As the US economy continues to improve with large-scale vaccination of the people and rapid recovery of their consumption habits, the demand for clothing and textiles imports to the US from Latin American countries is only expected to increase in H2 2021. The retail stores have already shown steep growth in the sales in March 2021. A report.

US Textiles and Clothing Imports from Latin America

Near the end of Q1 2021, the US economy started faster recovery with increased vaccination rate and rapid recovery of consumption by people. The retail stores showed steep growth in sales in March 2021. A dramatic rise has been observed in all textiles and clothing imports, especially in apparels.

According to brands and retailers, household incomes became steady in US this year and consumers are set to increase their spending this summer across key product categories including textiles and clothing. With more disposable income, increased consumer confidence and fewer restrictions, consumers plan to increase spending in the end of Q1 2021.

According to the BOXpoll report by Pitney Bowes Inc, a global technology company that provides commerce solutions in the areas of ecommerce, shipping, mailing and financial services, consumers plan to spend 12 per cent more on sporting goods and 9 per cent more on apparel and footwear.

The younger generation remained more inclined towards sporting goods. Urban consumers are expected to spend significantly more than people in suburban and rural areas. People with children plan to spend approximately two times higher as compared to people without children. The middle-income group has spent the highest as compared to lower and higher income earners.

Currently, more than 95 per cent of people in the US have been successfully vaccinated which further supported demand recovery. Since the beginning of 2021, China remained at the top in the share of total textiles and clothing imports from the US. But it has been observed that the US fashion brands, and retailers have lessened China imports amidst the pandemic.

In April 2021, the sudden rise in corona cases in India and China shifted business to Bangladesh, Pakistan, Turkey, ASEAN, and Latin American countries such as Mexico, Honduras, Nicaragua, Brazil, Chile, Peru and EL Salvador.

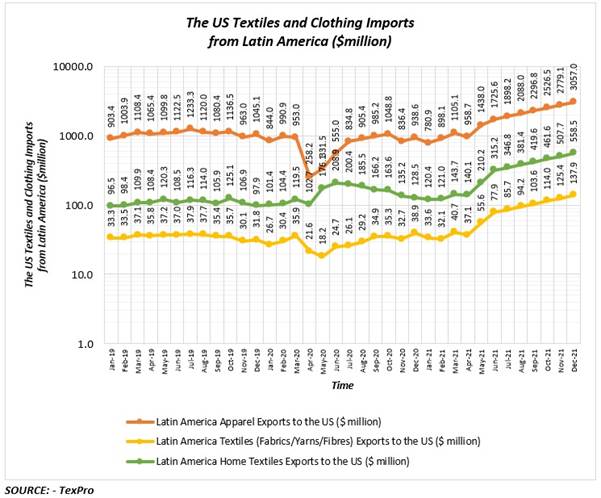

The US apparel imports from Latin America was $12881.69 million in 2019 with monthly average imports of $1073.47 million. It dropped to $9481.76 million in 2020 with a decline of 26.39 per cent due to the COVID-19 pandemic. In the Q1 2021, monthly average import has shown a rise of 17. 45 per cent to $928.01 million over the monthly average import of $790.15 million in 2020. The monthly average import of the US from Latin America in Q2 2021 reached $1374.11 million and showed a high growth of 48.07 per cent over the monthly average of Q1 with increased consumer demand in the US and drop in the import share from China and India.

Now the US import of apparel from Latin America is expected to move up to monthly average of $2440.94 million in H2 2021 with a surge of 77.64 per cent over the monthly average import in Q2 2021. Mexico, Honduras, Nicaragua, El Salvador, and Guatemala remained the top five exporters of apparel from Latin America to the US between January 2021 to April 2021.

The US textiles imports from Latin America was $390.61 million in 2019 with monthly average imports of $32.55 million. It dropped to $354.62 million in 2020 with a decrease of 9.21 per cent due to the pandemic. In Q1 2021, the monthly average import has shown a rise of 20.05 per cent to $35.48 million over the monthly average import of $29.55 million in 2020. The monthly average import of US from Latin America in Q2 of 2021 reached to $56.86 million and showed a significant growth of 60.26 per cent over the monthly average of Q1.

Now the US import of textiles from Latin America is expected to move up to monthly average of $110.15 million in H2 2021 with a surge of 93.73 per cent over the monthly average import in Q2 2021. Mexico, Brazil, Chile, Dominican Republic, and Colombia remained the top five exporters of fabrics from Latin America to the US between January 2021 to April 2021. Mexico, Honduras, Uruguay, Peru, Brazil, El Salvador, and Guatemala were the top suppliers of fibres and yarn from Latin America to the US during the first four months of 2021.

The US home textiles imports from Latin America was $1307.92 million in 2019 with monthly average imports of $108.99 million. It increased to $1792.32 million in 2020 with a rise of 37.05 per cent although the COVID-19 pandemic had ruined industry supply chains across the world. In Q1 2021, the monthly average import has shown a drop of 14.04 per cent to $128.40 million over the monthly average import of $149.36 million in 2020. The monthly average import of the US from Latin America in Q2 of 2021 reached $221.84 million and showed a surprisingly high growth of 72.78 per cent over the monthly average of Q1 with increased consumer demand in the US.

Now the US import of apparel from Latin America is expected to move up to monthly average of $445.93 million in H2 2021 with a surge of 101.01 per cent over the monthly average import in Q2 2021. Mexico, Dominican Republic, El Salvador, Honduras, and Colombia remained the top five exporters of home textiles from Latin America to the US between January 2021 to April 2021.

According to the report by National Retail Federation (NRF) and Hackett Associates, the retail ports in US remained busiest in Q2 2021. It may set a record in the upcoming months as vaccination helped consumers return to normal shopping patterns. Retailers and brands are back in stores and are working overtime. The demand is high, but shortages of labour, equipment and shipping capacity restrict meeting of that demand. The shipping costs have been rising continuously with port congestion. Guess Inc CEO Carlos Alberini says that the US is apparently ahead of other countries, and consumers show strong behaviour to pent-up demand. People are comfortable in going out for purchasing apparel and accessories from stores.

Mexico and Nicaragua have shown a strong export of jeans to the US. Guatemala is also planning to draw investment of $4 billion in fabric, especially for synthetic yarn, to export to neighbouring countries such as Nicaragua and Honduras which will help them increase apparel exports to the US.

As reported by National Society of Industries, Peru's apparel exports have shown prominent rise during H1 2021. More than 60 per cent rise has been observed and US accounted for 70 per cent of the total shipments. The major articles exported were t-shirts, knitted shirts, sweaters, pullovers, and other knitwear.

According to Coresight Research, approximately 7.50 per cent of retailers and brands showed buying interest in apparel, footwear, and fashion accessories in May 2021. In June 2021, the percentage of shoppers increased to 17.60 per cent who were inclined to buy textiles and clothing articles.

As per Vesta, an end-to-end online transaction guarantee platform, apparel has been accounted for maximum share of total trade of textiles and apparel business. According to the survey, apparel business has improved in US in Q2 2021 as people started socialising, attending events, enjoying vacation, attending offices and pre-pandemic clothing do not fit well now.

Comments