The UK government has taken a slew of measures to uplift the country's business sectors and ease trade relations between UK and other countries. This includes the UK Internal Market bill, UK's Membership in CPTPP, UK-Japan FTA and many others. Fibre2fashion presents a detailed report.

UK Internal Market Bill

The UK government has introduced a new bill in parliament to protect jobs and trade across the whole of UK after the transition period ends. From January 1, 2021, powers in a range of policy areas previously exercised at EU level will flow directly to the devolved administrations. Without urgent legislation to preserve the status quo of seamless internal trade, rules and regulations set in Scotland, England, Wales and Northern Ireland could create new barriers to trade between different parts of the UK with unnecessary red tape for business and additional costs for consumers.

The bill will recognise regulations from one part of the country to another. Each devolved administration will be able to set their own standards and will be able to benefit from the trade of businesses based anywhere in the UK. The rules in this bill will also bind the UK government when acting on behalf of England in areas of devolved competence. The bill will also enable the UK government to provide financial assistance to Scotland, Wales, and Northern Ireland with new powers to spend taxpayers' money.

From January 2021, the UK will be able to invest in communities and businesses nationwide with powers covering infrastructure, economic development, culture, sport, and support for educational, training and exchange opportunities both within UK and internationally. The proposals will allow the UK government to meet its commitments to deliver replacements for EU programmes, such as UK Shared Prosperity Fund, replacing bureaucratic EU structural funds and at a minimum match of the size of those funds in each nation.

The UK government has also laid out plans to establish an independent monitoring body, the Office for the Internal Market (OIM), to support the smooth running of trade within the UK. The body will sit within the Competition and Markets Authority (CMA) and provide independent technical advice to parliament and the devolved administrations on regulation that may damage the UK's internal market. The reporting and monitoring role undertaken by the OIM will be nonbinding and carried independently from ministers and devolved administrations, ensuring impartiality and transparency when developing its evidence.

Where there is a matter of dispute, the OIM will ultimately provide such reports to the UK parliament and each of the devolved legislatures and it will be for these bodies, supported by their respective administrations and intergovernmental processes to determine how to act in response, minimising the need to seek court action. The new independent Office for the Internal Market will stand ready to provide technical advice to the UK government and parliament and the devolved administrations and legislatures on the smooth running of trade within the UK. The CMA will ensure that the OIM fulfils its role with professionalism, impartiality, and analytical rigour.

UK Membership in CPTPP

The UK has taken a major step in the process of joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The UK held preparatory conversations with all CPTPP members.

Joining CPTPP would send a powerful signal to the rest of the world that Britain is prepared to work for countries with fair trade. The UK aims to join CPTPP because membership will help put the UK at the centre of a network of free trade deals with dynamic economies, making the country a hub for international businesses trading with the rest of the world.

The free trade area removes tariffs on 95 per cent of goods traded between its members, which could reduce costs for businesses and create new economic opportunities for British exporters. Since 2009 trade between the UK and CPTPP countries has grown by approximately 6 per cent every year till 2019.

UK-Japan FTA

The UK-Japan Free Trade Agreement (FTA) will allow clothing producers to undergo a single process in the UK and then export to Japan under tariff preference. According to the UK Fashion and Textile Association (UKFT), approximately 50 per cent of the inputs are sourced domestically. The FTA also allows for a more streamlined process to register design right protection in Japan and customs provisions that aim to minimise costs and administrative burdens. The FTA will cause tariffs reduction or elimination and more beneficial rules of origin regime. The present MFN tariff of 9.10 per cent on UK trousers and coats will be removed after FTA enters into force. Also, the 21.60 per cent tariff on leather and footwear will be removed from 2028 onwards. Japan is a third largest market for the UK fashion and textile industry after the EU and the US. The brands, especially those manufacturing in the UK, Japan is the topmost preferred market.

