Luxury fashion brands have been slow to embrace the online mode of commerce. They are not just known for selling high-end products but also a luxurious experience (post-purchase services), which has rendered the brick-and-mortar stores as an indispensable part. However, much has changed in recent years as luxury brands become more internet savvy. An analysis.

Luxury segments and brands until now have had varied responses to adopting e-commerce solutions. As luxury involves not just the product, but also the associated services, extravagant experience of shopping and sheer status attached to it, in-store customer interaction was always considered the better option by the brands. Luxury fashion, therefore, remained relatively untouched by growth of digital commerce in the retail industry. Even when many brands embraced the digital experience early in the 2000s, the end sale would eventually happen in a store. Despite the massive jump in digital traffic in 2020, online sales of large fashion houses such as Kering and Burberry (two of the few which reported the relevant numbers) represented only 13 per cent and 23 per cent of the overall sales. Burberry’s 2020 annual report also notes that most of its online sales was on its own website.

Two significant changes have emerged in the way luxury fashion is sold over the years. Contribution of multi-brand platforms has risen and the target group that luxury brands have started to cater to. The demand markets for luxury fashion have seen a major shift and buying has moved more towards digital, a trend exaggerated in 2020. Bain & Co’s analysis on luxury goods market shows that the share of online sales in overall luxury personal goods market has increased from 7 per cent in 2015 to 12 per cent in 2019 and 23 per cent in 2020. Also, brands still prefer to have their own website to increase their digital presence--e-commerce players such as Farfetch, YNAP, and now Amazon are merging luxury fashion with the benefits of large-scale online marketplaces. We will analyse these trends in detail below.

Why luxury brands weren’t keen on digital?

When it comes to luxury buying, economic theory suggests that demand is not related to price in the conventional sense. On the contrary, higher price is a signal of quality and higher social value in this market, therefore generating greater demand. However, price is still not the most significant factor for generating demand in this segment. In one of the studies analysing twelve Italian fashion houses, product quality and brand value came out to be two most critical factors for success, while costs were said to be important but were lower in the pecking order1 . One of the defining factors of brand value is the place where the product is made, particularly for luxury apparel. Luxury fashion has been peculiar in the way its supply chain is administered and around where the supply is concentrated. While manufacturing for luxury fashion now takes place in many emerging economies, fashion industry still largely revolves around the four fashion capitals (Milan, Paris, London, and New York). Italy is known to be home to the largest number of global fashion houses, with a keen focus on controlling quality and deriving value from relative scarcity of their designs.

That also meant that the thrust was not on generating volume sales. While many luxury brands went online early in 2000s, their online sales share was only paltry. Even as of 2020, wholesale channels constituted 54 per cent of the overall sales, while retail (particularly online) only recently started to gain more share. Bain & Co’s analysis shows that emphasis on mono-brand retail stores was around 31 per cent in 2020, seeing a rise from 29 per cent in 2015. The emphasis on mono-brand owned retail stores was to influence control on the entire supply chain and to provide the distinct luxury experience to the customers which was considered unique to the brand’s image and status. This also solved several other issues related to counterfeiting and pricing control. When it came to selling online, the medium was largely perceived as a conduit, which would eventually lead to increase in store sales.

