India and the EU are in the ninth round of Free Trade Agreement (FTA) negotiations, with numerous disagreements yet to be resolved. India is keen to secure better terms for the entry of its textile goods into the EU, as these currently face higher tariffs, putting Indian textile products at a significant disadvantage compared to those from Bangladesh and China. Turkiye is another major competitor for textile exports to the EU. India’s current negotiations also focus on the recent Carbon Border Adjustment Mechanism (CBAM) and other sustainability laws, which may result in products from countries like India being subjected to higher taxes.

Textile exports disappoint in the India-EU trade

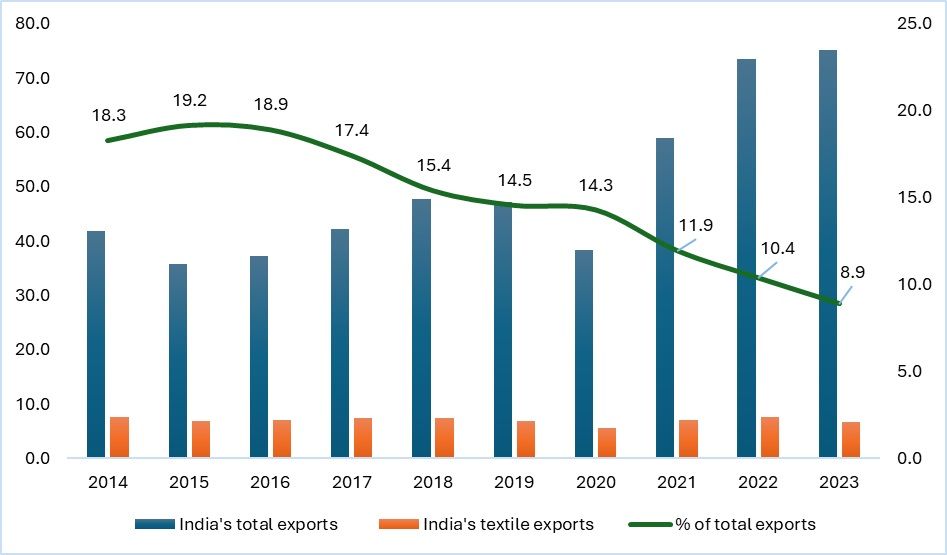

Despite the government's active promotion of textile exports to the EU, the sector's share of India’s total exports to the region has been steadily declining. In 2014, textiles made up a significant 18.3 per cent of India’s exports to the EU. However, by 2023, this figure had dropped to just 8.9 per cent. Projections suggest that this downward trend will continue, with the share expected to fall to 7 per cent by the end of 2024, and further decrease to 6.5 per cent by 2025. Since 2022, textile exports have been declining by over 1 per cent annually, a trend likely to persist unless major structural changes or FTAs are implemented to reverse it.

Exhibit 1: India’s textile exports as a share of the total exports (in %)