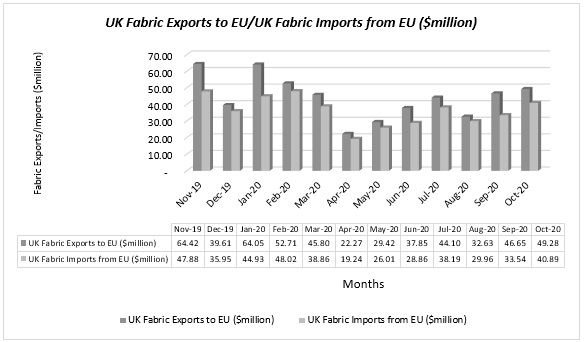

New Three Tier Lockdown and Impact on Retail Business

The earlier lockdowns have impacted the jobs extensively from companies such as John Lewis, Harrods, Marks & Spencer, Selfridges, Debenhams, the UK arm of Victoria's Secret, Laura Ashley, Kath Kidston and Edinburgh Woollen Mill.

According to UK's Office for National Statistics, retail sales volumes showed a gain of 0.80 per cent in August from the prior month. Within the retail distribution channel, apparel stores were more than 10 per cent below February's pre-pandemic levels.

Traffic levels at retail destinations have since fallen by 0.3 per cent last week from the week prior. According to brick-and-mortar retail activity tracking firm Springboard, a footfall traffic decline of 39 per cent has been observed year-over-year at UK high streets for the week ended October 4, 2020.

As per Office of National Statistics, UK's retail sales rose by 1.50 per cent in September from August and by 5.50 per cent rise from February's pre-pandemic level. However, apparel sales in August were still 12.70 per cent lower than in February in volume terms, and sales at department stores were 0.90 per cent lower. Online sales for textiles and apparel increased by 27.70 per cent in October but declined by 1.70 per cent from the August.

UK shop closures have hit record levels with over twice as many net stores closures in the first half of 2020 compared to last year, according to research by Local Data Company and PwC UK that shows 11,120 chain operator outlets have closed this year so far and 5,119 opened, creating a net decline of 6,001, almost double the decline tracked last year i.e 3509.

UK's Tax- and Duty-Free Process

In the month of August 2020, UK's Treasury department declared the suspension of tax-free shopping in the country. Tax-free shopping in the UK will be terminated on December 31, 2020. The government has announced the changes to value-added taxes (VAT) and duty-free shopping that will take effect on January 1, 2020. VATs are essentially broad-based consumption taxes assessed on goods and services bought and sold in European Union (EU) countries.

Currently, the VAT Retail Export Scheme allows shoppers to claim back 20 per cent of the purchase price that was paid in VAT for goods bought in Britain, provided they are from a country that's not part of the EU.

Some industry experts said that implementation of the planned VAT changes could result in the loss of 70,000 jobs, and pry $7.25 billion from the UK economy. Managing Director of Selfridges, Anne Pitcher said that the end to tax-free shopping was another nail in the coffin for city centre retailers. This should have been a golden opportunity to make Britain one of the most desirable countries to visit. Instead, with a single swipe, the government has taken more than $25.88 billion of opportunity from the economy.

UK, US Trade

The US and the UK trade talks are on track for a comprehensive agreement after the US election which would provide a significant and mutual benefit to their economies, according to the UK department of international trade. The round included focused discussions on market access for goods, including negotiations around product specific rules of origin, which determines whether or not a product can benefit from preferential tariffs under the free trade agreement.

UK Guidance for Retailers to Prepare for End of Transition

The UK department for business, energy, and industrial strategy (BEIS) have disclosed the information and guidance for the retail sector to prepare for the end of the transition period of the UK's exit from the EU. The period ends on December 31.

This UK Global Tariff (UKGT) will replace the EU's Common External Tariff, which applies until December 31, 2020. The UK generalised scheme of preferences (GSP) will continue to provide trade preferences to the same countries as the EU's GSP from January 1.

Rules relating to online activities in European Economic Area (EEA) countries may newly apply to UK online service providers who operate in the EEA from January 1. The e-Commerce Directive currently allows EEA online service providers to operate in any EEA country, while only following relevant rules in the country in which they are established. This framework will no longer apply to UK providers as the UK will have left the EEA.

