Net income of Michael Kors was $137.6 million, or $0.91 per diluted share compared to $202.9 million, or $1.32 per diluted share in the prior year. Adjusted net income was $192.5 million, or $1.27 per diluted share, compared to $204.5 million, or $1.33 per diluted share, in the prior year.

Michael Kors retail revenue of $643.9 million was approximately flat compared to the prior year. Comparable store sales decreased 2.1 per cent, which was in line with expectations. On a constant currency basis, comparable store sales decreased 1.3 per cent.

Michael Kors wholesale revenue declined 1.3 per cent to $457.8 million compared to the prior year.

Jimmy Choo reported revenue of $116.7 million. The company acquired Jimmy Choo on November 1, 2017 and compared to Jimmy Choo stand-alone results from the prior year, revenue increased double digits.

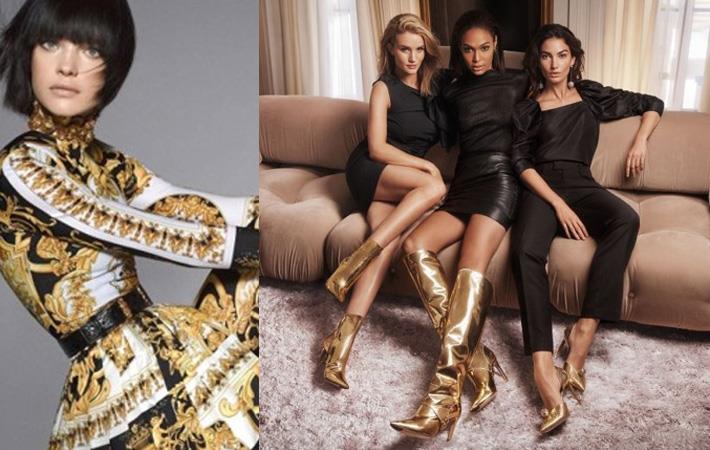

“We are pleased to report results that have again exceeded our expectations and are raising our fiscal 2019 EPS guidance to a range of $4.95 to $5.05, reflecting double digit earnings growth for the year. As we enter the second half of fiscal 2019 we look forward to welcoming Versace into our group. With the acquisition of Versace we have built one of the world's leading fashion luxury groups in just one year, setting the stage for accelerated revenue and earnings growth. This is a truly remarkable and historic moment for our company and we look forward to completing this transformational acquisition in the coming months,” said John D Idol, the company’s chairman and chief executive officer.

The company is raising full year adjusted earnings per share guidance by $0.05 to $4.95 to $5.05, reflecting better than expected second quarter performance for both the Michael Kors and Jimmy Choo brands.

For the full year, the company continues to expect total revenue to be approximately $5.125 billion, including between $580 million and $590 million of incremental Jimmy Choo revenue. Reported comparable store sales for Michael Kors is expected to be down in the low single digits, primarily driven by an unfavourable currency impact. The company has raised guidance for operating margin to approximately 18.2 per cent. Diluted earnings per share are expected to be in the range of $4.95 to $5.05. The company continues to expect EPS dilution from Jimmy Choo of $0.05 to flat.

For the third quarter of fiscal 2019, the company expects total revenue of approximately $1.46 billion, including approximately $165 million of incremental revenue from Jimmy Choo. The company expects third quarter retail revenue for Michael Kors to grow in the low single digits. Comparable store sales on a reported basis are expected to decline in the low single digits, primarily due to an unfavourable foreign currency impact. The company expects wholesale revenue to decrease in the high single digits, and licensing revenue to decline in the mid-teens. Operating margin is expected to be approximately 20.8 per cent. Diluted earnings per share are expected to be in the range of $1.52 to $1.57, which includes approximately $0.04 to $0.06 of accretion from Jimmy Choo.

Fibre2Fashion News Desk (PC)