The femtech apparel market is experiencing substantial growth due to increasing awareness and demand for products that prioritise women's health and well-being. Companies operating in this space often capitalise on advancements in wearable technology, material science, and design to develop innovative solutions tailored to the distinct requirements of women. Moreover, the proliferation of e-commerce and direct-to-consumer models has enhanced the accessibility of femtech apparel to consumers, enabling personalised shopping experiences and heightened product visibility.

Pink Revolution

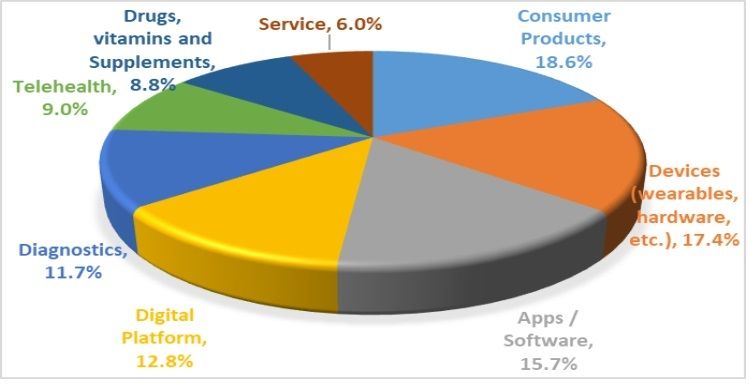

Consumer products represent one of the majority stakeholder segments in the Femtech market, chiefly comprising apparel-based products, which account for 19 per cent. This segment primarily caters to some of the stigmatised topics in society, such as menstrual health and post-cancer care, in the form of breast health solutions, among many others. Many brands are addressing the increasing awareness around menstrual hygiene and overall women's health. Revolutionary innovation is also evident in the introduction of new apps and devices that empower women to take charge of their health. Devices, which constitute around 17 per cent of the total market, followed by apps and software, forming another 16 per cent, assist in achieving these objectives.

Figure 1: Femtech categorisation by product

Source: Crunchbase, Arizton Advisory & Intelligence, IHS Markit, World Bank, Femtech Analysis

Source: Crunchbase, Arizton Advisory & Intelligence, IHS Markit, World Bank, Femtech Analysis

Digital platforms, accounting for 13 per cent of the total Femtech market, are enhancing the efficiency of care delivery. Virtual clinics and apps that facilitate the maintenance of health-related data are simplifying follow-ups and are steps towards making healthcare access easier and more far-reaching. Moreover, digital platforms are becoming more culturally sensitive and providing spaces to address women's issues.

Diagnostics is another area witnessing significant innovation. This sector, making up 12 per cent of the market, is addressing health issues that were once overlooked or inaccessible to many women. Improvements in care and diagnosis, for example, in pre-term births, are indicative of how the number of services could expand. This revolution is not only groundbreaking but also empowering for women, offering them greater awareness and control over their health and bodies, thereby enhancing their well-being. Other segments like telehealth, drugs, and supplements remain niche and relatively unexplored in the femtech market, primarily due to potential regulatory issues.

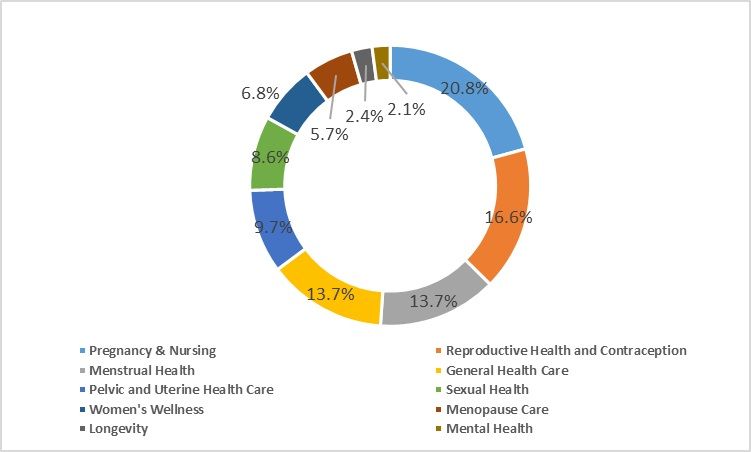

From a company perspective, the largest share is found in the pregnancy and nursing segment, where 21 per cent of the companies address the needs of women during and post-pregnancy. Another 14 per cent of the companies are involved in areas like menstrual health and general healthcare, producing products like period underwear, functional maternity wear, menopause wear, and pelvic organ prolapse solutions. The least explored sectors include mental healthcare and longevity. Many companies are also active in the reproductive and contraception market, where 17 per cent cater to young women's reproductive health issues.

