The traditional segmentation of denim jeans based on cost is disappearing as prices at the bottom have risen while those at the top have fallen. This has opened the door for a new untapped sector. So, if based on data analysis, if a country finds it is worth investing time, effort and money to increase its trousers market share, then it should focus on the fabric, production, and finishing and washing, to create the highest quality product at the lowest cost.

Denim Jeans is a major export product. However, for most countries it has become a closed market, controlled by a very few major exporting countries (For technical reasons, meaningful global data for denim trousers is not available. However, we can analyse in some detail import/export data for cotton trousers). When we look at the data, it appears certain that, other than the biggest suppliers, potential exporters from smaller exporting countries are locked out. This is quite true for the existing jeans market. However, for those willing to make the effort and investment, there is a way forward for a new denim jeans market.

The Problem

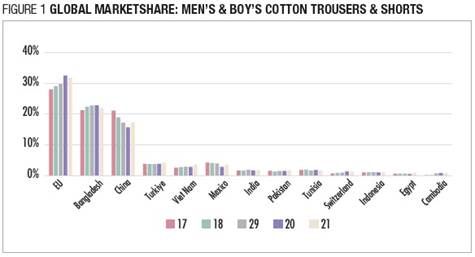

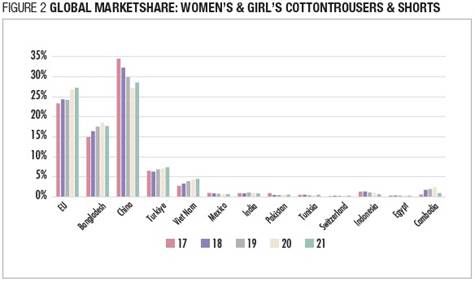

As we can see from the Figures 1 & 2, exporters of men’s and women’s cotton trousers can be divided into three categories: top tier, second tier and third tier.

The top tier, i.e., the top three exporting countries — EU, Bangladesh, and China — have a collective market share of 71 per cent for Men’s & Boy’s and 74 per cent for Women’s & Girl’s. These countries control the market.

The second tier, i.e., the next three exporting countries—Turkiye, Vietnam, and Mexico — have a collective market share of 11 per cent for Men’s & Boy’s and 13 per cent for Women’s & Girl’s. These countries have some share.

The third tier, i.e., the next seven exporting countries— India, Pakistan, Tunisia, Switzerland, Indonesia, Egypt, and Cambodia — have a collective market share of 11 per cent for Men’s & Boy’s and 13 per cent for Women’s & Girl’s. These countries are effectively locked out.

At this moment, when garment imports are in decline, and when importers are looking to reduce the number of their suppliers, trying to compete for market share with big players makes little sense.

At the same time, we must ask: Is it worthwhile to invest the time, effort and money to increase market share?

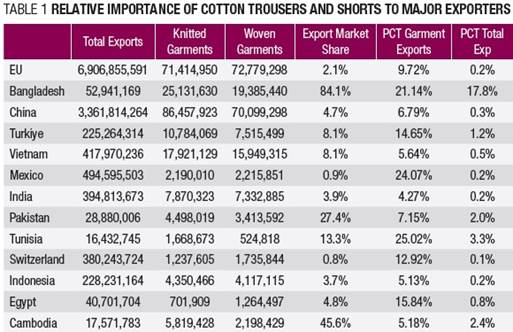

Table 1 provides relevant data:

Based on total product exports:

• How important are garments?

• How important are cotton trousers and shorts?

For example, the EU is the world’s largest product exporter. However,

• Garments account for 2.1 per cent its of total exports.

• Cotton trousers account for 9.72 per cent of total garment exports.

• Cotton trousers account for 0.2 per cent of total product exports.

Clearly, the EU has little interest in spending time, effort, and money to increase its trouser market share.

At the other extreme: Bangladesh considers garments to be a major export category.

• Garments account for 84.1 per cent of its total product exports.

• Cotton trousers account for 21.1 per cent of total garment exports.

• Cotton trousers account for 17.8 per cent of total product exports.

Clearly, Bangladesh will spend the time, effort and, money to maintain and increase its market share.

Consider India:

• Garments account for 3.9 per cent of its total product exports.

