It is no secret that the last two years significantly disrupted international trade, supply chains, and foreign relations between the most significant industrial hubs on the planet. To say that things will never return to their pre-COVID status is an understatement.

However even before the first COVID-19 cases broke headlines, a quick succession of major events would impact long-standing structures of global trade. Consider this:

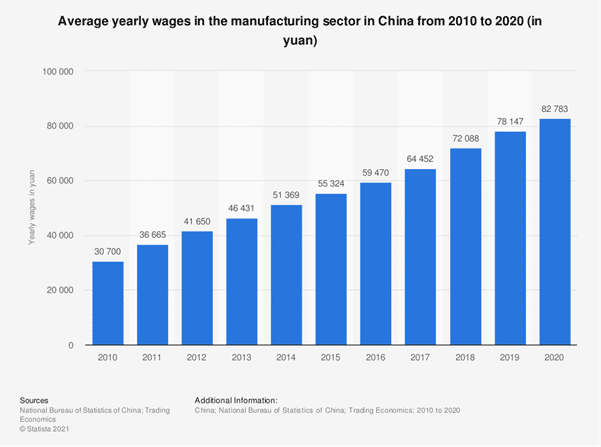

● From 2010 to 2020, manufacturing labour wages in China increased by nearly three-fold.

● In 2018, the United States began its trade war with China, characterised by billions of tariffs levied against Chinese imports across a number of material and product categories.

● In 2014, China launched its Strike Hard Campaign Against Violent Terrorism, which placed particular focus on surveillance and movement restrictions of its Muslim Uyghur community. In 2017, China progressed that policy into an all-out internment of Xinjiang Uyghurs, that included the building of labour camps and a sweep of forced sterilizations. These actions were decried by many in the international community as genocide, and in 2021, their continuance triggered mutual sanctions between China and the US, UK, Canada, and European Union.

Global pandemic aside, even before the COVID-19 outbreak, the above events had begun to prompt fashion brands to look outside of China for their garment, footwear, and accessories manufacturing and raw materials sourcing needs.

What Is China Plus One?

The China Plus One sourcing strategy emerged as a natural response to the shifts in perception of China’s trade friendliness.

Essentially, China Plus One refers to the practice of brands diversifying their sourcing strategy by expanding their producer and supplier networks to include partners from at least one other country outside of China. This allows them to counterbalance an overly weighted supply chain – and to do so carefully.

China Plus One allows fashion brands to avoid sweeping disruptions to their supply chain that could negatively affect their customers or their bottom lines. Instead of pulling all sourcing and production from China (in this case, presumed to be their sole or primary vendor location), they instead make gradual progress toward a more balanced, multinational supply chain policy. This not only eases the transition for brands; it also helps prevent an intensification of the political trade turmoil that might occur should European or American-based fashion brands fully pull out of the region.

An Obvious Shift to Supply Chain Diversification

Shifting sourcing strategies from China First to China Plus One makes sense for several industries, fashion among them. And it is easy to see why.

David Benichout, managing director at Alixpartners global business advisory firm, explained, “There are some categories where it becomes very interesting to source in Europe because the difference in prices is a very low percentage and it is so much more convenient, you do not have long to travel, you do not have custom taxes and you can be much more reactive.”

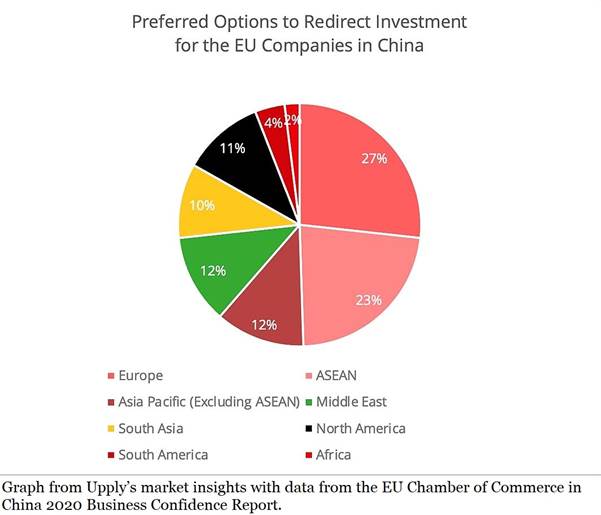

Other market watch experts, like Chinese fintech author and scholar Dr. Sara Hsu, believe that, for some industries, Southeast Asia will be the primary beneficiary, “One key determinant of how sustainable the trend [of China Plus One] will be is how quickly infrastructure can be built to accommodate more firms moving into other nations. However, companies that do choose to diversify into Southeast Asian nations will continue to be able to take advantage of the varied and easily accessible suppliers….”

