The global cotton yarn market plays a crucial role in the textile and apparel industries, with the 60/1 combed cotton yarn variety particularly notable for its application in high-quality home textiles, including bedsheets, towels, and clothing. Known for its smooth texture and comfort, this yarn is especially favoured in products where fabric feel is a priority, making it a key material in both home textiles and apparel. Major exporters, such as China and India, dominate the production of home textiles and cotton apparel, further emphasising the importance of tracking cotton yarn prices.

Given the wide range of uses for cotton yarn, from baby clothes to towels, the demand for this versatile material continues to grow. The global cotton yarn market, currently valued at approximately $65.50 billion, is projected to reach $108.99 billion by 2030. This growth is driven by rising apparel consumption, increased cotton production, and growing demand from key importers such as China and Bangladesh. However, fluctuations in cotton prices, along with external factors like weather conditions, trade policies, and geopolitical tensions, contribute to the volatility of cotton yarn prices. Understanding these dynamics is essential for analysing the future of the cotton yarn industry and its role in global trade.

India holds a dominant position in global cotton yarn exports, commanding a significant 31.2 per cent share of the market. As one of the largest producers of cotton yarn, India’s output for 2023-2024 is estimated at approximately 5,185 million kilograms, placing it among the top producers globally. With the world’s second-largest spinning capacity, second only to China, India has established itself as a critical supplier of cotton yarn to the international market. However, fluctuations in cotton production and prices significantly affect yarn prices. The Indian yarn industry, already facing disruptions due to the COVID-19 pandemic, has been further impacted by rising cotton prices and shortages. These challenges, combined with the uncompetitive pricing of cotton yarn, have led to reduced profitability for Indian yarn manufacturers.

China, on the other hand, is also a major producer of cotton yarn. Despite its large-scale production, China’s share of cotton yarn exports varies across different categories. For pure cotton yarn, China accounts for around 5.5 per cent of global exports, while for other yarn variants, it ranks as the second-largest exporter. This nuanced export profile highlights China’s significant presence in the cotton yarn market, though its dominance in production does not always translate into export leadership across all product types.

India & China’s yarn markets

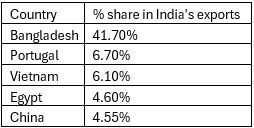

India is one of the largest exporters of both raw cotton and cotton yarn, with a significant portion of its cotton yarn exports concentrated in Bangladesh. As of April 2024, 41.7 per cent of India’s cotton yarn exports were directed to Bangladesh, highlighting Bangladesh’s reliance on Indian cotton yarn to support its thriving textile and garment industry. Bangladesh, as a major global hub for garment production, continues to be a key market for Indian yarn.

Other countries, such as Vietnam, also play an important role as garment production centres in Asia. While Vietnam is a notable competitor in the global textile industry, its demand for Indian cotton yarn is not as concentrated as that of Bangladesh. However, Vietnam still contributes to the broader regional dynamics of yarn trade.

Table 1: India’s major export destinations

Source: ITC Trademap

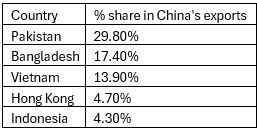

In contrast, China has a more diversified export portfolio for cotton yarn, with key markets spread across Pakistan, Bangladesh, and Vietnam. This diversification helps China maintain a steady export flow across multiple regions. However, a key factor influencing China's cotton yarn pricing is its strong domestic demand. As one of the world’s largest producers of apparel, China’s internal demand for cotton yarn is substantial, often driving prices in its domestic market. The high consumption of cotton yarn for domestic apparel production significantly influences both supply and pricing, making local demand a crucial factor in China’s cotton yarn market dynamics.

Table 2: China’s major export destinations

Source: ITC Trademap

Key factors influencing yarn prices in India and China

From 2015 to 2019, cotton yarn prices in China remained relatively stable, largely due to consistent demand from major textile-producing nations. This steady demand helped maintain balanced market conditions, preventing significant price fluctuations during this period.

In 2020, however, cotton yarn prices declined sharply as the COVID-19 pandemic caused widespread economic disruption. Supply chain issues, production slowdowns, and uncertainty surrounding Chinese trade policies severely impacted the market. The closure of borders and reduced production levels in China further destabilised the economy, leading to reduced demand from importing countries and a subsequent drop in prices.

In 2021, cotton yarn prices surged as global economies began to recover from the pandemic. Garment-producing countries experienced a sudden spike in demand for textile products, including masks and other essentials, resulting in a sharp increase in cotton yarn prices to meet these large-scale orders.

