The Houthis have already destabilised global trade channels with their attacks on the Red Sea, thus leading to an increase in global shipping costs along with an increase in overall uncertainty worldwide, threatening the disruption of supply chains globally. Initially, there was only one route affected, but now, the threat of attacks on ships approaching the Cape of Good Hope may also give rise to tensions and possible supply chain disruptions.

The extreme proliferation and price hike

The Houthis have randomly attacked ships passing through the Red Sea, which has globally spooked the container and shipping companies, leading to a spike in insurance costs and the overall cost of shipping. All textile-supplying countries from Asia are impacted and will continue to be affected in the future as more trade routes come under the attack range of the Houthis. This may also disrupt supply chains and lead to serious issues such as inflation and dampened manufacturing growth.

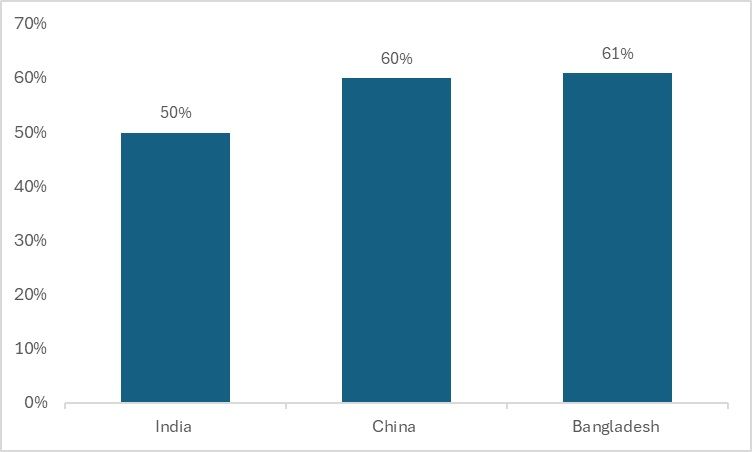

Figure 1: Global shipping prices (in $)

Source: Freightos

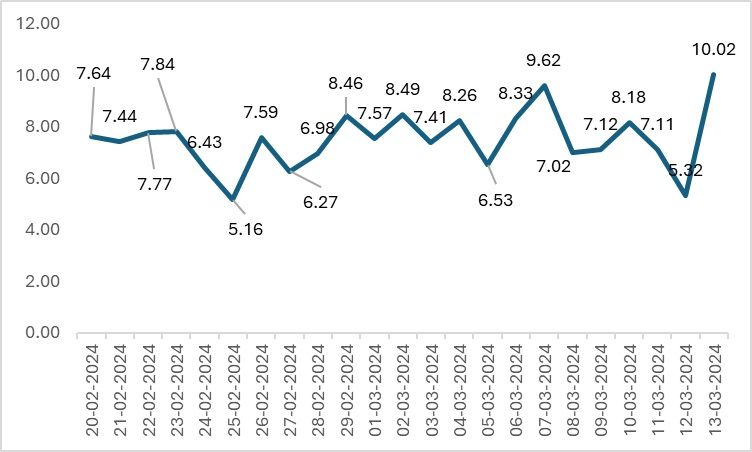

In case of the amount of total trade through the Red Sea, the Asian countries, which are major supplier hubs for the textile and apparel industry, have 30 to 60 per cent of their total trade passing through the canal. For instance, 60 per cent of Bangladesh's trade passes through the Suez Canal, followed by China and India, with 61 per cent and 30 per cent of their total trade, respectively. There is also a significant hike in shipping prices from Asia to northern Europe and the Mediterranean. According to Freightos, since November 2023, there has been a 286 per cent increase for the northern Europe route and a shocking 412 per cent increase for the Mediterranean route. Although the prices have been easing as of now, the current threat can lead to a further increase in overall insurance costs, thus affecting the supply chains.

Figure 2: Percentage of total trade by country passing through the Red Sea

Source: Fitch Ratings

Easing costs of shipping

In the last few weeks, the cost of shipping has been easing as there has been more predictability in shipping as far as the Cape of Good Hope is concerned. According to the International Monetary Fund, the total traffic in the Suez Canal has reduced by around 50 per cent, and the total volume of goods passing through the Cape of Good Hope is skyrocketing. According to recent data from the International Monetary Fund's Portwatch, almost 10.2 million metric tonnes of goods passed through the Cape of Good Hope until March. The number of ships passing through this route is also increasing, which shows that the route has normalised. Although the route is longer with higher traffic, trade is slowly stabilising; another shock in terms of an attack on the alternative route can have drastic effects in terms of disruptions.

Figure 3: Volume of goods transferred through the Cape of Good Hope (in mn metric tons)

Source: IMF Portwatch

Tough times for some, benefits for others

For Asia, which is a major supplier of garments and other textiles to Europe, this situation will impact the textile industries of the respective countries. These industries comprise Small and Medium Enterprises, which could be significantly affected if the current route also comes under Houthi attack. Since the Red Sea has been under attack, textile exporters, who already operate on slim margins, are either holding back their supplies or negotiating for higher prices. Countries like India have experienced a decline in textile exports, partly due to the Red Sea Crisis, which began in November 2023. Although the effect may not be immediately visible, it is likely to impact textile exports in the upcoming year and in 2025 if the uncertainty persists.

Therefore, the textile trade may be affected on a larger scale than imagined. If the current Cape of Good Hope is also attacked, then the overall textile trade stands to be significantly impacted. Countries like India, for example, are already feeling the brunt of the crisis, with small businesses there losing orders due to increased shipping costs. Industries are renegotiating costs, leading to a decrease in total profits. The situation is similar in Bangladesh, where the country is facing increased insurance costs and significant delays. The manufacturers are also now facing competition from Indonesia, which offers lower costs.

This situation represents a considerable negative external economy of scale for India. With supply chains at risk of disruptions, there is a higher chance that European countries may turn to Turkiye in this situation. The nation, strategically located between Asia and Europe, with its current infrastructure, is finding it easier to attract more orders from Europe during this crisis. With this shift, the nation and its economy are poised to benefit significantly from European and Middle Eastern countries.

What to infer

Examining the current situation, two inferences can be made: firstly, external factors, such as the Houthi attacks, can disrupt the entire textile supply chain, impacting suppliers in Asia who are unable to withstand the sudden increase in shipping costs. Secondly, although the change in external circumstances is benefitting countries like Turkiye for now, the specialisation in garment production that Asia has developed over the years cannot be quickly replicated by others. Exports may decline temporarily, but the presence of the complete textile value chain in some Asian countries is a significant advantage they hold over others.

Fibre2Fashion News Desk (KL)