Hometech textiles encompass technical components used in furniture, household textiles, and floor coverings. Key products include fibrefill, mattress and pillow components, carpet backing cloth, stuffed toys, and blinds. The Baseline Survey 2020 estimates hometech as having the highest production in this segment—₹13,231 crore ($1.5 billion) in 2019-2020. India's position as the 5th largest exporter of technical textiles and the 2nd largest exporter of hometech textiles, second only to China, underscores the importance of understanding and exploring the hometech textiles sector.

The integration of technical textiles into hometech solutions underscores a growing trend in enhancing living environments with advanced material science, making homes more comfortable, safe, sustainable, and efficient to meet modern lifestyle needs.

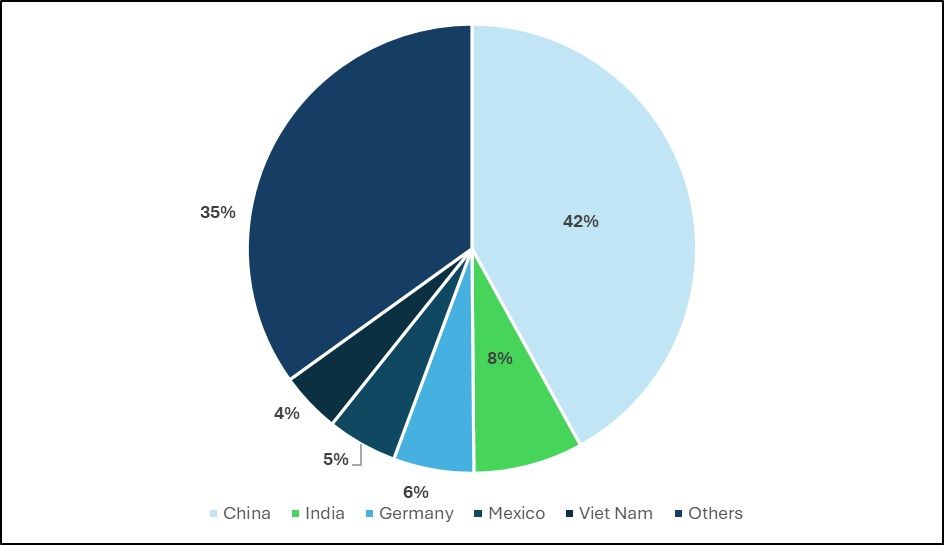

Figure 1: Top 5 hometech exporting countries in CY 2023

Source: ITC TradeMap

The graph above shows the top 5 countries exporting the highest volume of hometech textiles globally. India contributes approximately 8 per cent to global hometech textiles exports, with China leading the market. China's 42 per cent share in hometech textiles can be attributed to the nation's focused policies and enhancements in the manufacturing supply chain for technical textiles. India's prominence as a leader in technical textile manufacturing is driven by its strong production capabilities and commitment to modernisation. However even with notable economic growth, domestic consumption for technical textiles in India remains relatively modest, ranging from 5 to 10 percent. This contrasts sharply with the 30 to 40 percent average seen in developed economies, as reported by Invest India for CY2020.

Other key competitors to India in the Hometech Textiles market include Mexico in North America, Germany in the EU, and its Southeast Asian neighbour, Vietnam.

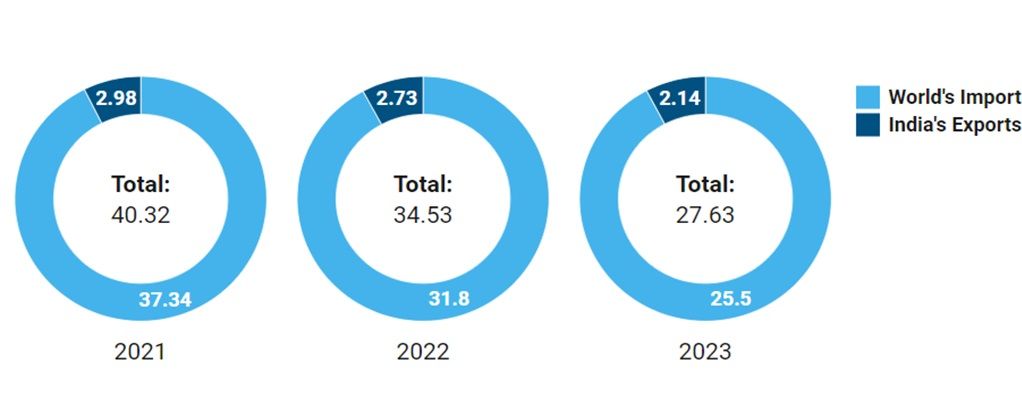

Figure 2: World’s imports and India’s exports of hometech textiles (in $ bn)

Source: ITC TradeMap

Source: ITC TradeMap

Hometech textiles experienced its peak year in CY2021, though India's share slightly decreased to 7 per cent, compared to the consistent 8 per cent it maintained in CY2022 and CY2023. To explore the potential of hometech textiles, F2F analyses both global and Indian markets, highlighting the top hometech products and those that have experienced a significant decline in recent years.

