In contrast, ‘other T-shirts’ include a wide range of materials such as polyester, poly-cotton blends, and specialised fabrics designed to meet various performance needs. These materials often offer enhanced functionality, including moisture-wicking, quick-drying, and anti-odour properties, making them ideal for athletic wear and high-performance activities. The versatility of these non-cotton T-shirts allows brands to respond to changing fashion trends and lifestyle demands, appealing to both casual wearers and those seeking sports or fitness apparel. This segmentation has enabled the T-shirt market to thrive across diverse demographic groups, from fashion-forward consumers to athletes, further driving market growth.

Global T-shirt import market overview

The global import market for T-shirts continues to grow robustly, positioning T-shirts among the most popular apparel products worldwide. In 2023, T-shirts accounted for 10.06 per cent of total apparel imports, reflecting their universal appeal. Over the past five years (2019-2023), the market has seen steady growth, with the total value of global T-shirt imports increasing from $41.85 billion in 2019 to $44.93 billion in 2023. This represents a compound annual growth rate (CAGR) of 1.8 per cent, indicating resilient demand despite global economic uncertainties, changes in fashion trends, and supply chain disruptions.

Several factors have contributed to this sustained growth, including the rising popularity of casual and athleisure wear, the expansion of e-commerce, and a growing focus on comfort in everyday clothing. Additionally, the shift towards more sustainable fashion choices has spurred demand for organic and ethically produced cotton T-shirts, further driving growth in this segment.

Key importing countries

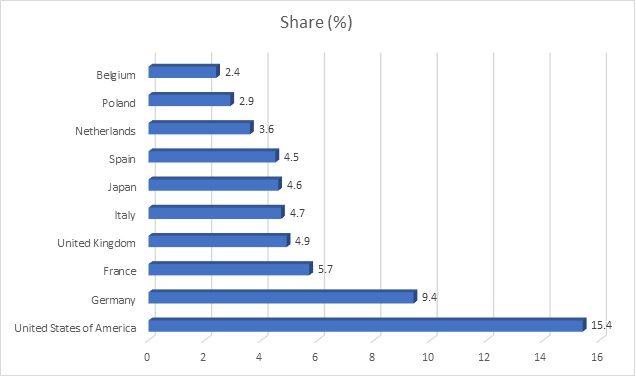

The United States emerged as the leading importer of T-shirts in 2023, capturing a significant 15.4 per cent share of global T-shirt imports. This underscores the enduring popularity of T-shirts in the US, where consumer preferences continue to favour casual and comfortable clothing. The country’s vast apparel market, along with its diverse consumer base, makes it a key destination for T-shirt exports from around the world.

Germany ranked second, with a 9.4 per cent share of global imports. The German market reflects strong demand for both cotton and performance-based T-shirts, driven by its well-developed fashion retail sector and the rising popularity of functional apparel, particularly for sports and outdoor activities.

France follows with a 5.7 per cent share, further demonstrating the appeal of T-shirts in Europe. The French market’s emphasis on both fashion and sustainability has led to increased demand for high-quality cotton T-shirts, particularly those meeting environmental standards. The United Kingdom, with a 4.9 per cent share, rounds out the top four, maintaining a strong tradition of T-shirt imports despite broader economic challenges and shifting trade dynamics due to Brexit.

Other notable importers in the top ten include Italy, Japan, Spain, the Netherlands, Poland, and Belgium. Each of these markets represents a unique blend of consumer preferences, with varying tastes in materials, styles, and functionalities. For example, Italy and Spain show a stronger preference for fashion-driven, high-quality T-shirts, while countries like Germany and Japan favour a balance of casual and performance-oriented apparel.

Exhibit 1: Key countries and their T-shirt import market share in 2023 (in %)

Source: ITC TradeMap

Global T-shirt demand market trends

The data highlights the sustained global demand for T-shirts, reinforcing their role as a cornerstone product in the international apparel market. T-shirts have become a ubiquitous wardrobe essential, prized not only for their casual appeal but also for their versatility in accommodating a variety of styles, fabrics, and functions. This category continues to thrive, fuelled by rising consumer demand for both fashion-forward designs and performance-enhancing features.

The export landscape reflects the global interconnectedness of the apparel trade, with both developing and developed nations competing to meet the growing global demand for T-shirts. From fast-fashion brands to premium retailers, companies worldwide depend on a consistent supply of high-quality T-shirts to cater to diverse consumer preferences. As market dynamics evolve, the ability to adapt to trends such as sustainability, ethical manufacturing, and functional apparel will be critical drivers of future growth in this segment.