By 2022, prices had declined again, influenced by speculations over potential sanctions on US cotton. China, a major consumer of cotton yarn, significantly reduced its imports, which exerted downward pressure on prices. The uncertainty surrounding US cotton supplies, coupled with China’s reduction in imports, further contributed to the price dip.

In 2023, the downward trend in cotton yarn prices continued, partly driven by US sanctions on Chinese cotton yarn. Additionally, the rise of the "China Plus One" strategy, where countries diversified their supply chains away from China to reduce dependency, led to a decrease in demand for Chinese cotton yarn. This shift, combined with the impact of sanctions, further contributed to the decline in prices.

General inflationary trends increased production costs, which were passed on to prices. Currently, the Chinese economy is facing potential disinflation, as consumer sentiment has weakened amid a declining currency and a softening economy. Fluctuations in the Renminbi against major currencies affected export competitiveness and pricing. Currently, the Chinese currency is at risk of strengthening against major currencies globally, which could cause Chinese exports to lose their competitiveness.

On the demand and supply front, India experienced an increase in yarn production in FY 2023, suggesting that yarn prices are likely to decrease in the near future. ICRA has forecast a further rise in cotton yarn production for the next financial year, reinforcing expectations of lower prices. Our analysis also indicates that increasing cotton yarn production in the coming years will lead to price reductions. However, if import duties on cotton are not reduced, yarn prices may still rise.

Raw cotton accounts for roughly 60 per cent of the total cotton yarn cost, making the cotton yarn spread (the difference between raw cotton prices and cotton yarn prices) an important metric. In FY 2023, the cotton yarn spread was around ₹100 (~$1.19) per kg, impacting the profitability of cotton yarn suppliers. In FY 2024, this spread is expected to be lower than in FY23, which could further affect the profitability of yarn producers in India.

Raw material, labour and energy costs also significantly influence yarn prices. Any rise in these costs directly affects the final price of cotton yarn. With increasing cotton prices and no relief on cotton import duties, yarn prices are likely to rise. Energy costs are another key factor, with electricity accounting for 15 per cent of the total production cost. Disparate state energy tariffs create unequal benefits for producers, prompting calls for a unified national power tariff. Additionally, rising machinery and labour costs, coupled with the need to comply with sustainability norms, are likely to drive up cotton yarn prices further.

Broader economic conditions, including inflation, currency exchange rates, and monetary policies, can influence production costs and pricing strategies. The Minimum Support Price (MSP) for cotton also affects cotton yarn prices. Recently, India raised the MSP for raw cotton by 7 per cent to ₹7,121 (~$84.79) per quintal from ₹6,620 (~$78.82) per quintal. The MSP is a crucial factor in determining the price of cotton yarn, as it plays a primary role in the production chain. Over the coming years, the MSP, along with other economic factors, will be a key determinant of yarn prices.

Geopolitical uncertainties may also have a significant impact on cotton yarn pricing. Current conditions in Asia, including the "China Plus One" policy and ongoing turmoil in Bangladesh, are likely to affect orders and demand for cotton yarn.

Government policies, tariffs, and trade agreements will continue to shape export prices and market dynamics. For instance, India's potential partnership with China and the proposed increase in import tariffs on man-made yarns could influence cotton yarn prices. A 10 per cent tax on cotton yarn imports helps maintain current price levels, but allowing cheap imports from China for textile manufacturing could further pressure domestic cotton yarn prices.

Technological advancements and improved production processes may reduce costs and impact pricing, although initial investment in new technology could temporarily increase prices due to higher setup costs.

