The United States is the largest garment importing country, and hence any changes in its imports can seriously impact its major garment supplying countries. This analysis provides a comprehensive overview of the past events, present situation, and expected changes in the future, highlighting the complexities involved in forecasting the future of the global garment industry.

The following is an analysis of the changes that will occur in the global garment industry going forward. It is based on the proposition that the ‘present’ is to a large degree based on the events of the past. The difficulty is the need to determine which past events are most relevant.

In this regard 2022 is an excellent example of what can go wrong. 2020, the year of the COVID-19 pandemic, was a terrible year for the global garment industry. However, 2021 showed marked improvement with the result that garment retailers believed that 2022 would be even better. Everybody increased their orders. Factories were overloaded and as a result were able to increase their FOB prices. Unfortunately, 2022 retail sales showed only marginal increases. The problem was that retailers failed to consider other factors such as the long-term decline of US garment retail demand and stagflation.

The net result is that going forward not only the original problems such as declining demand and stagflation, but also a new factor: the impact of the 2022 disaster.

It is the role of senior management to plan for the future. However, those plans cannot be over simplified, based on only one or two factors.

The Present

The United States is the world’s largest garment importing country with over a 20 per cent of the global market share.

As a result, changes in US garment imports can seriously impact on its major garment supplying countries. As we can see from Table 2, the US is the number one customer for each of its major suppliers.

The Immediate Challenge

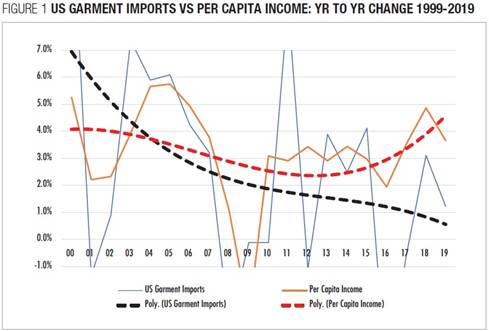

Bearing in mind that the US has virtually no domestic garment industry, relying on imports for over 95 of all garment retail sales, we can see a serious problem facing the garment industry both on the US retail side and its global suppliers going back 20 years which is totally unrelated to the COVID-19 crisis. As we can see from Figure 1, US garment imports have been in a state of decline. At the same time, the problem has become exacerbated because since 2004, garments have accounted for an ever-decreasing percent of US consumers’ disposable income.

The garment pie is shrinking. So, aside from any other problems, to maintain current sales volume, both US retailers and their overseas factory suppliers will have to increase their market shares.

Completely aside from other factors, based on the long-term trend, as shown in Figure 1, we must expect US garment imports to decline.

The Short Term Challenge

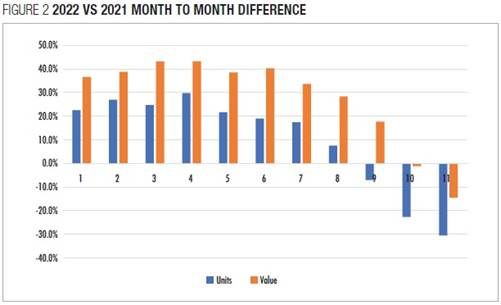

2022 was indeed the year of garment industry chaos. For the first six months, imports by value increased by over 40 per cent. However, this proved to be unsustainable.

From Figure 2 two salient points are clear:

• Imports by value showed greater change than imports in units.

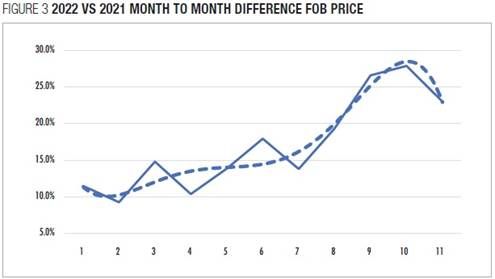

• While imports both in value and units increased in the first half of 2022, in the second half both went into decline, but as we can see from Figure 3, FOB prices continued to rise until October.

When we put these factors together (Table 3), we can see the nature of the problem.

Going forward, garment exporting countries will see a marked drop in units ordered and FOB prices will decline appreciably.

The Medium-Term Challenge: Stagflation

Stagflation is a very serious economic situation whereby a national economy moves simultaneously into a state of inflation (rising prices) and recession (falling gross domestic product). Fortunately, this is a very rare occurrence. The last time stagflation hit the US was over 50 years ago. The accepted solution, indeed, the only solution is for the government to raise interest rates sufficiently to force prices down.

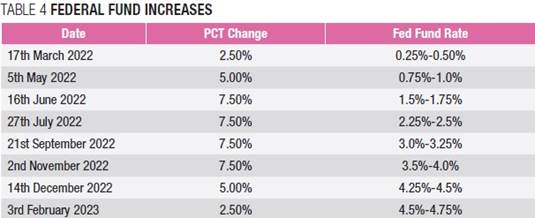

The US is now in a state of inflation. Since March 2022, The Federal Reserve Bank has been raising interest rates (Table 4).