UK GSP Launch

The UK's generalised scheme of preferences (GSP) will cover all countries currently eligible for trade preferences under the EU's GSP after the end of the transition period. The scheme will cover all eligible countries that do not have their existing trade agreements transitioned into a new agreement with the UK. The UK's textiles and apparel imports last year were $9.77 billion which was approximately 30 per cent of total textiles and apparel imports into the UK.

The UK GSP will have three frameworks such as least developed countries (LDC), general and enhanced. The countries in LDC framework are classified as LDCs by United Nations. Imports from these countries have quota-free access and nil rates of import duty on all goods other than arms and ammunition. Bangladesh, Cambodia, Ethiopia, Gambia, Haiti, Laos, Myanmar and Nepal are included in this framework.

The general framework has the countries that are classified as low-income and lower-middle income as per the world bank. Imports from these countries have reduced rates of import duty on certain goods. India, Indonesia and Nigeria are included in the general framework. Algeria, Egypt, Georgia, Ghana, Guatemala, Honduras, Kenya, Morocco, Tunisia and Vietnam will receive GSP market access if they do not implement a trade agreement with the UK before January 1, 2021.

The countries included in enhanced framework are classified by the World Bank as low-income and lower-middle income countries. They must also implement 27 conventions relating to human and labour rights, environment and good governance. Imports from these countries have a nil rate of import duty on certain goods. Armenia, Bolivia, Mongolia, Pakistan, the Philippines and Sri Lanka are included in this framework. The UK will provide a graduation period of at least three years before removing a country from the relevant framework.

Preferential rates of import duty may be suspended on a specific product group that is already highly competitive without trade preferences. This is known as goods graduation. The UK's first list of graduated goods replicates the EU's current list of graduated goods until the end of 2022. The next list of graduated goods will take effect in 2023. It will be reviewed every three years.

Sri Lanka to keep enjoying EU GSP benefit

According to UK's Export Development Board (EDB), Sri Lanka will continue to enjoy EU GSP benefit from 2021 post-Brexit. The UK is the second largest export market for Sri Lanka after the US. Exports to UK in the first 10 months of 2020 amounted to $766.72 million and rose by 39 per cent to $102.50 million in October as per provisional data.

According to EDB, after the transition period, the UK Global Tariff (UKGT) would replace the EU's Common External Tariff. UK Generalised Scheme of Preferences (UK GSP) would apply from January 2021.

The proposed Enhanced Framework of the UK replicating EU-GSP Plus criteria is expected to be enforced on January 1, 2021 for a three-year-period from 2021 to 2023. As per the information of the Sri Lanka High Commission in the UK, the current EU GSP Rules of Origin criteria will be applicable till December 31, 2023 and the exemptions of the EU-GSP Rules will be available in a different terminology such as bilateral, regional, cross-regional, and extended cumulation.

A beneficiary country intending to apply for extended or cross regional cumulation has the option to submit a joint application to the UK authority once the Enhanced Framework is enforced. With regards to the proof of origin of exported goods, the Registered Exporters System (REX system), which is in use at present, will be discontinued from December 31, 2020. However, a similar self-declaration form or a Certificate of Origin (COC) Form A will be introduced by the UK authority. More details and guidelines on the COC will be issued shortly by the UK authorities. During the three-year-period from 2021 to 2023, the UK will review the eligibility criteria, rules of origin criteria and guidelines to develop its bespoke preferential scheme. The stakeholders too will be consulted in this process.

UK-Kenya Agreement

The UK has signed an Economic Partnership Agreement with Kenya, benefiting UK-Kenya trade which was worth $1.71 billion in 2019. The trade agreement will ensure that all companies operating in Kenya, including British businesses, can continue to benefit from duty-free access to the UK market. The provisions of the agreement will apply from January 1, 2021. The deal was signed in London on December 8 by UK international trade minister and Kenya's Cabinet Secretary for trade. It will support jobs and economic development in Kenya, as well as avoid possible disruption to UK businesses.

For UK, the agreement would be a catalyst to deepen the mutual prosperity alongside the other areas of cooperation in Kenya that includes security, sustainable development, climate change, and cultural pillars.

