The US apparel and retail businesses saw fluctuations in trade throughout the months of April-May-June-July, all due to the Covid-19 pandemic, and it is estimated that it would take up to 5 years for offline sales to return to pre-pandemic levels. This is the time when many big US fashion retailers went bankrupt. A report.

The US Apparel Trade

April 2020: Considerable Drop in US Apparel Imports

According to the Commerce Department's Office of Textiles & Apparel (OTEXA), most of the apparel stores in US were shut down and importers were either cancelling or slashing orders due to the economic fallout from COVID-19 and government stay-at-home orders. The total apparel imports from the world plunged by 45 per cent in April compared to a year earlier to $3.41 billion. US apparel imports from China moved down by 46.44 per cent year to date through April to $3.89 billion compared to the same period in 2019. For the month of April 2020, imports from China diminished by 59 per cent to a value of $621 million, well behind the imports from Vietnam.

The imports from Vietnam declined just by 20 per cent in April year over year to $805.35 million. For the first 4 months of 2020, imports from Vietnam declined by 1.31 per cent to $4.19 billion. Among the prominent suppliers, only Bangladesh and Cambodia escalated for the year to date. Imports from Bangladesh increased by 2.13 per cent in the period to $2.08 billion, while shipments from Cambodia were up by 16.92 per cent to $946 million. Among the rest of the top Asian suppliers, India's imports were down 113.07 per cent year to date to $1.36 billion, Indonesia's fell 8.66 per cent to $1.43 billion and Pakistan's dipped 2.02 per cent to $456 million.

May 2020: US Apparel Trade and Retail Sales Recovery

As per latest data from Placer.ai, in year-over-year data comparisons, apparel sales in the US during the week of May 11 slightly improved as compared to the week of May 4. The apparel sales decline remained at 71.80 per cent in week of May 11 as against 87 per cent in week of May 4. During this period, apparel traffic in Florida improved the most. Traffic in this region improved from a decline of 87 per cent year-over-year for the week of May 4 to a decline of just 55 per cent for the week of May 11. Similarly, in Georgia, the apparel traffic improved from a 75 per cent year over-year decline for the week of May 4 to just 23 per cent decline in the week of May 11.

The US apparel imports in May went down by 58 per cent against the same month last year due to the spread of coronavirus pandemic. However, there was a resurgence in shipments from Central America and Mexico as retailers appear to have turned to those suppliers closest to home as stores started to reopen.

Drop in US Import of Men and Boys Denim Jeans

The US import of men & boys denim jeans showed a sudden drop in May 2020 both in quantity and value on yearly basis. The US imported 4,44,155 dozen in quantity and $37.95 million in value this year with fall of 75 per cent and 77.80 per cent, respectively. As compared to the previous month April, total men & boys denim jeans imported by the US plunged 25.57 per cent in value and 22.60 per cent in quantity. The US import of men & boys denim jeans in April 2020 was valued at $51 million. The import decline from January to May 2020 over the previous year remained at 38.78 per cent and was valued at $437.74 million, a $278 million less.

Mexico showed significant growth of 104.70 per cent in quantity of men & boys denim jeans exports to the US in May 2020 over April 2020, while it increased by 86.17 per cent in value terms. Bangladesh was the 2nd largest exporter of men & boys denim jeans to the US with 80,210 dozen shipment worth $5.82 million, which was a sharp decline of 80.30 per cent and 81.30 per cent, respectively, on yearly basis. Nicaragua registered a year over year plunge of 61.70 per cent in value and 57.40 per cent in quantity, while China tumbled by 80.40 per cent in values and 80.60 per cent in quantity in May 2020 over May 2019.

The big challenge faced by US retail fashion sector in May was financial uncertainty. As per Deloitte Global State of the Consumer Tracker, the percentage of US consumers visiting stores also increased to 42 per cent in May as against 30 per cent in April. But the number of online buyers for apparel dropped. As per the survey, 82 per cent of Americans planned to buy online, pickup in store in June. Only 40 per cent planned to use this service for safety reasons, down from 48 per cent. Rising inflation rates continue to diminish their purchasing power and curtail spending.

