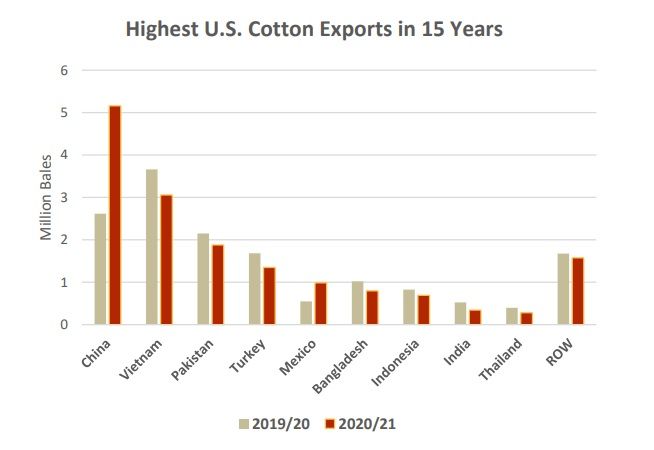

However, US exports to eight of its ten largest markets were down from the previous year, the foreign agriculture service (FAS) of the USDA said in its September 2021 report on ‘Cotton: World Markets and Trade’.

“Record US shipments through December boosted total exports as early season shipments were buoyed by the highest beginning stocks in 12 years. Shipments were strong, especially to China, despite US 2020-21 production falling 5.3 million bales from the previous year,” the report said.

US exports to China were the largest in 8 years with demand for US cotton mostly led by China’s State Reserve. US cotton was estimated to account for almost 90 per cent of State Reserve imports and nearly one-half of China’s total imports in 2020-21. Instead of sourcing from Brazil, the primary supplier in the previous two marketing years, the State Reserve returned to the United States, in part facilitated by the Phase One Agreement.

Relative prices (i.e., China cotton prices compared with US cotton prices) also played a role. China’s spot price (CC3128B) was significantly higher than imported prices (US origin) in 2020-21 compared with the previous year. Although higher domestic prices prevented the Reserve from purchasing domestic cotton, imports were an especially attractive option compared with the previous year. Imported US cotton averaged 10 cents higher than domestic China cotton in 2019-20, but in 2020-21 was approximately 8 cents cheaper (on average).

Higher prices in China relative to international were likely due to: (1) higher agricultural prices in China (e.g., corn and wheat), (2) quality issues with China’s 2020-21 cotton crop, and (3) the yuan appreciating roughly 10 per cent against the U.S. dollar.

Source: USDA

While 2020-21 US cotton exports were the largest in 15 years, it was also a record year for global imports. Bangladesh, Vietnam, Pakistan, and Turkey, rounding out the top 5 largest global imports (China being the largest), were all estimated to have had record imports in 2020-21. Higher yarn prices and rising global demand for cotton products spurred imports and cotton consumption.

Brazil and India helped supplant US exports in these respective markets; Brazil’s 2020-21 exports exceeded the previous year’s record by roughly 2 million bales, and India is projected to register its highest exports in 7 years.

US 2021-22 exports are forecast down from the previous year at 15.5 million bales, despite a larger crop at 18.5 million bales, with both lower US carry-in and global imports more than offsetting, the FAS report said.

China is once again forecast as the world’s largest importer at 10.0 million bales, but down more than 2.8 million from the previous year, it added.

Fibre2Fashion News Desk (RKS)