Figure 2: Distribution of femtech companies by subsector

Source: Crunchbase, Arizton Advisory & Intelligence, IHS Markit, World Bank, Femtech Analysis

The sector also presents a significant opportunity for the rise of female entrepreneurs and the creation of a more consumer-centric market, where innovations more closely address the health needs of women rather than solely focusing on profit. As the middle and upper-middle-class populations grow and awareness of women's healthcare issues increases, the importance of the sector and its innovations will become more significant than ever.

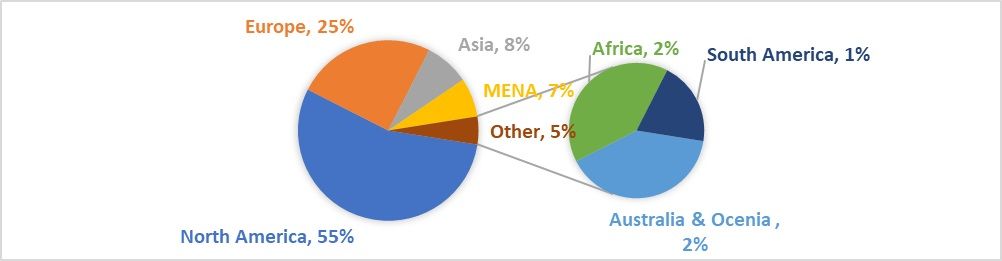

Figure 3: Distribution of femtech companies by region

Source: Crunchbase, Arizton Advisory & Intelligence, IHS Markit, World Bank, Femtech Analysis

North America stands out as a key market for femtech, followed closely by Europe, Asia, and other regions. The continually expanding population and the presence of a youthful, dynamic workforce contribute to the steady growth of the Asian market, positioning it to hold significant value shortly.

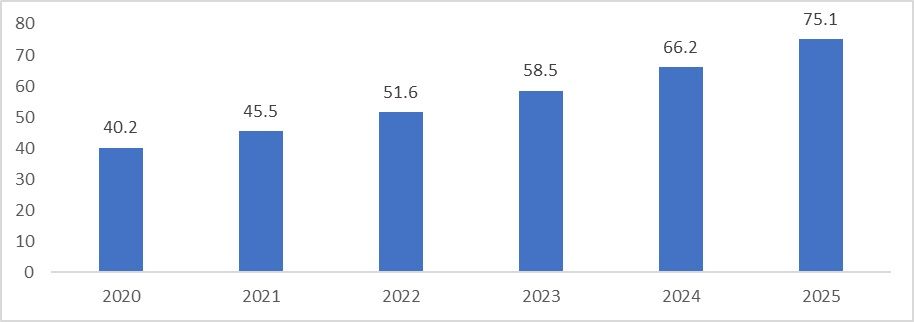

Just a few years ago, global investment in this sector was a mere $134 million annually. However, founders and entrepreneurs swiftly recognised the potential within this space, transforming what was once considered an uncomfortable topic into a lucrative business opportunity. This shift led to a substantial increase in investment, reaching $503 million in this sector. By 2019, the market had surged to $18.7 billion, boasting over 1,000 startup companies. Projections indicate that this market will continue to expand at a compound annual growth rate (CAGR) of 13.3 per cent in the years to come.

Figure 4: Femtech market (in $ bn)

Source: Arizton Advisory & Intelligence, IHS Markit, World Bank

Considering that the average female life expectancy stands at 75 years and women make up nearly half, or 49.5 per cent, of the global population, the potential market for femtech is substantial. Moreover, the global GDP is experiencing robust growth, expanding by 5.5 per cent. This economic growth is paralleled by increasing awareness of healthcare among individuals worldwide, alongside the ascent of the middle class and the steady rise in incomes.

With these factors in play, the femtech sector is positioned for significant expansion in the foreseeable future. As individuals become more health-conscious and technology continues to advance, there is a growing demand for innovative solutions tailored specifically to women's health needs. This presents a ripe opportunity for femtech companies to develop and introduce products and services that address a wide range of issues, from reproductive health to menopause management and beyond.

Furthermore, the rise of digital health platforms, coupled with the increasing adoption of wearable technology, is facilitating greater access to healthcare information and personalised solutions. This convergence of healthcare, technology, and consumer demand sets the stage for the continued growth and evolution of the femtech sector, making it an increasingly important and lucrative market for investors and entrepreneurs alike.

Fibre2Fashion News Desk (NJS)