Among all the stocks traded in the stock market, textile stocks are a category that is highly influenced by nearly all economic conditions in the country—from interest rates and fluctuations in consumer confidence to the prices of raw materials such as cotton yarn and raw cotton, as well as changes in geopolitical situations, all of which can impact stock prices. However, a clearer picture emerges when we look at some of the relevant statistics. This analysis will examine Indian textile companies across the value chain—from yarn manufacturers to fabric producers, apparel makers, and export manufacturers.

Market Capitalisation

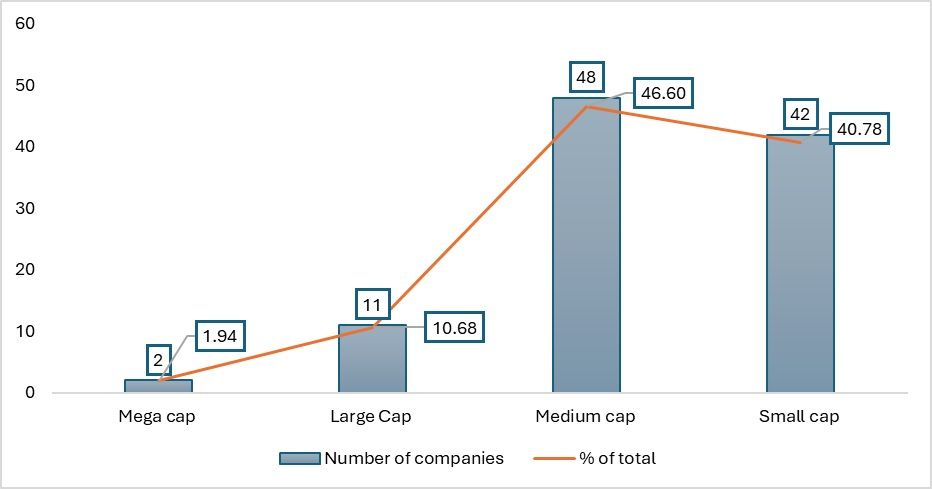

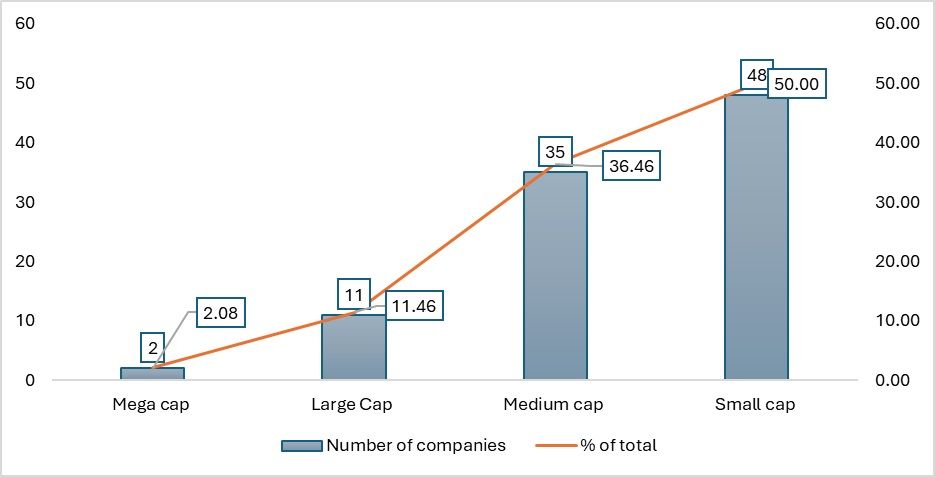

When examining the distribution of textile companies in the stock market according to their market capitalisation on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), most of the stocks are concentrated in the mid-cap and small-cap segments. This reflects the current stage of development that textile companies are at within the country. Market capitalisation is calculated by multiplying the total outstanding shares by the current stock price. Small-cap stocks have a market capitalisation of up to ₹500 crore, mid-cap stocks range from ₹500 crore to ₹7,000 crore, large-cap stocks range from ₹7,000 crore to ₹20,000 crore, and mega-cap stocks exceed ₹20,000 crore.

The latest data shows that approximately 87 per cent of companies in both indices, and most textile stocks, fall within the mid- to higher-risk category. Additionally, their dividend yields are generally higher compared to those of large-cap stocks.

Graph 1: Stocks according to market cap in BSE (in number and %)

Source: BSE

The current composition of companies in both stock markets suggests that many are either in their early stages or positioned for long-term growth. However, when considering the weight of sectoral indices, the textile sector barely registers, with its weight being well below 1 per cent. In the BSE, the sectoral weight is similarly insignificant. Even in the midcap index, the textile sector holds the lowest weight at just 1.59 per cent. This is surprising, given that the textile industry is the second-largest employer in the country after agriculture. A similar trend is observed in the agricultural sector, despite it being the largest employer and a key contributor to GDP and total manufacturing output.

Considering the relationship between market capitalisation and its influence on stock indices, it is important to note that market capitalisation determines the level of influence a stock has within an index. However, based on data from both the NSE and BSE, none of the textile companies hold significant weight in these indices.

Graph 2: Stocks according to market cap in NSE (number and %)

Source: NSE

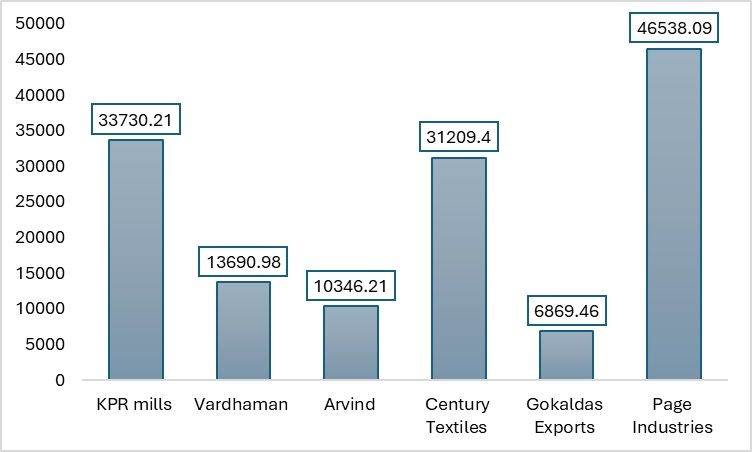

Comparison of major textile companies

It is essential to analyse some of the leading textile companies, considering the basic overview of the sector. Among the companies examined, Page Industries, Gokaldas Exports, and KPR Mills have the highest market capitalisation within the textile sector. Of these, only the first two are classified under the mega-cap group.

If one must analyse the market capitalisation of these companies, analysing the stock prices also becomes evident. Being some of the largest companies by revenue, the price-to-earnings ratio of these companies is more or less stable when analysed from n month’s perspective.

In addition to market capitalisation, analysing the stock prices of these companies is also important. As some of the largest companies by revenue, their price-to-earnings (P/E) ratios remain relatively stable when viewed over a period of several months.

Graph 3: Market capitalisation of selected textile companies (in ₹ cr)

Source: NSE

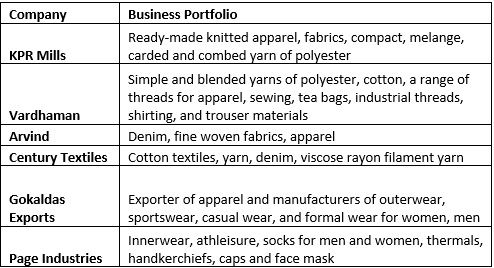

Table 1: Business portfolio of some major companies

Source: Screener, Annual reports of the companies

In the analysis of the selected companies, Vardhaman and Century Textiles are primarily focused on manufacturing intermediary materials, while Page Industries specialises in apparel production. Companies like Arvind, KPR Mills, and Gokaldas Exports have diversified their operations across the entire value chain. Notably, firms such as Vardhaman and KPR Mills are vertically integrated, while others depend on imported raw materials such as yarn and fabric.

