Also, the lower yields in Xinjiang, caused due to unfavourable weather, affected the country’s cotton production. China’s cotton harvested area in MY 2019/20 was estimated at 3.45 million hectares, down from the previous year. China’s cotton yield also declined to 1,720 kg/hectare. India’s cotton harvested area was estimated at 13 million hectares, up 3.20 per cent, despite reports on pink bollworm infestations and late-season monsoon rainfall. India’s yield in MY 2019/20 was estimated at 494 kg/hectare as compared to the previous season.

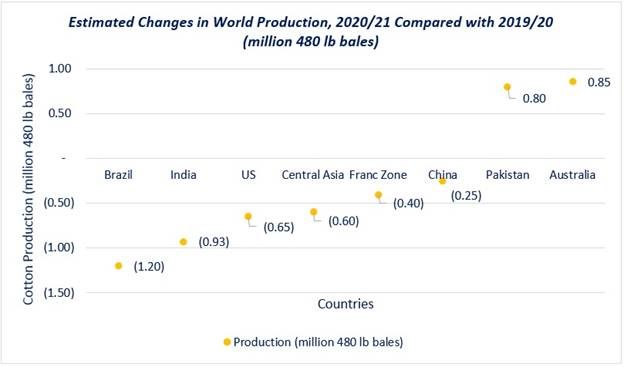

Total global cotton production is expected to reach 118.50 million bales in MY 2020/21, down by 2.31 per cent from MY 2019/20, with the declining cotton production area in a number of countries such as India, Brazil and the US. Cotton planted area has declined by about 4 per cent worldwide and is expected to offset the impact of rebounding yields in several countries. India’s MY 2020/21 cotton planted area is expected to fall by 3 per cent. At present, cotton prices in India are lower than the other crops competing for area. India’s MY 2020/21 cotton output is expected to reach 0.90 million bales showing a decrease as compared to the output in MY 2019/20.

Lower projected cotton planted area in Brazil is expected to cut the production by 1.2 million bales. Brazil had maintained the cotton planted area at record-high levels since last 2 years and has increased its underlying productive capacity significantly.

The cotton production of the US in MY 2020/21 is expected to move down by 0.60 million bales with declining cotton planted area. Higher cotton production is expected in Australia and Pakistan in MY 2020/21 which had setbacks in MY 2019/20.

Australia’s cotton output in MY 2020/21 is expected to surge by 0.80 million bales. High rainfall in Australia from January 2020 improved irrigation supplies which are expected to boost plantation and bolster the dryland prospects. Pakistan’s cotton output is anticipated to rebound by 0.80 million bales from the year before. Slight movement is expected in China’s total cotton production from the year before in MY 2020/21. As per the current surveys of planting intentions, China’s cotton area in MY 2020/21 will be slightly reduced as compared to the year before. China remained at the top in cotton production from 1982 until 2014, when it was first surpassed by India. China again obtained the 1st rank in MY 2018/19, but India is projected to be again the world’s largest cotton producer in MY 2020/21, as in MY 2019/20.

World Cotton Consumption

The global consumption of cotton was 122 million bales (480 lb each) in MY 2017/18, which declined by 2.30 per cent to 119.20 million bales in MY 2019/20. The global cotton consumption was estimated low with lower consumption in China, Vietnam, and Indonesia. The gain in cotton consumption has been observed in India, Pakistan, and Turkey. Uncertain market conditions slashed the consumption of China by 2 million bales as compared to the previous MY 2018/19. India and Uzbekistan have shown a considerable increase.

Total consumption is anticipated to increase to 121.20 million bales in MY 2020/21 with a growth of 1.68 per cent from MY 2019/20. China is expected to resume and expand imports. According to the IMF’s January 2020 forecast, global income gains are expected in calendar 2020 and 2021. Hence the cotton consumption is possible to grow. The Phase One trade agreement between China and the US reduced the uncertainty on global income gains. But suddenly after the agreement, the worldwide spread of COVID-19 caused the uncertainty in the demand and consumption.

China’s consumption gain is expected to reach to 1 million bales in MY 2020/21 which equals half of global consumption gain expected. China is expected to consume 38.5 million bales of cotton in MY 2020/21. China is the world’s largest cotton consuming country. But China’s share in the world cotton spinning has been falling since 2009, which has stabilised in recent years.