• Cotton trousers account for 4.3 per cent of total garment exports.

• Cotton trousers account for 0.2 per cent of total product exports.

Based on the data, India does not have an interest in expanding its market share.

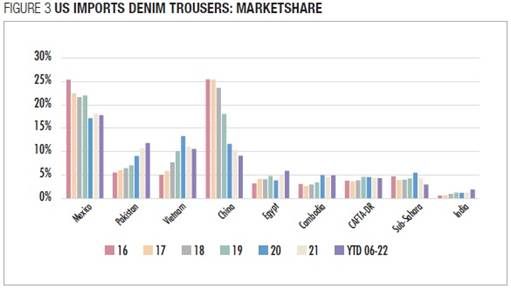

When we turn to denim jeans, we see a similar story. Data for global denim trouser exports is unavailable, however we do have accurate information of denim trouser impots to the US.

As with global exports of cotton trousers, US imports of denim trousers follow the pattern of market dominance.

The top four denim jeans exporting countries — Mexico, Pakistan, Vietnam, China — have a collective market share of 71 per cent, identical to the 71 per cent global market share for the top-tier cotton trouser suppliers.

When we look at the FOB prices (Table 2), we can see how countries such as India are not competitive. There are notable exceptions, particularly countries that are able to charge premium FOB prices. For example, Egypt ($9.07/$11.14) has duty free access to the US market, while CAFTA-DR ($7.89/$10.40) and Mexico ($9.12/$14.78) enjoy both duty free access and are in close proximity to the US.

The Way Forward

Given the current situation, we can ask: Is there any possibility for countries outside the top-few to gain access to the global denim trouser market?

Traditionally, the market for jeans has been segmented.

• The low end mass-market such as Wrangler for Walmart.

• The mid-market such as Levi Strauss.

• The up market such as Diesel.

• The high-end designer market such as Armani.

However, over a period of time, these sectors have compacted as prices at the bottom have risen while those at the top have fallen. This has opened the door for a new untapped sector.

Almost all jeans are produced from the same fabric with similar make. However, at the very top (jeans from $1,200-$5,000 ) the product changes.

The first and perhaps the most important is the denim itself. Almost all denim is woven from open-end yarn, which is most efficient for denim and other heavy fabrics. However, at the top of the market the highest quality denim yarn is ring spun, while the older traditional spinning is used for fine fabrics. Ring spun is coming back at all prices. As a result, while ring spun is a necessity. However, ring spun is only one part of the required change.

The next area is the production. We must expect that in this new sector orders will be much smaller. We must also expect that the make will be more difficult. We can look at production as a combination of standard jeans and tailored trousers. To reach this quality, the factory will require a production specialist from the high-end jeans business.

Finally, there is finishing and washing. This is a specialty profession in itself. As with all professions, the need is for qualified professionals who stay in the ever-changing fashion-loop.

Put it all together, we can have the high-quality design and the highest quality product at the lowest cost, with the greatest benefit for all—the brand, the factory, and the consumer. This is a very doable project. However, to succeed it must be a partnership between the mill, the factory, and the industry organisation.

**********

I will tell you a story:

Some years ago, I was running a factory producing designer dresses. One of my customers was the noted couturier Oscar de la Renta. Our factory produced his pret a porter — dresses that retailed for $400-$600, the low end when compared with his couture — dresses that retailed for $3,000-$7,000. On a trip to New York, I was accompanied by my partner, Gus Young. While at his salon Sr. de la Renta showed us his latest couture collection. Gus looked at the dresses and suggested, “David could do this production.” EMBARRASSED SILENCE!

I explained, that, yes! we could produce any style in the couture collection, but we would go broke in the process because our factory was built to produce one type of dress and that was not couture.

The point is that Gus was not an amateur. In fact, he owned and operated garment factories, but those factories were cut-and-sew knits, a world apart from our woven designer dresses. He simply did not understand the difference between his factory, our factory and Oscar de la Renta’s atelier. In his failure to understand he assumed they were all fundamentally the same.

**********

The point is: Do not underestimate the difference between the existing jeans factories and the factories that will make for the new jeans sector.

The great benefit is that rather than trying to compete with existing operations, the project is the first of its kind, producing for a market that does not yet exist, but has guaranteed customers.

Comments