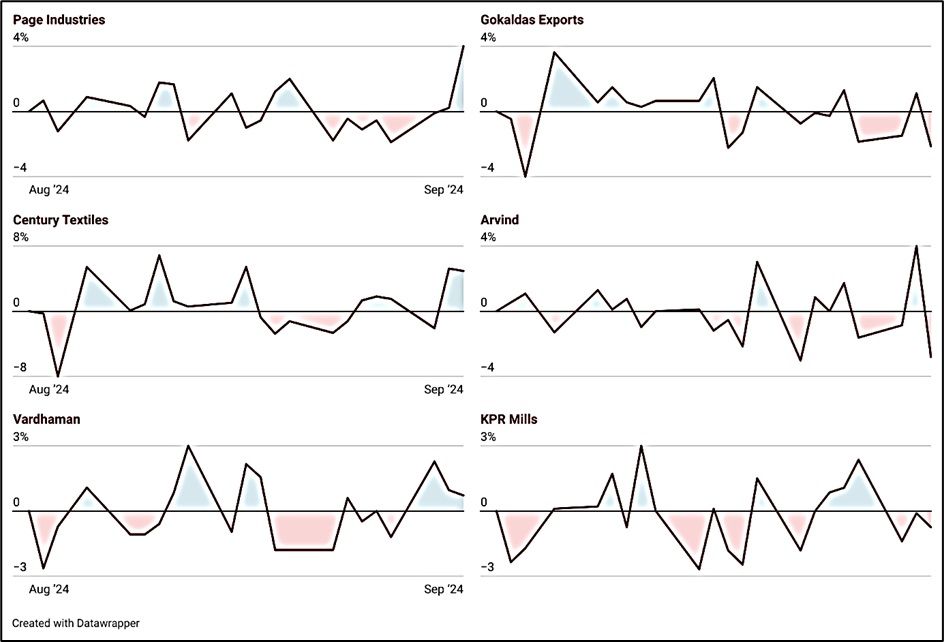

Graph 4: Changes in share prices of selected textile companies (in %)

Source: NSE, F2F analysis

When analysing the price growth of these companies' stocks—an essential factor in the calculation of market capitalisation—the per cent change in stock prices is something worth noting. Upon closer inspection, it becomes evident that the stock prices of these firms tend to rise and fall within the same periods. Additionally, companies that manufacture apparel, yarns, and fabrics exhibit similar movements in their share prices.

Table 2: Stock variable comparison

Source: NSE and Screener

High-growth potential

Undervalued with potential

Riskier choices

Asset-rich plays

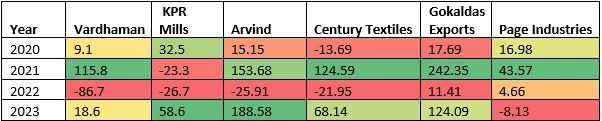

Table 3: Yearly returns on some major textile stocks (in %)

Source: NSE, F2F analysis

KPR Mills and Arvind have shown the most significant gains over the years, especially in 2021 and 2023, with KPR Mills demonstrating consistent growth. Gokaldas Exports delivered impressive returns in 2021 and 2023, reflecting its strong recovery in post-pandemic conditions. Arvind and Gokaldas Exports were highly volatile, with large gains and equally significant losses across different years. Observing the years 2021 to 2023, there is overall growth in all five companies, except a few. This growth can be attributed to the post-pandemic recovery in 2021 and the post-war recovery in 2023.

However, with companies like Arvind investing more into their operations, there are higher expectations for the stock to gain in the long term, potentially increasing demand for the stock. It is also important to consider the operating profits and profit after tax, which are declining for the company. Looking at the operating profits, Arvind, Vardhaman, and Century Textiles have experienced a decline, which can significantly affect investor confidence. In addition, net profit and sales also influence investor decisions. This highlights a crucial issue: textile companies need to undergo major structural changes to ensure operating profits increase over time. Currently, Vardhaman, KPR Mills, and Century Textiles have managed to maintain their operating profits, though with a slight slowdown.