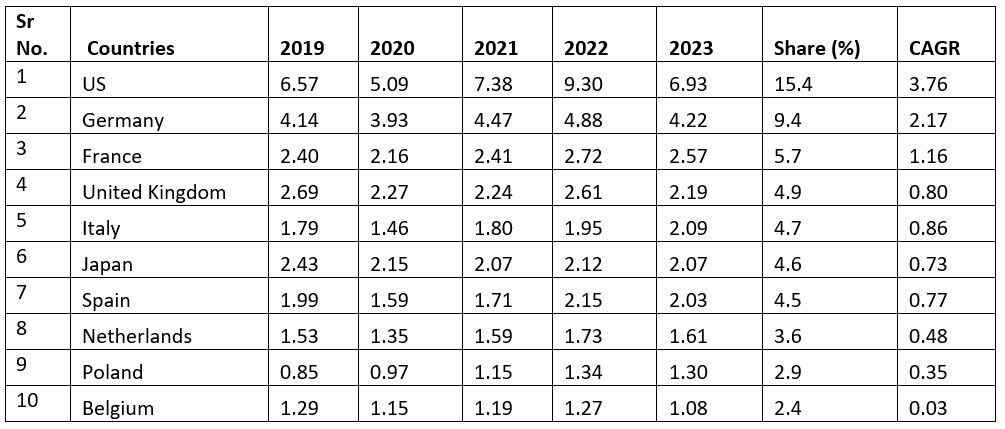

Table 1: Top T-shirt importing countries and growth patterns

Source: TexPro, F2F Analysis

Key insights from the global T-shirt import market (2019-2023)

Despite economic fluctuations, supply chain challenges, and shifting consumer behaviour, the global T-shirt import market continues to demonstrate resilience and steady growth. Between 2019 and 2023, the overall value of T-shirt imports experienced notable fluctuations, partly due to the impact of the COVID-19 pandemic on global trade and demand. However, the market rebounded strongly, with robust performance in 2022.

The United States remains the largest importer of T-shirts, holding a 15.4 per cent market share in 2023 and achieving a compound annual growth rate (CAGR) of 3.76 per cent over the past five years. The American market is driven by a diverse consumer base with varied preferences, ranging from basic cotton staples to performance-oriented and luxury T-shirts. The rise of e-commerce and the increased demand for casual wear during the pandemic further bolstered T-shirt imports in the US.

Germany ranks as the second-largest importer, with a 9.4 per cent share in 2023, reflecting strong demand from European consumers who value both casual and functional apparel. Germany’s mature apparel market continues to prioritise quality and sustainability, driving consistent growth in T-shirt imports.

France, the United Kingdom, and Italy also play significant roles in the global T-shirt import market, holding shares of 5.7 per cent, 4.9 per cent, and 4.7 per cent, respectively. These European countries maintain stable demand, fuelled by fashion industry innovation and consumer interest in high-quality garments.

Japan ranks sixth, maintaining steady demand for T-shirts despite its highly competitive apparel market. The country’s focus on quality and design has supported sustained imports, especially for premium and branded T-shirts.

Spain, the Netherlands, Poland, and Belgium complete the top ten importers, each reflecting a mix of fashion-forward and cost-conscious consumer bases. The consistent demand in these countries further underscores the T-shirt’s essential role in both casual and activewear segments.

Global apparel export market overview

On the supply side, China remains the world's largest exporter of apparel, accounting for 29.2 per cent of global apparel exports. The country's dominance is driven by its large-scale production capabilities, advanced manufacturing technologies, and well-established global supply chains. Bangladesh follows with a 9.2 per cent share, having established itself as a leading exporter thanks to its competitive pricing and emphasis on large-volume production. Vietnam, another key player, holds a 7.1 per cent share, benefitting from its expanding role in the global textile and apparel industry, supported by trade agreements and increased foreign investment.

Italy, traditionally renowned for luxury and high-end fashion, is also a significant exporter, contributing 5.4 per cent to global apparel exports. This reflects Italy's expertise in high-quality textile production, craftsmanship, and design, enabling it to maintain a strong presence in the global market.

The robust growth in global T-shirt exports highlights the industry's adaptability to changing consumer preferences, technological advancements, and a growing emphasis on sustainable and ethical production practices. As the T-shirt market continues to expand, fuelled by diverse consumer needs and the demand for both affordability and quality, major exporting countries are well-positioned to navigate the challenges and opportunities ahead.

