Role of FTA regions in US textile exports

The US has entered into numerous FTAs with various countries, some of which include specific provisions, like the yarn forward policy found in agreements such as CAFTA-DR. This policy stipulates that the yarn used in apparel production must originate from the NAFTA region, Central America, or the United States to qualify for duty-free entry into the US. The increasing influx of Chinese investments in all major Asian garment-producing nations, except India, is a growing concern for the organisation. It underscores the need for implementing stricter regulations to ensure adherence to sustainability standards when importing textile materials into the country.

For US textile mills, the Western Hemisphere region holds significant importance as it represents a vital market for their products. Losing market share in these countries could prove detrimental to the domestic textile industry. Additionally, domestic industries rely on the FTA region for exporting yarns and fabrics. Hence, it is imperative to maintain a strong presence and competitiveness in these markets to sustain the growth and stability of the US textile industry.

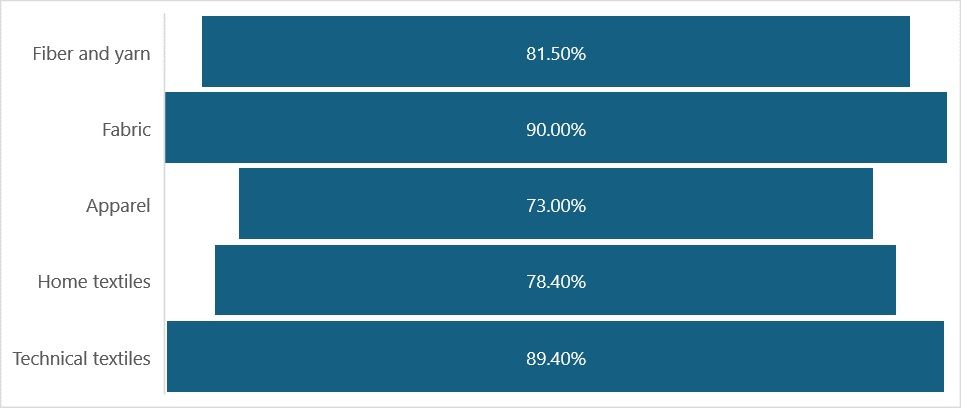

Figure 1: Category-wise concentration of US textile exports in Western Hemisphere (in %)

Source: Sheng Lu, OTEXA

Rising imports of textile materials from Asian nations, such as India and Bangladesh, pose a threat to the profitability and competitiveness of US textile exports to these regions. Additionally, in the trade of final products like apparel, US exports are not only lower but also more prone to fluctuations compared to imports. A deeper analysis could offer a clearer understanding of these dynamics.

Strong apparel trade with Aisa, muted with others

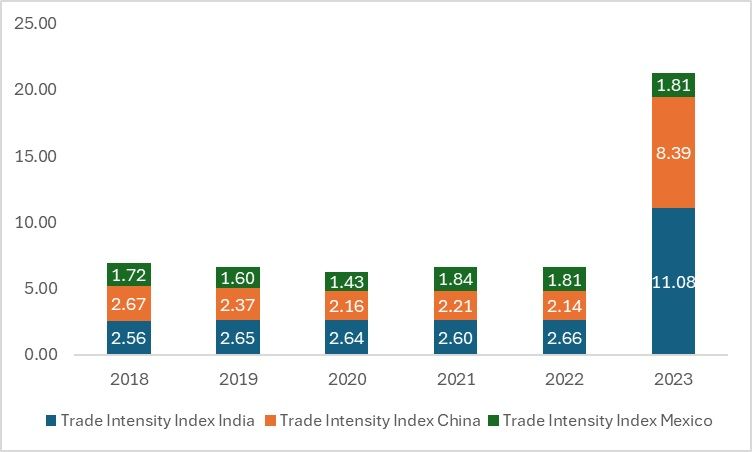

An analysis conducted using the Trade Intensity Index (TII) focused on four key countries in the apparel trade—India, China, Mexico, and Nicaragua—provides further support for the NCTO's argument. When comparing the TII of India and China with that of Mexico, it becomes evident that Mexico's TII is notably lower. This discrepancy can be attributed to factors such as Mexico's relatively lower labour costs, the presence of the entire supply chain within the country, and governmental support for the development of these industries. Consequently, apparel imported into the US from Mexico enjoys a competitive advantage due to these favourable conditions.

