The world of textiles is constantly evolving and growing with time. From just conventional textiles comprising of apparel that served the purpose of protecting our body from external surroundings, technology and innovation have paved their way into new verticals. One of them is technical textiles. Technical textiles are value-added textile products that provide added functionality and applications other than the regular fibre-to-fashion supply chain products. These technical textiles encompass high-performance fibres, yarns, woven, knitted, nonwoven, braided, and composite structures, and the scope of these functional-based textiles is expanding to a new horizon of high-end specialised assets. The growth drivers of various segments of technical textiles derive their strength from the growth of respective user industry segments. The details are listed in the table below (Table 1).

Table1: Technical Textiles Segments and their Growth Drivers

|

Segment |

Drivers |

|

Agrotech |

Increasing public awareness of environmental preservation initiatives including prevention of erosion, stopping water pollution, building sewage treatment facilities, and closing landfills. |

|

Buildtech |

Increasing spending on infrastructure development, and high use of products such as scaffolding nets and architectural membranes. |

|

Clothtech |

Increased awareness of technical textile-based products in regular use. |

|

Geotech |

Upgradation of existing government norms, and upcoming infrastructure planned by the government bodies. |

|

Hometech |

Upgradation guidelines for the use of technical textiles in public places, and increasing consumer awareness. |

|

Indutech |

High expansion of the manufacturing sector across the globe. |

|

Meditech |

Ever-growing population, and surge in healthcare industry. |

|

Mobiletech |

Increasing incorporation of items like airbags, seat belts, and automotive textiles, strengthening automotive industry, and upgrading driving safety laws. |

|

Packtech |

Ban on single use based plastic products, and innovation of new biodegradable products. |

|

Protech |

Easy production correlates with cheaper unit costs, eventually boosting consumer uptake. |

|

Sportech |

Increasing sports awareness amongst the youth, upgradation of the existing accessories used for various sports, use of sportswear garments by general population etc. |

1.0: Classification and Main Applications

At present, technical textiles have been broadly segmented into 12 categories in terms of their sectoral use, namely Agrotech, Buildtech, Clothtech, Geotech, Hometech, Indutech, Mobiltech, Meditech, Oekotech, Protech, Packtech and Sportech. The major uses are listed in the Table 2.

Table No.2: Technical Textiles Segments with Applications

|

Sl No. |

Sectors |

Main Applications |

|

1 |

Agrotech |

Bird protection nets, finishing nets, crop covers, mulch mats, shade nets |

|

2 |

Buildtech |

Floor & wall coverings, scaffolding nets, awnings & canopies |

|

3 |

Clothtech |

Interlinings, labels, elastic narrow fabrics, shoelaces |

|

4 |

Geotech |

Geo-composites, geo-bags, geogrids, geonets |

|

5 |

Hometech |

Blinds, mattresses, pillow components, carpet backing cloth, mosquito nets |

|

6 |

Indutech |

Industrial brushes, composites, ropes, cordages, conveyor belts |

|

7 |

Mobiltech |

Tire-cord fabrics, auto-upholstery, seat belts, insulation felts |

|

8 |

Meditech |

Industrial brushes, composites, ropes, cordages, conveyor belts |

|

9 |

Oekotech |

Waste management, environmental protection, recycling |

|

10 |

Protech |

Ballistic protective clothing, fire retardant apparel, high visibility clothing |

|

11 |

Packtech |

Wrapping fabric, jute sacks, tea bag filter paper, woven sacks |

|

12 |

Sportech |

Sports nets, sleeping bags, hot air balloons, parachute fabrics, sports composites |

This paper delves into the market overview of technical textiles to understand the dynamics of the trade in various regions and countries of the world including the Indian sub-continent.