This has had a major effect on exports from garment supplying countries. Indeed, these industries, and their factories, have enjoyed a double benefit.

This has had a major effect on exports from garment supplying countries. Indeed, these industries, and their factories, have enjoyed a double benefit.

As we can see in Table 3, FOB prices in 2022 have shown substantial FOB increases, reaching 27.9 per cent in October.

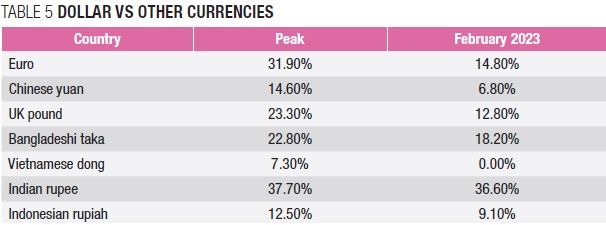

At the same time the value of the US dollar has dramatically risen against local currencies, providing an almost unique double profit.

Regrettably, the good times are about to come to an abrupt end.

As we can see in Table 4, in December 2022, the Federal Reserve believing that inflation was now under control began to moderate interest rate increases, with the result that the US dollar price premium began to disappear.

We have every reason to believe that this will continue well into 2023.

Based on the most recent data, we can expect the following:

• US garment import orders to decline,

• FOB prices in US dollars to decline, and

• The value of the US dollar to decline.

All of these together will lead to a massive decline in garment exports from countries dependent on the US market.

The Long-Term Challenge: The Secular Decline of the US Dollar

The following is speculation.

For the past 2,000 years when camel caravans travelled the Silk Road and before, trade was denominated in gold (or silver in the case of China). More recently the British Pound Sterling became, at least to some degree, accepted as payment. But as of 1947, the US dollar became the accepted global currency. Today, almost all internationally traded commodities and products are quoted in dollars and, for the most part, payments are made in dollars. The global debt market is almost entirely dollar based. Companies and governments issue bonds in dollars and must pay interest and redemption costs in dollars.

This has provided the United States with a unique advantage. The United States alone of all countries has no foreign debt. While everybody else must maintain US dollar reserves, the United States is free of this obligation.

The US consistently has had a negative balance of trade. US dollar outflows for imports exceed inflows for exports. Every year, the per cent of US currency controlled by foreigners rises, and, according to the latest data1, 41 per cent of the US currency lies outside the United States. However, for all practical purposes this is irrelevant because rather than keeping those dollars in the mattress, foreign governments, corporations, and international institutions either use funds for foreign direct investment (FDI) or buying US government bonds. We might say, “what goes out invariably comes back in”.

This state of affairs might have continued forever, if only the US Federal Reserve Bank was able to maintain rational monetary policies. In this regard the Fed itself is protected by law from political interference. The status quo, however, is now in jeopardy as the US Congress is trying to take control.

The danger is that seizing control of US monetary policy might reduce foreign confidence in the US dollar.

There is a common belief that the US dollar will always reign supreme because there is no other currency large enough and safe enough to replace the dollar. This is a misnomer. In today’s world there are alternatives to a single global currency. Many of these alternatives are now in operation and will become increasingly important should outsiders lose confidence in the continued value of the dollar.

For those who believe in the declining value of the dollar, these are the alternatives to keeping reserves in US dollars.

• Reduce FDI in the US

• Reduce purchases of US Treasury bonds

• The Euro Bond: Buying in one currency to be paid in a second currency, e.g., using US dollars to buy bonds repayable in a second currency such as the euro.

• Demanding payment in local currency. Major trading countries such as China and Russia are now insisting on payments in RMB and rubles.

The new result will put an end to the old “what goes out invariably comes back in” mantra.

Over time, any continuous downward movement will feed on itself: As the value of the US dollar falls, outsiders will inevitably lose confidence and move away from the dollar.

The time may well come when exporters will demand that the world’s largest importing country pay in euro, RMB, and rubles, forcing the US to raise interest rates to attract foreign funds, marking the end of the US as the world economic leader. This is certainly a worst-case-scenario, but it is one with rising probabilities.

Conclusion

While management must plan for the future, and to a large degree, that future will be based on the events of the past. However, the problem becomes more complex as we look further into the future because the past events that will determine the future may not have yet occurred.

For example, a professional working in 2018 could not have predicted the COVID-19 pandemic, which was the single greatest factor determinant of the industry of 2020. This is unavoidable. However, those truly unavoidable factors are somewhat rare. Many so-called unavoidable factors, such as stagflation and global warming had been recognised years earlier and should have been considered in company planning.

At the end of the day, planning for the future is not easy, but it is necessary and will produce good results if management does a proper job.

Comments