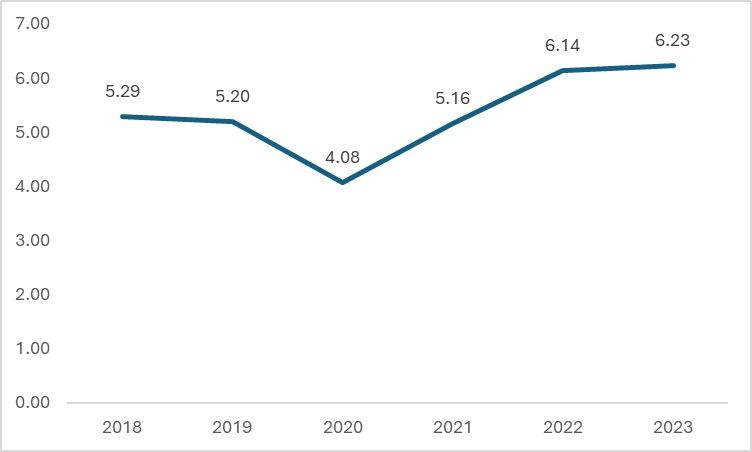

Figure 2: Trade Intensity Index of exporting countries with US (in units)

Source: F2F analysis

In 2023, both India and China saw a notable increase in their Trade Intensity Index (TII), with India experiencing a particularly significant rise, signalling a deeper trade partnership. Remarkably, despite the absence of a Generalized System of Preferences (GSP) or an FTA, the US became India's top trading partner for the year. In contrast, while China also saw a considerable increase in its TII, it was comparatively lower, reflecting the heightened scrutiny of Chinese imports by the US. On the other hand, Mexico, a significant exporter of apparel to the US in the region, showed a more subdued growth in TII compared to both India and China. This underscores the challenges posed by increasing apparel imports to the US, adversely affecting domestic industries.

The unfair economic advantage

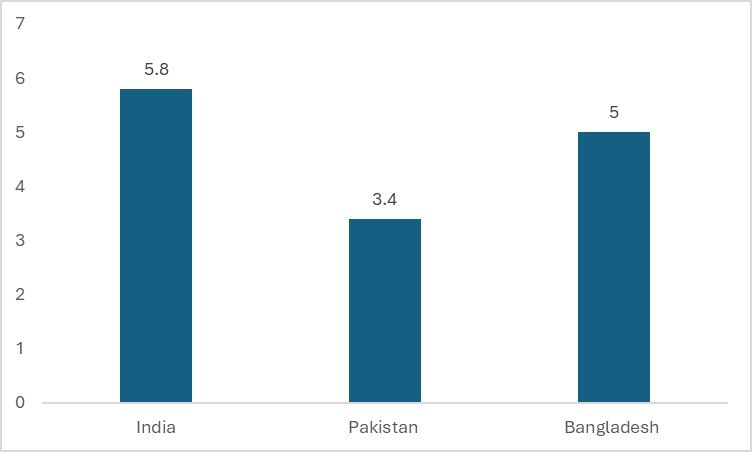

The US has attributed the unfair economic advantage of Asian countries to their lower labour costs. Furthermore, serious allegations have been levelled against these nations, particularly concerning the use of forced labour in China and the employment of child labour in the textile and apparel industries in Bangladesh, Pakistan, and India. Many of these allegations are supported by evidence. According to a 2021 report by Shape Charity, India has approximately 5.8 million child workers, Bangladesh has 5 million, and Pakistan has 3.8 million. The widespread presence of child labour contributes to the availability of inexpensive labour, which, in turn, is reflected in the lower costs of apparel production. Although these countries are making efforts to address child labour, socio-economic factors such as poverty play a significant role in the continuation of this issue.

Figure 3: Child labour in Asian textile industries as of 2021 (in mn)