2.0: Importance of Indian Technical Textiles Industry

The textiles and apparel industry plays a pivotal role in the Indian economy through its significant contribution to the country’s industrial output, employment generation, and export earnings. It provides direct and indirect employment and is a source of livelihood for millions of people. Unofficial estimate of direct and indirect employment stands at 55 million. The size of domestic textiles and apparel industry as per the Textiles Committee’s latest Market for Textiles and Clothing 2020 survey is $152 billion in 2021.1

The size of Indian technical textiles industry is estimated at $18.89 billion during 2019-20 while the global technical textiles market was projected at $217.81 billion. The level of penetration of technical textiles in India is at 5-10 per cent as compared to 30-70 per cent observed in developed countries.2 The National Technical Textiles Mission (NTTM) sets a domestic market growth rate at 15-20 per cent and projects the industry to reach a market size of $40-50 billion by the year 2024. The mission also plans to collaborate with international players to invest in technical textiles under the ‘Make in India’ initiative. The export target of the NTTM has been set at ₹20,000 crore, with a CAGR of 10 per cent.

The Indian technical textile industry is estimated to have been providing direct employment to about 12 lakh people and 3-4-fold more indirect employment during 2019-20. Conservative estimate of employment by the Ministry of Textiles is expected to be around 12.16 lakhs3 of which around 51 per cent is skilled. The major companies in India that recruit professionals frequently for their technical textiles operations are Supreme Nonwoven Industries Pvt. Ltd, Techfab India Industries Ltd., SRF Ltd., Bombay Dyeing Ltd., Arvind Ltd., Welspun India Ltd., Alok Industries Ltd., and Premier Mills Pvt. Ltd. The baseline survey of the Ministry of Textiles outlined the industry concerns pertaining to the lack of qualified and skilled manpower, and the ministry has taken necessary steps to skill more manpower in technical textiles.

3.0: The Global Market Overview

Global exports of technical textiles by segments and products

The overall textile market including technical textiles stood at $1,066 billion in 2022 of which conventional textiles contributed 85 per cent valuing $903 billion, while technical textiles accounted for the remaining 15 per cent share of $163 billion, excluding the commodities those fall under HSN lines 50-63. During 2022, apparel exports led the march with 58 per cent of the global share, while textiles had a share of 32 per cent, and home textiles exports were to the tune of 10 per cent. The global technical textiles market is expected to grow at a CAGR of 5.06 per cent between 2020 and 2025. At the global level, Oekotech, Geotech, Buildtech, Meditech, Protech, and Sportech are the six segments that are likely to grow at a relatively higher rate (CAGR > 5 per cent) in terms of the value of technical textiles consumption during the period 2020-25. Mobiltech, Indutech, Meditech, Packtech, and Sportech will constitute a major share of the value of the global market for technical textiles.4

From the data of IHS Markit, the global technical textiles exports have been mostly led by Packtech (23.9 per cent), Indutech (18.9 per cent), Hometech (17 per cent), Clothtech (14 per cent) and Sportech (11.7 per cent). These segments are growing at an annual average growth rate ranging from 1 per cent to 10 per cent through an 11-year period from 2012 to 2022.

During 2012-22, the overall technical textiles sector grew at a CAGR of 4 per cent. The leading segments showing high growths were Clothtech (10 per cent), Agrotech and Geotech at 7 per cent each, while Buildtech grew at a rate of 5 per cent. Packtech showed CAGR of 4 per cent, and Meditech and Mobiltech registered 3 per cent each (Table 3).

Table 3: Global exports of technical textiles by segments by million USD.

