Bangladesh, India, and Vietnam are key textile hubs in Asia facing pressure to adopt sustainable practices across the textile value chain. Despite the push for sustainability, there is a significant policy gap between supplier and consumer countries, raising concerns about the true sustainability of producing countries. Key sustainability components include labour rights, efficient energy use, and recyclable materials. Energy usage varies in the textile industry: fuel is predominant in wet processing, while electricity dominates yarn and spinning. Solar energy, though still under research, shows potential as a major energy source if solar panels become more efficient. Currently, many countries rely on coal-generated electricity, and industrialisation increases energy demand. Thus, it is crucial to consider the GDP growth and manufacturing sector development of these nations.

In 2023, India, Bangladesh, and Vietnam experienced real GDP growth of 7.8 per cent, 6 per cent, and 5 per cent respectively. According to the International Monetary Fund forecasts, India and Vietnam are expected to grow by 6.5 per cent annually until 2029, and Bangladesh by 6.98 per cent. There is a notable link between GDP growth and investments in renewable energy. In 2023, investments in renewable energy contributed 1.25 per cent in India, 1.9 per cent in the EU, and 3 per cent in China. The Asia-Pacific region invested 14 per cent of the total global investments in clean energy. Renewable energy investments are crucial, as energy costs constitute 15-20 per cent of the total costs in the textile industry, according to the Council on Energy, Environment, and Water.

Energy, sustainability and targets

Textile-producing nations in Asia have set targets for sustainable energy usage. India aims to generate around 500 gigawatts (500,000 megawatts) of renewable energy by 2030, according to the Indian Central Electricity Authority. Currently, India relies on coal for about 48 per cent of its energy. Vietnam relies on fossil fuels for 55 per cent of its energy generation, while Bangladesh is highly dependent on natural gas, with 98 per cent of its energy from fossil fuels. Therefore, these countries must increase renewable energy generation. Vietnam has a target of generating 4,000 megawatts of solar energy by the year 2025, whereas Bangladesh aims to generate 2.3 gigawatts of solar energy by 2030.

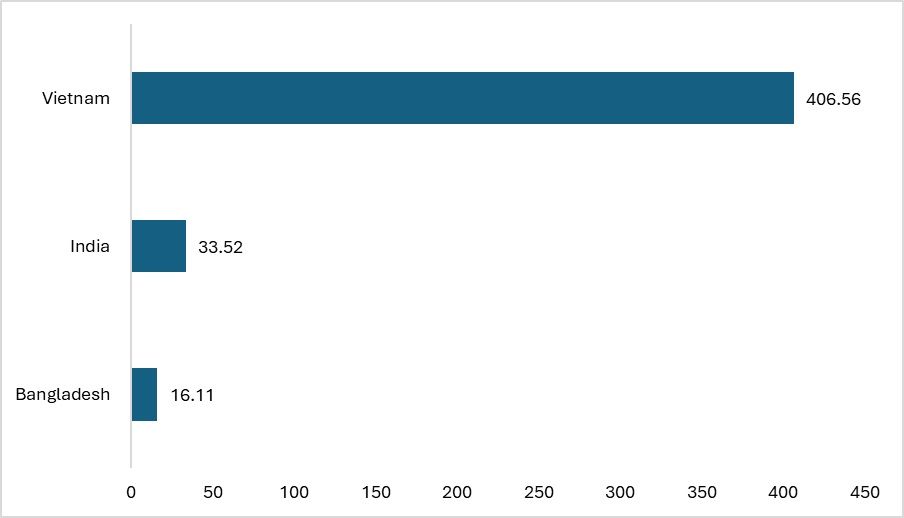

Figure 1: CAGR of solar energy generation (in MW) (2017-2022)

Source: TexPro

The exceptionally high compound annual growth rate (CAGR) of solar energy generation in Vietnam, compared to India and Bangladesh, is largely driven by the demands of international importers for sustainable practices in garment production. This demand has spurred significant investments in solar energy within Vietnam's garment industry, supported by favourable government policies like tax incentives and financing support from the government for the installation of rooftop solar units, and the country's overall push towards renewable energy to meet its growing energy needs sustainably. With many well-known apparel brands like H&M aiming for 100 per cent sustainable energy use by the year 2030, the exponential CAGR of solar energy in Vietnam is justified.