While China is still continuing investment in its own manufacturing regions in order to remain competitive, the shift for brands is already in motion. Fashion houses from Moncler to Saint Laurent are opening new factories outside of China, preferring instead to nearshore to Europe, Mexico, or Central America or reshore to India or one of the so-called “Tiger Club” regions of Vietnam, Malaysia, or Thailand. In fact, nearly half of all businesses redirecting their supply chain investments have preferred to diversify into either Europe and Southeast Asia specifically.

However, as the above graph shows, regardless of where individual brands choose to reshore or nearshore, the world of manufacturing regions outside of China are already feeling positive impacts from the nearly global adoption of China Plus One.

5 Advantages that China Plus One Affords Fashion Brands

It cannot be overemphasised that the growing trends of fashion producer and supplier diversification, reshoring, and nearshoring that characterise China Plus One are the natural results of both global pandemic fallout as well as the last several years of upended international tariff policies, shifts to the costs of Chinese labour, and persistent human rights concerns. Despite China’s impressive supply chain infrastructure and tried and true skill, both established and emerging brands have been recently reluctant to stitch together new factory networks fully based there.

Despite the challenges inherent in finding and vetting new apparel, footwear, and fashion accessories factories outside of China (something made simpler by partnering with factory networks like those pre-vetted and managed by B2B fashion sourcing partners like MakersValley), brands stand to benefit from diversified sourcing and production in a number of ways. China Plus One has prompted them toward something that has long been necessary – a more modern, diverse, and multinational supply chain model with at least four solid advantages:

1. Keeping Sourcing Costs Competitive

Especially for brands that previously worked with only a single or very limited manufacturing partner list, diversifying their factory network affords them greater vendor leverage. If one factory begins to price gouge, the brand may have the ability to shift some or all of their production away from that factory and onto another partner whose quality of workmanship and communication style they have already vetted and trust.

Essentially, the more diversified a brand’s factory and raw material supplier network, the more leverage a brand has to keep its sourcing costs competitive.

2. Crisis Management

COVID-19 in particular tore long-ignored holes in supply chain cohesiveness and dependability wide open. While supply chain diversification may not fully prevent a similar fallout from another rapid global crisis event, it would mitigate the impact of smaller, slower, and/or more isolated health, geo-political, or environmental crises.

Aside from large-scale, supply chain disrupting catastrophes like COVID-19 or Russia’s recent invasion of Ukraine, factories or materials suppliers may experience operating issues of their own. These issues could force their closure, a downturn in capacity, or a cessation of the factory’s ability to meet the deadlines, quality standards, or other contractual terms by which they had previously abided. In these instances, a more spread out and diverse supply chain could help the brand rally without customers noticing a dip in product quality or delivery time.

3. Raw Material Access

Different international manufacturing hubs have different product, fabric, or workmanship expertise. Working with a diverse factory network allows fashion brands to match product features to the best experts for top quality production, at the most reasonable costs to the brand, across all inventories.

Every manufacturer also tends to have its own trusted network of fabric suppliers and trim suppliers. These could help fashion brands source, for example, the best cotton in India or the best leather in Italy. This can save the brand time and money when it comes to sourcing specialty, organic, or custom fabrics and trims, and help them secure the most optimal raw materials for every product.

4. Supply Chain Transparency

The opportunity to onboard new fashion producers allows brands to do so with strong levels of transparency. That is because transparency strategies and workflows are easier to implement at the initiation of a new supplier-brand relationship, rather than forcing through changes after years of a well-functioning partnership.

That matters because transparency is something that fashion customers have been demanding for the past several years, at an increasing volume. In fact, according to The Honest Product Guide from the Consumer Goods Forum, a majority of global customers feel that brands do not offer enough information about how their products impact various social, environmental, safety, and health issues, and 90 per cent of corporate members surveyed believe that their customers have a greater interest in transparency related issues now than they had five years ago.

Brands seeking to collaborate with new producers have a novel opportunity in front of them: implement strategic transparency procedures on materials sourcing and product workmanship from the start. Then adopt strategies and technologies, like newly launched fashion tool Orma, to communicate these to customers in order to stand out in the marketplace.

An Era of Greater Options and Control for Fashion Brands

Fashion brands entered the era of China Plus One from a reactive position not without its frustrations. But what they now stand to gain is a more adaptable, resilient, and opportunity-focused supply chain.

While it remains to be seen which manufacturing hubs outside of China will best rise to the challenge of China Plus One, brands now have the ability to create a supply chain structure that not only answers the pragmatic needs of today, but that also establishes proactive measures to meet internal and external expectations for tomorrow’s fashion products. Hopefully, they will take full advantage.

Comments