A massive cargo ship recently struck the Francis Scott Key Bridge in Baltimore causing it to collapse in the river below. While the collapse is not expected to directly affect the textile trade, it does exemplify the interconnectedness of the supply chain and its potential impact on various components. Although it's challenging to immediately ascertain the full effects of the Baltimore collapse on the supply chain, a brief analysis might shed light on the implications of this current disruption.

The repercussions

The bridge collapsed at 1:12 am on March 26, 2024, leading to significant disruptions, affecting both the port and creating a bottleneck for the logistics industry, which relied on the bridge for transporting imported goods into the cities. This incident highlights a critical issue for supply chains: the impact of sudden disruptions on dependent industries. Furthermore, the collapse has disrupted operations at the Port of Baltimore, a key player in the US trade and supply chain landscape.

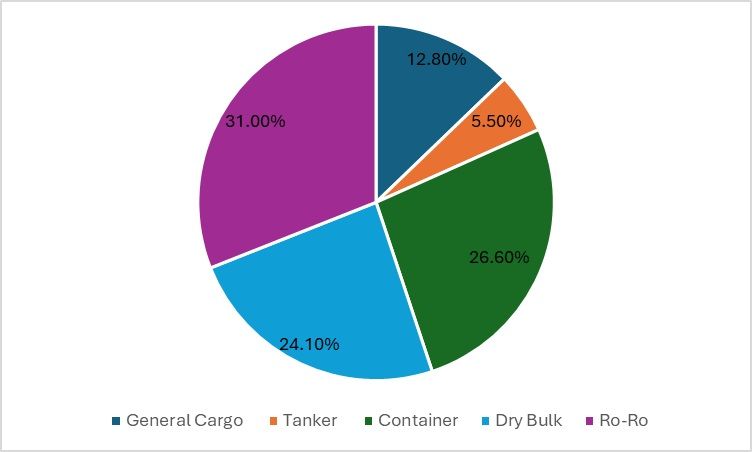

Figure 1: Vessel composition at Baltimore port (in %)

Source: IMF Portwatch

Examining the total composition of the vessels visiting the Baltimore port reveals that the majority are ro-ro (roll on–roll off) vessels, followed by containers and dry-bulk vessels. The sudden disruption at Baltimore is likely to impact the automobile industry first, along with other interconnected sectors. Although the manufacturing sector has not yet been affected, the supply chains are expected to face significant challenges in the short term.

Data from the IMF Portwatch simulator indicate that any disruption in port operations can have a considerable impact on both consumption and manufacturing in the relevant industry. With the disruption at the port, transportation is extensively affected, influencing the timing of final deliveries and impacting the stocking and inventory levels of retailers in the affected regions.

Moreover, this situation highlights the vulnerability of global supply chains to various disruptions, including geopolitical tensions, natural disasters, and unforeseen events like the bridge collapse.

Impact on domestic manufacturing and consumption

The Baltimore port handles large-scale imports and exports, including automobiles and coal, as well as energy, manufacturing machinery, and food and beverages. While the textile trade occurs at a lower volume through the port, it still poses certain risks to the manufacturing sectors of specific countries, such as those in the CAFTA-DR region. With the stabilisation of the economic scenario in the US, trade is expected to increase. Nonetheless, the current disruption is likely to affect the entire value chain in the US.

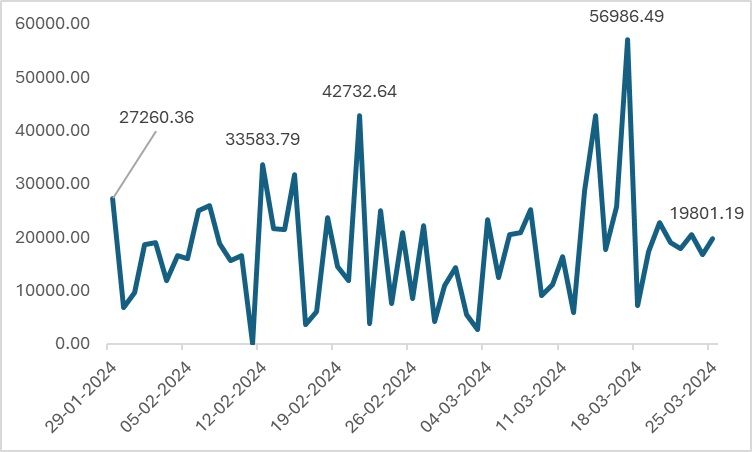

Figure 2: Import volumes at Baltimore Port (in metric tons)

