Each month the US government publishes the latest garment import data. This data is very important for three reasons:

1. The United States is the world’s largest garment importer, with the result that changes in US import patterns affect garment exporting countries everywhere.

2. The United States has virtually no domestic garment production. With 95 per cent of all retail garment sales derived from imports, changes in imports provide an important indication of retailers and brands future sales expectations.

3. US data includes all products that have passed customs, with the result that logistical delays, particularly at major ports have already been factored in.

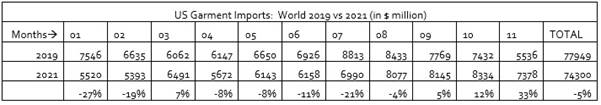

All data below is a comparison between 2019, the last year before the global pandemic and 2021.

November 2021 finally brought an end to the greatest import decline in the US history. The recovery that began in August has now been completed. The successful garment exporting countries have all shown increases in the second half of 2021

The view from the top

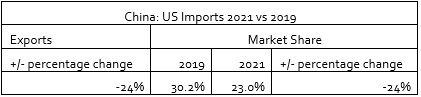

China: There is now strong evidence that customers are returning to China. As of YTD August 2021, imports from China were down 35 per cent compared with the same period in 2019, YTD September showed some moderation to 32 per cent. The latest data for November shows that the recovery that began in August is now firmly in place. Yes! imports for the year-to-date are still down at an aggregate of 24 per cent, but the most recent data is very positive.

Market share declines still do not look good, but that may now be short lived.

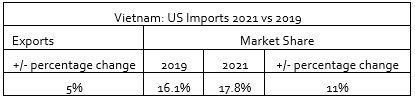

Vietnam: This is still the US’ second largest supplier. 2021 results have been uneven. September/October was disappointing, while August/November were excellent. All things considered, Vietnam is still the most important supplier after China, with a market share twice the #4 Bangladesh.

The table shows a moderate market share increase for Vietnam.

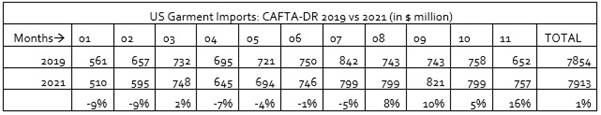

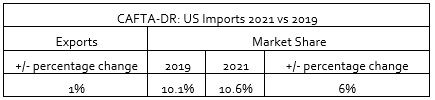

CAFTA-DR: This might be the great success story of 2021. After going nowhere for many years, they have moved up to 3rd place after China and Vietnam.

The table shows moderate market share increase for CAFTA-DR countries.

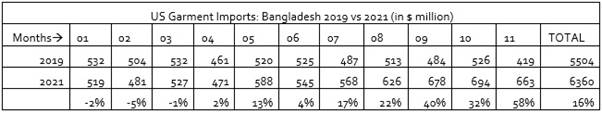

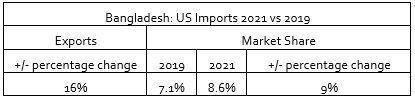

Bangladesh: This country has shown continuous increases during the second half of 2021.

The table shows strong market share increase for Bangladesh.

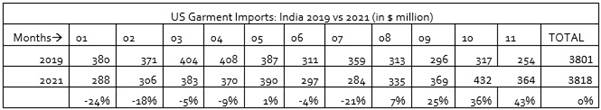

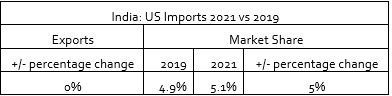

India: Moving forward from August to the present.

The table shows moderate market share increase for India.

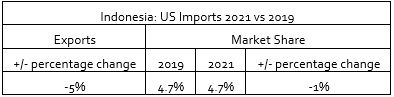

Indonesia: 2021 has not been a good year for this county. However, October/November has brought improvement.

The table shows that market share has stabilised for Indonesia.

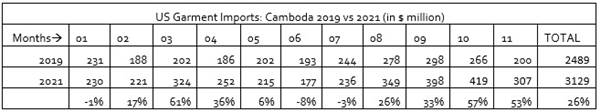

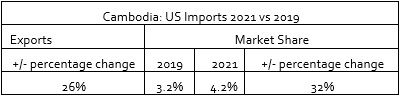

Cambodia: Looking excellent.

This is one of the two greatest per cent market share increases of all US garment suppliers.

