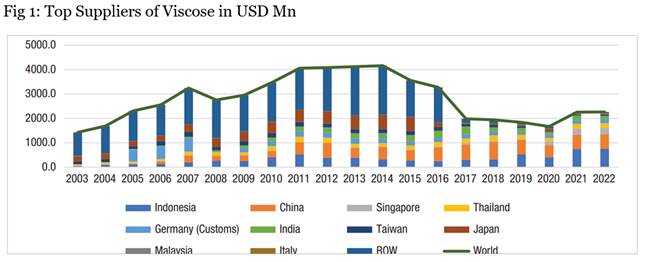

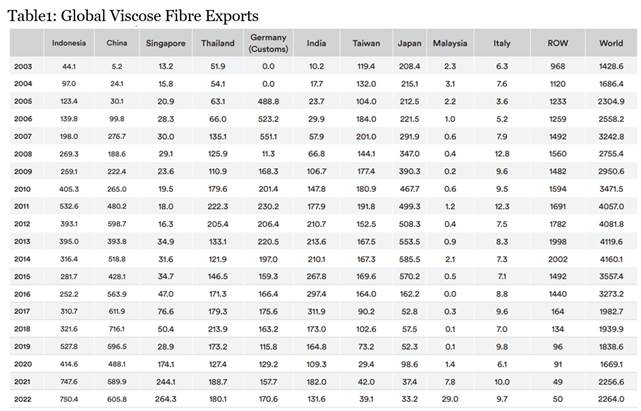

The global viscose industry is dominated by key players such as Indonesia, China, Singapore, Thailand, Germany, India, Japan, Malaysia, Taiwan, and Italy. Each country contributes significantly to the production and supply of viscose fibres, leveraging unique strengths and resources.

Indonesia

Indonesia holds a significant position in the global textile industry, particularly in the production of viscose fibre. The country benefits from abundant natural resources and robust manufacturing capabilities, enabling it to supply viscose fibres to both domestic and international markets. With its extensive environmental assets, Indonesia emerges as a key player in the cellulosic fibre sector, contributing approximately 3 per cent of the world’s total production.

However, despite its prominence in supplying raw materials to major cellulose companies like Sateri in China, Indonesia faces various sustainability challenges. The country’s leading viscose producer, APRIL, has come under scrutiny for its environmental practices, particularly allegations of involvement in deforestation activities within Indonesia.

In response to these concerns, APRIL is actively seeking to renew its certification from the Forest Stewardship Council (FSC). This certification is crucial for demonstrating the company’s commitment to sustainable forestry practices and environmental responsibility. By pursuing FSC certification, APRIL aims to address the allegations and reinforce its dedication to sustainable operations within Indonesia’s forestry sector.

This situation underscores the importance of balancing economic development with environmental conservation in Indonesia’s textile industry. As a major producer of cellulosic fibres, Indonesia has the potential to lead by example in promoting sustainable practices throughout its supply chain. Through initiatives like obtaining FSC certification and implementing responsible forestry management strategies, the country can mitigate environmental impacts while continuing to play a vital role in the global textile market.

China

China stands as a preeminent force in textile production on a global scale, boasting a well-established industry that excels in both quantity and quality. Renowned for its expertise in various textile categories, including viscose fibres, Chinese manufacturers play a pivotal role in satisfying the worldwide demand for these materials. Leveraging advanced production technologies and a resilient supply chain, China maintains its position as a key player in the global textile market.

As an export powerhouse, China serves as the primary hub for textile exports worldwide. The nation’s dominance extends to chemical-derived fibres and cellulose production, with an impressive 72 per cent of the total fibre output originating from its manufacturing facilities. Among the leading companies driving this industry are household names like Fulida and China Bamboo Textiles, which are instrumental in both domestic supply and international trade of cellulosic fibres.

This robust presence underscores China’s significance in shaping the landscape of the textile industry. With its unparalleled manufacturing capabilities and expansive market reach, China continues to set benchmarks for efficiency, innovation, and market competitiveness, solidifying its status as a global leader in textile production and trade.

Singapore

As one of the largest exporters of viscose rayon fibre, Singapore also functions as a vital strategic hub for the trading and distribution of textile materials worldwide. Leveraging its advanced logistical infrastructure and expertise, Singapore plays a crucial role in facilitating the seamless flow of viscose fibres across the global market.

Furthermore, Singapore is actively prioritising sustainability initiatives within its textile industry. The collaboration between Nanyang Technological University and various textile majors exemplifies the nation’s commitment to enhancing the sustainability of cellulose fibre production. This collaborative effort aims to develop innovative solutions and technologies that promote more sustainable practices throughout the entire lifecycle of viscose fibres.