Based on the stock returns, the following is what can be derived

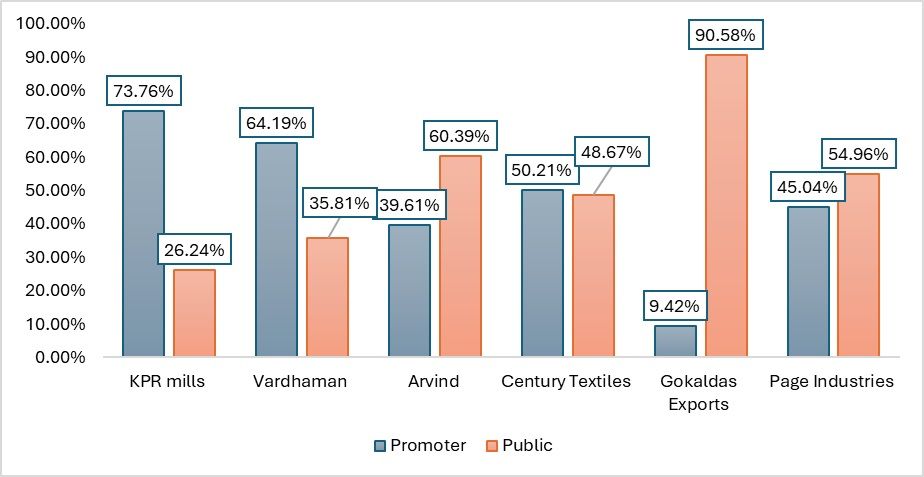

Graph 5: Shareholding of major textile companies (in %)

Source: NSE

All the firms have seen relatively stable shareholding patterns, though some companies have experienced notable shifts. While the shareholding patterns of KPR Mills, Century Textiles, and Page Industries remained unchanged, there were significant changes in the shareholding patterns of Vardhaman, Gokaldas Exports, and Arvind. In Gokaldas Exports, public shareholding stands at 90.50 per cent, the highest among the companies. Vardhaman, on the other hand, is reducing its promoter shareholding, while public shareholding is increasing.

When examining the shareholding patterns, KPR Mills, Century Textiles, and Vardhaman appear to have a more balanced structure. In contrast, other companies have a less balanced pattern, where the promoter's share is lower than the typical allowance. In textile companies, there is considerable psychological significance attached to promoter shareholding. A higher promoter shareholding often signals a positive outlook from shareholders regarding the company's prospects. The higher the promoter's shareholding percentage, the greater the demand for the company's stock in the market.

Therefore, when considering company preferences based on shareholding patterns, the important factors include:

Key takeaways

For the last week ending September 13, 2024, all the top gainers were in the mid-cap and small-cap range; however, the volume at which these stocks were traded remained much lower compared to other stocks on the bourses. In the textile sector, companies need to ensure the consistent maintenance of key ratios, as these are critical indicators for investors deciding whether to purchase a stock.

However, the most important factor is the contribution of textile companies to the stock market. The relatively minor weight given to textile stocks highlights the need for these companies to expand their operations and improve efficiency. While the weight assigned to textile companies in the index is based on stock price changes and market capitalisation, being the second-largest employer in the country, and with various schemes in place to uplift the sector, the performance and quarterly results of these companies suggest a pressing need for diversification and timely structural changes.

Despite these challenges, the textile sector remains lucrative, with many mid-cap and large-cap stocks offering significant gains to investors. As a sector heavily reliant on various economic factors—such as consumer confidence, interest rates, trade duty structures, and GST policies—textile companies need to implement timely changes and fully leverage India’s growth story. The stock market operates largely on psychological factors and investor expectations, in addition to technical indicators. Therefore, it is crucial for companies, in collaboration with the government, to enact positive changes that boost investor confidence, encouraging more investment in textile stocks.

Fibre2Fashion News Desk (KL)