India and Pakistan hold the 2nd and 3rd position in cotton consumption globally and are expected to continue growing in MY 2020/21. The cotton consumption in Bangladesh and Vietnam has been showing a decline in recent years and are expected to resume growth in MY 2020/21.

Cotton continued to lose share to polyester in global textile and clothing markets with relatively moderate losses since 2012. The cotton polyester price ratio has risen in recent months but remained within the range established since 2015. The International Cotton Advisory Committee is forecasting only a small fibre share loss for cotton in calendar 2020.

The Cotlook A index was 8800 cents/lb in MY 2017/18, which was curtailed by 13.07 per cent to 76.50 cents/lb in MY 2019/20. “A” Index is anticipated to increase to 79 in MY 2020/21 with a growth of 3.27 per cent from MY 2019/20 with projected lower stocks outside of China.

Estimated Changes in World Production, 2019/20 Compared with 2018/19 (million 480 lb bales)

Source: USDA

World Cotton Trade

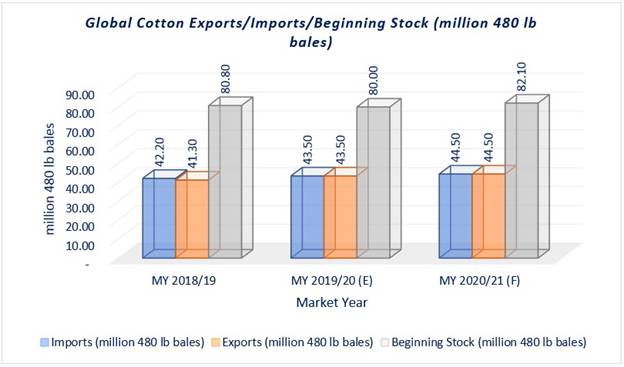

The global cotton export was 41.30 million bales (480 lb each) in MY 2018/19, which soared by 5.33 per cent to 43.50 million bales in MY 2019/20. The major exports from Brazil and the US have helped to fulfil the strong demand from China, Vietnam and Bangladesh. Also, the declined production in Pakistan and Turkey supported the overall cotton trade. China still holds the top position in the list of cotton importers despite the reducing cotton imports.

The supply from Brazil has been increasing with steady domestic demand and second crop (safrina) season. Cotton exports from West Africa’s Franc Zone is anticipated to move ahead from the previous year’s mark to reach 5.7 million bales, with Benin, Mali, and Cote d’Ivoire as the top three exporters in the region respectively.

China’s stock has dropped by approximately 2 million bales in MY 2019/20 from MY 2018/19. Higher global production and lower consumption mainly drove the stock-to-use ratio. India is anticipated to witness the highest rise, with stock projections reaching 13 million bales, moving up by 3.7 million from the previous year. The stocks of the US and Brazil are also expected to rise in spite of surging exports. Stocks apart from China are expected to soar by 9 per cent to reach 48.4 million bales. The world’s cotton export is anticipated to surge to 44.50 million bales in MY 2020/21 with a growth of 2.29 per cent from MY 2019/20.

Global Cotton Exports/Imports/Beginning Stock (million 480 lb bales)

Source: USDA

Estimated Changes in World Production, 2020/21 Compared with 2019/20 (million 480 lb bales)

Source: USDA

The global cotton import was 42.20 million bales (480 lb each) in MY 2018/19, which surged by 3.08 per cent to 43.50 million bales in MY 2019/20. It is anticipated to surge to 44.50 million bales in MY 2020/21 with a growth of 2.29 per cent from MY 2019/20.

China’s imports are projected higher in MY 2020/21. Exports from the US, Brazil, Australia, and Greece are expected to be flat, while exports from Central Asia and the Franc Zone will be lower on smaller crops. Exports from India are forecast higher despite lower production and higher use as stocks held in the Minimum Support Price programme are pushed back into the market.

The global beginning stock of cotton was 80.80 million bales (480 lb each) in MY 2018/19, which slumped by 0.99 per cent to 80 million bales in MY 2019/20. It is anticipated to surge to 82.10 million bales in MY 2020/21 with a growth of 2.62 per cent from MY 2019/20.

Comments