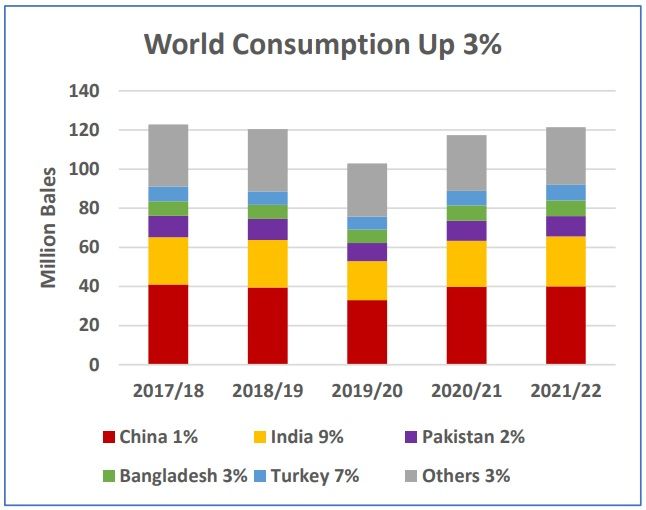

However, lingering pandemic related disruptions, i.e. reduced consumer demand and logistical issues, are expected to keep global cotton use below the 2017-18 record level, the Foreign Agricultural Service of the USDA said in its May 2021 report 'Cotton: World Markets and Trade'.

Image: USDA

Cotton use in 2021-22 is expected to witness growth in all top ten consuming countries, according to the USDA report. India will see cotton use going up by 2 million bales, accounting for nearly one-half of growth in global use. Consumption growth in Pakistan, Turkey, and Bangladesh is expected at or above the long-term world growth rate of around 2 per cent. Consumption in Vietnam is also forecast to increase.

Global cotton stocks at the end of 2021-22 season are forecast lower on smaller beginning stocks and consumption exceeding production for the second consecutive year. Stocks in China and India are both expected to decline by more than 1.5 million bales. China’s share of global stocks will decline to the second lowest level in 11 years. India’s consumption growth will exceed the expected increase in production, and lower stocks to their lowest level in 3 years. Stocks in the United States are also expected to decline. Brazil stocks are expected to increase due to the arrival of the second-largest projected crop at the end of the marketing year, the report said.

World trade is expected to contract slightly in 2021-22 from 2020-21, the highest in eight years. Shipments from the United States and Brazil are projected down on lower exportable supplies due to significantly lower carryin. Australia’s exports are forecast to more than double on dramatically higher production, with improved prospects relative to the extreme drought in 2020-21. India’s exports are up as higher world prices allow for the reduction of government-controlled stocks.

The second-highest projected global imports in nine years will be driven by higher global consumption relative to the previous year. China is projected to be the world’s largest importer for the second consecutive year, although imports are forecast lower than the previous year’s 8-year high. This follows the State Reserve’s expected return to replenishing stocks with foreign and domestic supplies. Pakistan imports are down slightly from the previous year’s record but significant due to the highest expected consumption level in three years and lower carryin.

Fibre2Fashion News Desk (RKS)