Source: Shape Charity

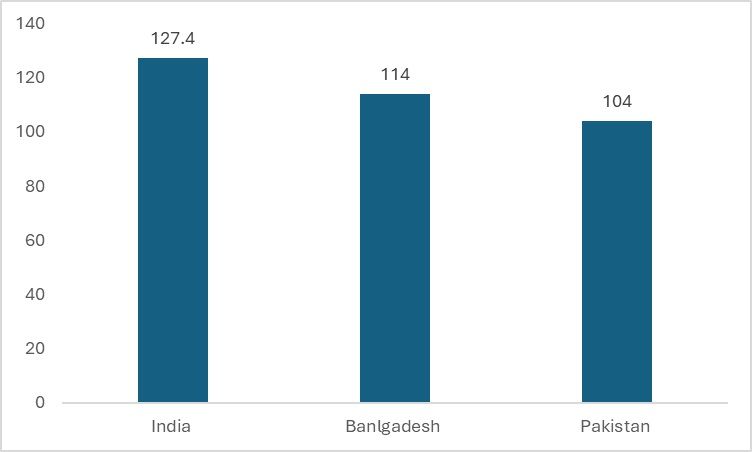

One significant disadvantage faced by the US is its lack of the entire textile value chain, a benefit predominantly enjoyed by Asian countries. Additionally, labour costs pose a considerable challenge. In countries like India, Bangladesh, and Pakistan, monthly wages for labour are substantially lower compared to the US, where average wages hover around $3,840. This stark difference in labour costs contributes to the overall affordability of apparel produced in these Asian countries compared to domestically manufactured goods in the US.

Figure 4: Monthly wages of labour in Asian countries as of 2023 (in $)

Source: The Voice of Fashion

In addition to social concerns, there's a pressing issue known as de minimis, contributing to the surge in apparel imports from China. This reached its zenith in 2023, and without heightened scrutiny from the CBP (Customs and Border Protection) on de minimis imports, apparel imports from China are poised to escalate further. Moreover, there's a suggestion to reconsider the inclusion of countries like Bangladesh and India under the Generalized System of Preferences. The NCTO argues that these nations already benefit significantly from price advantages, making additional benefits to enter the US market unnecessary.

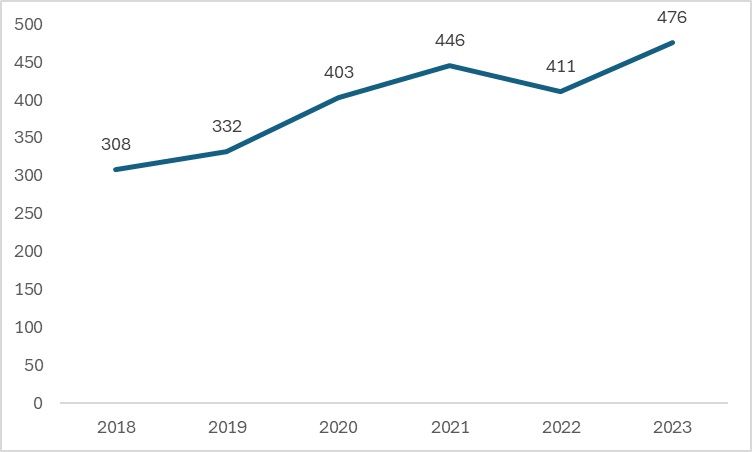

Figure 5: De minims imports from China (in $ mn)

Source: US CBP

Condition of US’ apparel exports

When examining US apparel exports, there is evidence of subdued growth. The domestic US textile industry holds significant importance, not only for its role in employment but also for its supply to various sectors, including defence through the provision of technical textiles. In 2023, the overall apparel exports saw a meagre increase of just 1 per cent, underscoring the need for strategies to bolster this crucial sector of the economy.

Figure 6: US apparel exports (in $ bn)

Source: UN Comtrade

The NCTO has pointed fingers at imports from Asian countries, citing their detrimental impact on overall US apparel exports and domestic production. These nations have emerged as major players in the global apparel market, dominating not only the US but also the EU and Australian markets. In contrast, the US heavily relies on the Western Hemisphere for its apparel trade. Consequently, recommendations have been made to address this issue, including closing loopholes in the de minimis threshold, promoting the yarn forward rule, excluding countries like India and Bangladesh from GSP benefits, and tightening customs checks.

Given the heavy reliance of many US suppliers on FTA regions for apparel exports, achieving a balance in both export and import policies is crucial. This raises the question: Should the US resort to protectionism, arguing for the safeguarding of domestic employment and industries, or should it opt for more nuanced measures such as phytosanitary regulations and stricter enforcement of laws like United States Fair Labor Practices Act (ULFPA)? The long-term effects of these decisions on the country remain to be seen.

The possible road ahead

The current testimony suggests a growing trend towards protectionism and the resurgence of non-tariff barriers, a path the US has trodden before. As countries worldwide increasingly sign FTAs, they often restrict imports or exports to certain nations while concurrently implementing policies aimed at achieving self-sufficiency and substituting imports. Whether the demands put forth by the NCTO will bring about the desired benefits for the US textile industry remains to be seen and will be revealed in due course of time.

Fibre2Fashion News Desk (KL)