Beth Ann Bovino, global US chief economist for credit ratings firm S&P, predicted that retail recovery in the US may take to 2021 and beyond.

Diminished US T-shirt Imports

As per Apparel Resources analysis, the value of t-shirts imported by the US declined by 65.50 per cent in May 2020 due to Covid-19 pandemic. The US imported $613.96 million worth of t-shirts in May, while its import value in the same month of 2019 was $1.78 billion. On monthly basis, the imports of t-shirts by US declined by 29.26 per cent in May 2020 over April 2020. China exported t-shirts to US worth $94.95 million in May. Bangladesh exported $23.16 million worth of t-shirts with a drop of 63 per cent approximately on year over year basis to the US where it was $63.47 million in May 2019. India's t-shirt export to the US moved down by 85.80 per cent to generate $14.40 million revenue. Exports continued to plunge in February, March, and April. Vietnam showed yearly plunge of 47.86 per cent in May 2020 with its shipment valued at $154.80 million. Vietnam remained the top t-shirt exporter to the US with over 25 per cent share in its total t-shirt import values.

Drop Observed in Apparel Import by US from India

According to OTEXA, US imports of clothing from India decreased significantly in May 2020. The US imported 19.63 million SME (square meter equivalent) garments, worth 62.98 million dollars, from India. The US imported $387.32 million of SMEs' apparel during the same month of 2019. The decline was also significant in May 2020 over April 2020, with volume and value by 70.17 per cent and 71.44 per cent respectively. This was the biggest decline in the list of exports of clothing to the US from India. An Indian apparel export value to the US from January 2020 to May 2020 declined by 27.08 per cent to $1,424.63 million from $1,953.74 million in the same duration of the previous year. From January 2020 to May 2020, the US imported apparel remained at $23.92 billion, with an annual decrease of 27.76 per cent. In the 2020 comparison period, Indian unit prices for shipping to the US also dropped to $3.50 from $3.56 in 2019 with a drop of 1.74 per cent.

June 2020: US Apparel Import

The US industrial production moved up by 5.40 per cent in June, but remained well below pre-pandemic levels. According to the Federal Reserve, it was the second straight monthly gain after a 1.40 per cent increase in May 2020. But it remained 10.90 per cent below the level in February 2020.

About half of US consumers were not interested in Chinese products, according to a study released in the week ending on June 13 by Coresight Research. Two-fifths of these American consumers were less willing to buy products made in China due to the Covid-19 pandemic. Over 3/5th of consumers expected the crisis to last for more than six months.

According to the latest data from OTEXA, the US apparel imports reached 1.5 billion square metres in June 2020, down 34.30 per cent year over year but up by 57.80 per cent month over month; the volume from China was 0.65 billion square metres, down by 32.50 per cent year over year but up by 65.40 per cent month over month, accounting for 43.40 per cent of the total apparel imports. From January 2020 to June 2020, the cumulative US apparel imports were 9.67 billion square metres, down 27.90 per cent year over year; the volume from China was 3.06 billion square metres, down 38.30 year over year. The US apparel import value in June was $3.97 billion, down 42.80 per cent year over year but up by 49.30 per cent month over month; that from China reached $1.16 billion, down 48.40 per cent year over year but up 59.70 month over month.

As the first country hit by Covid-19, China's apparel exports to the US dropped by as much as 49 per cent from January 2020 to June 2020 year over year. In February 2020, China's market share slipped to only 11 per cent, and both in March 2020 and April 2020, US fashion companies imported more apparel from Vietnam than from China. However, China's apparel exports to the US is experiencing a V-shape recovery as of June 2020, China has quickly regained its position as the top apparel supplier to the US, with a 29.10 per cent market share in value and 43.40 per cent share in quantity.