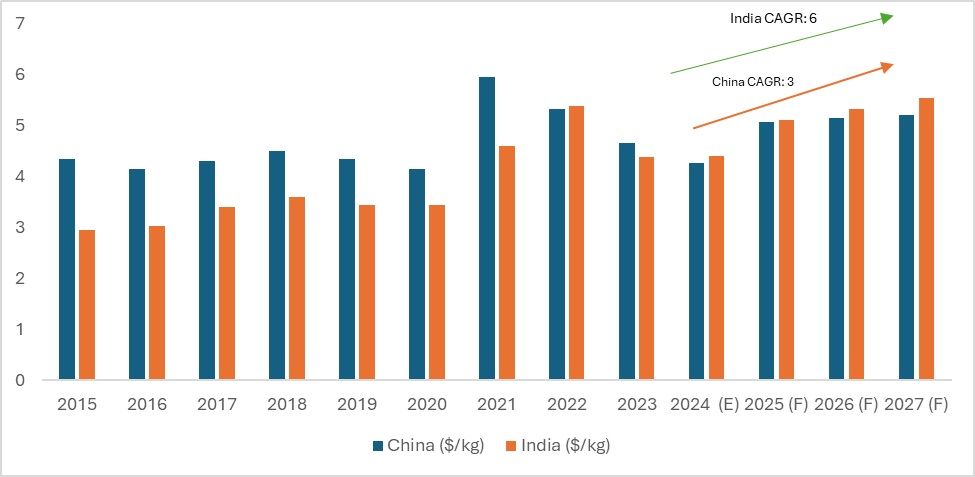

Figure 1: Pricing analysis and comparison between India and China

Source: TexPro, F2F Analysis

*E – Estimated, F - Forecast

From 2015 to 2027 (forecast), yarn prices in China have generally been higher than those in South India, ranging between $4 to $6 per kg, while South India's prices fluctuated from $3 to $6 per kg. South India consistently maintained a price advantage, particularly in 2015, 2016, 2017, 2019, and 2020, when its prices were consistently $1 lower than China's. In 2022, the price gap narrowed, with both regions recording the same price of $5 per kg. Looking ahead, slight variations are expected, but rising energy and labour costs are forecast to increase prices in both regions by 2027, with South India's prices projected to surpass China's at $6 per kg. Despite this anticipated reversal, South India has historically been the more cost-effective option, attracting buyers with its competitive pricing in the global yarn market.

Several factors contribute to these pricing differences, including lower labour costs, government subsidies, and a more efficient production ecosystem in South India compared to China. As a result, South India has been the preferred choice for buyers seeking lower costs. However, both regions face upward pressure on prices due to rising energy and labour costs.

Price fluctuations in cotton yarn often mirror changes in supply and demand. For instance, spikes in 2018 and 2021 were driven by increased global demand for textiles. Currently, India is experiencing an oversupply of cotton yarn, leading to price reductions due to weak domestic demand. In contrast, while China's production of cotton yarn has also increased, the higher domestic demand—driven by large-scale apparel production—has kept its prices more stable.

Cotton plays a significant role in determining the cost of cotton yarn, and the duty on cotton yarn imports also impacts prices. In India, there are no import duties on cotton, which helps keep prices in check. However, there was previously an 11 per cent import duty on extra-long staple (ELS) cotton, although duties on cotton yarn were removed. ELS cotton is crucial for producing high-quality yarn like 60/1 yarn, so balancing the minimum support price (MSP) is important to prevent skewed results and losses for specific sectors of the supply chain. Additionally, easing the prices of the Shankar-6 variety, a high-quality cotton, could further reduce cotton yarn prices in India.

Preference and the legal angle

When choosing between India and China for cotton yarn, international firms and apparel producers are likely to favour India, even if prices rise in the coming years. This preference is driven by the global shift towards sustainability and ethical business practices in the textile industry. Countries like Bangladesh, which currently rely heavily on China for cotton yarn, may eventually reduce their dependence on Chinese supplies in favour of alternative sources. India, renowned for producing high-quality yarn, is well-positioned to meet this demand, making it an attractive option for buyers focused on ethical and sustainable sourcing.

A key factor contributing to the projected rise in Indian cotton yarn prices, which are expected to grow at a compound annual growth rate (CAGR) of 6 per cent compared to China's, is the increasing emphasis on sustainability. The US Uyghur Forced Labor Prevention Act (UFLPA) has already affected Chinese textile and apparel exports, with many shipments from China and Vietnam being detained in 2023 due to concerns about forced labour. As apparel-producing nations prioritise access to international markets, the demand for Chinese cotton yarn is expected to decline. Major trade policies, such as the EU's Carbon Border Adjustment Mechanism (CBAM), which may include textiles by 2026, the US UFLPA, and the proposed New York Fashion Act, are driving higher sustainability and fair labour standards. These regulations could reduce the demand for Chinese yarn while boosting demand for Indian cotton yarn.

From a pricing perspective, although Indian cotton yarn may appear more expensive than its Chinese counterpart, these higher costs are justified by increasing demand from Asian garment producers, who manufacture apparel at a larger scale. Additionally, India’s expanding trade relationships, such as its upcoming Free Trade Agreement (FTA) with Peru, further enhance its market access and competitiveness. As India strengthens its market access initiatives and continues to prioritise ethical production, demand for Indian cotton yarn is expected to rise, solidifying its position as a preferred supplier in the global textile industry.

Fibre2Fashion News Desk (KL)