Singapore’s dedication to sustainability is particularly noteworthy considering its status as one of the largest exporters of cellulose fibres. By spearheading research and development initiatives focused on sustainability, Singapore is making significant strides towards mitigating the environmental impact associated with cellulose fibre production and reinforcing its position as a responsible global leader in the textile industry.

Thailand

Thailand boasts a well-established textile industry, with its manufacturers playing a significant role in both regional and global viscose fibre supply chains. Renowned for their commitment to quality, Thai producers contribute to the market’s diversity by offering a range of high-quality viscose fibres.

According to data from the Observatory of Economic Complexity (OEC), Thailand ranks as the 11th largest exporter of cellulose globally, highlighting its substantial presence in the international market. With Thai Rayon, a pioneering force in viscose staple production, leading the industry, Thailand’s textile sector is poised for steady growth, anticipated to achieve a Compound Annual Growth Rate (CAGR) of approximately 4 per cent.

Thailand’s exports of viscose fibres and fabrics are primarily directed within Asia, with key destinations including Burma, South Korea, Pakistan, and Sri Lanka, underscoring the country’s strategic importance in the region’s textile trade.

As Thailand continues to strengthen its position in the global textile market, opportunities for collaboration and innovation abound. By leveraging its manufacturing expertise and embracing sustainable practices, Thailand can further enhance its competitiveness and contribute to the sustainable development of the textile industry both regionally and globally.

Germany

Germany holds a prominent position in the European textile industry, renowned for its unwavering commitment to quality, innovation, and sustainability. German companies lead the charge in pioneering advanced processing technologies for viscose fibres, driving significant advancements within the industry.

Ranked as the fifth largest exporter of Viscose staple rayon globally, Germany demonstrates a strong foothold in the sustainable cellulose and viscose market. With the European Union’s implementation of a permanent ban on plastic use within the bloc, there is a growing demand for alternative materials, making cellulosic fibres increasingly vital across various sectors.

Companies like Kelheim exemplify Germany’s dedication to sustainability, actively pursuing innovative methods to enhance the production of cellulose fibre and related products. Through research and development initiatives, these companies strive to optimise manufacturing processes, reduce environmental impact, and meet the evolving needs of consumers and regulatory standards.

As Germany continues to lead the way in sustainable textile production, its efforts not only bolster the country’s economic competitiveness but also contribute to global sustainability objectives. By fostering collaboration, innovation, and responsible manufacturing practices, Germany is poised to shape the future of the textile industry while driving positive environmental change.

India

India boasts a rich heritage in textiles and has emerged as a prominent producer of viscose fibres on the global stage. Indian manufacturers make substantial contributions to the viscose fibre market, offering a wide array of products that cater to diverse textile applications. As the 14th largest exporter in the world for cellulosic fibres and the sixth largest exporter of viscose fibres, India plays a pivotal role in meeting international demand.

The Indian viscose fibre market is poised for significant growth, with projections indicating a compounded annual growth rate of 5.12 per cent. Within this sector, the viscose market specifically is expected to experience even more robust growth, with an estimated increase of approximately 12 per cent. This expansion is fuelled by rising export earnings and the increasing demand for viscose fibres worldwide.

Leading companies like Birla Cellulose are actively engaged in initiatives aimed at enhancing the sustainability of viscose fibres. Through continuous efforts and innovation, these companies are striving to make viscose production more environmentally friendly and socially responsible. Such endeavours align with global trends towards sustainable manufacturing practices and contribute to the overall growth and competitiveness of India’s textile industry.

With its strong manufacturing capabilities, diverse product offerings, and a commitment to sustainability, India continues to solidify its position as a key player in the global viscose fibre market, driving innovation and meeting evolving consumer demands.

Japan

Japan’s reputation for technological innovation and manufacturing excellence extends to its contributions to the viscose fibre market. Renowned for their precision and attention to detail, Japanese companies play a pivotal role in producing high-performance fibres and pioneering innovative solutions for diverse textile applications.

As of October 2023, Japan’s total viscose exports to the global market amounted to 2.53 million units, reflecting the country’s significant presence in the international fibre trade. Among Japan’s key export destinations, the United States stands out as a primary market for its viscose fibre products.

Man-made fibres dominate Japan’s fibre exports, accounting for an impressive 98 per cent of the total fibre exports. This underscores Japan’s specialisation in synthetic fibres, including viscose, and its ability to meet the demanding specifications of global consumers across various industries.