Britain-Singapore FTA

Britain's secretary of state of international trade and Singapore's trade minister signed the deal at a ceremony in the Southeast Asian city-state. The deal with Singapore largely mirrors a standing agreement the Southeast Asian nation has with the EU. But it is an important deal for Singapore, which counts Britain among its top trading partners for goods and services globally and its top investment destination in Europe.

Government Failures and its Impacts

Perplexed Brexit Deal

The two sides stuck over key issues including the resolution of future disputes and "level playing field" provisions, the standards the UK must meet to export into the EU. The biggest hurdle appears to be fish. EU countries want their boats to be able to keep fishing in British waters, while the UK insists it must control access and quotas.

According to Michael Gove, minister in charge of Brexit preparations, if there is no deal, there will be huge disruption, with the overnight imposition of tariffs and other barriers to UK-EU trade. The heavy burden will be on Britain, which does almost half its trade with the EU.

The decision has yet to be taken. Things will be smoother with a deal, which would remove quotas and tariffs on goods, though businesses still face new obstacles and red tape, including customs declarations and border checks.

Repercussion Over Brexit Deal

a. Investors and banks have predicted that a deal will eventually be done, so a no-deal would hit sterling, according to major foreign exchange traders.

b. Britain would lose zero-tariff and zero-quota access to the European Single Market of 450 million consumers.

c. Britain would impose its new UK global tariff (UKGT) on EU imports while the EU would impose its common external tariff on UK imports.

d. Non-tariff barriers could hinder trade, with prices predicted to rise for consumers and businesses.

e. Britain's reasonable worst-case scenario is that 7,000 trucks bound for the continent could stack up in the southern English county of Kent.

f. According to Britain's Office for Budget Responsibility (OBR), a no-trade deal would wipe an extra 2 per cent off British economic output in 2021 while driving up inflation, unemployment and public borrowing. The OBR said tariffs under WTO rules and border disruptions would hit parts of the economy such as manufacturing.

g. The shock would be felt unevenly across continental Europe, with those likely to be hit worst including Ireland, the Netherlands, Belgium, France, Luxembourg, Malta and Poland.

h. The Halle Institute for Economic Research estimated that EU companies exporting to Britain could lose more than 700,000 jobs if no trade deal is agreed.

i. Implementing the Northern Ireland protocol of the 2020 Brexit Treaty will be complicated without a trade agreement. Under the treaty, Northern Ireland remains, in effect, in the EU's single market for goods and aligned to its customs rules after December 31 unlike the rest of the UK. Exactly how checks, regulations and paperwork will work between Britain and Northern Ireland is not yet clear.

j. London, the British capital is the global centre for euro trading, a potential headache for the European Central Bank.

Online Business

As reported by the British Retail Consortium and KPMG, the UK retail sales in August have increased by 3.90 per cent. The latest data from the BRC-KPMG showed that the August sales moved up this year as compared to the down of 0.40 per cent a year ago. The growth has been fuelled by online orders boosted due to outbreak of pandemic. Online non-food orders rose by 39.30 per cent in August, compared to 29 per cent a year ago.

According to the report from BRC-ShopperTrak, the UK footfall dropped by 34.80 per cent in August, below the 12-month average decline of 27.60 per cent. High street footfall, which declined by 41.70 per cent year-on-year, was the worst-performing sector in August, falling below shopping centres for the first time since April 2018. Retail parks showed 11.10 per cent year-on-year decline in footfall due to locations in wider and open spaces.

In contrast, shopping centre footfall dropped by 37.40 per cent in August year-on-year. In-store discounting and demand for school wear have supported the increase in number of customers to the shops, but some offices are still closed and much of the public are avoiding public transport. It has a devastating effect on the local economies in

these areas, according to Helen Dickinson, OBE, CEO of the BRC. Many players have preferred the investment in making workplaces safer and government has advised to 'work from home if you can'. According to Dickinson, the future of retail sales is not clear. The prolonged shift to working from home has also affected the many city centre retailers that rely on high footfall locations, such as apparel and footwear.