|

Segments |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

CAGR 2012-22 |

|

Agrotech |

377 |

345 |

388 |

400 |

548 |

551 |

522 |

7% |

|

Buildtech |

1400 |

1502 |

1693 |

1718 |

1787 |

2419 |

2316 |

5% |

|

Clothtech |

4033 |

4650 |

4776 |

4640 |

4107 |

5034 |

10574 |

10% |

|

Geotech |

401 |

413 |

487 |

500 |

505 |

717 |

755 |

7% |

|

Hometech |

9073 |

9138 |

9768 |

9437 |

8361 |

10400 |

9926 |

1% |

|

Indutech |

20671 |

21290 |

23240 |

22519 |

20405 |

26099 |

20815 |

1% |

|

Meditech |

6580 |

5922 |

6472 |

6411 |

6402 |

7156 |

7623 |

3% |

|

Mobiltech |

8131 |

8303 |

9151 |

8951 |

7432 |

9709 |

10466 |

3% |

|

Packtech |

25212 |

26593 |

28839 |

30327 |

24008 |

31461 |

39635 |

4% |

|

Protech |

5278 |

5889 |

6451 |

6439 |

6037 |

7097 |

5023 |

-1% |

|

Sportech |

8908 |

9481 |

10298 |

10253 |

9611 |

17072 |

15889 |

7% |

|

Total |

90065 |

93526 |

101563 |

101595 |

89205 |

117716 |

123543 |

4% |

Source: Fibre2Fashion-TexPro, IHS Markit, S&P Global

Each segment of technical textiles has several products as per the use patterns. The main products in the Agrotech segment are crop covers (27.2 per cent), fishing nets (15.4 per cent), mulch mats (56.5 per cent), and shade nets (1 per cent). The former three products are growing at 6.8 per cent, 8.3 per cent, and 5.9 per cent respectively, while shade nets have stable growth rate. Tarpaulins and awnings are the main products of Buildtech and they grew over 5 per cent in the 11-year period. Geofabrics (97.9 per cent) are the main constituents of Geotech, besides base material (2.1 per cent). While Geofabrics grew at a CAGR of 9 per cent, the base material is indicating a declining trend. Indutech, which is very important for the industry, has several products such as aramid staple fibre; coated, covered, or laminated fabrics; conveyor belts; fabrics used in machinery/plants; high tenacity yarn; twine, cordage, ropes and cables; tire cord fabrics; narrow woven fabrics; polyester staple fibre etc. The sector product details, their value, share, and CAGR are given in Table 4 below.

