Cultural preferences, especially in Western markets, also play a prominent role in driving the rise of the sleepwear market. The US and the UK are the top importers of all kinds of sleepwear for all ages. Consumers in these regions have higher levels of spending and a long-standing history of sleepwear prominence. Sleepwear is also gradually evolving into loungewear, which is often worn for casual outings.

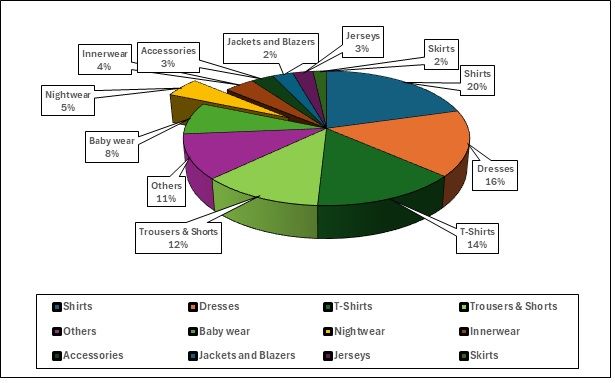

Exhibit 1: India’s total apparel exports in CY 2023 (in %)

Source: TexPro, F2F Analysis

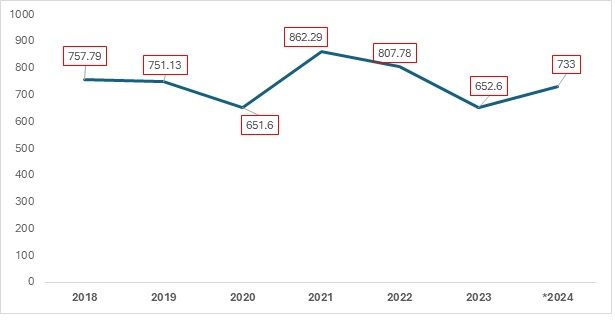

Exhibit 2: India’s nightwear/sleepwear exports to the world (in $ mn)

Source: TexPro, F2F Analysis

*CY 2024 figure is an estimate

India's sleepwear exports have exhibited a dynamic pattern from 2018 to 2024, with noticeable fluctuations shaped by various external factors. In 2018, exports stood at $757.79 million, which then fell to $651.60 million by 2020, largely due to global disruptions such as the COVID-19 pandemic. This period of decline was followed by a robust recovery in 2021, when exports surged to $862.29 million, marking a peak as demand for sleepwear increased.

However, the rebound was short-lived, as exports again declined in 2022 to $807.78 million and further dropped to $652.60 million in 2023. This trend reflects ongoing volatility. Looking ahead to 2024, there is an estimated rise to $733 million, signalling a cautiously optimistic outlook as global conditions begin to stabilise.

Overall, while the data shows notable swings in India’s sleepwear exports over these years, the anticipated recovery in 2024 hints at renewed potential for growth. The ability of the market to rebound, despite these fluctuations, suggests that India is poised to strengthen its foothold in the global sleepwear industry as demand gradually returns.

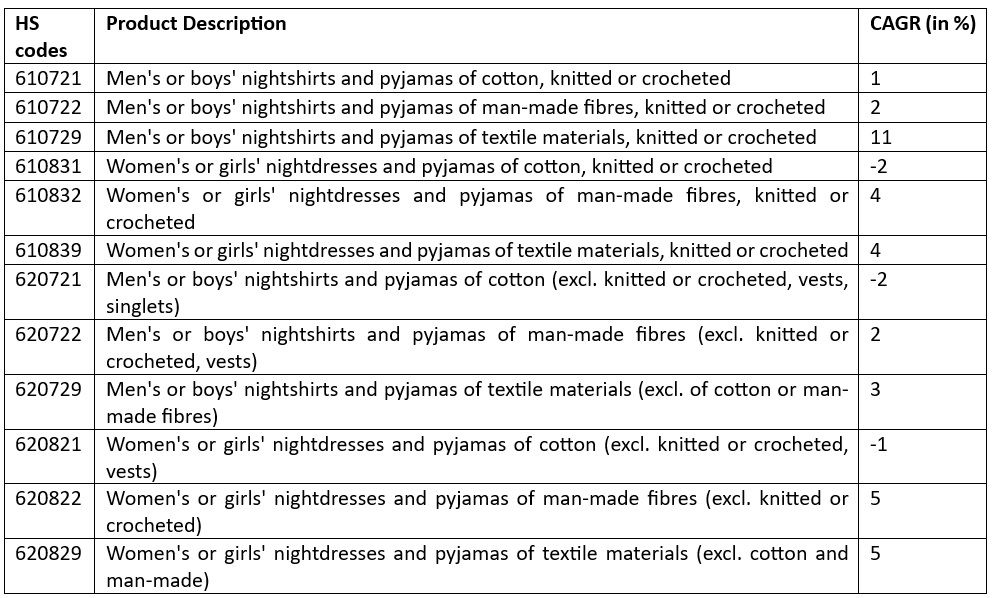

Table 1: Cumulative Average Growth Rate (CAGR %) for India’s sleepwear exports from CY 2018-2023

Source: ITC TradeMap, TexPro, F2F Analysis

The CAGR data for sleepwear apparel from 2018 to 2023 reveals diverse growth patterns across various segments, reflecting shifting consumer preferences and market dynamics. Men's or boys' nightshirts and pyjamas made from textile materials (knitted or crocheted) stand out with an impressive CAGR of 11 per cent, suggesting strong demand for innovative designs and high-quality fabrics in this category. Conversely, traditional segments like women's or girls' nightdresses and pyjamas made of cotton (knitted or crocheted) are experiencing a decline of 2 per cent. India has not performed well in this area, despite the product ranking 5th among the most imported sleepwear apparel.