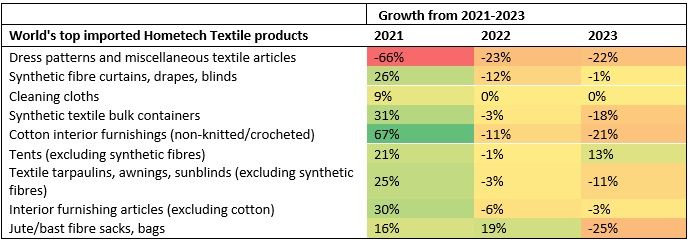

Figure 3: Growth in world's top imported hometech textile products (in %)

In recent years, the hometech textile sector has shown varied performance across different product categories. Tents (excluding synthetic fibres) have demonstrated notable resilience and potential, with a 21 per cent growth in 2021, a slight decline of 1 per cent in 2022, but a recovery with a 13 per cent increase in 2023. This suggests a strong rebound and growing consumer interest in durable, non-synthetic outdoor solutions. Cleaning cloths have maintained stability, with consistent growth of 9 per cent in 2021 and flat performance in the subsequent years, indicating steady demand for these essential items.

Synthetic fibre curtains, drapes, and blinds, although experiencing significant 26 per cent growth in 2021, faced a downturn with a 12 per cent decline in 2022 and a near-flat performance (-1 per cent) in 2023, reflecting potential challenges in this segment. Similarly, synthetic textile bulk containers saw robust growth of 31 per cent in 2021 but struggled with declines of 3 per cent and 18 per cent in the following years, pointing to volatility that could impact prospects. Cotton interior furnishings (non-knitted/crocheted), despite a significant 67 per cent increase in 2021, faced a substantial reduction of 11 per cent in 2022 and a further 21 per cent drop in 2023, highlighting a potential shift in consumer preferences away from cotton-based products.

On the other hand, textile tarpaulins, awnings, and sun blinds (excluding synthetic fibres), despite a strong 25 per cent growth in 2021, saw declines of 3 per cent and 11 per cent in the subsequent years, which may signal fluctuating market demands. Interior furnishing articles (excluding cotton), with an initial growth of 30 per cent in 2021, faced a slowdown with reductions of 6 per cent and 3 per cent in the following years, suggesting a cooling market.

Jute/bast fibre sacks and bags exhibited an initial growth of 16 per cent in 2021 and a further 19 per cent increase in 2022, but a sharp 25 per cent decline in 2023 indicates significant volatility in this segment.

Overall, the data suggests that products like tents and cleaning cloths have demonstrated more consistent performance and resilience globally, potentially offering stable opportunities in the hometech textile market, while others like synthetic fibre products and cotton interior furnishings face more uncertain prospects.

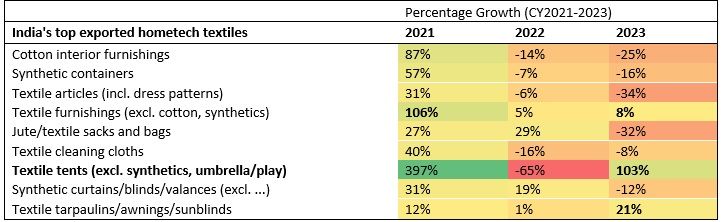

Figure 4: India’s growth over the years CY2021-CY2023 (in %)

Source: ITC TradeMap, Ministry of Textiles

The data above shows the year-on-year growth rate for India’s hometech textile exports from CY2021 to CY2023. Over these three years, India’s export figures for hometech textiles reveal a notable trend. Starting at $2.978 billion in 2021, exports experienced a slight decrease to $2.728 billion in 2022. However, the following year, 2023, saw a further decline to $2.137 billion. Below are the potential identified markets for Indian hometech textiles.

Textile tents (excluding synthetics, umbrellas/play tents): Despite significant fluctuations, the dramatic growth in 2021 and recovery in 2023 indicate strong potential, likely driven by increasing global demand for outdoor and recreational products.

Textile tarpaulins/awnings/sunblinds: Consistent positive growth across all three years suggests steady demand, possibly influenced by construction and outdoor shelter needs.

Synthetic curtains/blinds/valances: Although experiencing some volatility, overall growth indicates ongoing global interest in these home décor items.

India’s product-wise comparison with the world

India demonstrates notable strengths and opportunities in the global hometech textiles market based on its export performance in CY2023. In terms of strengths, India excels in the export of made-up articles of textile materials, including dress patterns, with a significant export value of $15.08 million. This figure underscores India's competitiveness, given global imports of $19.75 million, indicating substantial market presence and potential for further growth.