US T-Shirt Imports

According to Apparel Resources, US reported a 47 per cent increase in t-shirt imports in June 2020 month over month. The country imported t-shirts worth $902 million during the month. The US t-shirt imports on year over year basis during the first half of 2020, fell by 32.38 per cent to $7.09 billion as against $10.49 billion in the first half of 2019. All major shippers to the US registered a growth in t-shirt export in June 2020 over May 2020, but their imports failed to improve when compared to the imports in June 2019. Vietnam shipped $195.12 million worth of t-shirts in June 2020, noting 26.05 per cent increase from May 2020. However, the country's shipments declined by 36 per cent from June 2019. China too noted 66.13 per cent increase in its t-shirt exports to the US in June 2020 month over month. However, its shipments declined by 59 per cent from June 2019. Bangladesh also upped its t-shirt exports to the US by 20.95 per cent in June 2020 over May 2020 and hit $28 million revenue. Exports declined by 59.60 per cent in June 2020 as compared to exports in June 2019. India's t-shirt exports to the US surged by 54.66 per cent in June 2020 over May 2020. Inida achieved $22.27 million revenue from t-shirt shipment to US in June this year. Indian shipments fell by 72.60 per cent from June 2019.

Overall US Retail Sales to Drop in 2020

According to the latest forecast by eMarketer on US retail sales, total retail sales will drop by 10.50 per cent this year to $4.894 trillion, steeper than the 8.20 per cent drop in 2009. It would take up to 5 years for offline sales to return to pre-pandemic levels. Ecommerce remained as the only bright spot and jumped 18 per cent this year to reach $709.78 billion as US consumers are dependent on Amazon and other online retailers for necessities.

US to Impose Additional Tariffs on EU Products

The Office of the US Trade Representative announced that they have considered to modify the list of EU products subject to additional tariffs upon importation into the US and plan to increase the tariff rate up to 100 per cent. The USTR accepted comments whether specific products should be either added to or deleted from the lists and whether the rate on specific products should be increased. Comments were due by July 26, 2020. The current rate of additional tariffs is 25 per cent on EU products. Products of the UK were also included. The current lists of products include sweaters, pullovers, sweatshirts, suits, and swimwear along with other product groups. The lists are grouped by product category and country. Accordingly, not all covered products from each EU country are included, so importers are advised to review the current and proposed lists.

By June 2020, the Federal Trade Commission (FTC) planned to turn its 'Made in USA' standard into a new 'Made in USA Labelling' rule to enable it to seek civil penalties to deter violations. The FTC was also mulling an end to the 50-year-old care labelling requirements for clothing sold in the US.

July 2020: US Apparel Imports

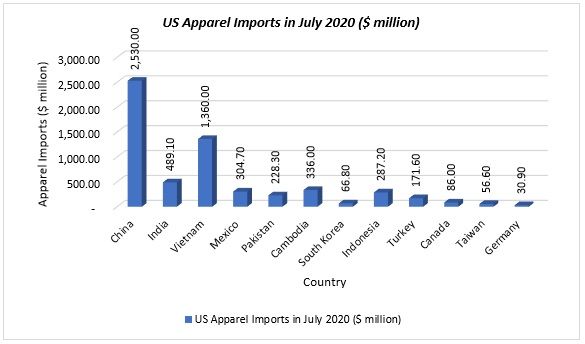

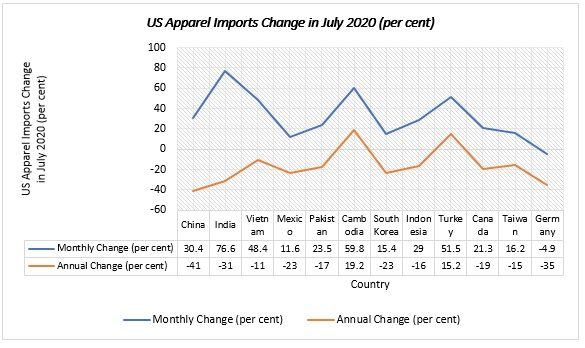

The US apparel imports plunged 32.00 per cent to $6 billion in value terms in July 2020 compared to a year earlier, according to figures released by the Commerce Department's Office of Textiles & Apparel (OTEXA). Companies have imported 30.68 per cent less apparel in the first seven months of 2020 and valued at $33.88 billion compared to $48.87 billion for the same period in 2019. The greatest impact has been on China, which posted a 49.34 per cent year to date decline through July 2020 to retain its position as the top supplier with $7.35 billion worth of goods imported.

