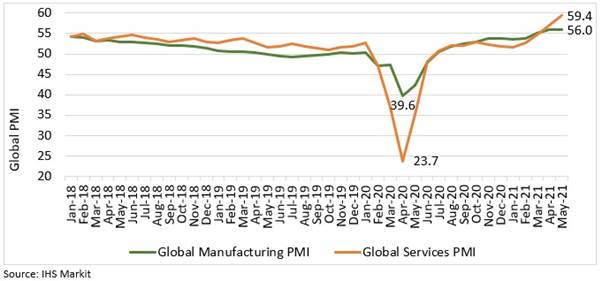

Global PMI rose to historic highs in May-21, largely due to faster recovery in the services sector for all major economies. It registered 56.0 for manufacturing and 59.4 for services. Input prices continued to rise due to supply chain issues, and only a small portion of this is being transmitted to end-consumers, resulting in squeezing of margins.

Global Composite Purchasing Manager's Index (PMI) indicated accelerated growth in economic activity for May-21, as it continued to rise for the fourth consecutive month since Feb-21, breaking through the uncertainties prevailing early this year. PMI is a sentiment index, where a value above 50 indicates expansion and a value below 50 indicates contraction from the last month. Global Composite Output Index reached 58.4 in May-21, a 181-month high, rising sharply from 56.7 in Apr-21. Composite New Orders Index also rose significantly, from 56.8 in Apr-21 to 58.5 in May-21, showing expectations of strong demand recovery. This is expected largely on the back of large economies such as US, EU and China opening up substantially. However economic activity in Japan and India recently hit a roadblock.

Composite Employment Index fell slightly from 53.4 in Apr-21 to 53.3 in May-21, indicating moderation in growth. US and EU both saw declining unemployment numbers, while China's job market has been slow to recover, and India had another round of economic restrictions, hurting jobs growth. Globally, demand recovery has been much faster than supply, pushing both input and output prices to newer highs. Input Prices Index reached 67.0 in May-21 and Output Prices Index was at 59.1, suggesting relatively greater acceleration in input costs and margin squeeze.

The composite indices' stellar performance was largely a reflection of the strength in services activity, while global manufacturing activity experienced moderate growth. Manufacturing PMI increased only slightly from 55.9 in Apr-21 to 56.0 in May-21. Manufacturing Output index even fell slightly to 55.6 from 55.8 in Apr-21, suggesting slower expansion. Manufacturing Employment Index also fell, from 52.6 in Apr-21 to 52.5 in May-21. Input Prices Index for manufacturing reached 71.6 indicating very rapid growth compared to Output Prices Index which stood at 62.6 in May-21.

Global PMI for services indicated a much larger expansion than manufacturing, with Services Business Activity Index rising to 59.4 in May-21, from 57.0 in Apr-21. A major part of this revival in services activity was from improvement in international trade flows. Amongst the 3 broad categories of services covered, business services are expected to see the largest expansion followed by financial services and consumer services. Employment Index for services saw a slight decline in May-21 (53.8 in Apr-21 to 53.5) and input prices increased faster than the final price charged.

Figure 1: Global PMI: Manufacturing & Services

Sector-wise PMI performance

PMI showed universal growth of business activity in May-21 across all the 21 sectors covered. All sectors except Tourism & Recreation saw expansion in employment, and several sectors saw record input and output price inflation.

The top 5 sectors which registered the strongest expansion in business activity in May were Real Estate, Tourism & Recreation, Healthcare Services, Insurance Services and Banking Services. Real Estate has topped the performance charts for the first time since Jan-20, and Global Real Estate Business Activity Index stood at 63.3 in May-21, highest since Oct-09. Tourism and Recreation has seen a sharp jump from Apr-20, when it stood at the 16th position amongst the 21 sectors for business growth. Healthcare Services also saw a sharp growth improving its position from 12th in Apr-21 to 3rd in May-21.

In terms of employment, all sectors except Tourism & Recreation have seen strong improvement over the last two months. For May-21, Healthcare Services, Insurance Services, Technology Equipment, Software Services and Banking Services saw the largest growth in employment.

Sectors like Metals & Mining, Forestry & Paper Products, Machinery & Equipment, Chemicals and Automobiles & Auto Parts saw the largest rise in input prices, with some of the sectors even reaching historical highs since Oct-09. Metals & Mining and Forestry & Paper Products also saw the largest rise in output prices albeit in moderation compared to their inputs.

IHS Markit Global Output Index also shows that on a relative basis, consumer goods industries have seen the slowest output growth since Sep-20 amongst eight major sectors: Financials, Basic Materials, Consumer Goods, Consumer Services, Healthcare, Industrials, Technology and Telecommunication Services. Consumer Services (including Media and Tourism & Recreation) has seen tremendous improvement and saw second largest growth in output in May-21.

