Shortages have now become ubiquitous in many sectors of the global economy. From semiconductor chips, container boxes, trucks to truck drivers--supply issues have made delays highlight of global trade flows lately. With demand picking up robustly and Asian countries facing renewed COVID-19 infections, the situation is expected to continue till late next year.

While we are seeing demand pick up in Europe and US as vaccine rollout gathers more pace, supply side issues have only caught up much faster. Operations were impacted last month on the Shenzhen and Ningbo-Zhoushan ports (two of the busiest ports in China) due to renewed COVID-19 cases and have more recently been stalled due to extreme weather conditions. Amidst this, number of coronavirus cases have continued to rise creating speculations about China’s policy measures to curb infections again.

Global demand recovery has been skewed towards the western countries while Asian countries continue to face renewed challenges. Import demand from US reached $283.4 billion in Jun-21 from $277.5 billion in May-21, growing the fastest in many months. Despite that, total throughput at five busiest ports in the US dipped from 1.75 million Twenty-foot equivalent unit (TEUs) in May-21 to 1.57 million TEUs in Jun-21. A few ports which have released data for Jul-21, such as Port of Long Beach, however, do hint at a possible recovery in Jul-21. Import price index released by US’ Bureau of Economic Analysis1 for the US reflects that almost half of the 2.1 per cent increase in import value in Jun-21, is due to inflation. Another important indicator is the decreasing volume of empty containers from the US ports, which could either mean that proportionately less containers are now going empty or just that there are overall less containers available now.

Container prices for major trade routes continue to rise steeply for the fourth consecutive month now, reaching $9,371.3 per 40-feet container as of end of last week. Data from Drewry Supply Chain Advisors shows that container prices are now 370.0 per cent higher than last year, and almost 35.0 per cent higher than the value two months back2. Rates for the Shanghai-Rotterdam route continue to remain the highest, averaging $13,628 last week rising 4.3 per cent in two weeks. Shanghai-New York rates rose dramatically to $13,489 over $11,872 two weeks ago, a 13.6 per cent jump. Shanghai-Genoa rates remained largely stable yet increasing at $12,792 over 12,773 two weeks ago. Rotterdam-New York rates saw the highest jump of 19.6 per cent, rising to $6,417 last week from $5,364 two weeks back.

DHL Ocean Freight Market Update shows that large ocean carriers have responded by placing new orders for new ships. Leading shippers such as MSC, HMM, Wan Hai, Evergreen and Zim respectively saw the largest increase in their capacity during first six months of this year, while Wan Hai, HMM and Zim respectively saw the highest percentage increases. The note also informs that ocean carriers, non-operating owners and other investors/lessors have ordered for 300 vessels in 1H2021. These ships are expected to increase the total capacity by 2.88 million TEUs, 11.7 per cent of the current capacity of 24.47 million TEUs. However, DHL also informs that space and equipment shortages continue and rates remain elevated in all major trade routes, be it from Europe to North America, Europe to Sub- Saharan Africa, Asia Pacific to Europe and North America and vice-versa. Most importantly, DHL expects the situation to prevail until Q4.

Latest advisories by Maersk also hints at further challenges in supporting infrastructure like warehouses, rail and road transport services contributing to the ongoing supply crunch.3 Space shortage at warehouses, languishing trucking and rail infrastructure have again kept shipments hauled up at the ports longer than usual recently. Pacific Merchant Shipping Association, in a press release last month, informed of the increasing dwell time at the San Pedro Bay ports (time a container stays at the port after being unloaded from an ocean carrier and leaving by truck)4 . Average dwell time increased to 4.76 days in Jun-21 up from 3.96 in May-21, with 23.6 per cent of containers being hauled by more than 5 days in Jun-21, up from 13.0 per cent in Apr-21. Bloomberg, in its recent article, highlighted these issues at a more micro level faced even by large corporations such as Honeywell International, Dover Corp, Stanley Black & Decker Co among others. The article cites freight broker C H Robinson Worldwide Inc warning thta his shortage could last at least till February next year, although clarifying that this is likely a very optimistic scenario5.

