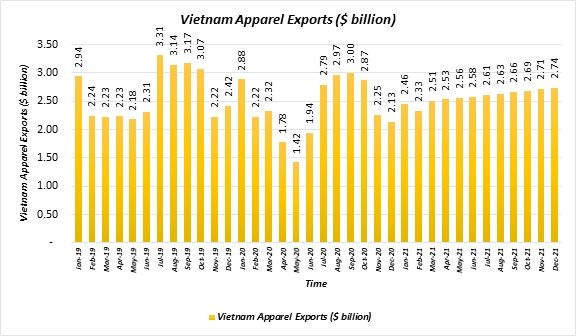

Vietnamese apparel exports were $31.48 billion in 2019 with a monthly average of $2.62 billion, which dropped by 9.19 per cent to $28.59 billion in 2020 due to the COVID-19 pandemic. Exports increased to $14.96 billion in the first half of 2021 with a monthly average of $2.49 billion, rising by 4.65 per cent over the monthly average in 2020, according to Fibre2Fashion’s market analysis tool TexPro.

The country’s apparel exports are expected to increase further in the second half of 2021 over the first half to reach $16.04 billion with a monthly average of $2.67 billion, recording a climb of 7.23 per cent.

In January 2021, Vietnam’s apparel production index surged by more than 8 per cent over the same month in 2020, according to the ministry of industry and trade. The EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) helped the nation boost trade amid the pandemic.

Israel and Vietnam recently negotiated the labour cooperation agreement and consented signing the pact in 2021 to bring more Vietnamese labourers to work in Israel’s agriculture sector.

According to the Economist Intelligence Unit (EIU), Vietnam has overtaken India and China in some aspects of the trade such as foreign direct investment (FDI) policy and foreign trade and exchange controls. The nation’s policies have been developed for low-cost manufacturing.

The exports orders of the country have been rising since the last quarter of 2020. The country’s scope for raw material imports has increased with new free trade agreements. Major raw materials such as yarn, fabrics and fibres were sourced from China earlier. But now some of the raw materials are imported from India, South Korea and European countries even though the quality or prices do not match with that of Chinese goods.

According to Vu Duc Giang, chairman of the Vietnam Textile and Apparel Association (VITAS), the demand for mid-range and convenient products such as homewear dresses and spandex products has considerably increased in the western markets, especially in the US.

Le Tien Truong, chairman of the board of directors of Vietnam National Textile and Garment Group (VINATEX) said that the commodity demand structure has shifted from high-end suits and shirts to protective clothing and knitwear in 2021. Truong also said that Canada and Japan are major export markets of the nation who are part of CPTPP.

According to VITAS, three development strategies were implemented in the nation to support apparel exports in the country. Firstly, they review the changes in consumer demand in the key export markets with major apparel exports share. Secondly, manufacturers have adopted advanced production technologies which help reduce the use of fossil energy, cut gas emissions and increase waste recycling. Thirdly, companies have invested in development of products along with their brands.

As per a representative of VITAS, Vietnam government will negotiate and sign strategic cooperation with the US to boost apparel overseas trade.

According to Hoang Quang Phong, vice president of the Vietnam Chamber of Commerce and Industry (VCCI), the UK-Vietnam free trade agreement (UKVFTA) has also supported trade and promoted partnership in green growth and sustainable development.

Apparel made in Vietnam with South Korean fabrics face lower tariffs in the EU, Vietnam’s ministry of trade, industry and energy stated. Vietnam is dependent on imports for 4/5th of its textile demand.

A survey conducted by VCCI and World Bank reported that approximately 35 per cent of businesses in Vietnam had to terminate employees due to the pandemic. About 97 per cent of the textile and garment companies faced the negative impact. The decrease in apparel exports in February were attributed to the new wave of pandemic in the country.

Better compliant processes and improved human rights are driving Vietnam’s exports besides the improved quality of fabrics and apparel, according to Khondaker Golam Moazzem, research director, Centre for Policy Dialogue (CPD).

Vietnam also has many advantages over its biggest rival Bangladesh. Vietnamese t-shirts earn more per 100 kg (approximately double) as compared to the t-shirts manufactured in Bangladesh. Vietnamese garments have achieved better diversity as compared to Bangladeshi garments. Vietnam’s lead time is approximately 1/3rd of the lead time of Bangladesh. Vietnam also has proximity to big raw material suppliers like China and has a better image due to sustainable development and better norms.

The apparel orders surged in Q1 2021 after Vietnam’s COVID-19 vaccination programme.

The country’s apparel manufacturers including Thành Cong Textile Garment Investment Trading JSC, shifted their production from personal protective equipment (PPE) to t-shirts and sportswear as the CAGR for sportswear has consistently been more than 5 per cent for the last five years, more than the industry average. According to VITAS, most apparel players mainly ordered sportswear till the end of April, and knitwear till July and August.

The UKVFTA that officially come into force on May 1, 2021, may further boost Vietnam's apparel exports to the UK. This FTA will remove almost all customs duties between the two countries when implemented completely.

VITAS has sent a proposal to the government for the vaccination of textiles and apparel workers on a priority basis and has asked to buy the vaccine directly from suppliers. Many of the Vietnamese garment producers are struggling to recover the money owed by US companies.

The US, the EU and Japan were major importers of Vietnam’s apparel in the Q1 and Q2 2021. Many apparel firms have signed orders until the end of Q3 2021. Many units have also signed contracts for orders until the end of the year and are entering into negotiations for 2022.

Fibre2Fashion News Desk (KD)