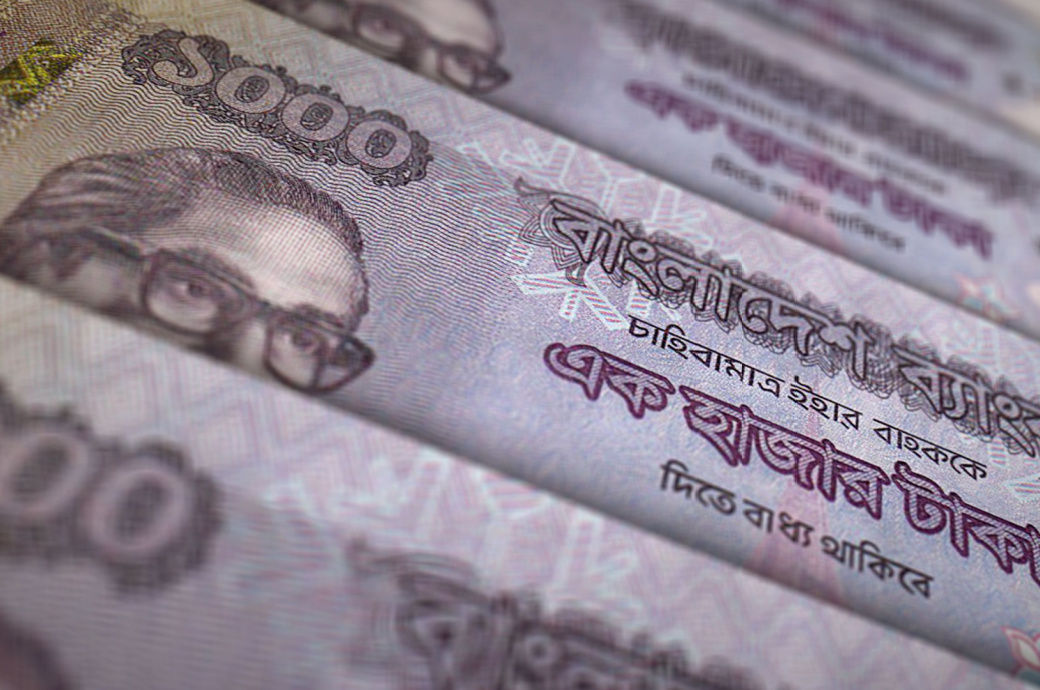

The Bangladesh Bank’s selling rate for US dollar reportedly rose to Tk 100 for the first time recently as it sold $78 million to banks to help settle import payments. The central bank has injected nearly $7.50 billion into the market till now since the current fiscal began in July last year to facilitate import bill clearance by the government and businesses.Several banks, however, do not have enough dollars to open letters of credit (LCs) for small importers, a domestic newspaper reported.

Higher import payments against slower-than-expected export earnings and remittance inflow during the last year resulted in the taka-USD exchange rate witnessing acute pressure.

The Bangladesh Bank's selling rate for US dollar reportedly rose to Tk 100 for the first time recently as it sold $78 million to banks to help settle import payments. The central bank has injected nearly $7.50 billion into the market till now since the current fiscal began in July last year to facilitate import bill clearance by the government and businesses#

So the central bank devalued its selling rate of the greenback several times last year, causing the country's foreign exchange reserves to sink from $44.4 billion a year ago to $33.7 on January 3.

Fibre2Fashion News Desk (DS)