In July 2020, 50.00 per cent less apparel, or $1.58 billion worth, was imported to the US from China compared to a year earlier. Apparel imports from Vietnam declined 11.06 per cent for the 7-month period to $6.94 billion and were down 11.00 per cent in July 2020 compared to a year earlier to $1.29 billion. However, Vietnam did post a 2.90 per cent volume increase to 393.29 million square meter equivalents (SME). Bangladesh stood at 3rd place and didn't fare much better, with year-to-date imports down 18.54 per cent to $2.91 billion and year over year shipments off 11.00 per cent to $436.34 million. For the year through July, imports from Cambodia rose 6.13 per cent to $1.54 billion and were up 19.20 per cent in the month compared to same month in previous year to $292.67 million.

US Jeans Imports

Despite a slight upward movement in July, the US imports of blue denim apparel, 97 per cent of which are jeans, declined by 35.26 per cent to $1.08 billion in the first seven months of 2020 compared to a 37.82 per cent decline in the first half, according to OTEXA.

Most denim brands and retailers have focused on working off inventory stuck in warehouses and stores and, curtailing import orders. Mexico's jeans imports fell by 53.04 per cent in the period to a value of $227.09 million. China became the 3rd largest supplier to the US, after the tariff-fuelled due to the China-US trade war. Bangladesh, which has suffered from cancelled orders, fared a bit better, as imports fell by 16.98 per cent to $254.28 million in the year through July. Vietnam reported a 0.14 per cent increase in the period to $192.72 million. The denim exports of Pakistan, Egypt, Nicaragua, Sri Lanka and Indonesia to the US slipped by 21.42 per cent to $116.53 million, 34.16 per cent to $63.25 million, 32.10 per cent to $46.02 million, 24.28 per cent to 23.65 million and 41.81 per cent to $23.41 million respectively.

Only three countries, all from Africa, posted increase in shipments to the US in the period. Imports from Madagascar rose 27.28 per cent to $17.59 million, shipments from Ethiopia increased 16.55 per cent to $11.03 million and imports from Tanzania were up 23.92 per cent to $8.61 million.

US Apparel Imports in July 2020

Source: OTEXA

US Apparel Imports Change in July 2020 (per cent)

Source: OTEXA

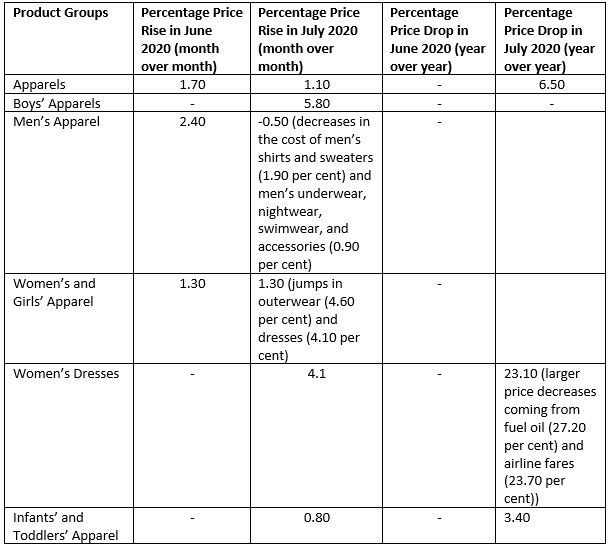

July 2020: The US Apparel’s Upward Price Momentum

Source: The Bureau of Labour Statistics (BLS) & Its Consumer Price Index (CPI)