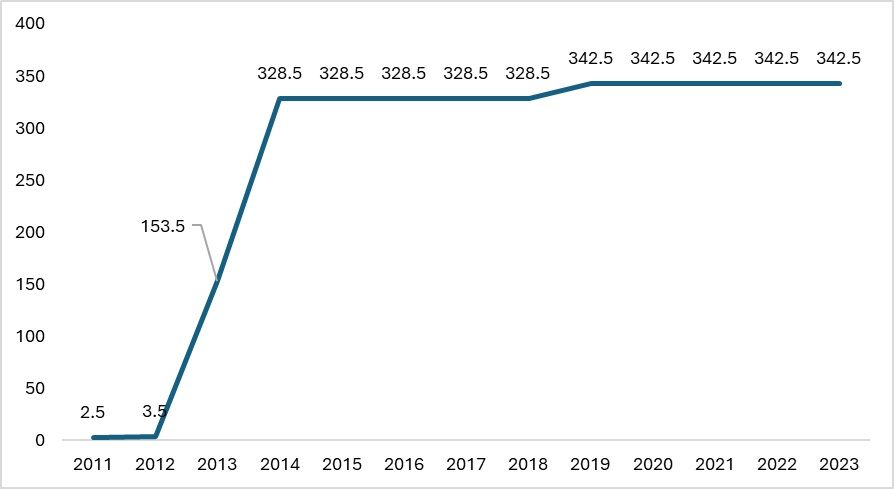

Figure 2: Solar energy generation in India (in MW)

Source: International Renewable Energy Association (IRNEA)

As seen in the case of India, solar energy generation and investment skyrocketed after 2013 and are predicted to reach around 345.2 megawatts (MW) by the year 2027, according to an analysis by Fibre2Fashion. If looked at closely, a positive correlation is found between solar energy generation, the Index of Industrial Production (IIP) of textiles and wearing apparel, and the exports for the Indian textile industry. This means that with the growth in the IIP of these sectors, solar power is going to increase. With the target of 500 gigawatts (GW) of clean energy generation and the current solar power generation of 1.4 gigawatts, the impact on IIP by costs incurred, imports, and exports of the respective industry suggests that reducing energy costs will also enhance the cost efficiency of the industry.

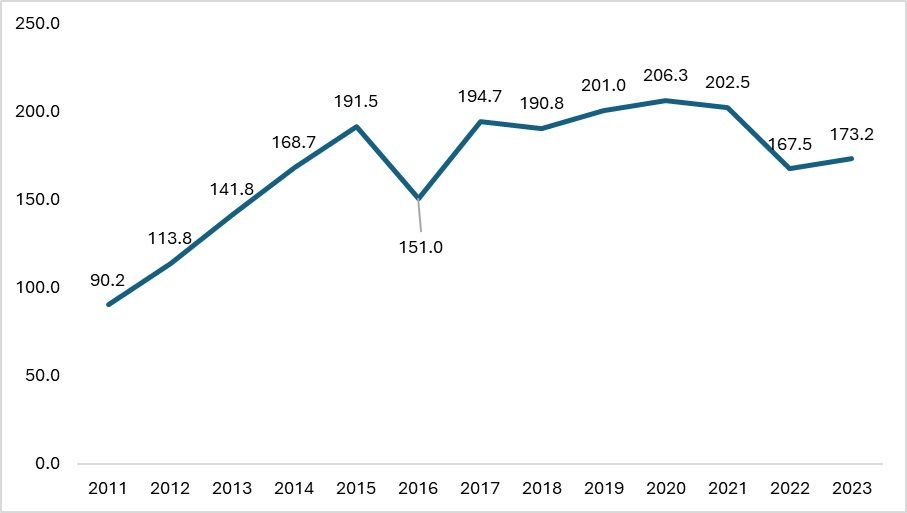

Figure 3: Solar energy generation in Bangladesh (in MW)

Source: International Renewable Energy Association (IRNEA)

According to the International Energy Agency (IEA), Bangladesh's energy imports have surged by 400 per cent, intensifying the impact of energy crises on its textile sector. The industrial sector, including apparel, consumes 26 per cent of the country's energy. The Bangladesh Textile Mills Association (BTMA) reports that the textile industry, reliant on uninterrupted electricity, has historically used gas-powered captive plants, consuming 169.1 billion cubic feet of gas annually to produce 1,700 MW of power. However, these plants face challenges due to dwindling natural gas reserves and recent supply gaps. Frequent power outages in 2022 disrupted apparel production, affecting major brands like Zara and H&M. To address these issues, optimising energy usage and increasing reliance on renewable energy sources are essential. Bangladesh is rapidly adopting solar energy, and data analysis shows a link between GDP growth, increasing exports, and solar power installation. Energy generation in Bangladesh is forecast to increase by an average of 3.5 per cent in the coming months.

Bangladesh also has the highest number of textile factories—around 213—with Leadership in Energy and Environmental Design (LEED) certification. LEED is the world's most widely used green building rating system and provides a framework for healthy, highly efficient, and cost-saving green buildings that offer environmental, social, and governance benefits. Compared to India, which has one major company certified, and Vietnam, which has 93 certifications, this certification makes Bangladesh a preferable destination for textile companies based on performance in energy, water, and waste management.

