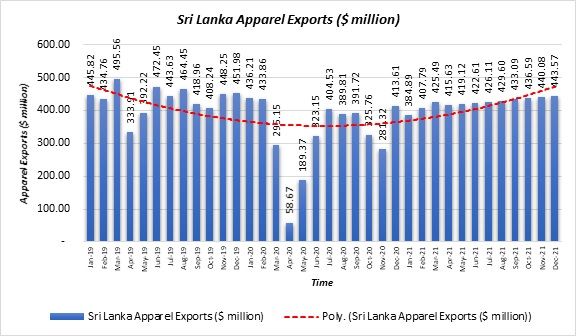

The apparel exports of the country were $5,210.23 million in 2019 with a monthly average of $434.19 million. They dropped by 24.32 per cent to $3,943.16 million in 2020 due to the pandemic. But the exports are expected to recover in 2021, growing by 28.95 per cent to cross the mark of $5,000 million, according to Fibre2Fashion’s market analysis tool TexPro.

The exports had recovered after the end of the first wave of the pandemic and rose between May 2020 and September 2020. In the last quarter of 2020, the transhipments at Colombo port declined due to the second wave of COVID-19 in the country. It created congestion at the container terminals.

The long-time restrictions due to the pandemic have substantially changed the buying behaviour of the people in the US and EU regions. They rarely visited the stores and did not spend on fashion, a commodity which is of limited use when sheltering in place.

Due to restrictions during the second wave of COVID-19 in Sri Lanka and its apparel markets in the west such as the EU and the US, the exports of Sri Lankan-made apparel were severely affected in the last quarter of 2020. The demand for Sri Lankan products is high from the EU and US as they are more compliant with standards. The EU is Sri Lanka’s second largest trading partner and main export destination.

In the beginning of 2021, many overseas organisations such as Mila Fashion invested in Sri Lanka for new apparel manufacturing units in the country.

Sri Lanka and China also entered into a Memorandum of Understanding (MoU) in January 2021 to boost the apparel sector, which was severely impacted by the pandemic. The nations aimed to strengthen the working relationship between the two associations, China National Textile and Apparel Council and Sri Lanka’s Joint Apparel Association Forum, to promote value chain cooperation in the two countries, increase mutual visits, promote exchanges and improve mutual trust among industry personnel. As casual, sports and leisurewear are major products of the country, it can tap the niches all over the world, especially China where the demand for technical textiles has been increasing due to the pandemic.

In Q1 2021, Sri Lanka’s department of commerce (DoC) launched an enhanced feature on the Sri Lanka Trade Information Portal (SLTIP) for integral step-by-step procedures functionality, funded by the EU. This captures all trade procedures in a sequential order including the relevant authorities to meet at each step, costs to be incurred, required time, necessary documentation, legal justification and the submission of complaints.

In March 2021, the third phase of American Chamber of Commerce (AmCham) and Sri Lanka’s TradeShifts project was concluded with the launch of a report, which provides the details about a study of 15 different industries including textiles and clothing.

The report explained the strengths and weaknesses compared to its peers in the region such as Vietnam, Thailand, Indonesia, the Philippines, India and Bangladesh. According to the report, Sri Lanka provides quality products, well-organised supply chains, an English-speaking workforce and a relatively high proportion of standards-compliant manufacturing facilities. But simultaneously, the country faces high costs, lack of economies of scale, external tariffs, unfavourable regulations, outdated laws and ad-hoc policy changes. The report provides recommendations to revamp the current situation such as government support for one-stop shops, incentives such as capital allowances and tax incentives, easy import of raw materials and the digitalisation of trade related customs and clearance processes.

Most of the global retailers avoid investments in the country for mass production though the minimum wage is lowered to $67 per month. Apparel industry contributed for around 40 per cent of country’s total exports. But Sri Lanka has extremely limited supply of raw material or fabric and imports around $1.5 billion worth of fabric, majorly from China (more than 75 per cent). Hence the industry faced a severe downturn when the pandemic hit China. Also, Sri Lanka is dependent on a migrant labour force.

In April 2020, the Sri Lankan government had banned imports of many textiles and apparel products to alleviate the impact of COVID-19 and to protect the local businesses. In 2021 budget, they kept the ban in place to stabilise the rupee. The EU has urged the country to rescind the ban on fabric imports as it creates barrier for trades in the partner countries.

The apparel sales in the US and EU are recovering to reach pre-pandemic levels as consumers have increased expenditure on clothing, which they could not do last year.

In May 2021, the pandemic spread to some of the most densely populated areas in the country. Many of the workers from the apparel business were infected by it, according to the epidemiological unit of the ministry of health. The Sri Lankan government and its Task Force failed to implement sustainable public health infrastructure during this global public health crisis.

According to industry experts, the Sri Lankan government should focus on the vaccination process as Sri Lanka allows free trade zones and significant export sectors such as apparel to function even during curfews and lockdown periods. The entire sector has been put at risk, which may derail the national economy. Experts believe the target of apparel exports for 2021 is achievable with the industry’s resilience and new initiatives.

Fibre2Fashion News Desk (KD)