Source: ITC trade map

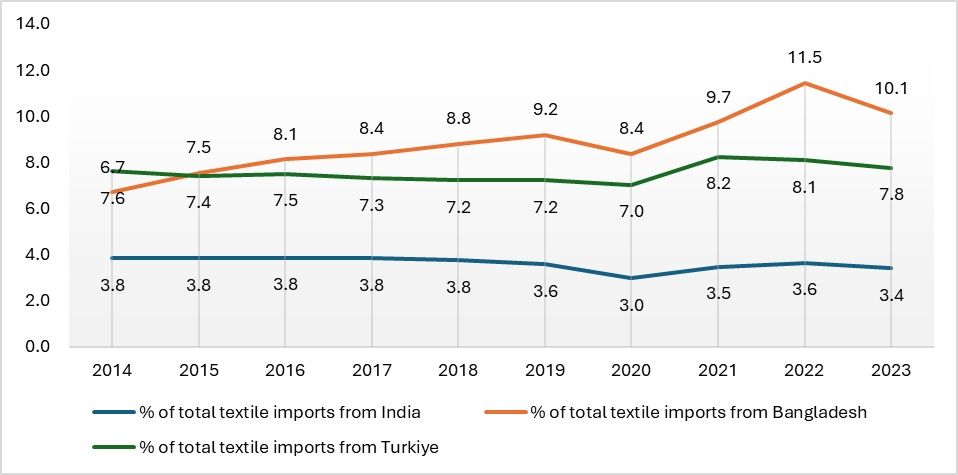

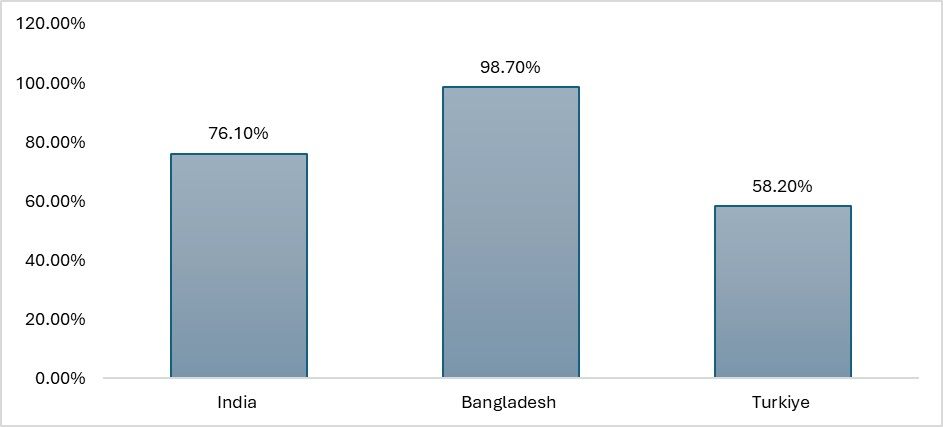

A similar trend is evident within the EU itself. The share of Indian textile products in the EU's total textile imports is significantly lower compared to that of other countries. In 2023, India’s share was just 3.4 per cent, the lowest among major exporters. In contrast, Bangladesh and Turkiye hold a considerably larger portion of the EU’s textile imports, reflecting stronger trade relations with these nations.

Exhibit 2: Country-wise share of EU’s textile imports (in %)

Source: ITC Trademap

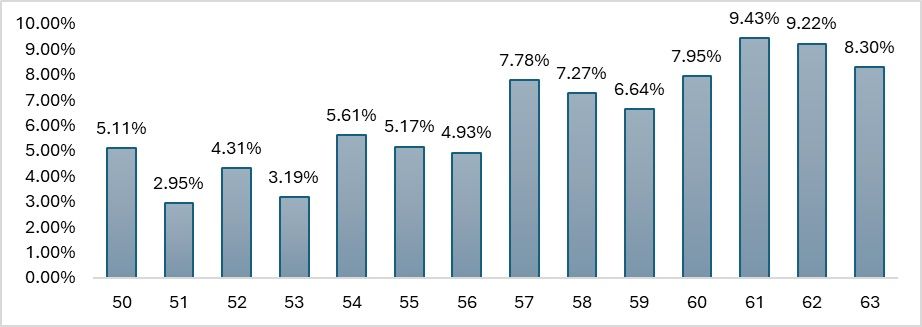

Tariff disadvantage

In addition to the declining share of Indian textile products in the EU, India faces another challenge in the form of an inverted duty structure applied to its exports. Finished products, such as apparel, fabrics, and home textiles, attract higher tariffs compared to raw materials and intermediary goods like yarn, raw cotton, and silk. As a result, Indian textile exports to the EU struggle to compete with those from Bangladesh and Turkiye, which enjoy zero-duty access for their textile products. This puts Indian exporters at a significant disadvantage in the EU market.

Exhibit 3: Duties applicable to the Indian textile products according to the HSN codes (in %)

Source: ITC trade map market access map

Turkiye benefits from zero-duty access to the EU market due to its participation in the EU Customs Union, while Bangladesh enjoys preferential treatment under the Generalised System of Preferences (GSP) due to its status as a least developed country. In contrast, India, being a developing nation and having yet to secure a trade agreement with the EU, faces relatively higher tariffs on its textile exports. This increases the cost of Indian products, reducing their competitiveness in the EU, which is one of the largest textile consumer markets in the world.

Given this scenario, the current negotiations are even more critical, as the EU is set to implement the Carbon Border Adjustment Mechanism (CBAM) in January 2026. This could potentially raise tariffs on certain products by as much as 20 to 25 per cent. Therefore, India must formulate a strategy and negotiate with the EU to mitigate the impact of these policies and seek relief for its textile exports.

CBAM’s impact on India

The CBAM is an EU strategy designed to align the carbon cost of imports with that of domestically produced goods. Under the CBAM rules, importers are required to reduce emissions associated with their imports and submit multiple certificates. This process could significantly raise the cost of imports from countries with higher carbon emissions during production.

Although the CBAM primarily targets sectors like cement, fertilisers, electricity, hydrogen, and steel, EU importers are also required to report both direct and indirect emissions associated with imported products. This could indirectly affect other industries, including textiles, depending on the carbon footprint of their production processes.