With its commitment to technological advancement and product quality, Japan continues to shape the future of the viscose fibre market, driving innovation and meeting the evolving needs of customers worldwide. Through ongoing research and development efforts, Japanese companies remain at the forefront of the textile industry, driving growth and competitiveness in the global market.

Malaysia

Malaysia has a growing textile industry with an increasing focus on sustainability. Malaysian manufacturers contribute to the production of viscose fibres, aligning with global trends towards eco-friendly and sustainable materials. The viscose and the overall cellulosic fibres stand a huge potential in terms of exports. The Country solely exported viscose fibres to markets like Iran in 2022 as Malaysia and Iran share a common link- the Organisation of Islamic Cooperation (OIC) and a Free Trade Agreement between them. Although the relations were strained due to religious reasons, the countries have been improving the relationships since the year 2018, both nations are striving to enhance the relations through high usage of FTAs and trying to enhance political support for each other.

Taiwan

Taiwan’s strategic partnerships, dedication to sustainability, and superior production capabilities allow it to have a leading position in the worldwide market for textile viscose fibre. Taiwan’s market share in viscose fibre is predicted to increase as demand for eco-friendly textiles rises, influencing the industry’s course toward a more inventive and sustainable future.

Italy

Italy is renowned for its excellence in textile design, fashion, and high-quality production. Italian manufacturers add value to the viscose fibre market by producing premium and fashionable fibres that cater to the demands of the global fashion industry. The country is also making consistent efforts towards sustainability as the European Union aims to make the textile sustainable by the year 2030.

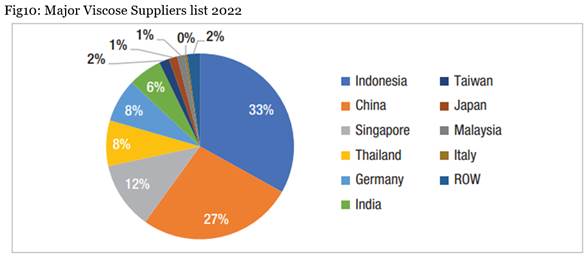

In 2022, the global market for viscose fibre saw significant contributions from key suppliers, each playing a crucial role in meeting the demand for this essential textile material. Among these suppliers, Indonesia emerged as the top exporter, with exports totalling $750.4 million, commanding a substantial 33 per cent share of the market. This dominance can be attributed to Indonesia’s abundant natural resources, efficient production processes, and established market presence.

Following closely behind was China, exporting $605.8 million worth of viscose fibre, capturing a significant 27 per cent share. China’s strong manufacturing capabilities, extensive supply chain networks, and competitive pricing strategies have solidified its position as a major player in the global viscose fibre market.

Singapore, Thailand, and Germany also made notable contributions, exporting $264.3 million (12 per cent), $180.1 million (8 per cent), and $170.6 million (8 per cent) worth of viscose fibre, respectively. These countries leverage their technological advancements, trade relations, and industrial expertise to meet the demands of both domestic and international markets.

Meanwhile, India, with exports totalling $131.6 million (6 per cent), continues to play a significant role in the global viscose fibre trade, leveraging its rich textile heritage and expanding manufacturing capabilities.

Despite its relatively smaller market share, Taiwan exported $39.1 million (2 per cent) worth of viscose fibre, showcasing its dedication to quality production and sustainability initiatives. Japan and Malaysia also contributed with exports of $33.2 million (1 per cent) and $29.0 million (1 per cent) respectively.

Lastly, Italy and other regions collectively accounted for $9.7 million and $50 million (2 per cent) respectively, demonstrating the diverse geographic distribution of viscose fibre suppliers.

Overall, these figures highlight the dynamic nature of the global viscose fibre market, with various countries making significant contributions driven by factors such as production capabilities, technological advancements, and market demand. As demand for eco-friendly textiles continues to rise, these suppliers are poised to play a pivotal role in shaping the industry’s future towards sustainability and innovation.

Conclusion

Conclusion

The global viscose fibre market is dynamic and diverse, with key players across multiple countries contributing significantly to meet the demand for this essential textile material. Indonesia leads in exports, leveraging its abundant resources and efficient production processes. China follows closely behind, with its strong manufacturing capabilities and competitive pricing strategies. Other notable contributors include Singapore, Thailand, Germany, India, Taiwan, Japan, Malaysia, Italy, and various regions. As demand for eco-friendly textiles grows, these suppliers play a crucial role in shaping the industry’s future towards sustainability and innovation, reflecting a global commitment to responsible production practices.

(1)_Big.jpg)

Comments