This situation becomes explainable when we look at bottlenecks in the road transport services in US, particularly trucking. Currently, there is tremendous shortage of labour in the trucking industry in US and other parts of the world. Trucks are essential to take the shipments out of the port for final delivery. Less truck drivers mean less truck rides and slower clearing of shipments from ports, increasing delays and space shortages further. However, as we have highlighted in our previous notes on container prices, these shortages have been there since some time now, and have only become painful lately due to pandemic induced exigencies. A recent survey by International Road Transport Union (IRU) highlighted a 25 per cent gap in supply of truck drivers across the world6. This shortage has become even more stark in the UK post Brexit as foreign nationals (from other EU countries) who were otherwise employed in the trucking industry are no longer allowed to work or live there. The situation is also almost enormous in the US where there was a shortage of 60,000 drivers in 2019 and is expected to increase to 100,000 by 20237.

Even when fleet operators in the US have now started to look for drivers from other countries, like Canada and South Africa, driver shortage is just one part of the problem.

Shortage of semiconductor chips has led to a simultaneous shortage of heavy-duty vehicles and trucks in the US. General Motors, which holds close to 30.0 per cent of the market for pick-up trucks in the US, halted production of its pickup trucks beginning last month. The shortage in both trucks and drivers has led to stagnating truck tonnage in the US since the beginning of this year (Source: American Trucking Association). According to the American Trucking Association, 72.5 per cent of the freight in US got transported by trucks in 20198 , highlighting that this shortage will likely impact last mile delivery of goods further in the US.

As we suggested in our previous note, exploding container prices is likely due partly to structural issues and partly to misallocation of containers. The way shipping companies have responded to such mismatches have caused further issues and exaggerated delays in the supply chain. To illustrate, huge variation in container prices for different routes has created a situation at least in the US where importing has become easier than exporting goods. Consider a shipping company operating between China and West Coast of US, the average rate differential (Shanghai-LA vs LA-Shanghai) was almost $9,000 per 40-ft container, as of last week. This makes sailing with empty containers much more sensible than waiting at the port for loading goods for exports. This further feeds into the shortage of space in warehouses, as export shipments get piled up while containers are hard to find.

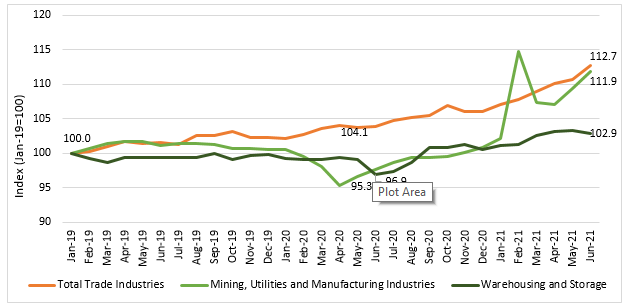

Greater integration of the supply chains has allowed consumers to demand more imported goods. With continued economic recovery and demand uptick, the demand and supply gap is expected to rise further, putting further pressures on supply chains and prices. With both shipping and air freight prices continuing to rise, inflation has further seeped into many industrial goods. This has become starkly reflected in the producer price index (PPI) in the US, with PPI for trade industries rising more rapidly than for all manufacturing industries and for warehousing and storage services.

Governments across the world have given both demand and supply side boost to their economies, but a very vital part of the global supply chains, ocean shipping, remain out of their control. As much as global trade depends on ocean freight for easy flow, slightest of friction in the shipping channels has tremendous impact on global value chains. Global economic recovery then, not just depends on domestic production, which have recovered well this year but also on trade enablers, which have been impacted the most, either due to equipment or labour shortages. Governments can hardly do anything to ease the situation and have very rightly stayed out of fixing it.

With increasing uncertainty about COVID-19 infections once again in several of the Asia Pacific countries, normalcy might take longer. Shortages and price increases are usual aspects of recovery from economic recessions, but continued frictions to supply chains could be devastating to industries which had seen partial demand recovery beginning this year. For instance, it is estimated that chip shortages could lead to a loss of $110 billion in revenues for the global automotive industries. As we go ahead then, many more sectors of the economy could see inflationary impact and perhaps a renewed impact on their finances if the situation demands implementing restrictions on economic activity all over again.

1https://www.bls.gov/mxp/

2https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index-assessed-by-drewry 33https://www.maersk.com/news/articles/2021/08/05/critical-help-needed-congestion-increasing

4June-2021-Container-Dwell-Time-Press-Release.pdf (pmsaship.com)

5Supply-Chain Snarls Seem Never-Ending for Manufacturers, So What Now? - Bloomberg

6https://www.iru.org/resources/newsroom/new-iru-survey-shows-driver-shortages-soar-2021

7A Trucking Crisis Has the U.S. Looking for More Drivers Abroad - Bloomberg

8https://www.trucking.org/economics-and-industry-data

Comments