Source: IMF Portwatch

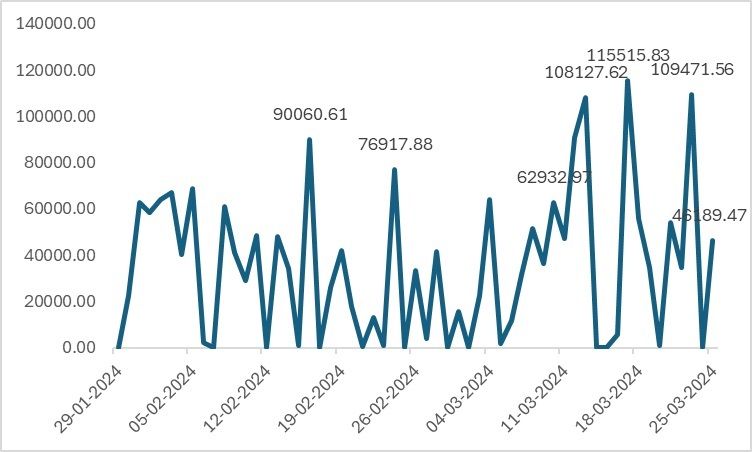

Figure 3: Export volumes from Baltimore Port (in metric tons)

Source: IMF Portwatch

Over a period of two months, Baltimore's imports fluctuated significantly, ranging from 30,000 metric tonnes to 19,000 metric tonnes in terms of volume. The Port of Baltimore has crucial upstream and downstream connections, and the disruption could potentially impact several major ports.

Impact on consumption and industrial output

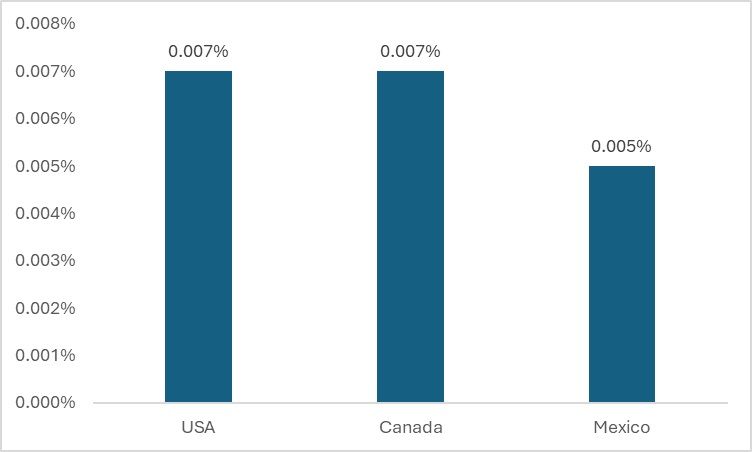

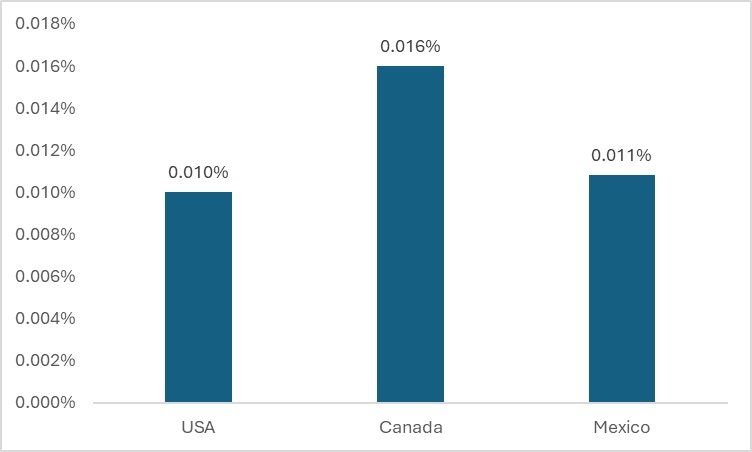

The current disruption might have minimal effects on consumption and industrial output. To illustrate, consider the NAFTA countries. For instance, a week's disruption in Baltimore could jeopardise 0.007 per cent of the total US industrial output, reflecting the risk to production due to interrupted supplies of intermediate goods. The following breakdown illustrates the affected sectors: In Canada, the US, and Mexico, the textile manufacturing sector might experience impacts of 1.02 per cent, 2.43 per cent, and 2.25 per cent, respectively.

Figure 4: Industrial output affected due to disruption at Baltimore (in %)

Source: IMF Portwatch

The impact on consumption mirrors that on industrial output. Delays in imports or transportation can affect final consumption, not necessarily through immediate price changes, but due to inventory shortages at retail points, contingent upon demand. Specifically, textile and apparel sectors in Canada and Mexico may see a modest short-term reduction of 0.99 per cent and 0.42 per cent, respectively. However, the full impact of the supply chain disruption on final consumption will vary, influenced by several factors within the supply chain, such as retail and logistics. With a critical segment of the chain disrupted, prolonged delays could escalate cost disadvantages throughout the supply chain.

Figure 5: Effect on total consumption due to disruption at Baltimore (in %)

Source: IMF Portwatch

Road ahead

The collapse of the Baltimore Bridge represents a significant negative externality for the Port of Baltimore, with potential ripple effects on the supply chain, manufacturing, and consumption sectors. In the short term, this event could constrict the supply chain, resulting in delays in delivering goods to their intended destinations.

Fibre2Fashion News Desk (KL)