The COVID-19 pandemic has increased attention on supply chains and social responsibility by consumers, NGOs, media and investors. The #PayUp campaign exposed the cancelation of orders in the apparel sector with the goal to get brands to pay for the orders and therefore pay workers what they were owed at the beginning of the crisis. Upon converting lines to create personal protective equipment (PPE) reports emerged about poor working conditions in some factories as they attempted to recover financially and keep up with orders. The issues converged this month for UK fast fashion brand Boohoo. Just days apart, the fashion brand was in the news for an investigation into one of its suppliers operating under COVID lockdown, unsafe working conditions and for paying workers less than minimum wage.

Currently facing investigations into modern slavery conditions in its supply chain Boohoo is the newest face of corporate negligence to ensure compliance to its supply chain sustainability standards. Citing the company’s inadequate response to reports of poor working conditions in its supply chain, Aberdeen Standard Investments sold the majority of its stake in Boohoo. This stories rings familiar, although not as devastating, as when brands and retailers discovered subcontracting in the Bangladesh apparel supply chain through the Rana Plaza disaster.

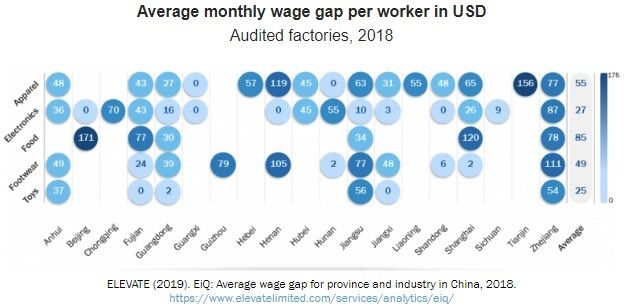

ELEVATE has long advocated for transparency and are a proponent of using data to gain deeper insights into risks, and opportunities, in the supply chain. In 2018, ELEVATE data revealed 40-60% of vendors and factories in China subcontract without authorization. We also found a connection between transparency levels and visibility into the supplier wage gap, 80% of matched factories in our system thought to be low risk were found to have falsification violations. Furthermore, ELEVATE data suggests a gap in the correct payment of overtime and piece rate compensation. To conduct proper due diligence, it is necessary to look at compliance to the correct payment of wages. For example, in 2018 we calculated a wage gap in the Chinese apparel sector to be approximately USD 275 – 300 million per month based on the percentage of workers paid incorrectly. This supplier wage gap is a hidden risk for brands and investors.

Investors that fail to recognize and understand the wage gap in supply chains may find themselves with overvalued assets and portfolios. In a July article, the Financial Times asks, “Why did so many ESG funds back Boohoo?”. The answer? Because companies don’t disclose the supply chain information that enables investors to assess performance and investors (and rating agencies/reporting frameworks) don’t ask the right questions to ensure that they do.

Join Mark Jones, Kevin Franklin and Erin Lyon for our September 10th webinar. We will explore the issue of hidden subsidies in supply chain and what this means for profitability, investor due diligence and the implications for social responsibility programs.

References:

1. https://www.vogue.com/article/remake-payup-campaign-social-media-garment-workers-wages-gap

2.https://theconversation.com/how-asias-clothing-factories-switched-to-making-ppe-but-sweatshop-problems-live-on-141396

3.https://www.forbes.com/sites/andrewbusby/2020/07/05/with-allegations-of-slavery-and-unsafe-working-conditions-is-boohoo-the-unacceptable-face-of-fast-fashion/#60d9541b16e9

4.https://www.theguardian.com/business/2020/jul/10/boohoo-shareholder-sells-off-shares-aberdeen-standard-investments

5.https://www.nytimes.com/2013/04/25/world/asia/bangladesh-building-collapse.html

6.https://amp-ft-com.cdn.ampproject.org/c/s/amp.ft.com/content/ead7daea-0457-4a0d-9175-93452f0878ec

Comments