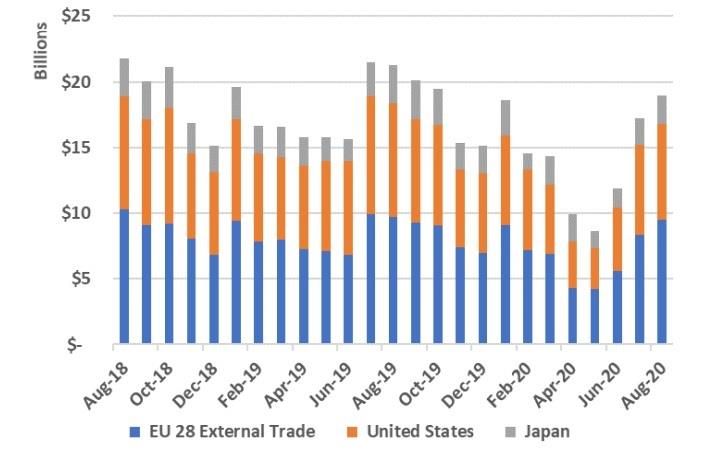

"Consumer demand was impacted on multiple fronts – changing behaviour, lockdown restrictions, and rapid unemployment which reduced discretionary income. Global apparel imports dropped dramatically in April and May, with US imports for May down 55 per cent from the previous year. EU and UK imports were down over 40 per cent, while Japan fell 30 per cent in the same period," the Foreign Agricultural Service of the USDA said in its November 2020 report 'Cotton: World Markets and Trade'.

The decline in textile and garment exports was felt in all major markets, but not equally. Exports from Bangladesh and India fell by 85 and 90 per cent respectively, while shipments from Pakistan, Turkey, and the European Union witnessed 60-per cent declines. Vietnam textile and garment exports fell roughly 30 per cent, the USDA report said.

The impacts of COVID-19 hit both demand and supply at the same time. Lockdown restrictions slowed consumer spending while also halting cotton-related processing. Spinning mills’ operating rates in India, Pakistan, and the United States fell over 90 per cent, while declines were slightly lower in China. Similar to the export data, Vietnam’s operating rate declined by only 30 per cent.

Recovery in the spinning sector has also been uneven – COVID-19 first impacted China and coincided with the Chinese New Year holiday. China’s recovery is faster than in many other countries, with operating rates returning to near pre-COVID-19 levels in 3 to 4 months, with other countries’ rates still below pre-COVID-19 levels after 6 months. While the rapid shutdown of spinning mills somewhat limited the buildup in yarn and fabric inventories, cotton stocks expanded rapidly.

"When COVID-19 emerged, most of the 2019-20 crop was harvested and the current year’s planting had begun. Expectations for 2020-21 world production have declined only slightly since February; however, global consumption is a different story. Comparing November’s global consumption to the February USDA Outlook, 2019-20 use is 17 million bales lower (14 per cent) and the 2020-21 forecast is 7 million bales lower (6 per cent). As a result, 2020-21 global cotton ending stocks are now forecast 22 million bales higher (22 per cent) than at the Outlook Forum," the report said.

However, the speed of recovery in consumer demand is uncertain, since recent apparel imports include deferred demand as consumers made purchases that were initially delayed. Moreover, some demand that was lost, such as school uniforms, 2020 summer and vacation clothing, hotel use of cotton bed sheets and towels, and other seasonal clothing items, may never be recovered. Further, the long-term impacts of remote work on workplace and school attire purchases remain unknown, the USDA said.

Fibre2Fashion News Desk (RKS)