Retail sales is one of the most accurate indicators of consumer sentiment and a leading indicator for overall economic activity. For many major economies, retail sales of textile, clothing and footwear have seen only moderate to slow growth due to recurring Coronavirus infections. An analysis.

We have come a long way from the demand slump of last year, however recurring coronavirus infections in many countries have kept the growth very volatile. Policymakers have reacted promptly to any rise in infections and kept restrictions high in many parts of the world. Coronavirus infections remain a major concern in the East Asian economies, and in the European markets as well and recurring waves of infections pose risks to a stable growth. The economic revival has consequently been quite varied across the major economies and has perhaps failed to perform as per earlier expectations. Business sentiment as reflected by Purchasing Managers' Index (PMI) suggests that global manufacturing activity is slowing down after reaching historic highs, although it still signals an expansion going further. Sentiments for services industry are much more bullish and has kept the hopes high for a less tight recovery. Manufacturing activity in China and other East Asian nations is facing challenges due to renewed coronavirus cases, but demand from the importing nations remains high especially from US and Canada.

Retail sales for apparel & footwear has not seen a strong recovery across the world. This has resulted from both shocks to consumer demand and extreme supply chain bottlenecks. Although now almost all large economies have a very high vaccination rate (north of 60 per cent), not all have taken similar approaches to deal with renewed surges in infections. Evidently, countries which have had a more relaxed approach have seen a more consistent increase in demand and also less supply issues. However, global logistical challenges remain uniformly troublesome for all and play a major role in the current supply-demand mismatch in retail trade. Let us have a look at how different countries’ retail markets have performed recently.

Retail sales performance in major markets Europe

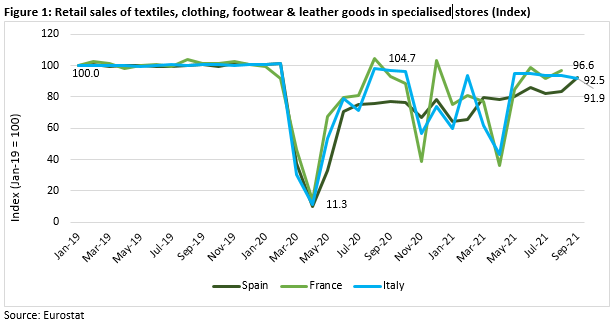

Consumer confidence across many industrial nations appears to have lost pace early on after a solid recovery last year. This is particularly true for the European countries as clothing and footwear retail sales have plateaued for all the major economies in Europe except Turkey and Denmark which have performed slightly better. Retail store sales are generally considered to be a much better leading indicator of economic growth. Figures 1 & 2 show indexed retail store sales of textile, clothing, footwear, and leather goods for major European markets. Spain, France and Italy were perhaps the worst hit from the pandemic in April last year, while economies such as Belgium, Denmark and Turkey saw a much lesser impact.

Even with a much sharper downturn, the rebound has been tepid in the first group of countries. France and Italy have seen a comparatively better recovery than Spain, however retail consumer spending in all the three remains lower than pre-pandemic levels. World Footwear reports that footwear sales in Spain have remained lower by 20 per cent through Aug-21 relative to pre-pandemic levels of 2019.1 However consumer confidence in Spain is estimated to be increasing consistently since last year, with the index of consumer confidence at 97.3 in Oct-21 compared to 48.5 in Oct-20.2 Recovery in apparel and footwear sales in France and Italy was quicker, but both economies have seen greater volatility and their sales also remain lower than pre-pandemic levels. Consumer confidence in both France and Italy has also risen consistently over this year but actual growth in retail sales of apparel and footwear has not followed the trend. The actual sales trend is impacted mostly by surges in coronavirus infections which were around the same periods as the dips in retail sales in the graph, although consumers maybe bullish about their near-term prospects. This is also not reflective of online sales, which is probably performing better than store sales in these economies.

Turkey and Denmark, on the other hand, have seen much better and recently more consistent growth in apparel and footwear sales, sales being up by 40.4 per cent and 27.7 per cent in Sep-21 respectively relative to Jan-19. Supply side issues on the shipping side are also probably not very significant right now as Denmark imports a major part of its apparel from China and Bangladesh (around 36.0 per cent)3 and is seeing a robust growth in store sales. On the other hand, Belgium which imports a large part of apparel from Europe (54.8 per cent)4 has seen only slight recovery in sales recently.

North America

Compared to the European countries, retail sales in North America – US and Canada – has been very strong. Again, this has much to do with much more accelerated vaccination rates and a more relaxed policy approach to increased cases more recently. New infections also increased in the US recently reaching a peak of 200,000/day in Aug-21 but that only had a muted impact on store sales of clothing and footwear. Sales in US were higher by 18.6 per cent in Sep-21, relative to levels in Jan-19. Branded stores in the US are now in fact struggling to cater to the burgeoning festival demand which has led to strong demand for second-hand goods. Similar shortages have now been reported for the month of September in Canada, which will reflect in the data point once released. US and Canada have been more relaxed in terms of coronavirus restrictions this year as last years’ lockdown measures severely impacted these economies.

Asia

Coming to the Asian markets, the economic recovery as we know has remained mired with uncertainties as COVID-19 infections continue to keep optimism in check. Vietnam, as an example, was among the least impacted countries from coronavirus last year and is now almost at the opposite side of the spectrum. In China, previously extreme weather conditions and port disturbances hit its production rates, which got exacerbated by more severe curbs on energy use and property market slowdown.

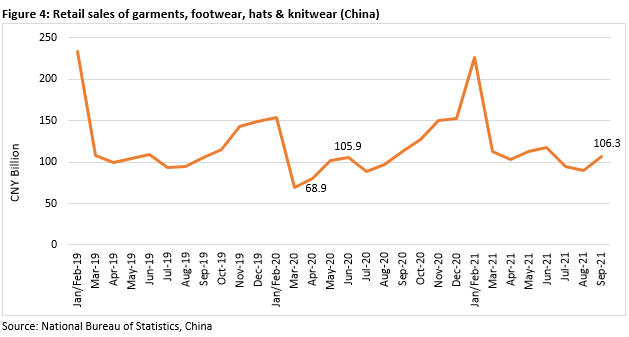

Demand in China however remained strong until very recently, and retail sales of clothing and footwear grew by about 6.0 per cent in Jul-21 from last year. On YTD basis, until Jul-21, sales grew on average by 28.1 per cent relative to last year. Over the last two months (Aug-21 and Sep-21) however, this trend has started to reverse as consumer demand appears to have lost some momentum due to above discussed factors. Figure 4 shows retail sales of garments, footwear, hats and knitwear in China.

Over pre-pandemic levels in 2019, sales in China have only grown by an average of 2.1 per cent for YTD 2021 until September, reflecting demand in China has grown only modestly when compared with some of its western counterparts. These retail sales numbers match well with the overall economic growth numbers which also reflected a slowdown in the third quarter of 2021. 5 This trend is expected to continue primarily because of the severe energy crisis facing the economy and fears of a real estate market crash in China looking more real.

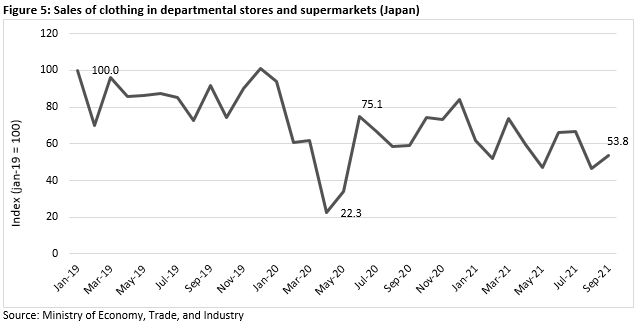

Renewed supply and demand side pressures have continued to hurt the Japanese economy as well. A recently released survey of economists shows that Japan’s economy is expected to contract in the third quarter (quarter ending Sep-21), while growth is expected to rebound in the current quarter as COVID related restrictions were lifted recently.6 Retail store sales of clothing in Japan has seen volatile performance this year and the numbers for Sep-21 were lower both y-o-y and relative to values in 2019. The trend shows that retail clothing sales in Japan have effectively gone down after last year’s revival post the pandemic shock. Japan has been under strict COVID related restrictions for most of this year and that has curbed consumer spending tremendously.

To sum up

Apparel and footwear industry is currently facing both renewed supply and demand challenges. Large consuming nations in Europe and even China are seeing moderate to slow rates of recovery, and even in the US the growth might taper as and when stimulus measures are phased out. On the supply front, while coronavirus infections in Vietnam and Bangladesh have now become more manageable, the shipping industry’s woes continue as a major bottleneck for the value chain. Retail store brands saw a sharp slump in demand last year as online sales soared amidst the lockdown. The current situation has similar aspects but now the supply demand mismatch is also because of misallocation in the logistics industry. Nonetheless, large economies like France, Italy and China with higher vaccination rates have remained cautious even with the slightest increase in infections. Until the policy remains for a zero tolerance of COVID infections, the volatility in economic growth will likely persist.

1https://www.worldfootwear.com/news/retail-takeoff-in-spain-is-not-clear-despite-improvement-in-confidence/7116.html

2http://www.cis.es/cis/export/sites/default/-Archivos/ICC/2021/ICC_10-21_3338.pdf

3TexPro

4TexPro

5 https://www.ft.com/content/b543917f-6d4b-4a4a-b684-b5ddc1e8050c

6https://www.reuters.com/business/japans-economy-seen-back-decline-covid-19-supply-issues-2021-11-11/

Comments