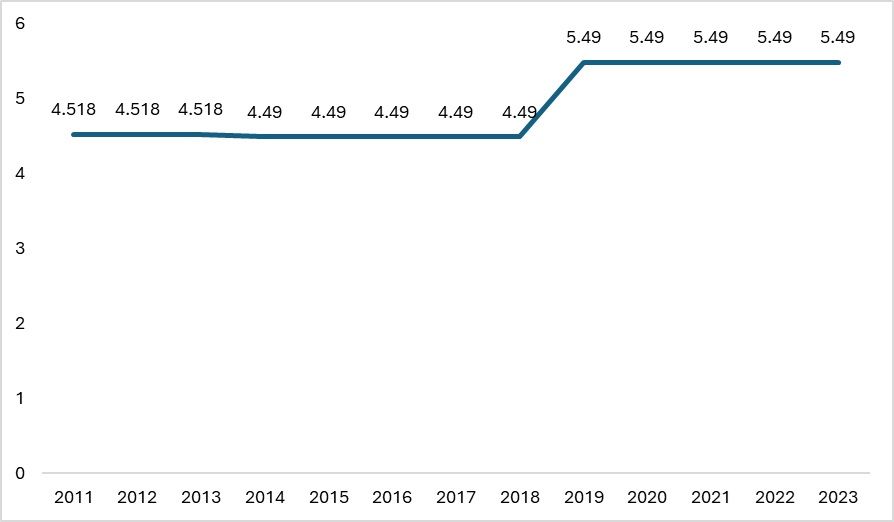

Figure 4: Solar energy generation in Vietnam (in MW)

Source: International Renewable Energy Association (IRNEA)

According to the Asia Natural Gas and Energy Association, Vietnam heavily relies on coal for energy. Solar energy generation in Vietnam has stagnated, yet there is a strong correlation between energy generation and apparel exports. Energy generation is forecast to increase by an average of 1.5 per cent annually until 2029, which could boost exports. Cost-efficient production will support this surge, potentially reaching the $70 billion export target set by VITAS by 2030. Under pressure from importing countries, Vietnam has increased solar power generation, with garment factories increasingly using solar energy to meet demands from markets like the European Union.

Both India and Bangladesh have made significant progress in solar energy generation, with India's vast land and ambitious targets making it a major player in the global market. Both countries stand to gain from reduced reliance on fossil fuels, promoting sustainability, cost savings, and economic growth through solar energy investment.

Factors affecting the effectiveness of textile industry

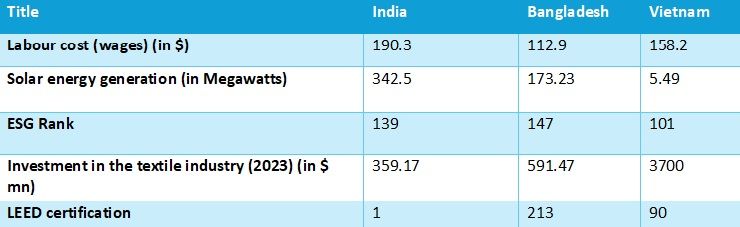

Apart from solar power generation, the effectiveness of the textile industry in different countries is influenced by several other variables. These include wages, Environmental, Social, and Governance (ESG) rank and investments in the textile industry. All these variables are equally important when analysing which countries have an atmosphere suitable for establishing and sustaining a textile industry that adheres to sustainability standards.

Table 1: Textile stats of India, Bangladesh and Vietnam

Source: DPIIT, Bangladesh Bank, Vietnam Textile and Apparel Association (VITAS) & TexPro

In 2023, Bangladesh received $591.47 million FDI for the textile industry, while India and Vietnam also secured significant foreign direct investment (FDI). However, several factor, including acute energy shortages, labour protests, and economic crises in importing regions like the EU, which led to a 50 per cent drop in production affected the Bangladesh textile industry in a negative way. Conversely, India attracted FDI due to its Production Linked Incentive (PLI) schemes and market access programmes. Vietnam benefitted from FDI in the garment sector due to government efforts in green energy investment, attracting investors from Japan, Hong Kong, and other regions.

The question of which country is best for textile investment is complex. Bangladesh has the lowest labour costs and the highest GDP growth projection, suggesting it could attract significant textile investments and FDI. Despite this, Vietnam, with the highest investment and best ESG score, remains a strong contender, particularly from an ESG perspective. In terms of solar energy, India and Bangladesh are comparable, but Bangladesh's LEED certifications and other statistics make it the most attractive destination for setting up textile units, followed by Vietnam.

Bangladesh emerges as the best country for textile investment due to its lowest labour costs and highest projected GDP growth amongst the aforementioned countries, which compensates for its lower ESG rank. The cost-effectiveness combined with robust economic growth prospects makes it a highly attractive option for textile investors. However, if sustainability and ESG factors are prioritised, Vietnam might be preferred due to its superior ESG ranking. India also has its benefits when it comes to the textile industry. With its value chain and a less risky ESG score compared to Bangladesh, along with policies incentivising the generation and use of renewable energy like solar power, India will eventually become the best destination from the perspective of the textile investment industry.

Fibre2Fashion News Desk (KL)