Countries to watch: Moving Up

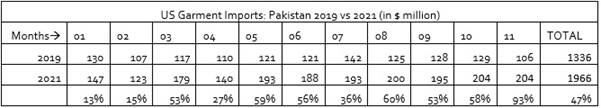

Pakistan: Looking Excellent.

This is the second of the two greatest per cent market share increases of all US garment suppliers.

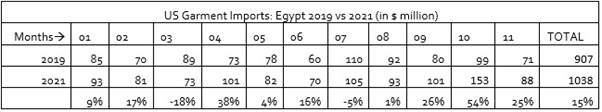

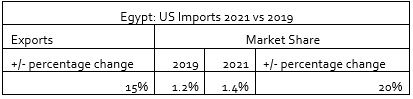

Egypt: This is a country with real potential.

The table shows strong market share increase for Egypt.

Fashion garment suppliers to fill the China gap

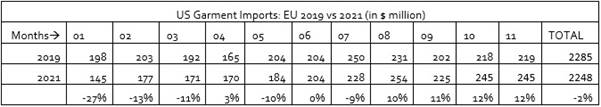

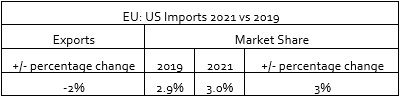

EU: This is now the world’s largest garment exporter. The home of global fashion.

With a 3 per cent US market share, this says more about the United States retail industry than about the EU as a supplier.

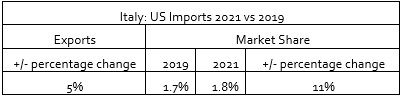

Italy: Probably the world’s 4th largest garment exporter and home to the best fashion textile industry.

Again, with a 1.8 per cent US market share, this says more about the US retail industry than about Italy as a supplier.

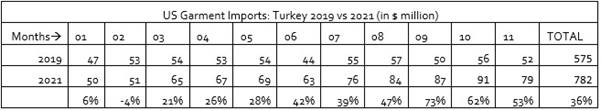

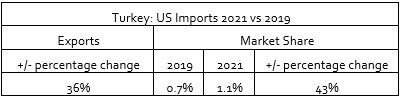

Turkey: This is one of the world’s largest garment exporters and home to a first-class textile industry. US might be beginning to recognise its importance.

There is a great increase in market share albeit from a very low level.

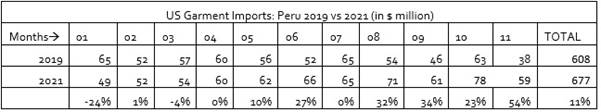

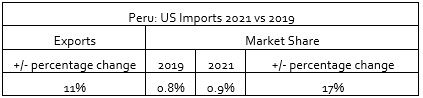

Peru: Moving up. Great quality, great product.

Again, there is increased market share albeit from a very low level.

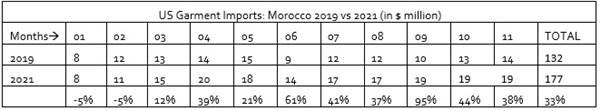

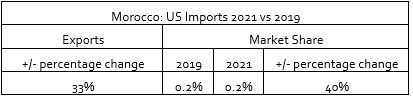

Morocco: The leading fashion industry in Africa

Again, there is increased market share albeit from a very low level.

Countries to watch: Moving Down

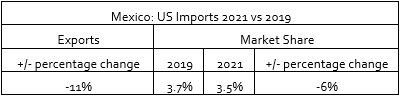

Mexico: Once a major US supplier, now in decline.

This is a country that is desperately in need of an industry strategy.

The Disasters

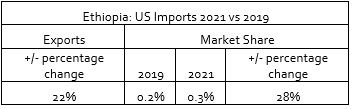

Ethiopia: The data looks good, but not the politics. This was to be the new model garment industry: sustainable, ethical, profitable. NO MORE. Murder, rape, and the US has locked the country out of AGOA.

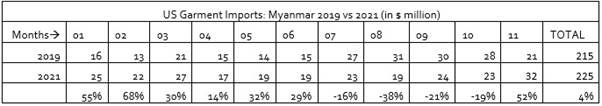

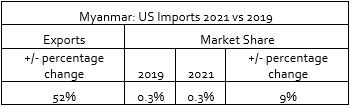

Myanmar: Home to a very good fashion garment industry. It’s the politics that is dragging down its industry.

Comments