India has sought concessions on customs duties for various goods, including cars, commercial vehicles, and machinery from Sri Lanka. While the initial FTA covered goods, the two countries are now negotiating to expand the agreement to include additional goods and services. As of 2013, the agreement stipulates that garments classified under Chapters 61 and 62, while still on the negative list, will benefit from a 50 per cent tariff concession for 223 products, with an annual quota of eight million pieces allowed at zero duty. This concession aims to facilitate increased exports of Sri Lankan apparel to India.

Sri Lanka has expressed a strong interest in enhancing its market presence in India, given that apparel is a significant source of export revenue. The country's main markets, the US and the UK, have experienced a decline in demand, reducing their share of Sri Lanka's export market to 20 per cent due to decreased spending on discretionary items like textiles and garments. Consequently, India remains a crucial partner for Sri Lanka, particularly due to the logistical advantages provided by proximity to the ports of Mumbai and Chennai. This is especially pertinent considering Sri Lanka's economic crisis of 2019, which has exacerbated resource limitations.

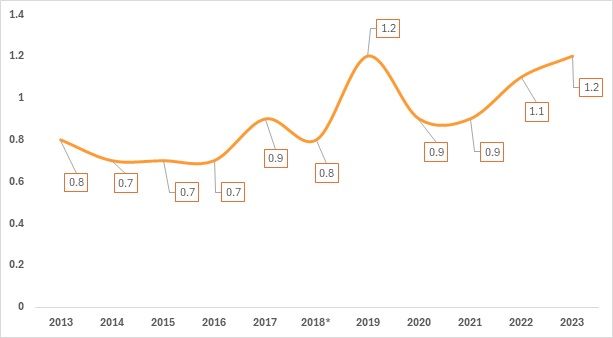

Figure 1: India’s imports of garments from Sri Lanka (in %)

Source: TexPro, F2FAnalysis

The share of India in Sri Lanka's apparel exports has shown overall stability, fluctuating between 0.7 per cent and 1.2 per cent over the years. Despite significant economic and political crises in Sri Lanka starting in 2019, India's role as a market for Sri Lankan apparel has remained relatively steady. Notably, there was an increase from 0.7 per cent in 2018 to 1.2 per cent in 2019, indicating a positive reception from India towards Sri Lankan apparel amidst broader challenges. Even as Sri Lanka faced severe disruptions post-2019, the share of exports to India remained steady, peaking at 1.2 per cent in 2023.

The data indicates some fluctuations, particularly with a dip to 0.9 per cent in 2020, likely due to the COVID-19 pandemic and the after-effects of the 2019 economic crisis. This was followed by a recovery to 1.2 per cent in 2023, suggesting a stabilisation or adaptation in trade relations despite ongoing challenges. The relatively small percentage of Sri Lankan apparel exports going to India hints at either strategic market diversification by Sri Lanka or competitive trade conditions in India. However, the gradual increase towards the end of the period suggests the potential for further growth in India's market share, contingent on improved economic conditions or more favourable trade relations.

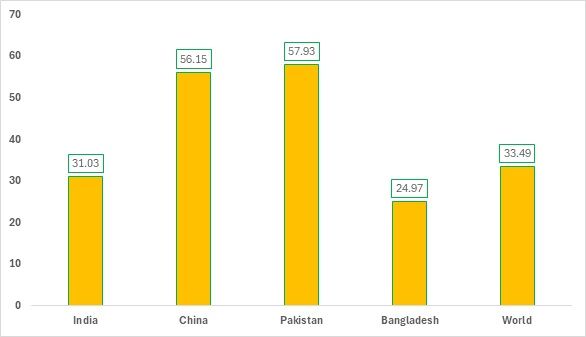

Figure 2: Sri Lanka’s unit rate for apparel exports to different countries (in $)

Source: TexPro, F2F analysis

In 2023, Sri Lanka's fabric imports show notable pricing differences among its suppliers. Sri Lanka imports fabric from India at $6.08 per kg, which is lower than the global average of $7.74 per kg, highlighting India's cost-effectiveness as a fabric supplier. In comparison, fabric from China costs $6.62 per kg, and from Pakistan, $6.97 per kg. Although both are more expensive than fabric from India, they are still below the global average. Fabric from Bangladesh is the least expensive at $5.12 per kg. These cost variations suggest that while India offers competitive pricing, Sri Lanka may also benefit from considering Bangladesh for lower-cost fabric options. Despite India's competitive prices, it has decided to relax fabric sourcing restrictions on Sri Lanka’s insistence.

Sri Lanka’s apparel export prices also show significant variation depending on the destination. Exports to China and Pakistan are priced highest, at $56.15 and $57.93 per unit, respectively, reflecting strong value in these markets. In contrast, exports to India are priced at $31.03 per unit, which is significantly lower than those to China and Pakistan but lower than the global average of $33.49 per unit. Exports to Bangladesh are the lowest, at $24.97 per unit. This pricing trend indicates that Sri Lanka secures higher prices in markets like China and Pakistan, potentially due to higher demand or perceived value, while the prices in Bangladesh are comparatively lower, possibly due to more competitive market conditions.