Recent changes in the luxury market

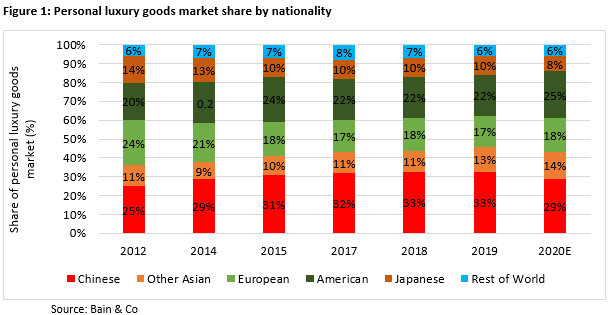

This was also a function of who was buying these goods. Until 2010, Americans and Europeans were the largest spenders on luxury globally, however buying online is still lower in these regions, as e-commerce is still (in 2020) 13 per cent2 and 20 per cent3 of the overall retail revenue. Around 2012, Chinese consumers surpassed the incumbent groups as the largest luxury spenders (Figure 1). Chinese consumers now constitute close to 30 per cent of the luxury goods market and are expected to reach a share of 45 per cent by 2025. However, shopping online was insignificant before 2020, as Chinese consumers were largely buying luxury goods outside China, as tourists hopping out for lavish spending in Europe and America. This has also undergone a change recently as Chinese consumers bought a large proportion of luxury goods online in 2020 due to COVID-19 related travel restrictions. Overall, global share of online purchases went up from 12 per cent in 2019 to 23 per cent in 2020 and is expected to surpass 30 per cent by 2025.

Another trend which has brought a massive change to luxury fashion demand is the consumer demography itself. Deloitte Global Powers of Luxury Goods Report 2019 highlights the changing trends and how luxury brands are increasingly focusing on a consumer segment which is technologically savvier and seeks to spend more. The consumer group called high earning not rich yet (HENRY) constitutes those aged 43 years on average in the US, earning more than USD 100,000 a year with wealth less than USD 1 million. A significant feature which attracts brands to this segment is their extravagant spending habits and yearning to access high-end fashion, something which was until now bought largely by high-net-worth individuals. Consequently, several luxury brands have made significant changes to the range of products on offer. For instance, high-end brands have recently begun to partner with streetwear clothing companies to lure the younger generation. Also, luxury fashion brands have become increasingly more aggressive on digital marketing expecting to attract greater attention within this segment of the population.

Multi-brand e-commerce and luxury fashion

While, e-commerce platforms are flourishing with fast fashion demand, luxury fashion sales are yet to show significant growth. Currently a few major platforms exist, Farfetch and YNAP being the largest and more popular ones, while Amazon has also recently launched its Luxury Stores platform leveraging its large customer base. These platforms have played an important role in providing market access to smaller brands and boutiques which would have lost their entire business when the physical channels of sales were affected tremendously last year. Apart from these streamlined marketplaces, brands also began to use social media platforms much more aggressively. Using Instagram and Tiktok for reaching fashion influencers and gaining traction from the younger cohort has become an integral part of the marketing strategy for many luxury brands and designers.

Large investors also appear to be bullish on e-commerce for luxury goods. Recently, Richemont and Alibaba announced to invest a cumulative USD 1.1 billion, half of which will go to building Farfetch China, a new joint venture. Although, multi-brand e-commerce platforms are expected to grow fast, there is a fundamental challenge to how luxury fashion’s appeal could be maintained in the process. Competition in multi-brand luxury e-commerce has only started with several regional players flexing their muscles. As larger players like Amazon and Alibaba gain more foothold, on the one hand luxury brands will get a greater market reach but on the other they would increasingly become more mass market. This concern is reflected well in the luxury brands’ focus on mono-brand online channels which is nothing but the digital copy of their stores. This again brings us to brands wanting to maintain more personalised and luxurious experience for their customers than having greater volumes.

In a nutshell

Without any doubt luxury will increasingly be delivered online, but perhaps not as a substitute to offline. Pure-play e-commerce players are gaining traction in luxury goods purchases. However, their role may be limited when it comes to creating value for the brands. Luxury brands generate social value from exclusivity and custom services that mass market brands can hardly provide. There is also a possibility that some luxury brands signal exclusivity by only operating their own online channels as complimentary to offline stores. Nonetheless, the demography in focus (the HENRYs) will perhaps largely determine the pace and the direction of this trend.

Reference

1 https://link.springer.com/chapter/10.1007%2F978-3-319-31104-3_7

2https://www.statista.com/statistics/187439/share-of-e-commerce-sales-in-total-us-retail-sales-in-2010/

3https://www.statista.com/statistics/187439/share-of-e-commerce-sales-in-total-us-retail-sales-in-2010/

Comments