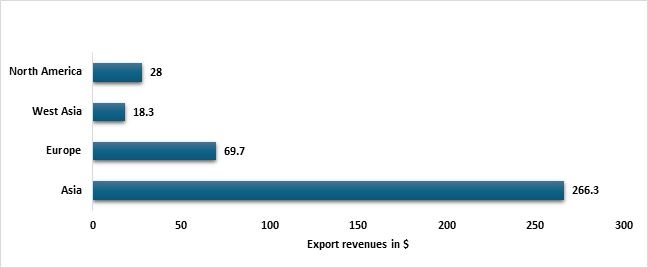

Region-wise comparison of apparel export

To gain a deeper understanding of the global apparel export landscape, it is essential to examine the performance of key exporting countries within their respective regional contexts. This analysis presents a region-wise comparison, categorising major apparel exporters into distinct geographical groups: Asia (including China, India, Bangladesh, Vietnam, Hong Kong, and Cambodia), West Asia (Turkiye), Europe (Germany, Italy, and Spain), and North America (the US).

Exhibit 1: Region-wise composition of apparel export for CY 2023 (in $ bn)

Source: ITC Trade Map, F2F Analysis

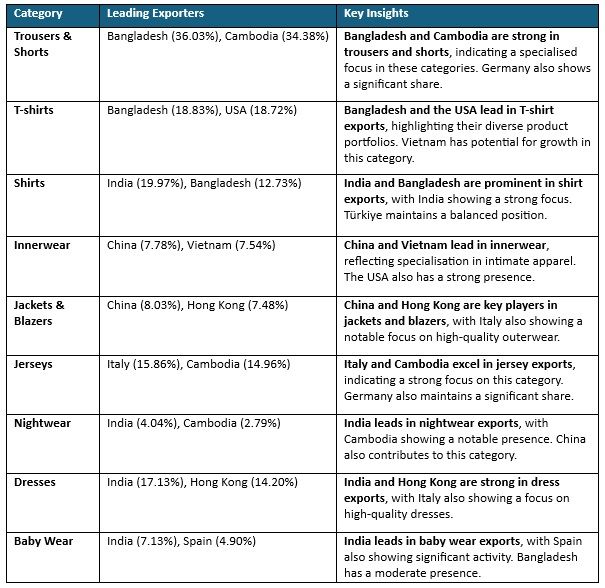

Table 1: Findings and key insights for CY 2023

Source: ITC Trade Map, TexPro, F2F Analysis

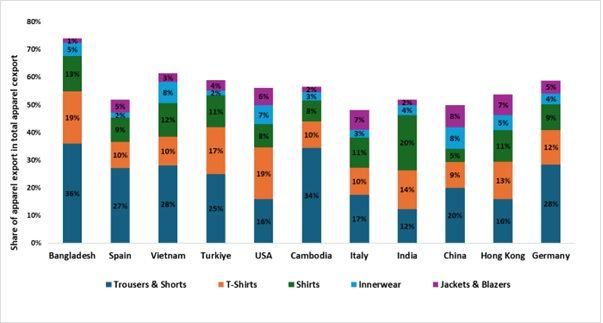

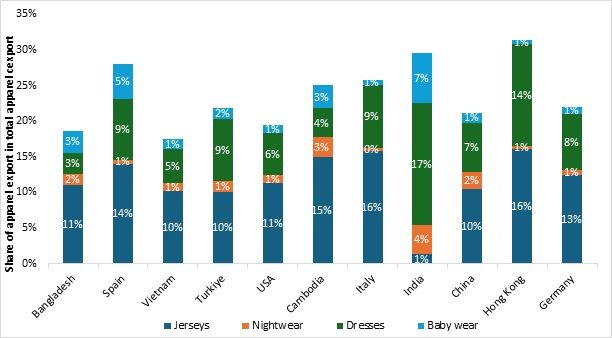

Product-wise composition of apparel exports from major exporting countries

The analysis of the product-wise composition of apparel exports from major apparel-exporting countries reveals several critical insights:

Exhibit 2: Product-wise composition of apparel exports from major exporting countries in CY 2023

Source: TexPro, F2F Analysis

Exhibit 2A: Product-wise composition of apparel exports from major exporting countries in CY 2023

Source: TexPro, F2F Analysis

Table 2: Findings and key insights

Source: TexPro, F2F Analysis

Comparative ESG Analysis of Leading Apparel Exporting Countries

In the context of increasing consumer awareness and demand for sustainably and ethically produced goods, the Environmental, Social, and Governance (ESG) rankings of apparel-exporting countries provide critical insights into their competitive positioning in the global market. This comparison highlights the need for targeted improvements and strategic measures to enhance ESG performance, particularly as the industry faces growing pressure to adopt sustainable practices.

ESG rankings are assessed by evaluating a company's performance across three critical areas. The assessment typically involves analysing various indicators such as carbon emissions, labour practices, diversity, and board structure, using data from corporate reports, third-party sources, and direct disclosures. A high ESG rank indicates strong sustainability practices and ethical governance, while a lower rank suggests areas needing improvement.

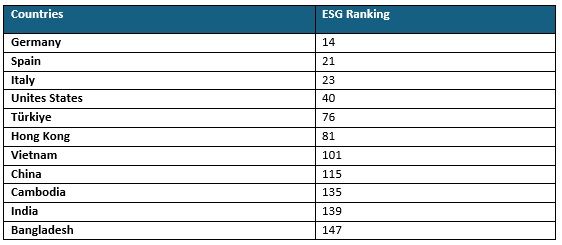

The table below presents the ESG rankings of key apparel exporters, highlighting the need for improved sustainability practices and ethical standards within the industry.

Table 3. ESG rankings of major apparel exporting countries

Source: TexPro

Insights from ESG Rankings

Germany, Italy and Spain lead in ESG performance

Germany (14), Italy (23), and Spain (21) stand out with high ESG rankings, indicating strong commitments to environmental sustainability, social responsibility, and robust governance practices. These countries have established frameworks and regulations that promote sustainable production methods, ethical labour practices, and corporate accountability. Their high ESG performance enhances their appeal to environmentally conscious consumers and investors. For example, Germany saw a 10 per cent increase in exports of sustainable apparel products in 2023, driven by consumer demand for green products.

Furthermore, as significant players in European apparel exports, these countries face increasing regulatory pressure as the EU targets full circularity by 2030. This has led to the adoption of eco-friendly raw materials and innovative production methods, with natural fibres like cotton, silk, and wool becoming more popular. Technological advancements such as blockchain, AI, and augmented reality are also enhancing sustainability and efficiency, helping meet both regulatory requirements and consumer expectations for ethical production.

Moderate ESG Performance in US and Turkiye

The US (40) and Turkiye (76) demonstrate moderate ESG performance. The US benefits from advanced regulatory systems and a growing emphasis on sustainability within the private sector. Meanwhile, Turkiye, although facing challenges, shows potential for improvement through enhanced governance and social initiatives.

Challenges in Asia's major apparel exporters

Asia’s ESG landscape: The ESG rankings for countries in the Asia region, particularly Bangladesh, Cambodia, China, India, and Vietnam, reveal a critical need for concerted efforts to improve sustainability and ethical practices within the apparel industry. Despite being major players in global apparel exports, these nations lag behind their Western counterparts in ESG performance.

Bangladesh (147), Cambodia (135), China (115), India (139), Hong Kong (81), and Vietnam (101) have lower ESG rankings, indicating significant room for improvement in their environmental, social, and governance practices. These countries, which are crucial to the global apparel supply chain, must address issues such as environmental degradation, poor labour conditions, and weak governance structures to enhance their ESG performance and global competitiveness.

Outlook and way forward

Economic conditions, geopolitical tensions, and market demand influence the global apparel export industry. Although China remains dominant, it faces increasing competition from other countries. Germany and Italy maintain their positions through quality and innovation, while countries like Bangladesh and Vietnam leverage cost advantages. Challenges such as inflation, geopolitical instability, and changing trade policies significantly impact these markets. Our findings highlight the need for adaptability and strategic planning to navigate the complexities of the global apparel export landscape.

Fibre2fashion News Desk (SA)