Performance of the largest economies

United States: US economy saw sharp recovery in manufacturing activity, as PMI increased from 60.5 in Apr-21 to 62.5 in May-21. Both output and new orders continued to see accelerated growth, indicating strong recovery in both demand and supply. However, supply-side shortages for many industrial inputs continued to increase supplier prices. The input price inflation was also passed on to the consumer, leading to simultaneous rise in final prices.

Services PMI Business Activity Index for the US saw a steep rise since late-2009. Services PMI rose to 70.4 in May-21 up from 64.7 in Apr-21, accelerating for the fifth month in succession. Similar cost pressures prevailed for services sectors as well, leading to services inflation also rising to multi-year highs. Employment trends in the services sectors remain strong, and business confidence improved due to relaxations in Covid related restrictions.

Eurozone: Eurozone manufacturing PMI stood at 63.1 in May-21, reaching historical highs. Netherlands saw the highest PMI reading at 69.4, followed by Austria at 66.4, Germany at 64.4, Ireland at 64.1 and Italy at 62.3. However, for Germany, this was a 3-month low, largely impacted by supply-chain delays. Rise in input prices have had a significant impact on output production in the Eurozone. However, renewed demand for many countries kept production growth high.

Services PMI Business Activity Index rose sharply to 55.2 in May-21 from 50.5 in Apr-21. Greater backlog of work led to a strong demand for employees, and positive expectations for the future led to increased hiring activity. IHS Markit notes that the sentiment was the highest recorded by the survey in the last 17 years.

China: China manufacturing PMI reached 52.0 in May-21 rising only slightly from 51.9 in Apr-21, suggesting slow growth in manufacturing. New orders/business saw renewed growth, but the pace of production was slower due to rising supply shortages and input prices going higher. The higher production was largely supported by increased demand in both domestic market and abroad.

Services PMI Business Activity Index stood at 55.1 in May-21, lower than the 56.3 in Apr-21, yet indicating much stronger growth than manufacturing. Customer demand recovering sharply and new offerings for sale have largely driven the growth. Employment across China's services sector grew for the 3rd consecutive month, however the rate of growth softened slightly since Apr-21. Cost pressures remained a significant bottleneck to growth for all categories of services.

Japan: Japan manufacturing growth turned softer in May-21, with manufacturing PMI falling slightly to 53.0 in May-21 from 53.6 in Apr-21. New business orders also continued to rise in May-21, albeit at a slower pace from Apr-21. Employment rose in manufacturing sector in Japan in response to the output demand. Due to expected supply shortages, manufacturers increased their inventory of inputs, however business sentiment continued to improve.

Services activity in Japan was still contracting in May-21, and the PMI Business Activity Index fell from 49.5 in Apr-21 to 46.5 in May-21. Resurgence in COVID-19 infections and resultant restrictions, hurt service providers tremendously, and led to a faster contraction in activity. New business orders declined at a faster rate in May-21, continuing the downward run for 16 months. International demand for Japanese services also fell, as other Asian markets also saw a renewed surge in cases. Rising cost pressures continued for the 6th consecutive month.

India: India's manufacturing sector activity continued to see slower growth in May-21, as PMI fell to 50.8 from 55.5 in April. This is the lowest reading in 10 months, driven by fresh round of lockdowns and curfews imposed by several state governments. New business orders grew at the slowest pace since Aug-20. Slowing new orders and Covid restrictions led to companies reducing their employment numbers, and the pace of decline increased from April. As reported globally, input prices continued to push costs higher.

Services activity contracted in the month of May-21, with PMI Business Activity Index falling from 54.0 in Apr-21 to 46.4. The index was in the contractionary territory for the first time in 8 months, driven mostly by greater restrictions due to surging COVID-19 infections. Exports of Indian services also shrunk at the quickest rate in 6 months, driven largely by restrictions on travel and business closures. Service providers covered in the survey expected demand revival in the coming 12 months, but optimism weakened to the lowest since Aug-20.

Resurging Covid infections remains a significant risk in several countries, particularly in India and Japan. With successful vaccine rollout, the threat of further disruptions to economic activity could become less severe, and demand may likely increase faster. Rising input prices and resultant cost pressures are however expected to continue, as supply chain delays will be prolonged. These delays are largely driven by port shortages, container shortages and shortages in key industrial commodities like copper, aluminum and iron ore. These shortages are related to capacity and infrastructure and adding new facilities for ramping up production will only be more gradual, while demand recovery will be growing much faster. This makes cost-push inflation more likely to remain strong for the coming months.

Comments