Table 4: Product analysis of technical textiles by segments and products

|

Segment |

Product name |

2022 value in USD Mn |

per cent Share |

CAGR 2012-22 |

|

|

||||

|

Agrotech |

Crop covers |

141.8 |

27.2 |

6.8% |

|

Fishing nets |

80.2 |

15.4 |

8.3% | |

|

Mulch mats |

294.4 |

56.5 |

5.9% | |

|

Shade nets |

5.1 |

1.0 |

0.0% | |

|

|

||||

|

Buildtech |

Tarpaulins & awnings |

2315.7 |

100.0 |

5.3% |

|

|

||||

|

Clothtech |

Braids |

18.8 |

0.2 |

4.2% |

|

Labels |

263.3 |

2.5 |

-1.5% | |

|

Made-up articles |

6338.0 |

59.9 |

42.9% | |

|

Net fabrics |

38.9 |

0.4 |

1.4% | |

|

Nonwovens |

181.1 |

1.7 |

5.7% | |

|

Other woven fabrics |

2199.8 |

20.8 |

2.4% | |

|

Others |

2.4 |

0.0 |

-2.9% | |

|

Pile fabrics |

358.1 |

3.4 |

3.1% | |

|

Sewing threads |

46.9 |

0.4 |

-4.5% | |

|

Stockings |

133.1 |

1.3 |

1.0% | |

|

Synthetic filament |

956.4 |

9.0 |

-2.4% | |

|

Woven fabrics |

37.6 |

0.4 |

2.4% | |

|

|

||||

|

Geotech |

Base material |

15.7 |

2.1 |

-12.2% |

|

Geofabrics |

739.4 |

97.9 |

9.0% | |

|

|

||||

|

Hometech |

Base fabrics |

3.9 |

0.0 |

12.3% |

|

Canvas |

56.5 |

0.6 |

10.5% | |

|

Carpet backing fabrics |

0.7 |

0.0 |

30.4% | |

|

Carpets |

852.6 |

8.6 |

-6.2% | |

|

Cleaning cloths |

298.1 |

3.0 |

2.2% | |

|

Coated, covered or laminated fabrics |

5046.2 |

50.8 |

2.4% | |

|

Coir fibre |

63.6 |

0.6 |

4.3% | |

|

Curtains and blinds |

176.2 |

1.8 |

6.0% | |

|

Felts |

0.3 |

0.0 |

0.8% | |

|

Floor coverings |

1932.2 |

19.5 |

3.7% | |

|

Furnishing articles |

259.3 |

2.6 |

-1.5% | |

|

Linen |

36.9 |

0.4 |

-11.8% | |

|

Mattress supports |

547.1 |

5.5 |

5.2% | |

|

Mosquito nets |

82.0 |

0.8 |

35.5% | |

|

Others |

5.0 |

0.1 |

-2.9% | |

|

Pile fabrics |

94.6 |

1.0 |

3.1% | |

|

Quilts |

14.1 |

0.1 |

4.7% | |

|

Rugs |

221.8 |

2.2 |

-5.5% | |

|

Wall coverings |

61.3 |

0.6 |

3.4% | |

|

Woven fabrics |

173.4 |

1.7 |

2.4% | |

|

|

|

|

|

|

|

Indutech |

Aramid staple fibre |

327.2 |

1.6 |

12.4% |

|

Bolducs |

32.8 |

0.2 |

-4.5% | |

|

Bolting fabrics |

275.1 |

1.3 |

8.3% | |

|

Cabled yarn |

162.6 |

0.8 |

-0.2% | |

|

Canvas |

2.2 |

0.0 |

10.5% | |

|

Coated, covered or laminated fabrics |

2491.5 |

12.0 |

2.4% | |

|

Conveyor belts |

452.8 |

2.2 |

6.8% | |

|

Elastane fabrics |

641.6 |

3.1 |

1.3% | |

|

Elastomeric yarn |

37.5 |

0.2 |

-9.2% | |

|

Fabrics used in machinery/plants |

67.6 |

0.3 |

-3.5% | |

|

Felts |

578.5 |

2.8 |

0.8% | |

|

Glass fibres |

3015.8 |

14. |

-5.4% | |

|

High tenacity yarn |

463.7 |

2.2 |

4.1% | |

|

High tenacity yarn fabrics |

65.2 |

0.3 |

-8.0% | |

|

Metal thread fabrics |

2.7 |

0.0 |

0.2% | |

|

Narrow woven fabrics |

2327.9 |

11.2 |

5.9% | |

|

Nonwovens |

852.0 |

4.1 |

5.7% | |

|

Others |

2557.2 |

12.3 |

-2.9% | |

|

Polyester staple fibre |

2255.2 |

10.8 |

1.8% | |

|

Printer ribbon |

513.3 |

2.5 |

-1.8% | |

|

Rubber cords |

452.4 |

2.2 |

9.6% | |

|

Textile hose pipes and tubes |

148.8 |

0.7 |

-1.1% | |

|

Textile wicks |

4.4 |

0.0 |

-0.6% | |

|

Twine, cordage, ropes and cables |

1622.4 |

7.8 |

4.1% | |

|

Tire cord fabrics |

1140.3 |

5.5 |

-0.6% | |

|

Woven fabrics |

299.2 |

1.4 |

2.4% | |

|

Yarn – impregnated, coated or covered |

25.3 |

0.1 |

7.2% |

Note: Fibre2Fashion-TexPro product analysis also includes the raw material used for the manufacturing of technical textiles along with finished products.

3.1: Major Global Suppliers by Regions and Countries

(a) Major suppliers by region:

Asia Pacific5, NAFTA6, and Middle East Countries7 are the major suppliers of technical textiles. Asia Pacific region leads the supply of technical textiles products to the world and controls more than 83 per cent of the exports, followed by the NAFTA region. Countries in NAFTA such as Mexico, Canada, and the US supply to the extent of 8.7 per cent, while Middle Eastern countries control about 4.1 per cent of the supply to the world.