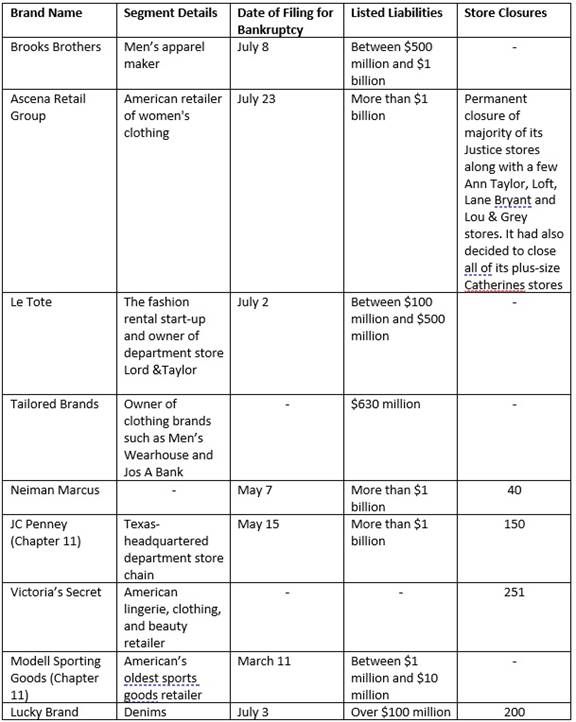

The US Fashion Retail Bankruptcies

Approximately 43 retailers have filed for bankruptcies so far, according to S&P Global Market Intelligence report. Latest retailers to go into administration include Le Tote, owner of Lord & Taylor, and Tailored Brands, parent company of Men's Wearhouse. S&P Global also told that many retail bankruptcies have already taken place in the US this year than in the past eight years. The pandemic has created a major difficulty for the retailers as consumers' preference for online shopping has increased. Simon Property Group and Authentic Brands Group hope to salvage at least 125 stores of the apparel maker's stores through their $350 million bid.

US fashion retailers would have an uncertain future with second round of store closures due to resurgence of the pandemic. The US fashion retailers could operate during the crisis, they recorded a 7.30 per cent decline in merchandise revenues in the week ending July 19, revealed by Affinity Solutions figures. Revenue of retailers in California, Texas and Arizona also declined. Revenues of California retailers declined by 19.90 per cent while those of Texas dropped by 13.20 per cent and Arizona by 18 per cent (as reported from the data from Opportunity Insights, a team of economists based at Harvard University).

United States-Mexico-Canada Agreement

The US Mexico Canada Agreement (USMCA), the updated version of the North American Free Trade Agreement (NAFTA), ensured Mexico and Canada as key trade partners of the US. The USMCA has taken effect on July 1, 2020. The deal would help prosper the principal industries including garment and textiles and streamline customs clearances between the three countries. This would be done by reducing costs and implementing a single-window system.

Domestic manufacturers and importers view the agreement as an extension of the North American Free Trade Agreement (NAFTA) that ruled trade between the three countries for a quarter century. Though experts viewed NAFTA as a threat to local jobs, US textile companies viewed it as a gateway to an export market in the south.

US & International Apparel Companies Call On Washington

A group representing some of the largest US and international apparel companies has called on Washington to convince other countries to pressure China to end forced labour in its Xinjiang Uygur autonomous region. An official of the American Apparel and Footwear Association said that more countries must join diplomatic efforts to halt forced labour in the region. They also added that the US need to try and bring other prominent countries, the UN, and international institutions into this discussion.

US Textile and Cotton Industries to Support CBTPA Extension

The National Council of Textile Organizations (NCTO) and National Cotton Council (NCC) sent a letter to the chairs and ranking members of two key congressional committees and supported for a timely extension of the Caribbean Basin Trade Partnership Act (CBTPA) that expires on September 30, 2020.

The letter follows the one sent by a collation that included the American Apparel & Footwear Association, the Footwear Distributors and Retailers of America, National Retail Federation, Council of Fashion Designers of America, the Accessories Council and the Outdoor Industry Association to United States Trade Representative urging CBTPA's renewal.

According to data from the Office of Textiles and Apparel, imports from Haiti decreased by 33.65 per cent to 128.37 square metres equivalents (SME) in the first half of the year and declined 35.32 per cent in value to $304.92 million. CBTPA, also known as the Caribbean Basin Initiative, that includes other island nations, posted apparel imports to the US of 986.49 million SME in 2019, an increase of 11 per cent over 2018.