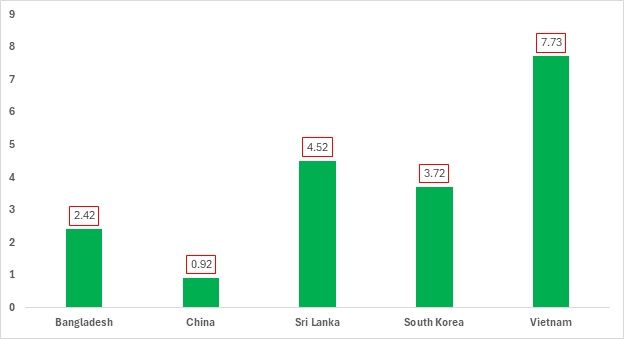

Figure 3: India’s unit rate for imports from different countries (in $)

Source: TexPro, F2F analysis

The unit rates for Indian imports of apparel from various countries reveal significant pricing differences. Vietnam leads with the highest unit rate at $7.73, indicating that apparel from this country is priced at a premium, potentially due to higher production costs or superior quality. Sri Lanka follows with a unit rate of $4.52, suggesting a moderate price point that could reflect competitive quality and production standards. South Korea, an FTA partner of India, offers a mid-range option with a rate of $3.72. Meanwhile, Bangladesh, with a rate of $2.42, represents a more cost-effective choice, likely due to lower production costs. China has the lowest unit rate at $0.92, representing the most economical option, which could result from high-volume production and competitive pricing strategies.

These varying rates highlight the diverse pricing strategies and production economics across these key apparel-exporting countries. India can benefit from importing at better rates from apparel giants such as China and Bangladesh, as well as from South Korea, one of its Asian FTA partners. In contrast, Sri Lanka stands an abysmal chance for procurement by Indian importers currently given its higher unit rate charges.

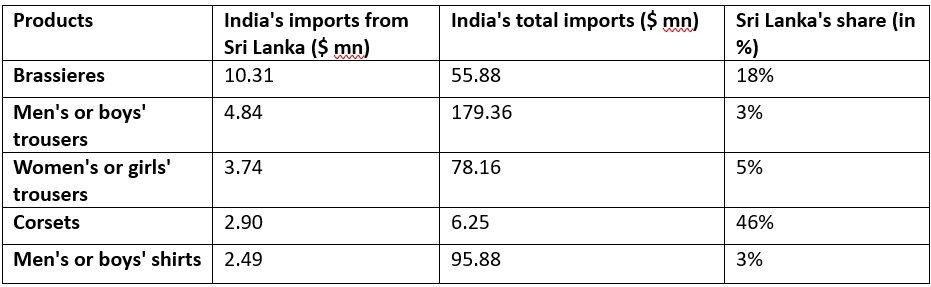

Table 1: India’s garment imports from Sri Lanka and total garment imports (based on 6-digit HS codes)

Source: TexPro, F2F analysisTop of Form

The table provides insights into the dynamics of India's imports from Sri Lanka across various HS Codes. HS Code 62129, which pertains to corsets, represents a notable 46 per cent of Sri Lanka's total exports to India, amounting to $2.90 million out of India's $6.25 million total imports for this category. This high percentage underscores Sri Lanka's substantial role in supplying these specific accessories, indicating that Sri Lanka is a key player in this particular segment of India's import market.

In comparison, other products show varied levels of Sri Lanka's contribution to India's total imports. For example, HS Code 621210, which covers brassieres, constitutes 18 per cent of Sri Lanka's total exports to India, with $10.31 million out of India's $55.88 million total imports. HS Code 620342, dealing with men's and boys’ trousers and the highest imported undergarments and apparel in India, represents only 3 per cent of Sri Lanka's total exports to India, despite accounting for $4.84 million of India's $179.36 million total imports. Similarly, HS Code 620520, which includes men's or boys’ shirts, also reflects a 3 per cent share, contributing $2.49 million of India's $95.88 million imports.

The data indicates that while Sri Lanka plays a significant role in certain textile categories, its influence varies widely across different HS Codes, highlighting the strategic importance of specific import categories in India's trade relations with Sri Lanka. It also emphasises two products—corsets and brassieres—that could likely affect the demand for Indian-made products of similar types.

Way forward

Sri Lanka has significant potential in certain garment segments in the Indian market. However, it faces stiff competition in other major categories of products imported by India. Additionally, Sri Lanka has not been able to fully meet the 8 million pieces quota set by India, which falls under a zero-duty structure. As of the calendar year 2023, Sri Lanka has only fulfilled approximately 5.5 million pieces.

While removing the quota restrictions may not significantly impact the domestic market overall, it could affect specific Indian companies that produce items such as corsets and brassieres.

Fibre2fashion News Desk (NS)