India and UK have announced an investment and trade deal worth USD 1.4 billion involving private participants, as part of the Enhanced Trade Partnership, aiming at doubling bilateral trade between the two nations. A much-needed break from its stalled trade negotiations, a possible FTA between the two nations could significantly boost India's lagging exports.

Trade remains the single largest factor in an economy's development process. Increased trade linkages allow an economy to expand its market from beyond its domestic consumers and improve quality of its industries and technology due to increased knowledge sharing and competition. Current industrial behemoths such as the UK, Germany, Japan, China, Taiwan, South Korea have all made their mark at the global stage through increased participation in trade. India as the sixth largest economy has a relatively lower trade intensity. One could think of several reasons for this - from long-continuing regulatory hurdles at the factory level or customs which increased costs, to lack of both quality and cost competitiveness in India's products. Supply side factors like the former have been eased to an extent, as indicated by India's improvement on Ease of Doing Business rankings. But India's trade has still been struggling to grow over the last decade predominantly due to global demand and India's unsuccessful attempts at forging stronger trade ties with major economies.

India's trade-to-GDP ratio peaked in 2011 at 55.6 per cent, subsequently declining to 39.6 per cent through 2019. During the last decade (2010-19), India's exports grew at an average of just 4.3 per cent, dwarfed by the previous decade's (2000-10) average growth rate of 17.9 per cent. Growth in the last decade has also been more volatile, due to both global factors as well as domestic policy related issues. Imports have performed equally bad, as average growth fell to 3.5 per cent during 2010-19 from 20.8 per cent in the previous decade. In the export basket, many major partners except the US, China, UAE and Singapore have lost share over the last two decades. Similar trends have emerged in India's import basket, where the oil-producing nations such as UAE, Saudi Arabia & Iraq, China and the US have gained more traction. However, India's trade with other large economies such as Germany, Japan, UK and France has grown relatively slower and seen tremendous decline in share.

Recent positive developments on India's trade front

Of particular interest recently, has been the announcement of an investment and trade deal between India and UK, during a virtual summit held early last month. Both countries have announced a total of USD 1.4 billion worth of private trade and investments, of which close to USD 330 million will be invested by the Serum Institute of India for clinical trials for COVID-19 vaccines, R&D and manufacturing of vaccines. There are heavy speculations now that a FTA between the two countries is underway, and the two countries are reported to finalise an interim deal by Dec-21. This trade deal is a part of the greater goal of doubling India-UK trade by 2030. During the preliminary talks, both countries have agreed to removing trade barriers and enabling market access for respective companies in both countries.

This comes as a silver lining for India's external trade as it promises increased access to a biger market like the UK for Indian industries. Early on, it could be said that sectors such as ICT, financial services, food & drinks and pharmaceuticals will benefit more out of the trade and investment pact, and will only be clear as the negotiations progress further. This coupled with easing economic restrictions across the world could lead to speedier recovery for India's trade flows. It is even more positive because India has had major frictions over sealing a FTA with either the EU or US, while its competitors Vietnam and Bangladesh have gained global accolades due to their FTAs with the two largest economic blocs of the world. There are also renewed talks between India and EU on their earlier stalled Broad Based Trade and Investment Agreement (BTIA), and between India and Australia on their Comprehensive Economic Cooperation Agreement, which had its last round of negotiations in 2015.

UK-India trade deal will benefit both nations

Being the fifth and sixth largest economies in the world respectively, trade flows between UK and India demands greater attention. Trade between UK and India shrunk dramatically over the years. Although India's imports and exports with UK have grown in absolute terms over the last two decades, their relative share has declined tremendously. UK's share in India's imports has gone down from 7.6 per cent in 2000 to 1.4 per cent in 2019, while its share in India's exports has shrunk from 5.2 per cent to 2.7 per cent. India's share in UK's exports has remained stagnant at close to 1.3 per cent between 2000-2019, while its share in UK's imports improved only slightly from 0.7 per cent to 1.4 per cent.

Both the economies provide large markets but with very different opportunities that could be leveraged through better trade integration. India provides a large pool of educated workforce, and a large talent pool of technically trained people, which can prove useful for UK's growing economic needs and a cheaper source of labour now that Europe's workforce will no longer be accessible as before. The relatively young population also provides a brimming consumption market which has continued to attract international brands world over. UK, on the other hand, is a much more mature market with a large technological base and a history of leading global innovations. Improved investment and trade relations with the UK could help Indian companies leverage new-age technology much faster. India's industrial competitiveness has hardly improved over the last ten years (rank 42 on UNIDO's Competitive Industrial Performance Index in 2018 vs rank 43 in 2010). Greater trade and investment ties with industrial nations like the UK can help Indian industries jump the technological curve, participate better in global value chains and generate greater surplus.

The proposed deal is expected to remove mobility restrictions for employment seekers from India, but on the condition that illegal Indian immigrants in the UK are taken back. It is also expected to lift tariff/non-tariff barriers on various categories of imports from UK including medical equipment, fruits (British apples, pears and quince could very well be exported to India for the first time), legal services and financial services.

India's financial services industry is yet to mature and has experimented tremendously with digitisation. Over the last few years, a vast proportion of its population has come to embrace financial services apart from traditional banking through digital applications. Data from Securities and Exchange Board of India (SEBI) shows that close to 10.7 million demat accounts were opened between Apr-20 and Jan-21. Access to financial services market in India holds tremendous potential for UK firms as the possibilities are still largely unexplored. UK educational qualifications are expected to be given greater recognition in India and will likely increase the flow of Indian students to UK universities. The deal will also impact intellectual property related transactions (predominantly pharmaceuticals) between the two nations, as India is expected to relax certain restrictions.

