Brexit will help Indian manufacturers

KG Denim Limited is a denim and apparel fabric manufacturer, which caters to fashion brands and retailers across the world. The company offers various products, such as denim fabric, apparel fabrics, home textiles, and others. Sriramulu Balakrishnan, MD, KG Denim discusses the growth story of denims and the consequences of global politics on the Indian textile industry.

Which are your major markets for denim fabrics, jeans, and bed & bath ranges?

Denim fabrics are mainly exported to Asia and Africa for conversion into garments for export to Europe and the US. Jeans are mostly exported to European countries. Home textiles products are mostly exported to the US. However, we have opened up business in the UK, the Middle-East and the Pacific countries.

How big is the global denim market? What is the percentage claimed by India in it?

The global denim demand would be around $55 billion (2015) and is expected to be about $60 billion expected by 2021. India's share would be $1.2 billion, which is about 2 per cent.

What are your expectations from the GST?

At present, fabrics do not attract excise duty or sales tax (in most states in India). Post-GST, the textiles industry expects that it should be nil rate of tax or be minimum. Representations have been made to the ministry of textiles by TEXPROCIL. Branded apparel is subject to both excise duty and sales tax. Any GST on fabrics and yarn can be utilised by brands and retailers as credit for their operations.

Which product segments are faring well, and which face fierce competition?

All products in the textiles and apparel segment face competition. Our strategy has been to focus on niche segments so as to insulate our price and margin structure. Our ethical practices regarding labelling in organic and other segments have helped us build trust with our customers. Also, we have invested in sustainable manufacturing process fulfilling our customers' need for eco-friendly products. KGDL is a member of the Sustainable Apparel Coalition. We also constantly innovate in new product development which enables collaboration with our customers.

Are the global trends in denims in terms of weaves, fabric blends, and finishes steady or are they changing rapidly? What factors are major brands paying attention to?

Global demand for denim fabrics are changing every season with innovative finishes and technical aspect of the product. Jeans is a fashion product, brands and retailers are moving towards fast fashion. Our customers are moving towards selling fashion at a price, trying to imitate the Zara model. Therefore, there is constant pressure to provide new products on a regular basis.

Will the presidency of Trump and the Brexit have a major impact on the Indian textile industry?

US imports of textiles and garments from India are already subject to tariff. India does not enjoy any preferential tariffs relating to the US. Any increase in import tariffs will not affect Indian exporters, and this increase will be applicable to all countries. India's export of denim fabrics is to many countries in Asia, Africa and South America which in turn are exporting garments to the US on a favourable nation policy. Only after concrete policies are announced in the US, can we discuss the impact of protectionism.

Brexit, on the other hand, will help Indian manufacturers as the bilateral deal with the UK will be better than the current EU system, where they provide tariff advantages to Pakistan and China. We see advantages in Brexit.

What is the rate at which the demand for denim is growing? What forces are driving this demand?

The demand for denim in the domestic market has grown at a strong rate of about 7.5 per cent CAGR in the past 6 years (2009-10 to 2015-16). Domestic market demand will continue to grow, with short-term variations due to demonetisation, fashion and domestic economic cycles. Export demand is currently stagnant due to uncertainties in many overseas markets.

Which points of sale are working well for your denim brand Trigger? Do you plan to diversify into more products for the brand?

Trigger is a jeans brand, and it will continue to be a sportswear brand. Trigger is sold as a mid-market fashion brand and is currently available in many good multi-brand outlets. Our franchise stores are primarily in South and West regions in India.

What are the sustainable policies followed at KG Denims?

Our entire manufacturing is based on sustainability, from the fuel used in the co generation plant, to fully recycling water. We also have audited our plants for carbon footprint, chemical usage, and water quality. Our commitment to sustainability is for everyone to see https://youtu.be/uZGhiwq6XSM. We have been certified by many international organisations for our environmental initiatives.

How has the demand and consumption for denim evolved over time?

In the 1990s, there were as few as four players; currently, there are 35 denim manufacturers with a capacity of around 1400 million metres per annum. Growth has been exponential. The Indian denim market has further room to grow, but at a slower pace. KGDL products are positioned for the fashion business segment, while the new capacities are aimed at mass market products.

Which two textile start-ups are you following closely?

We are looking constantly for new products in the technical textiles area and automotive sector. Startups in the textiles sector are concentrated in the brands. There are many successful brands and these are potentially our customers.

What are the future investment plans?

Our investment plans are geared to increase sales annually in our three segments of denim and apparel fabrics, home textiles and Trigger apparel. These investments are for organic growth; we do not plan to increase our debt substantially than our current levels.

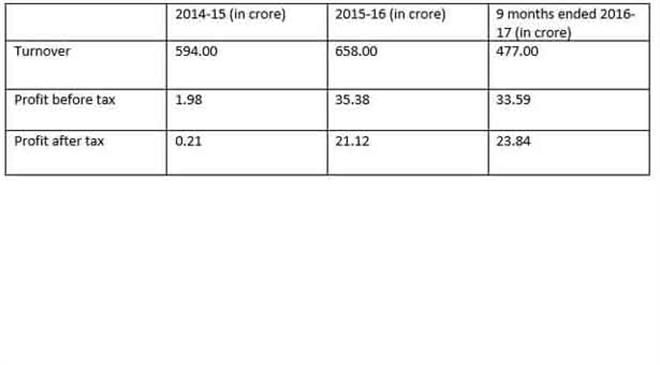

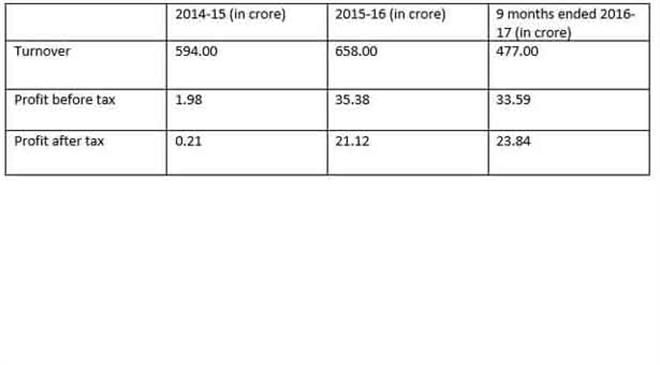

Please share details of the last two fiscal years and your expectations for the next two.

Table below: