With the new Environment Improvement Programme, the United Kingdom (UK) has identified seven sectors—including textiles—which can be harmful to environmental stability. The UK's textile industry is one of the most instrumental links in the recycling chain. However, this very link is on the verge of collapse due to the lack of infrastructure required for recycling textiles.

How severe is the UK's textile waste issue?

With various countries in the European Union (EU) implementing laws to ensure the circular life of apparel, the UK has also enacted laws to imbibe circularity in its textile industries. Similar to the EU, the UK faces a problem of lacking the infrastructure to recycle apparel within the nation's borders, which forces the country to export a significant amount of disposed apparel as used apparel to African nations, thereby destabilising their environment.

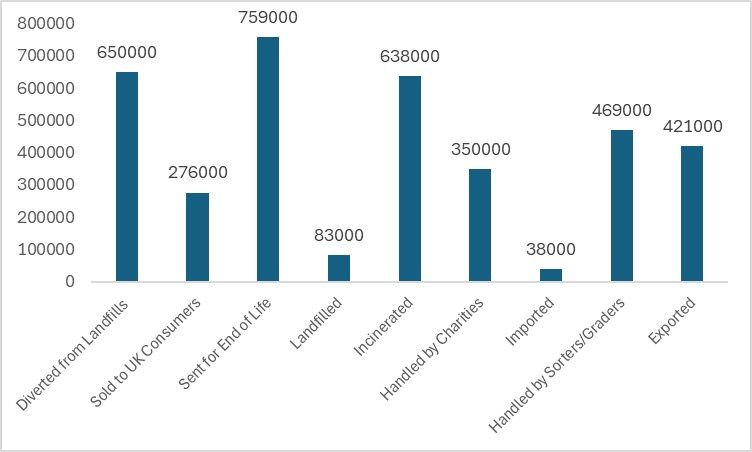

According to the Government of the United Kingdom, 60 per cent of UK households have dumped unwanted clothing, out of which 30 per cent goes to landfills. According to the UK organisation The Waste and Resources Action Programme (WRAP), an estimated 83,000 tonnes of textile waste went to landfills in 2022, and a much higher amount is incinerated in the UK.

Figure 1: Quantification (tonnes) of post-consumer textiles at different stages and routes in UK in 2022

Source: WRAP Report on UK used textiles, 2024

Further, a significant amount of clothing is handled by recyclers or graders or is exported. The main destinations for exporting used clothes are countries like the UAE and Pakistan, but these nations’ measures to reduce textile waste are also adversely affecting the UK’s used clothing and recycling industry. Countries in Africa and Asia are now considering charging higher tariffs for the import of used clothes from the UK, which could potentially hamper how the UK manages its post-consumer textile waste.

Higher tariffs for the imports of used clothing

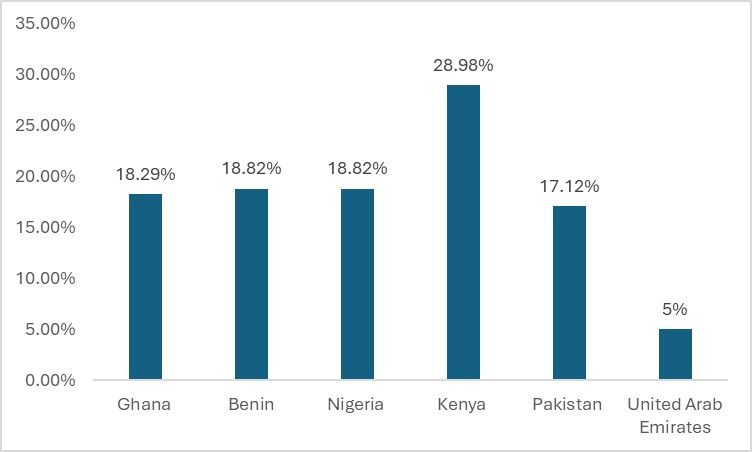

The UK primarily relies on the export of used clothing as one method for disposing of textile waste generated by households. It mainly exports used clothing to countries in Africa, as well as to Asian countries like Pakistan and to the Middle East, such as the United Arab Emirates. Recently, all African countries, including Kenya—a preferred destination for used clothing exports from both the US and the UK—have imposed higher taxes on the imports of used clothing. Kenya has now imposed a tariff as high as 28.8 per cent to reduce the imports of used clothing.

Figure 2: Tariffs on used clothing imports from UK (in %)

Source: ITC Trademap

Even though the UK exports used clothing to EU nations like Lithuania, the recently proposed EU ban on the exports and imports of used clothing will further jeopardise the UK textile waste industry as a whole. Several EU countries including France, Denmark, Sweden, Finland, and Austria have proposed the ban, citing environmental concerns in the importing nations. More than 11 per cent of the UK's textile waste is exported to African and Asian destinations. Without proper recycling methods in the nation, the current regulations and underlying conditions could lead to a total collapse of textile recycling.

What will happen in the current scenario

With the proposed EU ban on the trade of used clothing and higher taxation in African countries, the employment in the UK's sorting systems will be affected. Of the household textile waste that is collected, 45 per cent comes from door-to-door collection, followed by 32 per cent through charity donations. The ban and higher taxation in the importing nations will result not only in uncertainty in the jobs within the sorting sector but also in another crisis: an increase in the amount of used clothes sent to landfills or incinerated.

Figure 3: Destination of disposed of clothing in UK in 2022 (in %)

Source: WRAP Report 2024

As per the estimated figures for 2022, almost 17 per cent of clothing in the UK was incinerated, followed by exports to other nations. Although 20 per cent of post-consumer waste is sent to end-of-life processing, the capacities are highly limited compared to the waste generated in the country. Without proper investments in the recycling part of the chain, there could be a greater impact on the sorting and grading sections of the chain.

Although there is no specific number for the total job losses predicted, according to the Textile Recycling Association UK, one in twenty-five jobs will be directly under threat if recycling capacities are not expanded, and bans are fully implemented.

Will sorters face the consequences of the lack of recycling capacities?

The Association in the UK has already indicated the overutilisation of recycling facilities in the country, which might lead to a potential halt in textile collection services. As of today, there are approximately 50 firms in the country involved in various types of sorting. Compared to those, there are only around 14 recycling firms active in the UK as of 2024.

Figure 4: Number of sorting and recycling firms in the UK

Source: WRAP Report 2024

Almost all the firms involved in recycling in the UK recycle post-industrial textile waste, and only a few accept entire garments. The maximum capacity they can handle, according to the WRAP database of sorters and recyclers, averages around 5,000 tonnes per annum, which is significantly less than the actual waste generated in the UK over the whole year. With households generating most of the clothing waste, a lack of these capacities will result in a screeching halt to textile recycling initiatives in the UK, with sorters and graders being the most affected.

The problem may seem minor, but in reality, the vast difference between the number of sorting and recycling firms means that in the coming period, there will be a lesser intake of clothing items due to no expansion in the capacity of the recycling firms in the UK. This will lead to a much more multi-faceted problem for the UK's textile industry.

Can EPR help?

The European Union has mandated the Extended Producer Responsibility (EPR) Act, whereby producers must take full responsibility for their apparel until the end of its lifecycle by 2025. With the UK increasingly exporting textile waste to the EU year after year, aligning policies with the EU will help protect the UK from potential shocks that could disrupt the entire sorting and recycling chain. The implementation of the EPR will offer multiple benefits to the UK. With EPR in place, firms will have to either establish new recycling capacities within the country or invest in existing facilities for expansion. Moreover, EPR implementation will lead to potential greenfield or brownfield investments in recycling, which may prevent the collapse of the recycling and sorting sector. However, some variables, such as the cost to firms and the actual impact of such policies, have yet to be evaluated; thus, the UK must proceed carefully with the next steps.

Fibre2Fashion News Desk (KL)