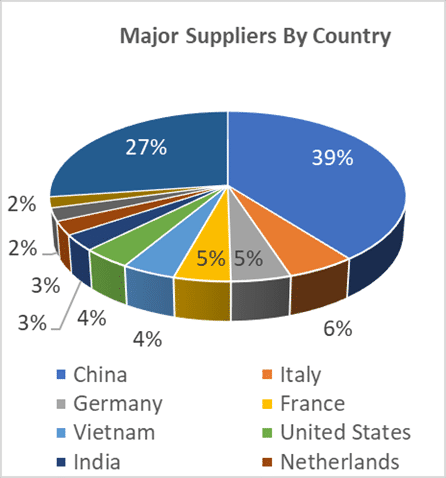

(b) Major suppliers by country:

The major countries in the Asia-Pacific region are China, Vietnam and India while the major country that produces and exports technical textiles from the NAFTA region is the United States. The European nations which are still in the business of textiles are Germany, Italy, France, and the Netherlands. In the Asian region, China (39 per cent) and India (27 per cent) are the leaders in the production and supply of technical textiles, besides Vietnam (4 per cent).

4.0: India’s Exports and Imports of Technical Textiles in 2022

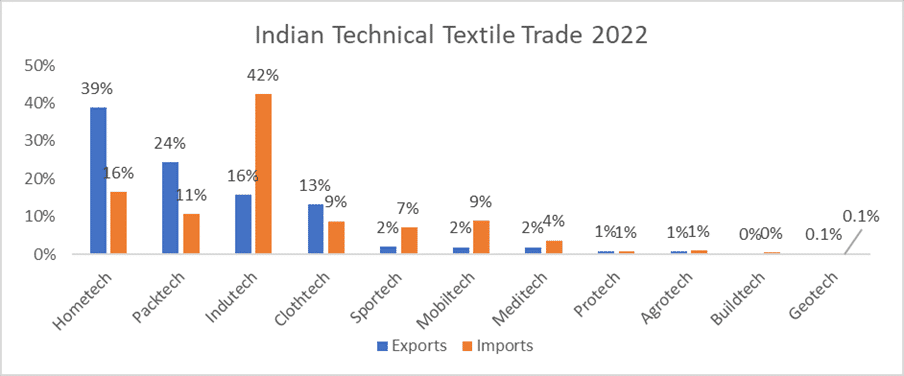

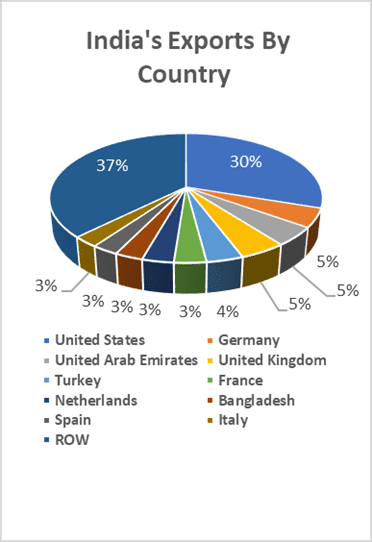

Six segments, namely, Hometech, Packtech, Indutech, Clothtech, Sportech and Mobiltech are the significant contributors to the Indian export. The country is steadily moving for a better pie in the production and export of other segments such as Protech, Agrotech, Buildtech and Geotech. The country mainly exports to NAFTA and the Asia Pacific regions, Middle East countries and Africa. The baseline survey of Government of India underlines a growth rate of CAGR 8.25 per cent to reach a figure of $28.06 billion in 2024-25.

Besides export, the government procurement through various ministries and institutions suggests a greater use of products such as fishnets, agrotech-kits, tarpaulins, tents, posters, uniforms, sports jerseys, geogrids, geomembranes, other geotextile products, floor carpets, vinyl coated upholstery, filter fabric, air and oil filters, conveyor belts, surgical items, kneecaps, tyres, canal lining, jute bags, HDPE bags, bullet proof jackets, flame retardant fabrics, fibre glass boat etc in the recent past.

4.1: Why These Segments of Technical Textiles will be Produced and Exported?

During 2019-20, the production surplus has been to the tune of ₹1,890 crore in Agrotech. Fishing nets constituted the largest share of the Indian Agrotech market in 2019-20, followed by shade nets, mulch mats, and anti-hail and anti-bird nets.