US Revokes Special Trade Status of Hong Kong

Hong Kong's special trade status came to an end in July 2020 by the US. Hong Kong now is expected to be treated the same as mainland China, meaning its goods could be subjected to additional tariffs. The US also had signed the Hong Kong Autonomy Act, which passed in Congress earlier in July 2020 and penalised banks doing business with Chinese officials who have implemented the security law. The US government also directed officials to revoke license exceptions for exports to Hong Kong and revoked special treatment for Hong Kong passport holders.

US-Sri Lankan Apparel Accord to Raise PPE Export

The US has made coordination with Sri Lankan apparel producers to export personal protective equipment (PPE) to the US. In partnership with the Joint Apparel Association Forum (JAAF) and the Sri Lanka Export Development Board (EDB), the US Embassy in Colombo organised two webinars recently for over 100 industry participants to prepare them to break into the US market. The project was funded by the US Agency for International Development and was implemented by Deloitte Consulting, according to a press release from the embassy. The first webinar explained how to comply with the US Food and Drug Administration's (FDA) regulations. The second webinar focused on accessing the US market and featured in-depth discussions with US experts on market demand for PPE, including federal demand, distribution chains, and how to sell these to the US federal government. Participants learned about US government acquisition regulations and examined criteria to consider in deciding whether PPE manufacturing would be a feasible and strategic long-term decision.

USTR Soughts List of Cancelled Orders

The US Trade Representative (USTR), has sought a list of retailers that cancelled work orders with Bangladeshi firms due to the ongoing coronavirus pandemic. After securing the list, the US government was expected to urge the retailers to accept their shipments of previously cancelled work orders. A senior official of the USTR expressed his organisation's willingness to carry out this initiative during a virtual meeting of the Trade and Investment Cooperation Forum Agreement (TICFA) Council with Bangladesh's representatives on August 25, 2020.

A considerable number of work orders for garment items totalling $3.2 billion have either been cancelled, deferred or withheld at various seaports as retailers in the US were reluctant to accept deliveries amid the current economic uncertainty, according to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA). Now, buyers have asked for up to 180 to 210 days to complete their payment.

USFIA Report

A United States Fashion Industry Association (USFIA) report revealed that approximately 90 per cent of fashion companies planned to increase hiring over the next 5 years, particularly in production and supply chain roles. China remained the foremost location for apparel sourcing and manufacturing even as fashion companies diversified their sourcing throughout Asia, and to lesser extents, in Mexico and Sub-Saharan Africa this year. The long-term focus of these companies is to find partners outside of China that meet quality and compliance standards.

Asia - Favoured Sourcing Destination

The 2020 Fashion Industry Benchmarking Study, jointly conducted by the US Fashion Industry Association (USFIA) and the University of Delaware, reported that top 10 most-utilised sourcing destinations for US companies in 2020 remained the same as last year and 8 Asian countries, including Bangladesh, saw a higher utilisation rate this year than 2019. The study surveyed some of the country's largest brands and retailers, including the top 25 US based fashion brands, retailers, importers and wholesalers. Approximately, 55 per cent of fashion brands in the US wanted to source from Bangladesh in the next two years while around half of the companies planned to modestly increase procurement from Indonesia, Vietnam, and India.

Bangladesh managed to become the 3rd largest sourcing destination for the US with 85.70 per cent respondents opting for US, while China and Vietnam secured 100 per cent and 95.20 per cent respectively followed by India at 81 per cent, Indonesia at 71.40 per cent, Cambodia at 66.70 per cent, Philippines at 57.10 per cent and Sri Lanka at 52.40 per cent.

In the first five months of 2020, Bangladesh accounted for 9.40 per cent of total US imports, despite Covid-19 and the US-China trade war. The country's strong ability to produce yarn and fabric locally without relying on imports despite labour cost contributed to a significant price advantage for Made in Bangladesh products.

Comments