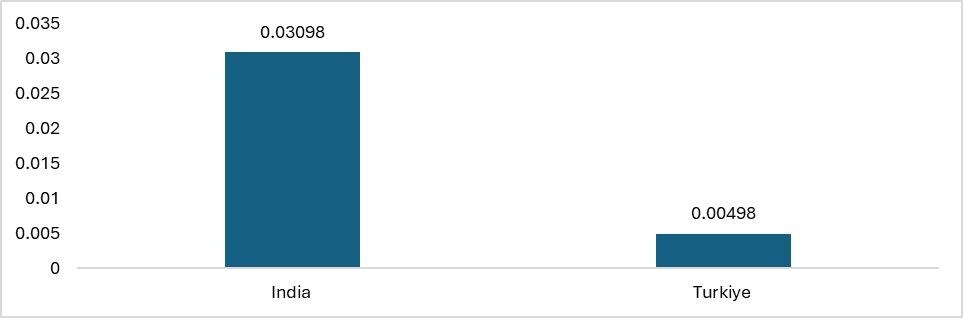

Exhibit 4: The relative aggregate CBAM exposure index

Source: World Bank

According to the World Bank’s CBAM exposure index, India’s competitiveness will be affected after the implementation of the policy, as producers will have to pay extra for manufacturing products when exporting them to the EU. Although the textile sector is not currently included in the CBAM, it will eventually be covered by the act, which could result in both importers and manufacturers bearing the additional costs of obtaining certificates required for every 1,000 tonnes of CO2 generated. Consequently, countries like India, and others with more lenient climate change policies, will face significantly higher costs for obtaining certificates for CO2 emissions. Therefore, India is negotiating with the EU to secure further reductions on the tariffs applicable to textile products.

Exhibit 5: Use of fossil fuels for energy generation (in %)

Source: TexPro

Given that electricity is included in the first tranche of the CBAM, the generation of electricity using renewable energy sources will become crucial for countries. Since most countries still rely heavily on fossil fuels, it will be imperative for them to transition to renewable energy sources.

India has already implemented the Sustainable Textile Policy 2023-2028, which focuses on the adoption of cleaner technology, reducing emissions and waste, and incorporating circularity into the value chain. The country is also working to make manufacturing processes in small and medium-sized units more sustainable. However, this transition will take considerable time due to the fragmented nature of the industry. This underscores the importance of bringing the EU’s CBAM policy to the negotiating table for the FTA, along with the reduction of tariffs on textile products.

There is a strong possibility that textiles will be included in the second tranche of the CBAM, given the sector’s significant global emissions. If the sector is included, circularity and labour norms will become central issues, along with the Zero Liquid Discharge Policy (ZLD). In addition to CBAM, textiles are already part of the EU’s Green Deal and the ‘Fit for 55’ Package, which aims to reduce carbon emissions in the EU by 55 per cent. As a result, these existing regulations, combined with CBAM, could have serious repercussions for the textile industries in India, Bangladesh, and other countries. Therefore, India must negotiate for duty-free entry of textile products into the EU.

Road ahead

The CBAM is one of the EU’s most ambitious plans to eliminate carbon emissions from the bloc. However, there is a significant policy gap between countries that implement such policies and those that do not. Most textile-producing countries have not yet actively implemented similar policies, and the CBAM could push them to introduce regulations that might initiate a virtuous cycle of sustainability and emissions reduction.

When negotiating an FTA, significant differences can arise when both parties do not have similar policies. While the EU seeks access to India’s vast market, home to 1.4 billion people, India risks being a major loser if the terms of trade are not favourable. India, which produces both sophisticated technological goods and highly labour-intensive goods like textiles, faces high tariffs when exporting to the EU. These tariffs make Indian exports less competitive compared to those from other countries. With the introduction of new EU policies focused on sustainability in 2025 and 2026, India could incur substantial costs, further reducing the competitiveness of its textile exports.

As a result, India must address the impact of the CBAM, the Green Deal, and other sustainability policies during FTA negotiations. Even if India succeeds in negotiating duty-free entry for its textile products into the EU, the CBAM and Green Deal policies could neutralise the benefits of tariff reductions. Therefore, while sustainability and green initiatives are vital, it is also crucial to ensure that India’s textile exports remain competitive to benefit the country and the businesses involved in exports.

India, therefore, must focus on securing favourable terms through the FTA. Currently, the utilisation rate of India’s FTAs is as low as 25 per cent, compared to other nations that have rates exceeding 40 per cent. Hence, it is critical to ensure that any negotiated FTAs align with the broader economic benefits that India seeks from these agreements.

Fibre2Fashion News Desk (KL)