Potential for more

This surely appears to be the beginning of a much greater partnership between the two nations. The last statement of the India-UK Joint Economic and Trade Committee (JETCO) explores some of the above-mentioned themes and several others where we might see more action over the coming years. One of the key areas of engagement will be green energy, and investment flows between the two nations have already started to grow. The JETCO expects greater collaboration on sectors such as ICT, food & drinks and life sciences.

This collaboration is coming at an important time as investment and trade flows will enable both economies to generate employment in their export sectors and provide fuel to post-pandemic recovery. UK is likely to create more strategic ties with India and other nations, to make up for its economic loss from Brexit. But more importantly, this will continue in order to create synergies outside of China. India will also have similar considerations. India's concerns for not joining the Regional Comprehensive Economic Partnership (RCEP) were predominantly based on China's over-bearing presence in the region and its likely impact on India's agricultural and manufacturing sectors. India's trade growth then largely depends on tilting towards other large economies such as the US, EU and now UK separately, Japan and Australia.

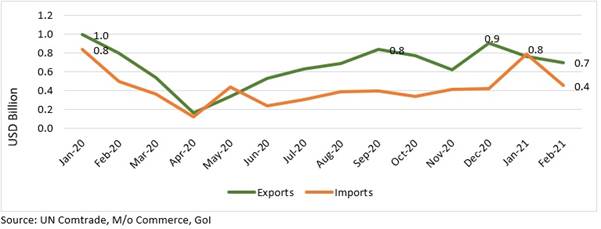

Post-Brexit, the need and the urgency of this deal for both economies has increased. For India, now it is being perceived much easier to strike a pact with the UK than earlier when there were 27 nations involved. Early trends of India-UK trade flows post Dec-20, are not reflective of any transformative shift as neither India's exports nor its imports from the UK have crossed the pre-pandemic levels. However, this may purely be due to COVID-19 related disturbances. Perhaps, a large part could also be attributable to trade and tariff related uncertainties after Brexit.

Figure 1: Monthly trade flows from India to UK

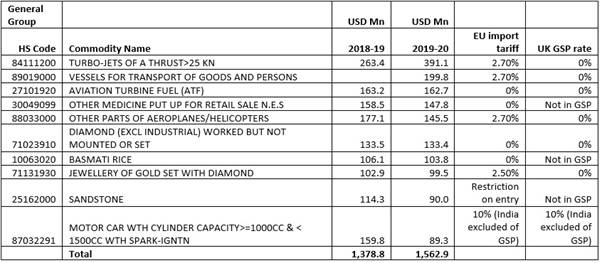

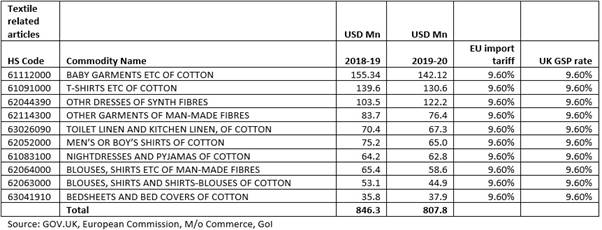

One of the very first policy decisions from UK was to slash import duties on close to USD 42.5 billion of imports. India is likely to benefit from this as well, as its exports to the UK stood at USD 8.7 billion. Additionally, UK implemented the UK Global Tariff (UKGT) replacing EU's Common External Tariff (CET), keeping India's GSP position intact. The UKGT has reduced import duties on several products, of which we consider here, for illustration, only the top 10 that India exports to UK. However, duty on India's exports of textile and garment products has not changed. The top 10 textile related exports to the UK continue to attract a 9.6 per cent duty as they did pre-Brexit.

Table 1: Top 10 categories – India’s exports to UK

Table 2: Top 10 textile related categories – India’s exports to UK

A free-trade agreement between the two countries will perhaps have a much larger impact as many commodities which are currently not a part of their trade basket or continue to attract higher duties might get a significant boost. For instance, the UKGT schedule excludes Indian automobile exports from the GSP benefits, same as EU's CET. Despite this, UK's imports of Indian cars have only risen over the years. UK's auto industry is struggling currently and trade deal with India would only benefit Indian carmakers, more so if the duty is reduced.

On the textile front, India does not hold a substantial share in UK's imports - 7.1 per cent in cotton exports, 3.6 per cent in man-made filament exports, 2.8 per cent in man-made staple fibre exports, 1.5 per cent in knitted or crocheted fabric exports, 6.1 per cent in apparel and clothing exports and 11.7 per cent in made-up articles exports (Source: TexPro). However, in the particular categories mentioned in Table 2, India is amongst the top 3 producers in many. India-UK FTA could strengthen India's position in categories such as cotton shirts, baby garments, toilet and kitchen linen where it already holds the majority share in UKs imports. Additionally, it could provide boost to exports of other products in categories such as apparel and made-up articles from India where competitors like Pakistan, Bangladesh and China have a tremendous cost advantage.

This announced investment and trade deal is overall a good starting point. If it succeeds, it will end a long period of friction in India's bilateral ties with its trading partners. Benefits from this are to accrue only eventually; but in the current global conditions, it is important to have closer strategic ties with other countries irrespective of their tangible benefits as the intangible value could be immense.

Comments