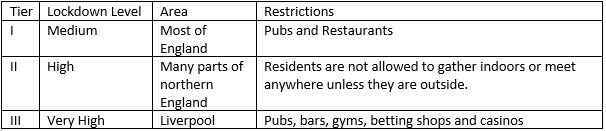

UK Apparel Exports to EU/UK Apparel Imports from EU

Source: TexPro

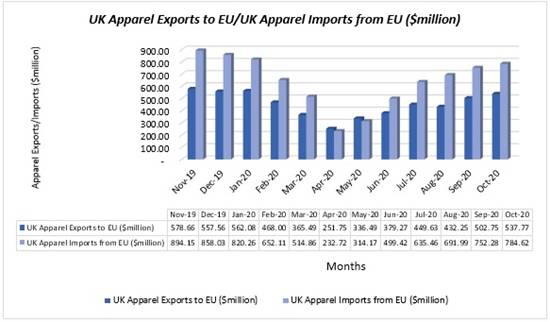

UK Fibre Exports to EU/UK Fibre Imports from EU

Source: TexPro

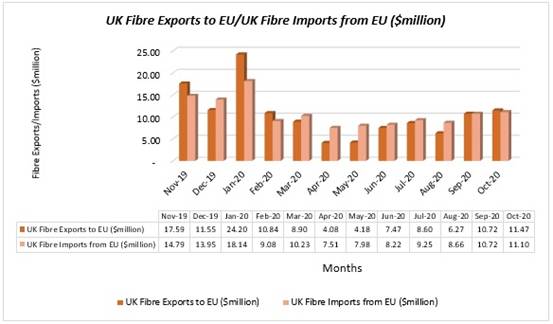

UK Fabric Exports to EU/UK Fabric Imports from EU

Source: TexPro

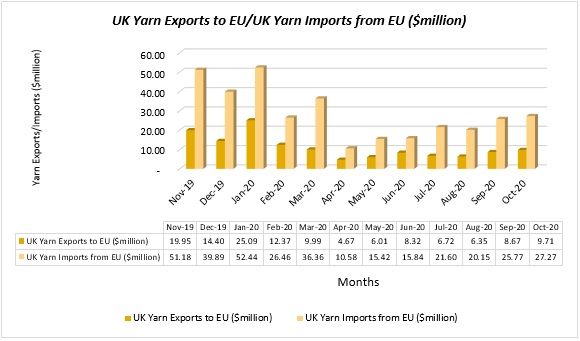

UK Yarn Exports to EU/UK Yarn Imports from EU

Source: TexPro

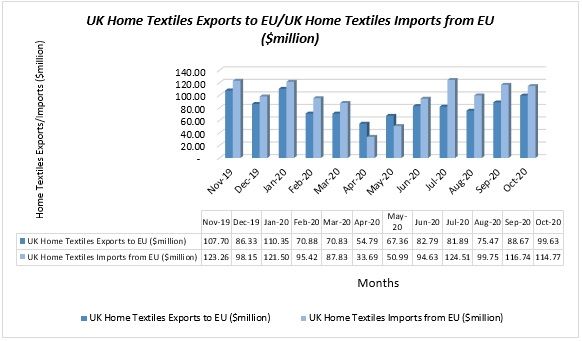

UK Home Textiles Exports to EU/UK Home Textiles Imports from EU

Source: TexPro

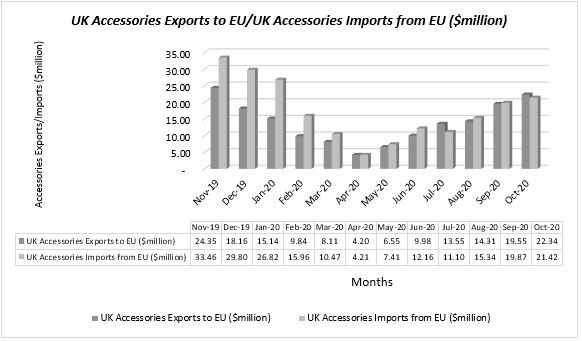

UK Accessories Exports to EU/UK Accessories Imports from EU

Source: TexPro

Comments