India also performs well in the export of cleaning cloths, where its export value of $2.46 million closely aligns with global imports of $2.63 million, highlighting strength and stability in this segment.

However, there are clear opportunities for improvement to better cater to global demand. For instance, in the category of articles for interior furnishing, particularly those made of cotton and other textile materials, India exported $0.69 million and $0.37 million, respectively, trailing behind global imports of $0.77 million (cotton) and $0.41 million (other materials). This indicates a need to enhance market share through increased competitiveness and possibly diversification of product offerings.

Similarly, in the segment of tarpaulins, awnings, and sunblinds, India exported $0.34 million compared to global imports of $0.45 million, suggesting room for improvement to capture a larger share of the market. Lastly, in the category of sacks and bags made of jute or other textile bast fibres, India's exports totalled $0.23 million, falling short of global imports amounting to $0.34 million, highlighting the potential benefits of expanding market presence and product diversity to meet global demand effectively.

India’s current scenario in hometech textiles

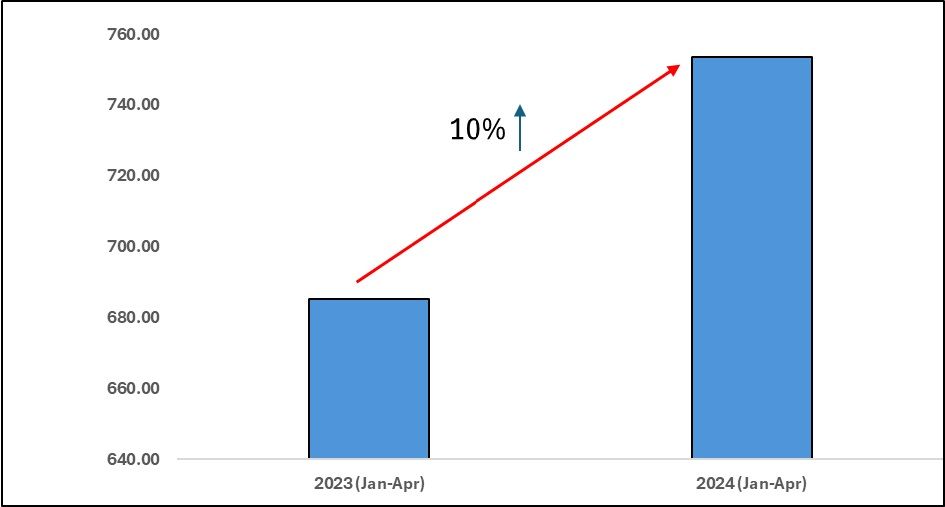

Figure 5: India’s hometech textiles growth from CY2023 to CY2024 (Jan-Apr) (in %)

Source: TexPro

India's exports of hometech textiles reached $753 million from January to April 2024, marking a 10 per cent increase from $685 million during the same period in 2023. This growth is closely linked to the significant increase in the Union Budget allocation for technical textiles. The allocation of ₹175 crore (~$20.90 million) in FY2023-2024 has proven effective, contributing substantially to the 10 per cent rise in hometech textile exports.

Looking ahead, the Union Budget for FY2024-2025 has been significantly increased to approximately ₹375 crore (~$44.79 million), representing a 120 per cent year-on-year boost. This enhanced funding is expected to further strengthen production capabilities and drive continued growth in the export of technical textiles, including hometech textiles, throughout CY2025.

Future Outlook

In India, the policy framework for technical textiles aims to bolster domestic production capabilities and enhance competitiveness in the global market. Policies such as the Production Linked Incentive (PLI) scheme for technical textiles are designed to incentivise investment and promote manufacturing excellence in key areas like medical textiles, agro textiles, and geotextiles. These efforts are geared towards establishing India as a global hub for technical textiles, leveraging its strengths in textile manufacturing to meet both domestic demand and export requirements effectively.

The allocation for the National Technical Textiles Mission increased by 120.59 per cent in 2024-2025 to ₹375 crore (~$44.79 million) from ₹175 crore (~$20.90 million) in 2023-24. With an ambitious target of growing the technical textiles industry to $40 billion, Indian exporters, particularly in the hometech textiles sector, should focus on exporting to institutions with a specific need for hometech textiles. These include offices, businesses, hotels, and high-end residential areas where there is increasing awareness of fire safety regulations.

However, there is a certain mismatch between Indian hometech textiles exports and global demand. The introduction of new tariff lines for technical textiles, effective from October 1, 2024, is expected to significantly benefit the industry by improving classification accuracy and aligning with international standards. This improved classification will streamline customs procedures, reducing delays and administrative burdens associated with trade. By providing clearer data on trade volumes and market trends, it will enable better market analysis and informed decision-making. Aligning Indian hometech textiles with global standards will bolster the competitiveness of Indian technical textiles in international markets and facilitate smoother trade negotiations.

Fibre2Fashion News Desk (NS)