The global T-shirt market remains a vital and expanding segment within the apparel industry, sustained by consistent demand from both developed and emerging markets. With major importers like the US, Germany, and France driving growth, and leading exporters such as China and Bangladesh ensuring supply, the market is set for continued expansion. Looking ahead, key trends such as sustainability, the rise of performance apparel, and technological innovations in textile manufacturing will play a crucial role in shaping the future of the T-shirt trade.

Projected T-shirt imports for 2024: A global overview

The forecasts for 2024 indicate a positive trajectory for both cotton and other T-shirt imports across the world's major markets. T-shirts, as a wardrobe essential, continue to dominate the global apparel trade, with sustained demand driven by factors such as casual wear trends, athleisure, and an increased focus on sustainability and performance fabrics. These projections highlight the resilience and growth potential of the T-shirt market, with distinct variations in demand for cotton and other materials across regions.

United States: Leading the global market

The United States is expected to maintain its position as the largest importer of T-shirts in 2024. Cotton T-shirt imports are projected to reach $7.11 billion, underscoring the strong preference for cotton garments among US consumers due to their comfort, breathability, and sustainable attributes. Meanwhile, imports of other T-shirts—comprising synthetic fabrics like polyester and blends with performance features—are forecast at $2.86 billion. This reflects the growing demand for versatile, functional apparel suited for activewear and sports, which are increasingly integrated into everyday fashion in the US.

Europe: Strong performances across key markets

Germany and France, two of Europe’s largest apparel markets, are also projected to show strong import numbers in 2024. Germany is expected to import $3.28 billion worth of cotton T-shirts and $1.35 billion worth of other T-shirts. This reflects the country’s diverse apparel needs, spanning both casual and performance-driven garments. France, another key player, is forecast to import $2.10 billion in cotton T-shirts and $0.71 billion in other T-shirts, reinforcing the demand for quality and fashionable clothing among French consumers.

The United Kingdom is expected to import $1.71 billion in cotton T-shirts and $0.76 billion in other T-shirts, indicating stable demand across both segments. Italy and Spain are set to follow similar trends, with Italy’s projected imports at $1.68 billion for cotton T-shirts and $0.68 billion for other T-shirts, while Spain is forecast to import $1.75 billion in cotton T-shirts and $0.56 billion in other materials.

Expanding consumer base in other European and Asian markets

Other significant players in the European market, such as the Netherlands and Belgium, are forecast to contribute notably to the overall T-shirt import market. The Netherlands is expected to import $1.52 billion in cotton T-shirts and $0.49 billion in other T-shirts, while Belgium is projected to import $0.83 billion in cotton T-shirts and $0.35 billion in other T-shirts. These projections reflect stable demand, driven by a well-established retail infrastructure and evolving consumer preferences for both casual and performance-oriented apparel.

In Asia, Japan is expected to remain a major importer, with $1.29 billion in cotton T-shirts and $0.47 billion in other T-shirts. The Japanese market is known for its high standards of quality and design, with consumers favouring premium T-shirts made from both cotton and advanced materials, reflecting their demand for both fashion and functionality.

Poland rounds out the top 10 projected importers, with forecasts of $1.20 billion for cotton T-shirts and $0.29 billion for other T-shirts, highlighting its growing importance as an emerging market in Europe. Poland’s rising demand is indicative of broader trends in Central and Eastern Europe, where increasing disposable incomes and shifting fashion preferences are driving up T-shirt imports.

Cotton vs other T-shirts: A comparative outlook

The 2024 projections indicate that cotton T-shirts will continue to dominate the market across most countries, underscoring the strong consumer preference for natural fibres due to their comfort, softness, and increasing alignment with sustainable fashion trends. The rising demand for organic cotton products, in particular, is contributing to this growth, as consumers become more environmentally conscious and seek ethically produced garments.

However, the market for other T-shirts, including materials such as polyester, poly-cotton blends, and specialty fabrics with moisture-wicking and quick-drying properties, is also expected to expand. This segment is driven by the growing popularity of activewear and athleisure, as consumers seek garments that offer both style and performance. While smaller than the cotton T-shirt market, the ‘other T-shirt’ category is poised for growth, particularly in markets where demand for functional, high-performance clothing is on the rise, such as the US, Japan, and parts of Europe.