Similar is the case of Buildtech products but the consumption in this case is more intensive that Agrotech. HDPE tarpaulin constituted the largest share of Indian Buildtech industry followed by hoardings & signages. Though a larger share of Clothtech industry is used for India’ s own consumption, the sector also exports. The recent data clearly indicates inroads in the export market. While the country imports buttons, labels, sewing threads, synthetic filaments etc for domestic consumption, it is moving faster to play in the global market.

India’s production of Hometech exceeds consumption and the gap is increasing very fast indicating good opportunities for Hometech producers to address new export markets. Fibrefill (polyester staple fibre) comprises the biggest portion of the domestic market, and furniture fabrics and other coated fabrics have the second largest share. India’s exports far exceeded the imports in the year 2022.

Geotextiles form the biggest portion of the domestic market of Geotech segment at a share of 37.32 per cent and geonets, geogrids and geostrips at 25.12 per cent have the second largest share. India is currently an importer and is likely to become a net exporter due to expected higher rate of increase in production despite increase in consumption till 2024-25.

India is a net importer of Indutech and is likely to remain so till 2024-25 except that the trade deficit percentage will be reduced during this period. The highest share of domestic Indutech market in terms of value is comprised of glass fabric, and it is coated abrasives that make up the next largest share of the Indian Indutech market.

India is a net importer of Protech items, but moving forward it is likely to become a net exporter by 2024-25. High altitude clothing and bullet proof jackets constitute the highest market share product categories.

India has been a net importer in Mobiltech, Meditech, and Sportech. However, the expected rapid growth in mobility market will attract significant capacity addition in India’s domestic Mobiltech industry in the near future. Tyre cord fabric is the product with the largest share of the domestic Mobiltech market in terms of value of technical textile component.

In case of Meditech and Sportech, the deficit is likely to increase in the coming years due to increase in popularity of sports, sports medicines, and also general medicines demand for new health-conscious modern-day population. Surgical dressings constitute the largest share of the Indian Meditech market in 2019-20, followed by surgical sutures. The domestic Sportech market is dominated by the Sports footwear components category which makes up for more than three-fourths of the Sportech categories.

India’s technical textiles exports are mainly directed to the US, Turkiye, France, Germany, and the UK. India’s exports to the US alone are one-fourth of India’s total technical textiles exports. India’s imports of technical textiles are mainly from China. South Korea and Germany are also significant supply sources for catering to demand of India’s technical textiles market. Eight technical textiles segments – Packtech, Clothtech, Hometech, Mobiltech, Protech, Agrotech, Sportech, and Buildtech – have witnessed trade surplus in the past and are likely to stride to make a dent in India’s export to the world.

5.0: The Way Forward

The level of penetration of technical textiles in India is at 5-10 per cent as compared to 30-70 per cent observed in developed countries. There is great opportunity for India to stride further for consolidating many of the segments for increased production and consumption, besides export. As the country moves ahead towards becoming a net exporter, the sector’s immediate responsibility rests on not only expansion and quality production but also creation of adequate testing infrastructure in the country. The centres of excellences set up by the ministry of textiles have done an excellent job in developing testing mechanisms. These further need to be made reliable and replicable. That amounts to adhering to certain international standards for establishing India as a quality conscious country. Some of the relevant areas which need improvement are to reskill and upskill the existing labour force, besides skilling more workforce to meet the demand for increased production in the country.

In addition to skill development, technological advancement is an important criterion for increasing quality production and productivity. The Government of India has already extended schemes such as the TUFS/ATUFS, besides giving capital subsidy for importing hi-tech machinery. Further promotion measures may be initiated in consultation with producing and user industry segments. A study by the United Nations puts India at a disadvantage by 15 per cent as against its competitors on account of inappropriate infrastructure in the country for export. However, the ease of doing business has been significantly improved for India from a ranking of 147 in 2014 to 63 in the 2019.8 Over the years, there has been a significant development in surface transport facilities and automation of customs in India, but modernisation of ports and domestic vessels for shipments needs greater attention by the government and relevant authorities.

Comments