On a positive note, women's or girls' nightdresses and pyjamas made from man-made fibres and textile materials both show a healthy growth rate of 4 per cent, highlighting the increasing acceptance of synthetic materials that offer durability and ease of care. Similarly, men's or boys' nightshirts and pyjamas made from man-made fibres exhibit modest growth at 2 per cent, reflecting a stable interest in functional sleepwear. The negative growth in other traditional categories, such as men's or boys' nightshirts and pyjamas made of cotton (excluding knitted or crocheted) and women's or girls' nightdresses and pyjamas made of cotton (excluding knitted or crocheted), reinforces the need for brands to innovate and adapt to changing consumer expectations. Overall, focusing on the higher-growth segments and exploring eco-friendly and contemporary designs will be crucial for manufacturers aiming to capture market share in the evolving sleepwear landscape.

It is important to note that India has experienced negative performance in three of the five most imported sleepwear apparel categories. Given India’s dominance in the cotton sector, cotton sleepwear should have been the most rapidly growing segment. However, India has not been able to capitalise on its abundant raw material resources in the sleepwear sector.

Women’s and girls’ cotton nightdresses and pyjamas (HS code 610831) saw a decline in CAGR from 2018 to 2023, with Vietnam being the exception, reporting an 8 per cent increase in exports compared to CY 2022, while other nations faced declines. This category is crucial in the global sleepwear market due to its high demand. Similarly, men’s and boys' knitted or crocheted cotton nightshirts and pyjamas (HS code 610721) rank third among imported nightwear products. Despite India's rich cotton resources, its growth rate dipped from 2018 to 2019, although it remains the third-largest exporter. In contrast, Vietnam, the Netherlands, and Poland have increased their global market shares, with Vietnam ranking sixth overall and seeing a 19 per cent rise in trade value from CY 2022 to 2023, significantly impacting India's market share.

Additionally, women’s cotton nightdresses and pyjamas (excluding knitted or crocheted items) experienced a slight CAGR decline, facing fierce competition from China, which increased its exports by 7 per cent, and Turkiye, which also saw improvements. Sri Lanka notably boosted its exports from $9.8 million to approximately $15 million year-on-year. European countries such as Poland, Germany, France, and Spain have begun to consume a larger share of the market, further diminishing India’s export opportunities.

Sleepwear primarily relies on long-staple cotton for its soft, silky texture. However, India has faced rising cotton prices due to a global increase in 2022-2023, which has impacted domestic garment exporters. Although demand for cotton remains robust as of late CY 2023, the price of yarn has risen by ₹20 per kg since February 2024, discouraging apparel manufacturers from using domestic cotton. While Indian cotton is competitive in international markets, local producers have struggled to fully capitalise on these benefits. A persistent tug-of-war exists between garment manufacturers and cotton producers, with the latter earning more profits in the international market. This situation is exacerbated by soaring cotton yarn prices globally, which eat into the profits of Indian garment exporters.

In 2022, this tension led garment exporters to call for a ban on cotton exports, citing the burden of rising raw material costs. These challenges have contributed to stagnation in India’s sleepwear sector, which heavily depends on cotton, preventing it from achieving the growth it needs.

Future outlook

The US primarily imports sleepwear from China, Vietnam, and Cambodia. China and Vietnam lead due to their high productivity in producing cost-effective apparel, while Cambodia is emerging as a strong competitor. Cambodia holds a top 3 position in the US market, the largest sleepwear importer, with approximately 4 per cent of its total apparel exports by product being sleepwear.

In the UK, Bangladesh closely follows India in sleepwear exports, with Cambodia ranking fourth overall. Bangladesh also dominates the sleepwear export market to Germany, with India trailing in second place. However, India does not appear in the top 10 sleepwear exporters to Japan, the fourth-largest importing country globally.

Regarding France, India ranks second in sleepwear exports, while China and Bangladesh occupy the first and third positions, respectively. Cambodia is also among the top 5 exporters to France, positioning itself as a significant competitor to India. Despite its status as a developing nation, Cambodia boasts a highly export-oriented apparel industry with a well-established, low-cost manufacturing base.

A deeper analysis of the 6-digit HS codes for both India and Cambodia could help identify popular sleepwear export subcategories that India should focus on to strengthen its leadership in the sector. Additionally, India should target markets such as Japan, Australia, and Canada, all of which are significant sleepwear importers. With a good Revealed Comparative Advantage in both Australia and Canada, India already has strong trade relations with these countries. The free trade agreement with Australia has been beneficial for several Indian exports, indicating that the sleepwear sector could also find a foothold in a high-demand market like Australia. India’s current negligible presence in these markets could hinder the growth of this promising apparel subcategory.

Fibre2Fashion News Desk (NS)