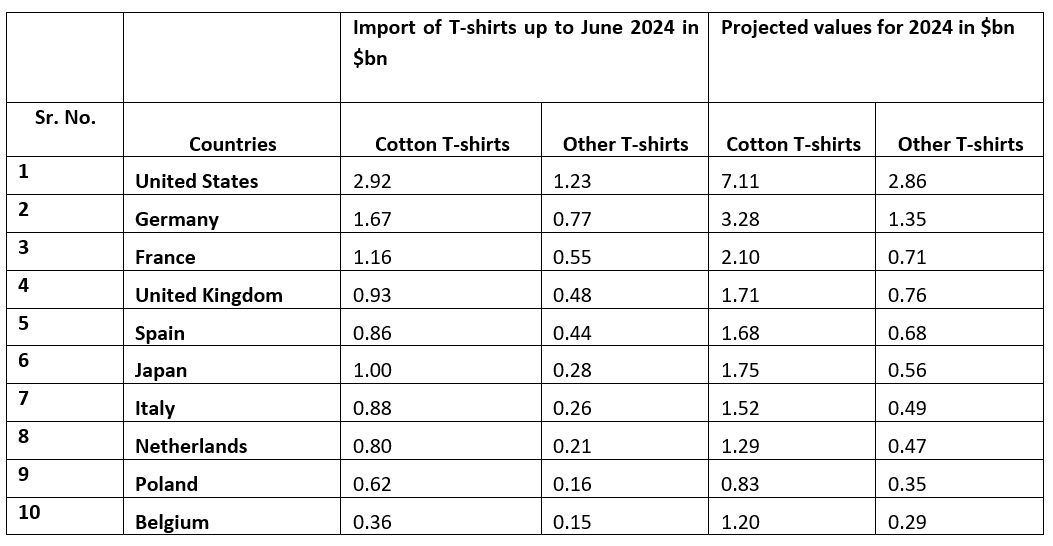

Imports of T-shirts in 2024: Overview and forecast

The latest data on T-shirt sales up to June 2024 indicates a strong market presence for cotton T-shirts, particularly in the United States, which leads with 2.92 million units sold, significantly outpacing other countries. Germany and France follow with cotton T-shirt sales of 1.67 million and 1.16 million units, respectively.

In contrast, sales of other T-shirts are lower across the board, with the US again leading at 1.23 million units, while Japan shows the weakest performance in this category at just 0.28 million units. The UK, Spain, and Italy all have modest sales, highlighting regional variations in consumer preferences.

Notably, Poland and Belgium represent smaller markets, reflecting overall lower sales figures for both cotton and other T-shirts. This data suggests a robust preference for cotton T-shirts in major markets, while the other T-shirt segment faces more significant challenges, indicating a potential area for growth and marketing focus.

Table 2: T-shirt import data and projections for year-end

Source: TexPro, F2F Analysis, ITC Trade Map

The forecasts for cotton and other T-shirt sales in the calendar year 2024 reveal promising growth trends across major markets. The United States is expected to maintain its dominant position, with cotton T-shirt sales projected at 7.11 million units and other T-shirts at 2.86 million units. Germany and France are also set for strong performances, with cotton T-shirt sales forecast at 3.28 million and 2.10 million units, respectively.

The UK and Spain are showing competitive numbers as well, with cotton T-shirts expected to sell 1.71 million and 1.75 million units. Notably, the Netherlands and Japan are also projected to contribute significantly to the market, highlighting a diverse and expanding consumer base across Europe and Asia. Overall, the data suggest a robust demand for cotton T-shirts, while the other T-shirt segment, though smaller, shows potential for growth, indicating a dynamic and evolving market landscape.

Conclusion: A Robust and Evolving Market

The projections for 2024 suggest a strong demand for T-shirts, with cotton T-shirts remaining the preferred choice for consumers in major markets such as the United States, Germany, France, and the United Kingdom. However, the growing interest in performance apparel and athleisure is also driving demand for non-cotton T-shirts, particularly in countries with more active lifestyles and a strong sports culture.

As the global apparel industry continues to evolve, brands and retailers must stay attuned to these shifting consumer preferences, especially the increasing emphasis on sustainability and multifunctional clothing. The diversification of materials, along with the rise of e-commerce and fast fashion, will likely play pivotal roles in shaping the future of the T-shirt market, providing opportunities for innovation and growth across both traditional and emerging markets.

Fibre2Fashion News Desk (NS)