The Australian government has taken a significant step by reducing import duties, a move that has had a considerable impact on Australia's economy. The country, which derives much of its GDP growth from exports, has been experiencing inflation and an increase in living costs due to various factors, including rising inflation and a gas crisis, among others. Hence, this recent measure comes as substantial relief for the nation.

The Australian industry

The Australian fashion industry, heavily dependent on imports from Asian countries such as China, India, Vietnam, and Bangladesh, is projected to grow by an impressive 15 per cent in 2024, reaching $9.79 billion. Australia is the second-largest consumer of clothing, trailing only the United States. On average, an Australian household consumes 27 kg of clothing per year. The government's recent decision to eliminate taxes on all imports is likely to have a positive effect on the country, which is also struggling to control its inflation. Furthermore, the current tax regime is expected to save approximately $30 million in compliance costs and facilitate trade worth $8.5 billion. This reduction in costs presents an additional opportunity for companies to invest in the industry and generate employment.

Figure 1: Size of the Australian fashion industry (in $ bn)

Source: Commission factory

The recent decision also indicates a move towards enhancing the profitability of Australian companies. The import tariffs, along with GST and the associated compliance costs, which are typically passed on to consumers, have been affecting the cost of living. As the country with the highest number of textiles per person, Australia is home to numerous clothing retail stores that rely heavily on imports. Moreover, the industry employs almost 3.7 per cent of the total labour force and contributes 1.5 per cent to the national economy. Considering the impact and the expenditure by households, this change is expected to significantly influence the overall industry.

The basic economics of taxation

Import duties function as a tax on the products that are imported. The underlying principle of any tax applied is this: the higher the tax imposed, the lower the consumption of the product. In Australia, the import duty on clothing was set at 5 per cent, alongside a GST of 10 to 12 per cent. Higher tariffs result in increased compliance costs, which in turn elevate the prices passed on to consumers. The figure below illustrates the various tariffs and measures applied to textile products.

Figure 2: Tariff lines on specific categories of textiles and apparel (in numbers)

Source: Treasury Department of Australia

With the reduction of these tariffs, there will be higher profitability, thus encouraging greater investment and providing the much-needed boost to the country's textile industries. Australian textile industries are particularly renowned for their technical textiles and the manufacturing of eco-friendly apparel. By easing taxes on raw materials, the country can also stimulate its manufacturing industry.

The consumer impact:

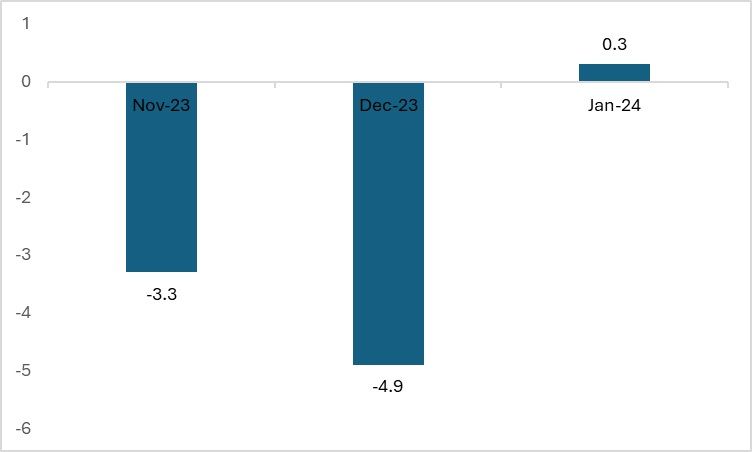

As the country with the second-highest per capita consumption of apparel and clothing products, the consumer plays a crucial role in the entire value chain. The duties, coupled with inflation, have affected consumer spending both directly and indirectly. The figure below represents the index for consumer spending in Australia on clothing and footwear, which was at its lowest in January 2024. Australia is currently grappling with inflation issues, with the rate at 4.1 per cent—above the central bank's tolerance level of 2 to 4 per cent.

Figure 3: Index of consumer spending in Australia

Source: Australian Bureau of Statistics (ABS)

As inflation increases, consumer spending on discretionary items tends to decline, as individuals seek to curb their expenses. To counteract this over the long term, the central bank implements various strategies—for instance, raising interest rates to discourage hasty borrowing, which can exacerbate inflation. While these inflation control measures have been effective in reducing inflation, they have, conversely, suppressed the consumption of clothing and footwear. In December 2023, there was a notable decline of 4.9 per cent in this sector, attributable to the country's inflationary pressures. Import duties also contributed to fuelling inflation, as the associated costs were passed on to consumers. Although the recovery in January was not promising, it is expected to improve with the implementation of certain measures.

Figure 4: Fall in spending on clothes and footwear (in %)

Source: Australian Bureau of Statistics (ABS)

A drop in imports

Due to higher tariffs and the standard GST on products sold, increased prices have led to a decrease in demand throughout the entire value chain. Higher prices deter consumer demand, resulting in a drop in orders from retailers. This situation arises from the compounded effect of higher taxes and GST, which has squeezed the profit margins of clothing retailers. Consequently, diminished consumer demand prompts retailers to reduce orders, ultimately causing a decline in imports. This trend was notably visible in 2023.

While there are exceptions, such as India and Vietnam, with whom Australia has Free Trade Agreements (FTA), allowing imports from these countries to remain stable or increase marginally, the situation with China is different. Despite having an FTA with Australia, the recent measures to de-risk supply chains, coupled with strained diplomatic relations, have led to a noticeable reduction in apparel imports from China.

Figure 5: Australia's apparel imports (in $ bn)

Source: ITC Trade map

Looking ahead

With import duties now reduced to zero for all textile and apparel products, the country is poised to reap substantial benefits. Tariffs and GST have historically inflated product prices, but this new measure promises to significantly lower costs for retailers, thereby increasing their profitability. Moreover, consumers stand to gain from a surge in surplus as prices decrease. This move creates a win-win scenario for Australia, bolstering its economic landscape.

Fibre2Fashion News Desk (KL)